Day 92

The markets turned positive this week, helping me reduce some of my steep losses.

Market Recap

Both the SPY and the QQQ kept steadily rising through the week, ending on a positive note.

Last Week:

- SPY ($685.91): +$5.49 (+0.81%)

- QQQ ($625.51): +10.31 (+1.68%)

Last 1 Year:

- SPY: +$78.47 (+12.92%)

- QQQ: +$103.03 (+19.72%)

Year To Date:

- SPY: +$96.52 (+16.38%)

- QQQ: +$111.21 (+21.62%)

VIX is back below 16.

Trading Update: November 24 - December 5, 2025

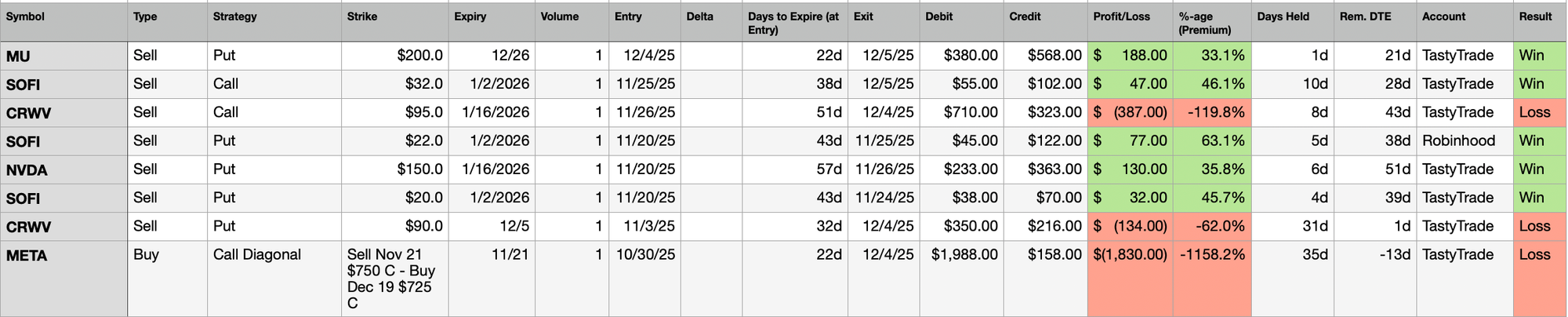

I closed the following trades in the last 2 weeks.

I lost a net of $47 across seven trades (excluding the META diagonal that I finally closed). I closed one position in MU, three in SOFI, two in CRWV, and one in NVDA.

I made an earnings play in MU when I saw it was going down while the rest of the market was up. I speculated that MU would not fall outside of a 1-Standard Deviation move. I made a quick $188 almost overnight.

I had also sold a more typical CRWV Put position a while back assuming it would not fall ~40% in 50 days. But it did. This was one of the trades where I kept thinking that surely this thing is not going to fall any further, and yet it continued its free fall. Between Oct 29 and Nov 20, CRWV fell more than 50%! It has since crawled up a bit, and is almost where it was 3 months ago. Overall, I lost $355 across all CRWV trades, including other past weeks, not just this one. Would this go any differently if I was in a similar situation again in future? Have I learnt anything? I don't know - I think I did what I could do and managed to keep the loss small enough when compared to some other losses I have had this year.

