Day 90

3rd consecutive week with a 100% of personal wins. Markets are super choppy and I have enough risk on the line!

Market Recap

Both SPY and QQQ went down this week.

Last Week:

- SPY ($672.32): -$12.09 (-1.77%)

- QQQ ($612.15): -$21.02 (-3.32%)

Year-over-Year:

- SPY: +$79.24 (+13.36%)

- QQQ: +$103.75 (+20.41%)

VIX spiked above 22 before sliding down towards 19 at the end of the week.

Trading Update: November 3 - November 7, 2025

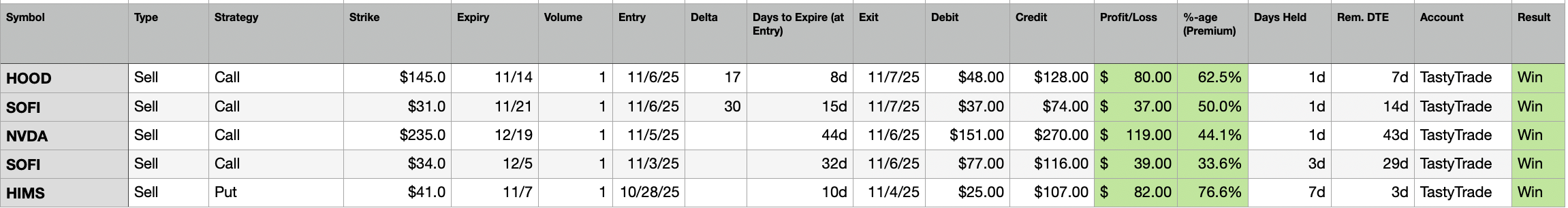

I closed the following trades this week.

4 out of the 5 trades I closed were opened this week.

1 was opened last week.

3 trades were held just for a day.

All of NVDA, SOFI, and HOOD were near their all time highs. I speculated that the rate of their rise will see a slowdown. I was not necessarily bearish but just a bit skeptical about their velocity and bet that their next all time high will take longer.

Then the market had a minor correction sending all my sold calls in green, and I did not have to wait a lot to find out if my speculation was right! I will gladly take the win.

