Day 80 - Restart

Happy Labor Day!

Market Recap

Both SPY and QQQ were slightly bearish last week, SPY ending with a modest decline, QQQ slightly more bearish.

Last Week:

- SPY ($645.03): -$0.40 (-0.06%)

- QQQ ($569.68): -$2.64 (-0.46%)

Year-over-Year:

- SPY: +$84.26 (+15.03%)

- QQQ: +$94.64 (+19.92%)

QQQ underperformed SPY for a third straight week.

Trading Update: Aug 25 - Aug 29, 2025

After a tumultuous previous week where I lost ~25% of my portfolio, I am giving myself a mental reset.

I also want to give this format of sharing information a refresh. The current approach has resulted in me sharing open positions, but I now want to get away from that.

From now on, I would now only be sharing positions I have closed, and avoid sharing open positions. That way, I can narrate the full history of a bet, and hopefully can capture some learnings for myself as well.

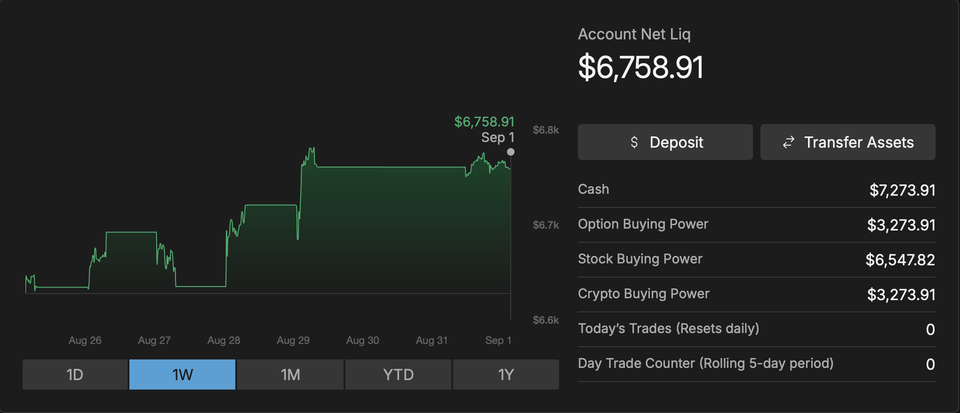

Portfolio Status

The total Realized Profit/Loss for the year currently stands at -$5,495.

I went into this journey with my eyes wide open about possibly losing all of my capital. Yet, losses still hurt. And, they play with my ego.

