2025 - A Year in the Trenches

There is no amount of reading, theory, or watching YouTube videos that can teach you how to swim well, ride a bike safely, or in our context here, trade options successfully.

At the start of 2025, I started recording my trades in an "end-of-week" journal series (see the series here). While it started as a somewhat frivolous exercise (see my introduction here), I did actually learn quite a bit in this journey so far - I am writing this post as a retrospective of the entire year.

tl; dr

Know thyself.

Once Upon A Time

I began the experiment with a starting capital of $11,100.

I was fixated on PnL. Here is a snippet from first week.

The only thing that really matters is what is your P&L (Profit and Loss), all else is gimmickry.

I had a good few weeks at the start of the journey, and I got ambitious.

... if I was profitable on a few trades, it will be akin to a monkey hitting a dart right. Well, the monkey is now feeling ambitious.

The Big Bet teased me and I got sucked in. I was convinced of a short-term market direction, and put a large portion of my portfolio on MSFT and GOOGL LEAPS.

I am strongly convinced I have entered the right LEAPS. Still waiting for the market to begin moving MSFT and GOOGL northward. The game of cat and mouse with the market is truly on. Let's see who blinks first!

Reader - I blinked.

Not only was I wrong in the short-term, I also went from writing about an active trading journey to a semi-passive strategy with LEAPS. I kept waiting for a market reversal that came way too late. And to top it off, instead of getting out, I doubled down by rolling out the LEAPS, locking in substantial losses and compounding my error.

Week 10 led me to one of the results of the chaotic application of the theories I had learnt and I fell well behind in SPY - one of my stated goals at the start of the year had been beating SPY.

I saw too much red on my page and made some impulsive and not so well thought out decisions.

As I am writing this down, I realize I do not know how to manage LEAPS. They have been the single biggest reason of the drawdowns in my account this year.

.....

I have now spectacularly fallen behind SPY.

The meltdown - while being a major financial event in my short journey - forced me to understand my psychology better. I attempted a painful post-mortem of the trades I had made so far.

At the time, I noticed that the core strategy of selling premiums was working, but hedges and LEAPS were making a dent larger than the premium profits could cover.

And soon came the overall market crash, which sent my portfolio tumbling down by ~41% and I wrote:

My best case scenario is to just survive the year and not lose it all.

I adjusted my goals to survival instead of profitability. I had the right diagnosis, but unfortunately, not the right solution.

I leaned towards Spreads as a cost efficient vehicle to give me some wins. Which they did. I managed to get a 4 week winning streak. But then towards the end of August, I ran into a sharp move and tried to catch a falling knife, which meant:

In just over half an hour, I lost more than I’d made all year.

Reset

At this point, I had two key takeaways - concentration risk and position sizing. My biggest losses of the year came when I took outsize positions (by my portfolio size) on a single bet.

I began adjusting my trading style to take smaller bets. This helped me when there was a spike in volatility. I had capital to spare and without seeking it, I found myself in the right set of trades, leading to my best week of the year where everything clicked.

Taking smaller bets, knowing that no one trade can cause a huge dent in my account, building through multiple wins - they all helped me get into a more settled mindset.

An example of this was when I last faced a big loss - I started scalping in the opposite direction of my original (and wrong) hypothesis and cut my loss in half. See Anatomy of an Unfavorable Call Diagonal here for more on this.

The Final Tally

Here are the usual graphs I have journaled throughout the year.

Numbers

- Total Net Liquidity: $27,829

- Total Number of Bets: 226 (counting a strategy like Iron Condor as a single bet, even though it may have many legs/trades)

- Total Realized Profit and Loss: -$4201 (includes ~$300 in commissions and fees). This would be at least 2K to 3K more in losses if we consider the opportunity cost of not investing in an index like SPY.