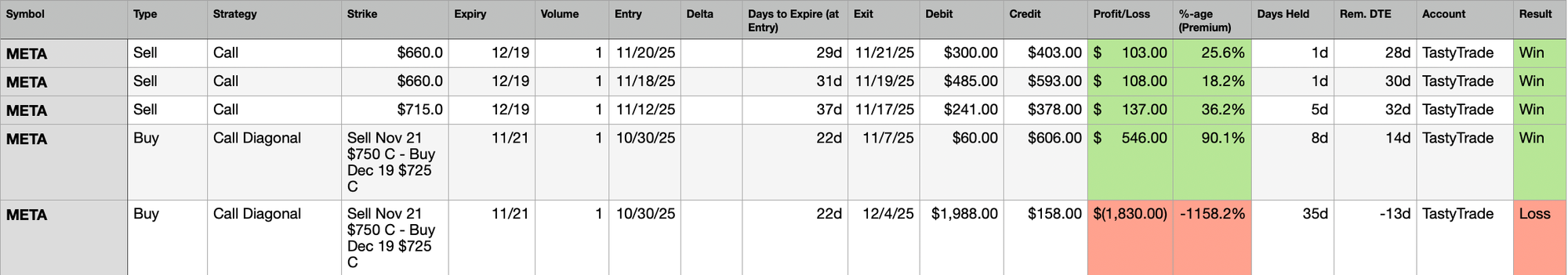

I finally got out of the META Diagonal position I had opened at the end of October at a net loss of $936. Here are all the trades I did as part of reducing my loss on META.

This is what I wrote about the Anatomy of an Unfavorable Call Diagonal last week.

I have managed to cut the loss nearly in half, going from almost $2K in loss down to now ~$1K in loss.

Portfolio Status

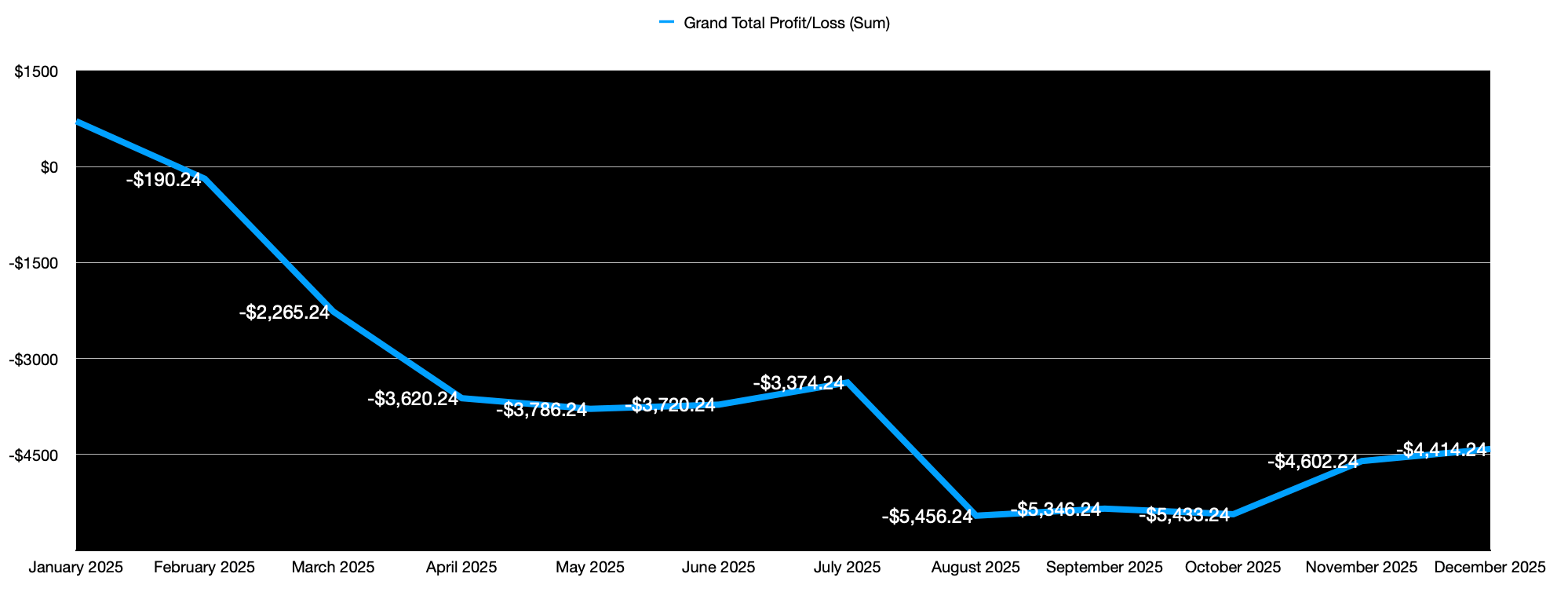

In terms of wins and losses, after multiple weeks of only having winning trades, I lost this week.