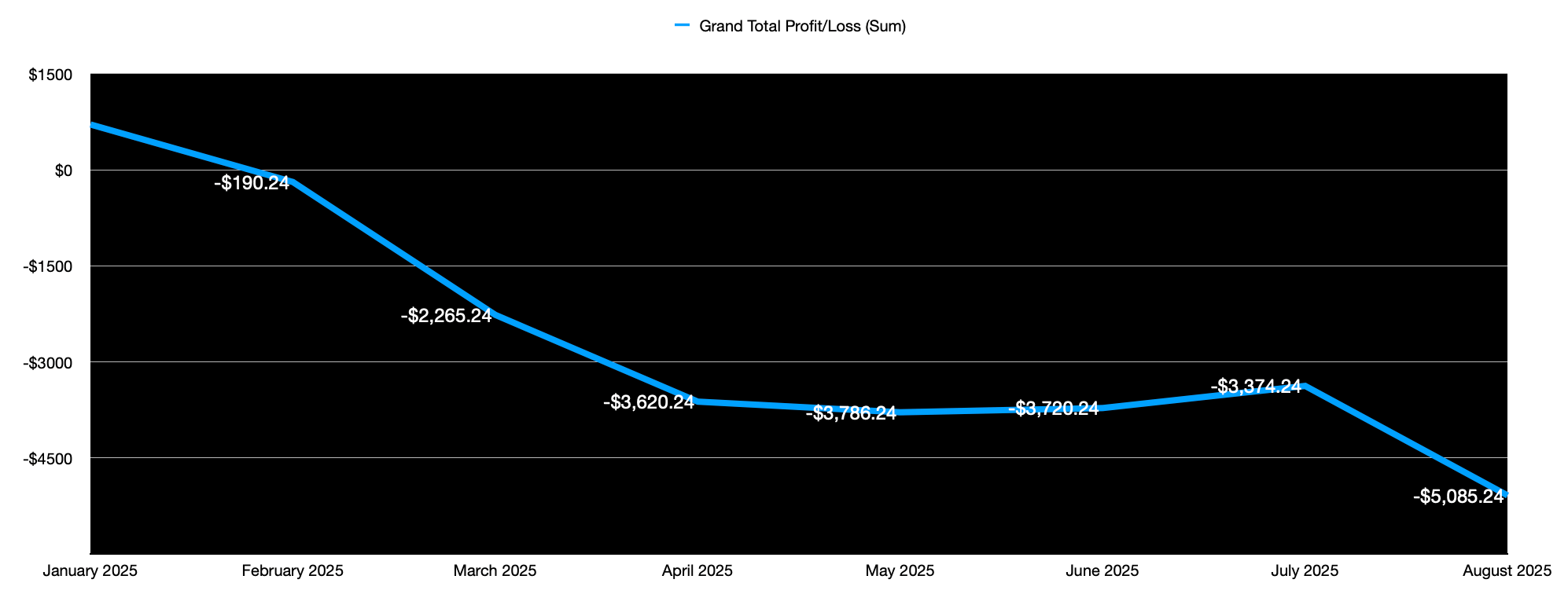

Here is the Profit/Loss trend for the year.

Every time I think I know something and start making profits, comes along a series of trades that wipe out all gains.

This shows one of the following possibilities:

- I am unable to stay disciplined.

- The losses are reflecting the true risk I am taking on.

- The amounts are too small to let the law of large numbers work in my favor.

If it is the first, it is fixable.

If it is the other two, I still have some ways to go to refine which strategies make sense in what market conditions, i.e., I am still learning.

And, from Wolfram:

A "law of large numbers" is one of several theorems expressing the idea that as the number of trials of a random process increases, the percentage difference between the expected and actual values goes to zero.

The number and volume of my trades are still too statistically insignificant. I cannot for sure say that with less than at least a hundred trades of each strategy, what I am attempting is a success or a failure. The trick then is to continue to save money and continue to refine my trading behavior such that the trend curve reverses and starts to show some gains, when my actual probability of wins starts to match expected probability.