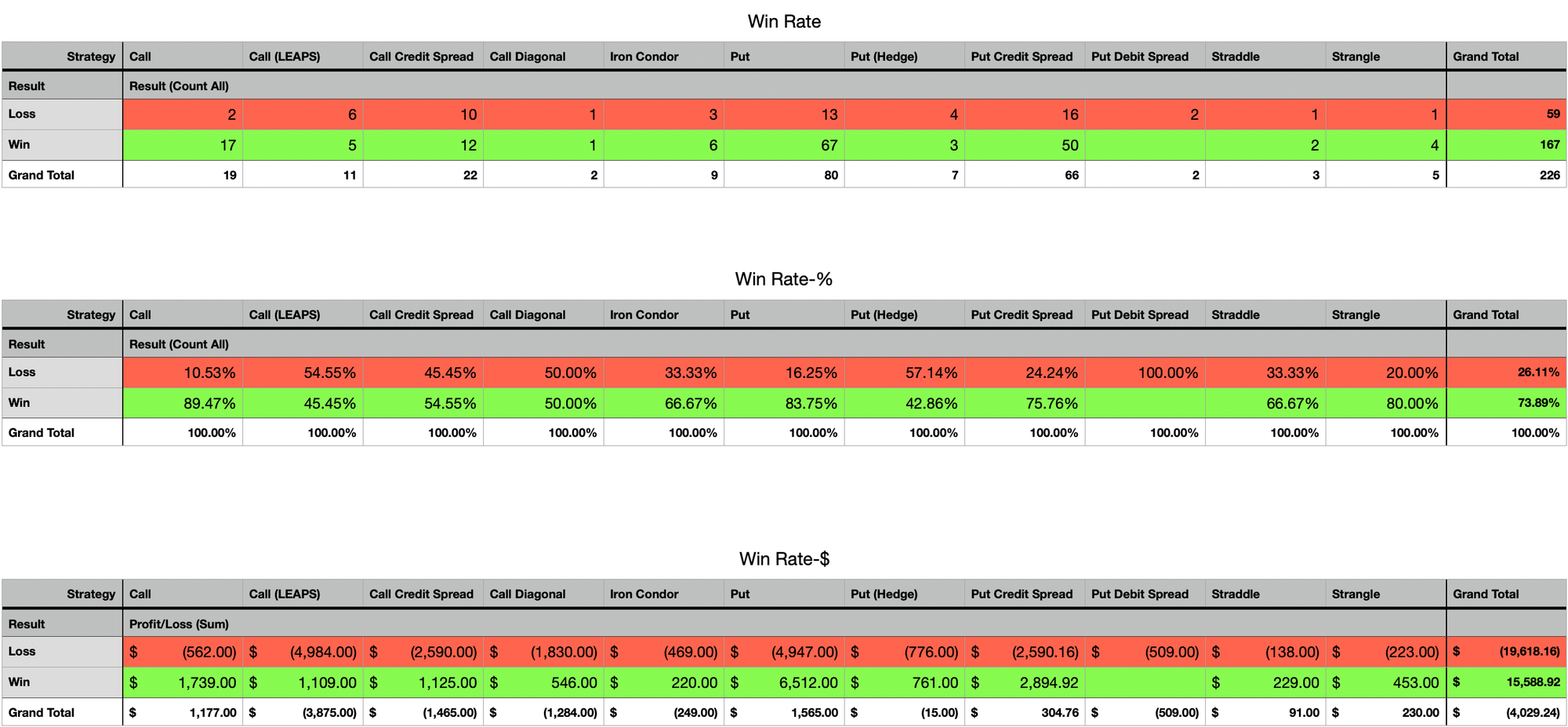

Here are the win rates. None of the strategies used this year could reach a statistically significant sample size of 200. One important thing to understand is that reaching the sample size of 200 requires you to first survive long enough.

