Day 69

Market Recap

Both SPY and QQQ were mostly flat last week, ending the week slightly lower than where they started.

- SPY: -0.25%

- QQQ: -0.45%

Year-over-year:

- SPY: +10.47%

- QQQ: +10.59%

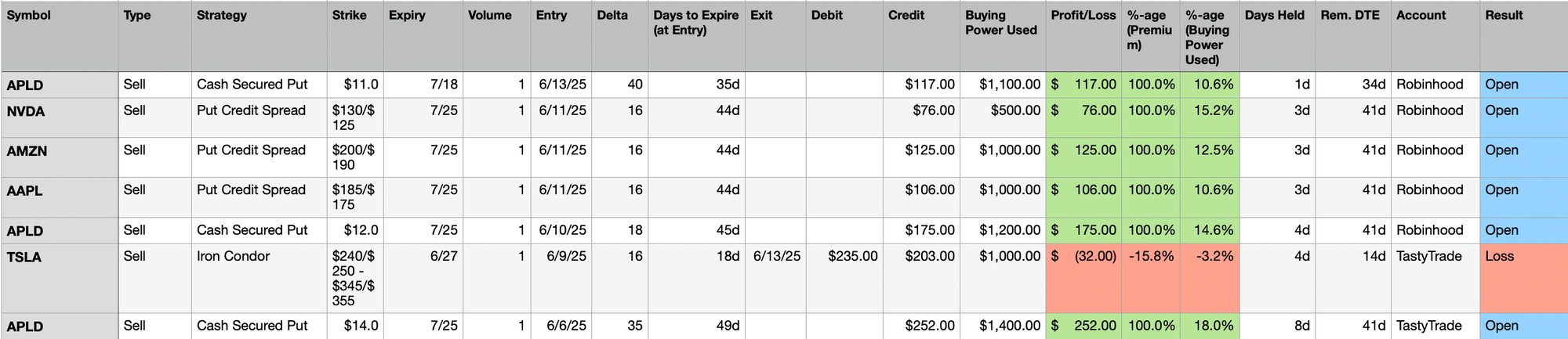

Trading Update: June 9 – June 14, 2025

Here is a summary of all trades made during the week (details listed below).

- Unrealized Profit/Loss: +$851

- Realized Profit/Loss: -$32

- Buying Power Used: $6.2K

- Buying Power Remaining: $4K

Closing Trades

I managed an Iron Condor in TSLA at a loss. I think I would have had better luck rolling though. The way I had structured the trade was that I opened the IC with strikes ±1 Standard Deviation away from the ITM price.

Then the stock started to move up, so the Sold Puts side of the trade became profitable, and I closed that a profit. The Sold Call side got tested, and I was hoping to close that at a profit too when volatility reduced, but I think TSLA is one of the more eccentric options out there, and while the stock did start to go down, it never really reached a point well enough to make me whole.

However, the point at which I closed the trade, I could very well have rolled the trade too. But the primary driver for me to close the trade was that when entering the trade, I had told myself that it's ok to enter a sub-45 DTE trade since I am trying to play short term volatility crash, and so I did an 18 DTE entry, which if you look at my past few weeks, I have tended to avoid completely and stick to 45 DTE.

Any how, I think it is ok to have such trades once in a while. A $32 loss is a well managed loss, I think, for the risk I took ($1000).

Open Trades

I was restless to open some trades, so I do not think I picked wisely this week. But I was at least mechanical, and stuck to a 45 DTE window (mostly, except one trade which is 35 DTE).