Portfolio Status

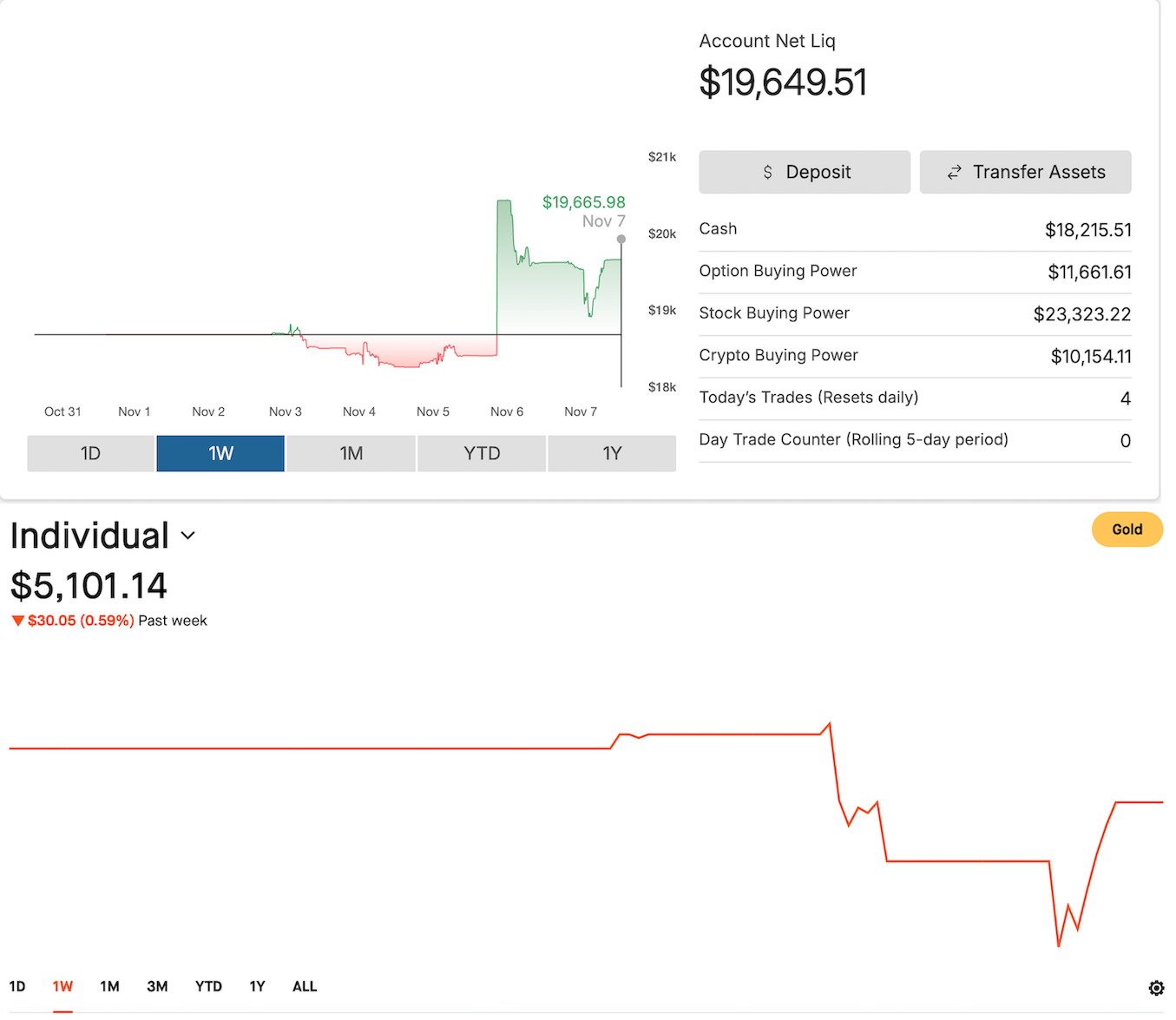

This is my longest run of weekly wins - 3rd in a row. I netted $357 in profits.

My last five weeks (latest first): W-W-W-L-W.

Year-to-date realized P/L: –$3,911.

Here is the Profit/Loss trend for the year.

Portfolio

When I had started journaling my daily and weekly options on foolish trader in January this year, I had started with ~$11K in Robinhood - see my first ever post here.

About 45 trading days in, I felt the need for some decision automation, and after realizing that Robinhood was not sufficiently meeting my trading needs, I started a TastyTrade account with $1000 in capital - this was 50th trading day - see my blog here for that day: Day 50.

All of the seed capital for these accounts have come from my hard-earned savings from my day job. So I cannot truly afford to lose this capital.

As a reminder, trading is not my day job, I do it for learning and entertainment, and I do it before I go to work and during my lunch breaks if my schedule allows. This is also why you may not see me trading every single strategy under the sun. I tend to stick to moderately active strategies - ones which are enough to be covered by the 1 or 2 hours I get in the trading day.

With that, here is a current snapshot of my TastyTrade and Robinhood portfolios. I am close to having $25K across these two accounts.