My last five weeks (latest first): L-W-W-W-W.

Year-to-date realized P/L: –$4,414.

Here is the Profit/Loss trend for the year.

Portfolio

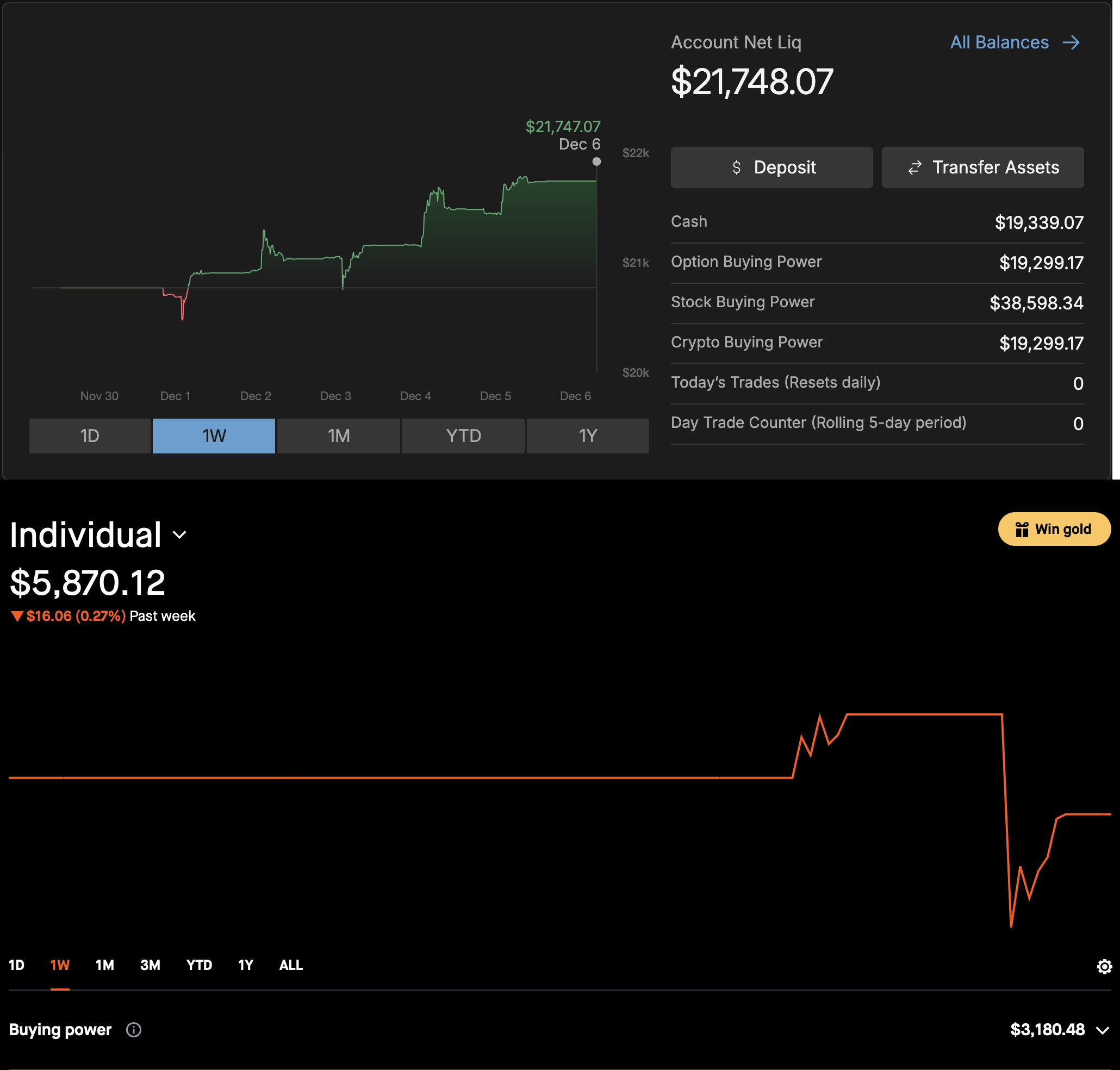

Here is a current snapshot of my TastyTrade and Robinhood portfolios.