- APLD

- Sold 1 Cash Secured Put , Strike $11.0, Expires 7/18

- Sold 1 Cash Secured Put , Strike $12.0, Expires 7/25

- NVDA

- Sold 1 Put Credit Spread, Strikes $130/$125, Expires 7/25

- AMZN

- Sold 1 Put Credit Spread, Strikes $200/$190, Expires 7/25

- AAPL

- Sold 1 Put Credit Spread, Strikes $185/$175, Expires 7/25

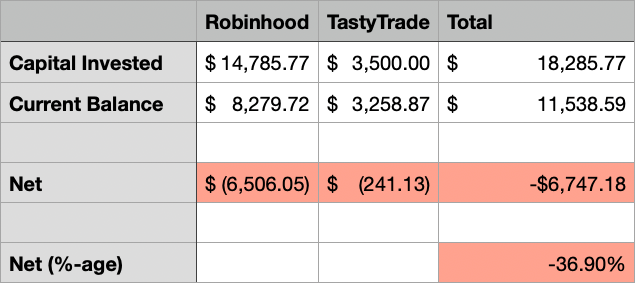

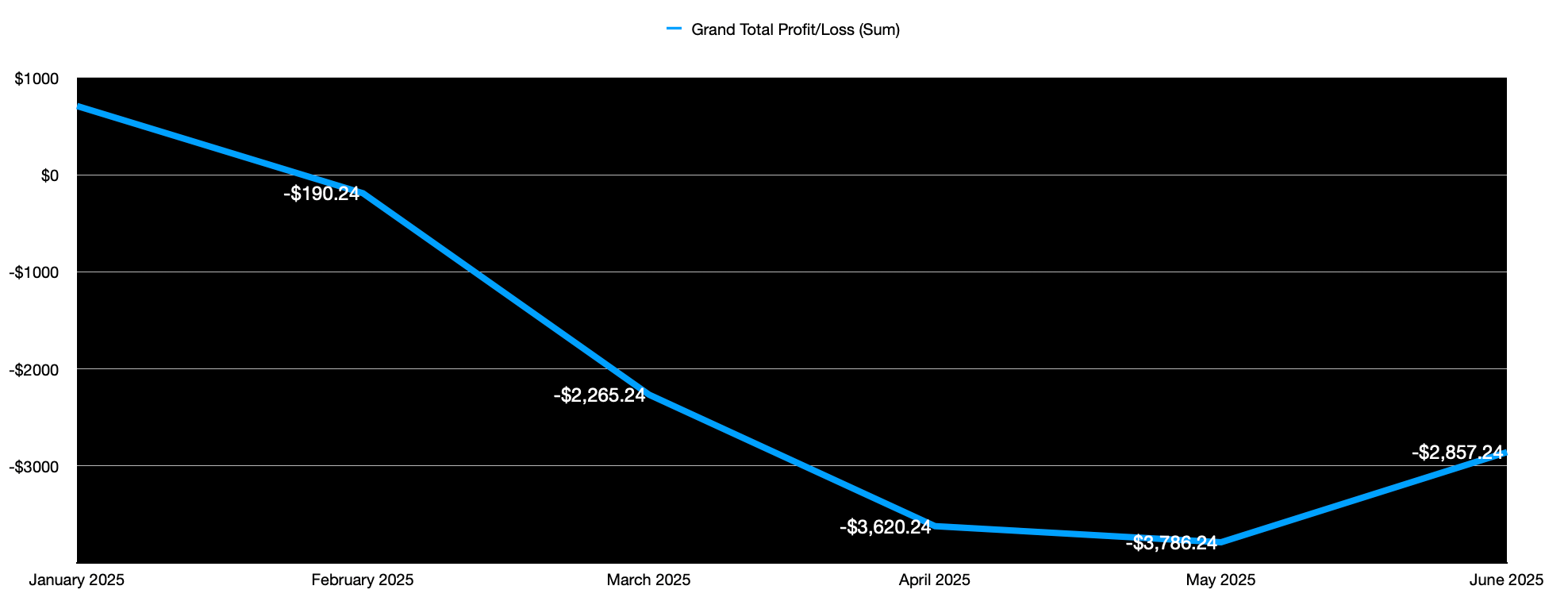

Portfolio Status

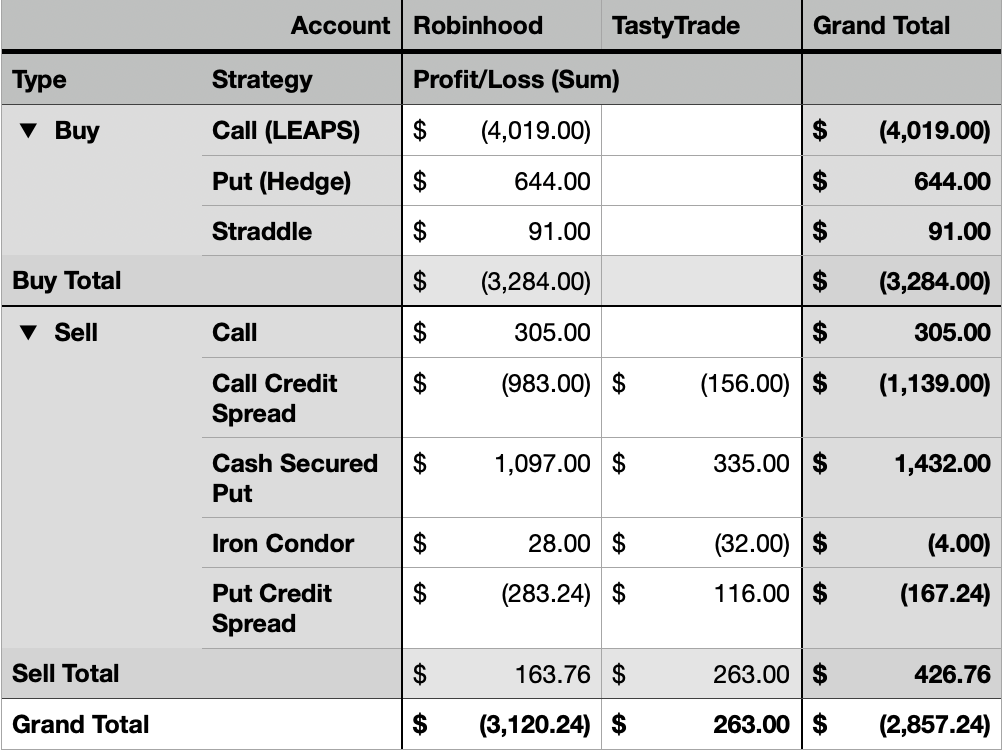

- 2025 Net P&L: Down $2.86K

- All Time: Down $6.75K

Profit and Loss Trend - Monthly

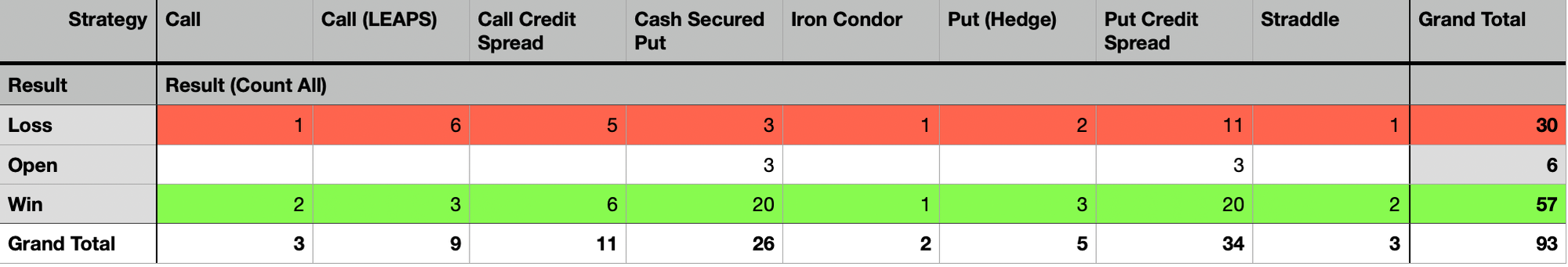

Portfolio Strategy Breakdown

Here is a table showing my Win Rate by Strategy.

Here is a breakdown of P/L by strategies I have used so far.

- Best Performing Strategy: Cash Secured Put

- Worse Performing Strategy: Call (LEAPS)

Plan for Next Week

For the first time in the past few months, the portfolio seems to have inched forward in consecutive weeks. I am not quite happy with the progress though.

The thing that has stuck me as odd is how my Put Credit Spreads have resulted in losses, but my Cash Secured Put have not. They are both bullish strategies so they should both be reasonably aligned in their trajectory. Perhaps they will eventually, when I have stacked enough trades to get a statistical alignment in the two strategies.

I have resisted putting all my capital on the line so far, but that may change in the next 4 weeks. I am looking to put up to 90% of my available capital into the trades and see if that helps in moving things along faster. I am getting a bit ambitious and actually want to beat SPY for the year, and not just try to keep my capital intact. Right now, I am ~35% down, while SPY is ~1.5% up, so my task is to say the least, quite ambitious.

The tricky part is there seems to be no way I can grow that fast unless I either increase my capital, or increase my risk appetite, or both. Part of my brain wants to increase the number of Bull Put Spreads I open, part of it wants to buy more LEAPS even though recent history shows LEAPS are my most loss-making trades, and part of it is busy fighting brain-fades.

I am also finding it difficult to track every decision manually. Today is one of the days again where I question my commitment, but I saw a rising star section today on Tasty Trade and that gives me hope. Leaving a link here in case you find it uplifting too.

Thanks for following along - see you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.