Portfolio Strategy Breakdown

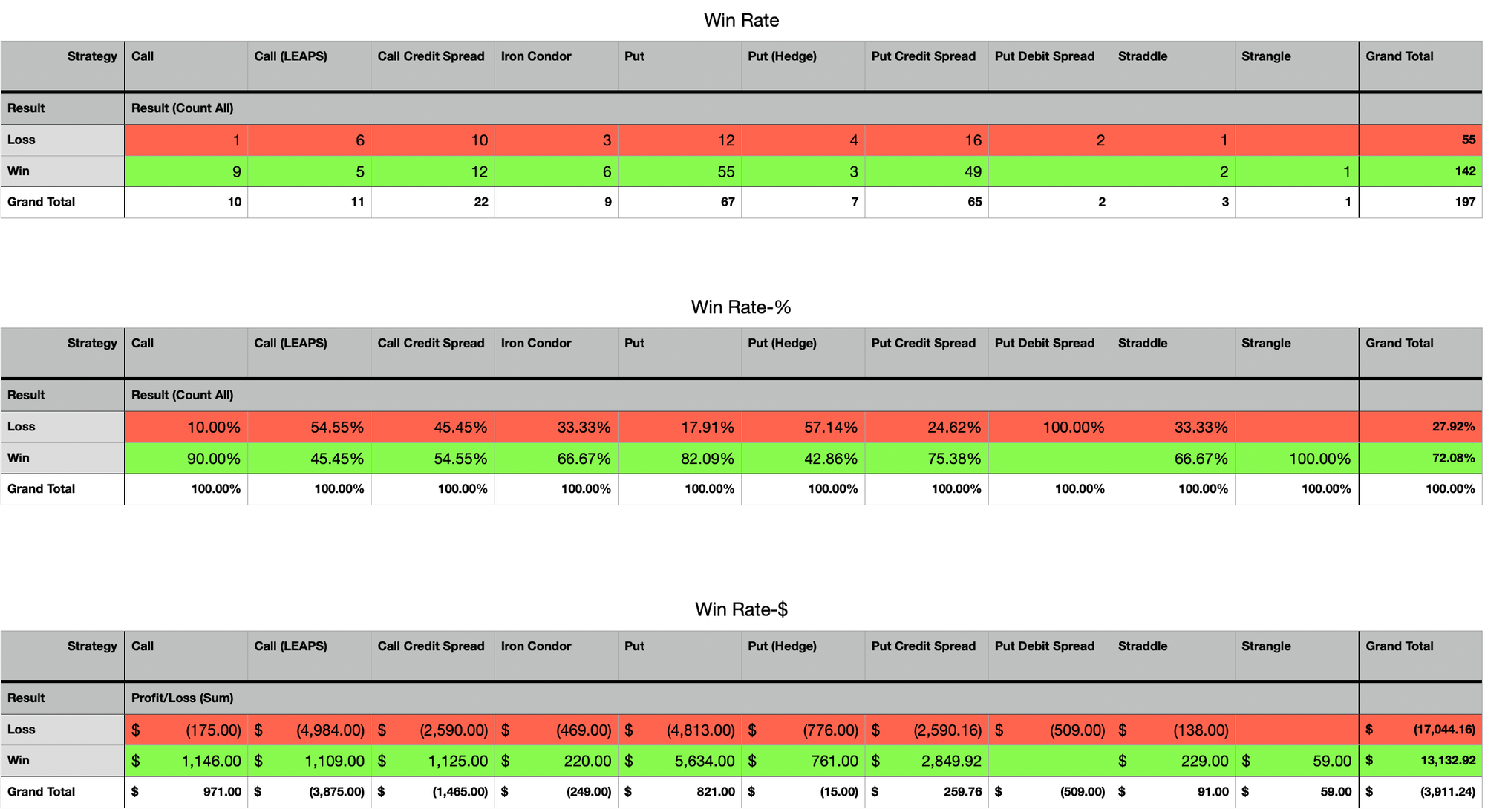

Here's a view showing my Win Rate breakdown by strategy deployed.