Portfolio Strategy Breakdown

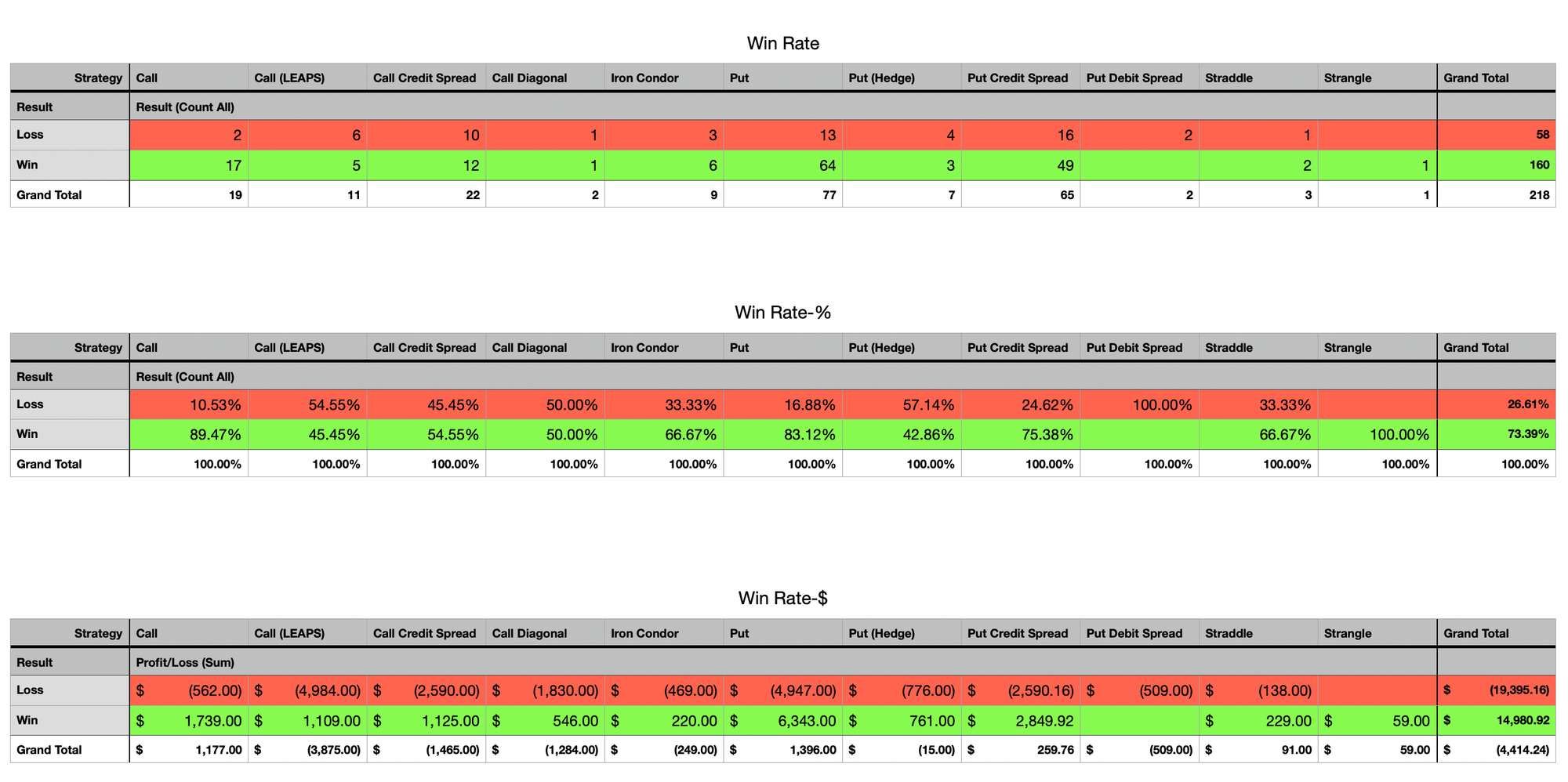

Here's a view showing my Win Rate breakdown by strategy deployed.