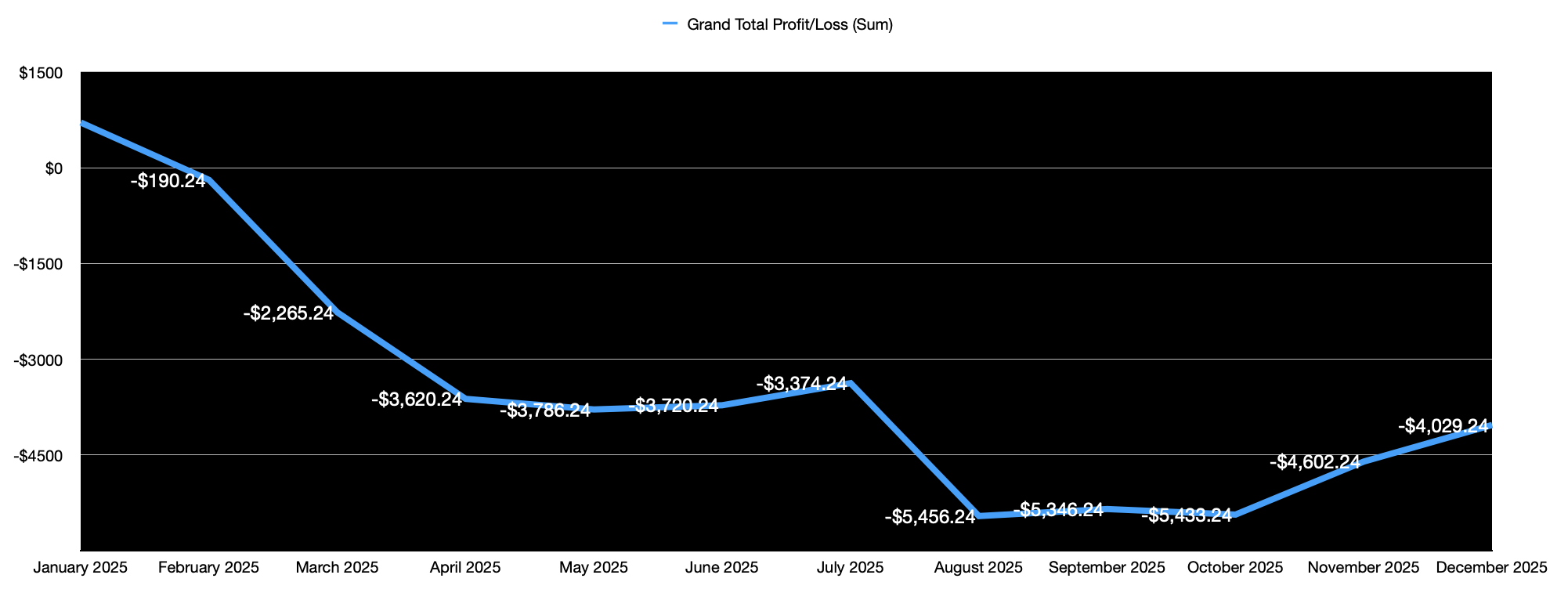

Here is the trend line for PnL for 2025. After the big drop from July to August, I had realized I will not be able to shotgun my way through this journey. As I mentioned in the Reset above, I changed tactics, but also the changed tactics required another infusion of capital. The positive slope since October gives me hope.

Lessons

A key lesson I learnt was marrying patience with speed and preparedness. You want to be patient, but patience can also look like inaction - you must pounce on any opportunity you come across - and to do that you must be prepared.

There are many ways to make money in the markets. I took a circuitous route to find mine. Understanding my own psychology took a while. These journals helped me see what I was doing, helped me diagnose, but the inspiration from experimentation was all my own.

To find out what works, you still have to do the work. And anything worth doing is hard.

But why did I keep doing it throughout the year? Why not park everything into an index?

Actually - I have. Most of my 401k, Roth, IRA, etc. is in FXAIX and VOO.

But two reasons for doing this.

One, I find options trading and the data present in the lead up to a decision, its outcome, and its influence on future decisions present a raw story that is - not generated by an AI, not predictable by most standards, and uniquely mine in this entire world.

And two, if I am not going to bet on myself, who will?

What's Next?

Like I said earlier - I have not yet reached a statistically large enough sample in my trading journey. My goal now is to reach that sample size, hopefully in 2026.

Thanks for following along. Happy New Year 2026!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.