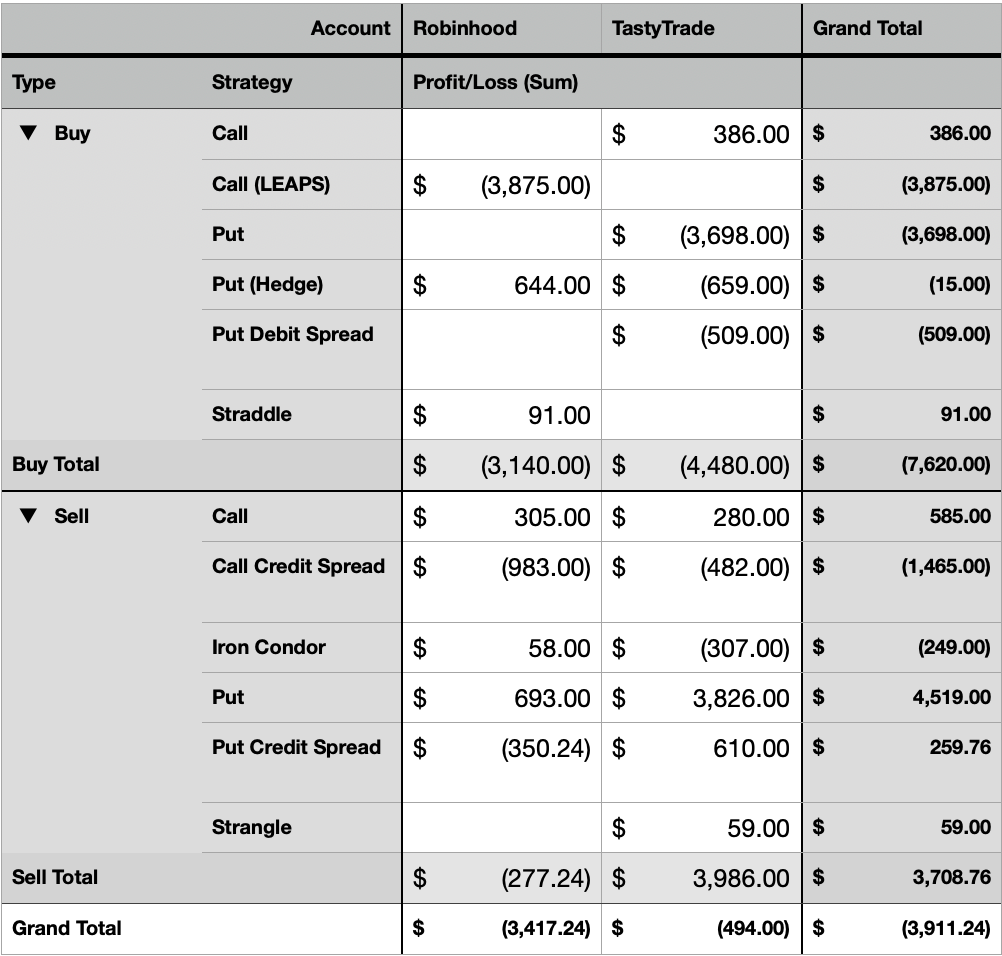

Here is a breakdown of P/L by Buy v/s Sell strategies I have used so far.

Now, while I have said before that selling Puts continues to be profitable, one strategy that I did not notice has made me money is related to Calls, excluding LEAPS Calls. Looks like my trading style with Calls has made money overall - both while buying calls as well as when I sold them. Now some of those sold calls wins came in this week, but I am pleasantly surprised about this observation.

Plan for Next Week

Because of the spike in VIX, I entered some new trades this week.

In about a week, META fell over 125 points/handles, going from above $750 to under $625. I had opened a Bull Call Diagonal in META as I mentioned last week.

META has seen a massive drawdown and has opportunities. I have an open Call Diagonal position on META.

The Sold Call part of the Spread was 90% in profit, so I closed it. Now I only have a Call option open on it that expires next month. I am speculating META will rise over the next couple of weeks. So I need to continue to monitor this position. I will add it to my tracking sheet once the entire diagonal trade is closed to see how it did since this was my first ever diagonal play.

And then, I hope VIX stabilizes this week so I can close some of my currently open positions at a profit as well as reducing the buying power I am using. I am at about 50% of my buying power as things stand - I usually like to keep it under 30%.

Here is my current watchlist. The watchlist varies but I tend to keep general prices of about 20 tickers in my head - and so I chop and change to stay close to that number. And even in this, I tend to not trade symbols in here when their liquidity is not 4 stars - this view is from a custom watchlist I have setup on TastyTrade.

My general approach is to first look at my open positions and see if they need any management. Then run through this watchlist to see if there are any opportunities using V-V-L, that is, Volatility (IV Rank and IV Index), Volume, and Liquidity. And then act on those opportunities if I have enough capital. I can say there are way too many opportunities available for me to act on than my account size allows!

In a future post, I will share an example of how I look at prices once I have decided what symbol to speculate on.

Thanks for following along. See you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.