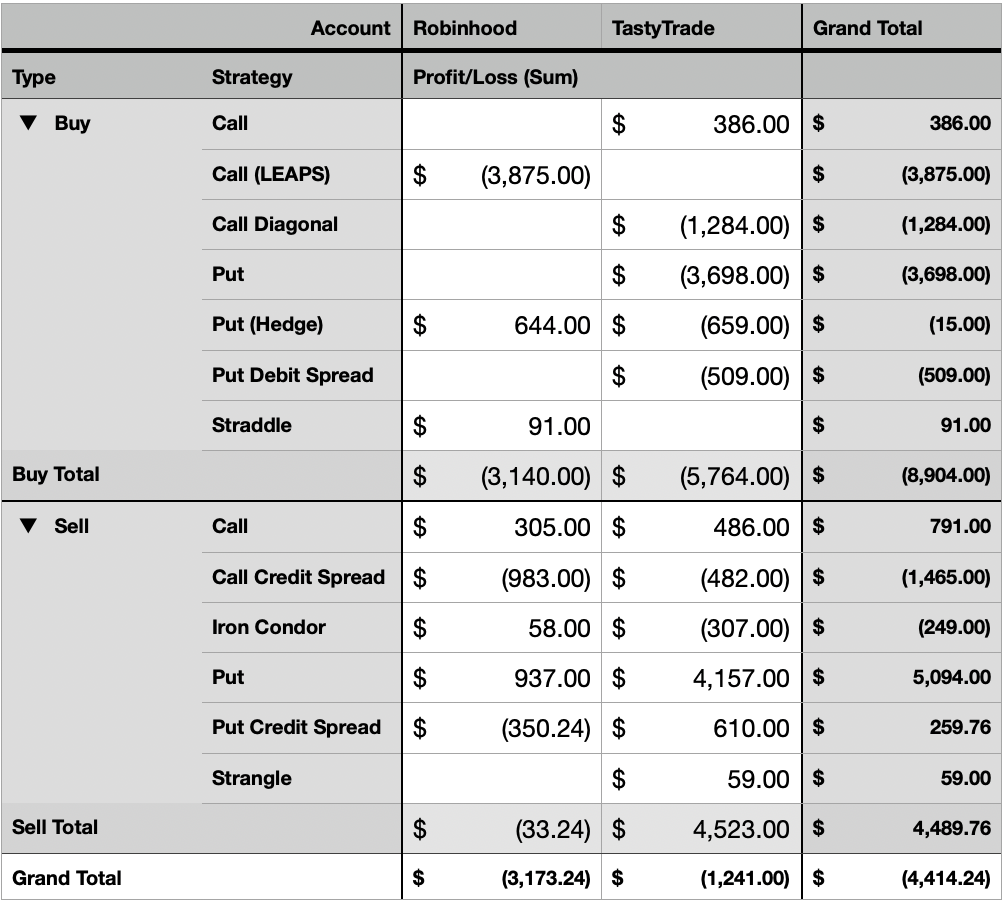

Here is a breakdown of P/L by Buy v/s Sell strategies I have used so far.

Plan for Next Week

I am closely following SOFI and NFLX next week.

SOFI has issued additional shares into the market, causing a devaluation of their current stock, and consequently a small drop. Curiously though, the stock still remains within its 1-Standard Deviation move range before this news was announced.

NFLX is acquiring Warner Brothers (https://about.netflix.com/en/news/netflix-to-acquire-warner-bros) and with that, quite a few premium properties like the rights to Batman. There is likely going to be some challenges to the merger (https://www.wsj.com/business/media/paramount-raises-concerns-about-netflixs-bid-for-warner-bros-discovery-1ef9a8c5). Regardless, the stock has been beaten down a lot in the last three months, falling over 30% since June 30th, so there is may be an opportunity for a contrarian play (against the market) here.

I have some open positions in both that might go either way depending on whether or not the current price has already baked this news in (I think it has!).

Thanks for following along. See you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.