Portfolio Strategy Breakdown

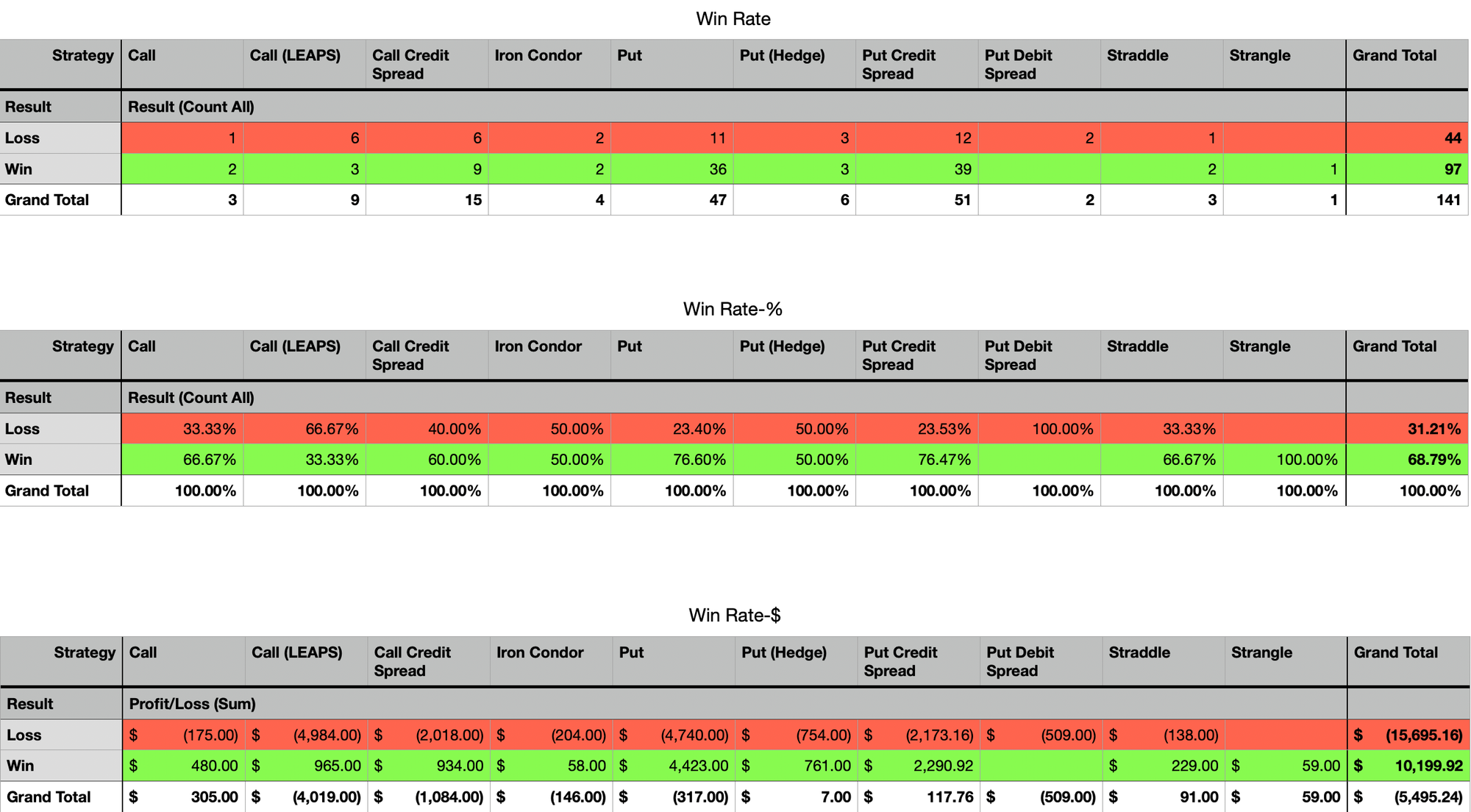

Here's a view showing my Win Rate breakdown by strategy deployed.

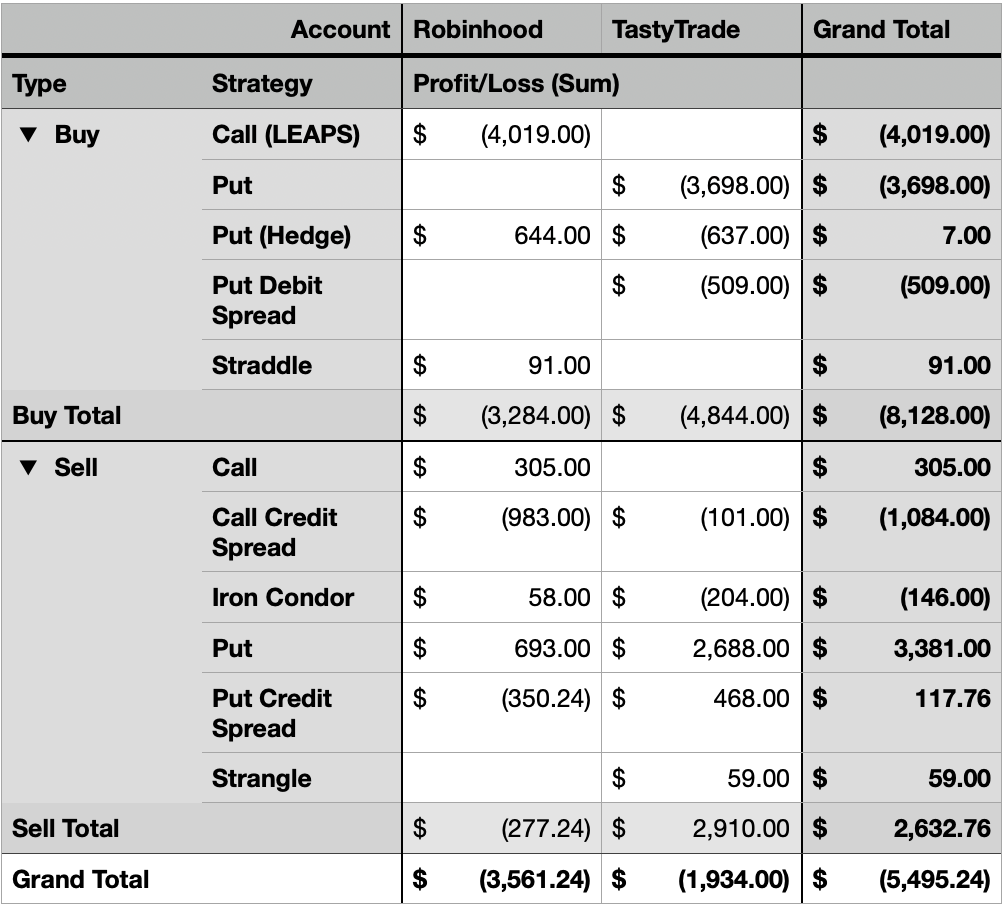

Here is a breakdown of P/L by Buy v/s Sell strategies I have used so far.

Win rate and P/L by strategy remain skewed by oversized losses like last week’s.

Plan for Next Week

I have 4 open positions that do not yet need management, and I am using ~50% of my buying power. Not expecting to make any new trades unless IV is really great.

If an opportunity does present itself, I will likely continue to bet on Spreads.

Thanks for following along - see you next week! Hope you tune in.

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.