Day 72

Market Recap

The market continued a bullish run last week. SPY was up nearly 11 points and QQQ was up nearly 8 points.

- SPY: +1.84%

- QQQ: +1.41%

Year-over-year:

- SPY: +13.27%

- QQQ: +12.99%

Trading Update: June 30 – July 3, 2025

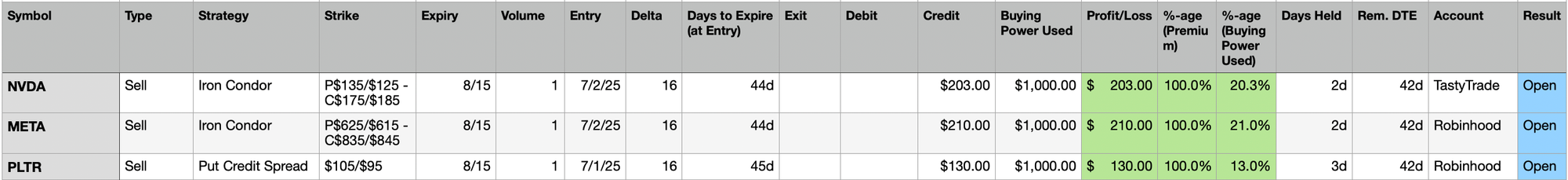

Here is a summary of all trades I made during the week (details listed below).

- Unrealized Profit/Loss: +$1200

- Realized Profit/Loss: N/A

- Buying Power Used: $6.6K

- Buying Power Remaining: $6.5K

Closing Trades

None this week.

New Trades

- Sold NVDA 8/15 $10 Wide Iron Condor

- Sold $135 Put, Bought $125 Put - Sold $175 Call, Bought $185 Call

- 44 DTE

- Risk: $1000

- Premium/Credit Received: $203

- Sold META 8/15 $10 Wide Iron Condor

- Sold $625 Put, Bought $615 Put - Sold $835 Call, Bought $845 Call

- 44 DTE

- Risk: $1000

- Premium/Credit Received: $210

- Sold PLTR 8/15 $10 Put Credit Spread

- Sold $105 Put / Bought $95 Put

- 45 DTE

- Risk: $1000

- Premium/Credit Received: $130

Last week, I noted:

... VIX is currently at 16. This low VIX means the premiums for selling are not quite juicy enough. I will wait for something to show up for a few days, and if nothing does, will most likely open some spreads on QQQ or SPY on their red days ...

It did not look like SPY or QQQ were going to have any red days, so I went seeking elsewhere for volatility.

I found a little bit of it on a few technology stocks - PLTR, META, and NVDA. They had some decent Intrinsic Volatility.

For each of the stock, I am generally bullish. I started with a Put Credit Spread in mind, and did so for PLTR. For META and NVDA, I instead opted to sell Iron Condors. My rationale for those is that they are perhaps at the right currently optimal price, and so I do not expect huge swings up or down in the next 45 days.

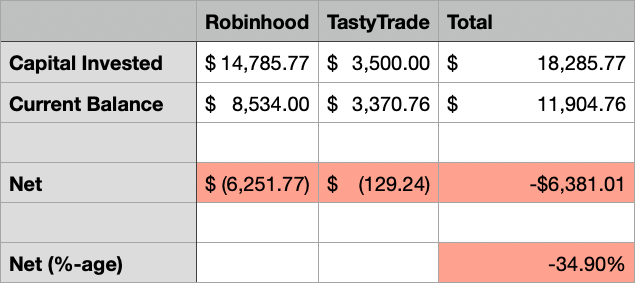

Portfolio Status

No new gains or losses to show this week. All current trades are waiting to be managed or closed.

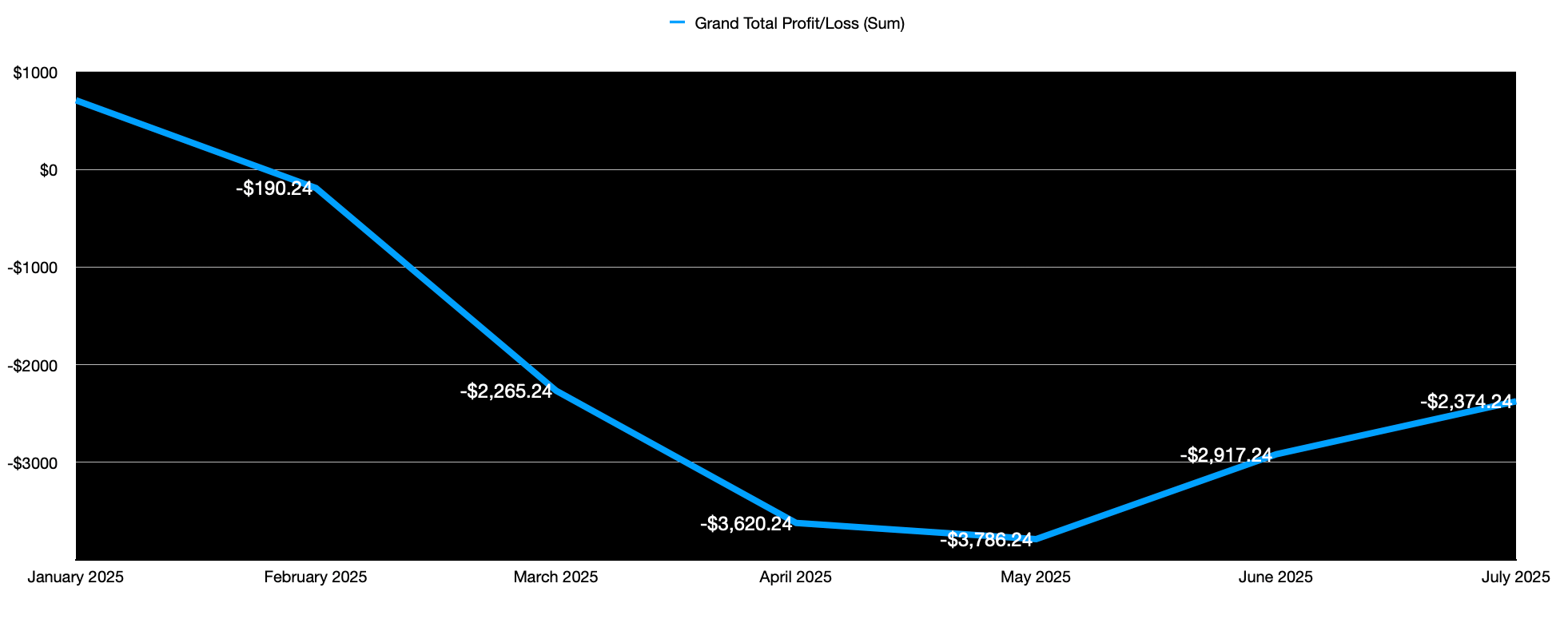

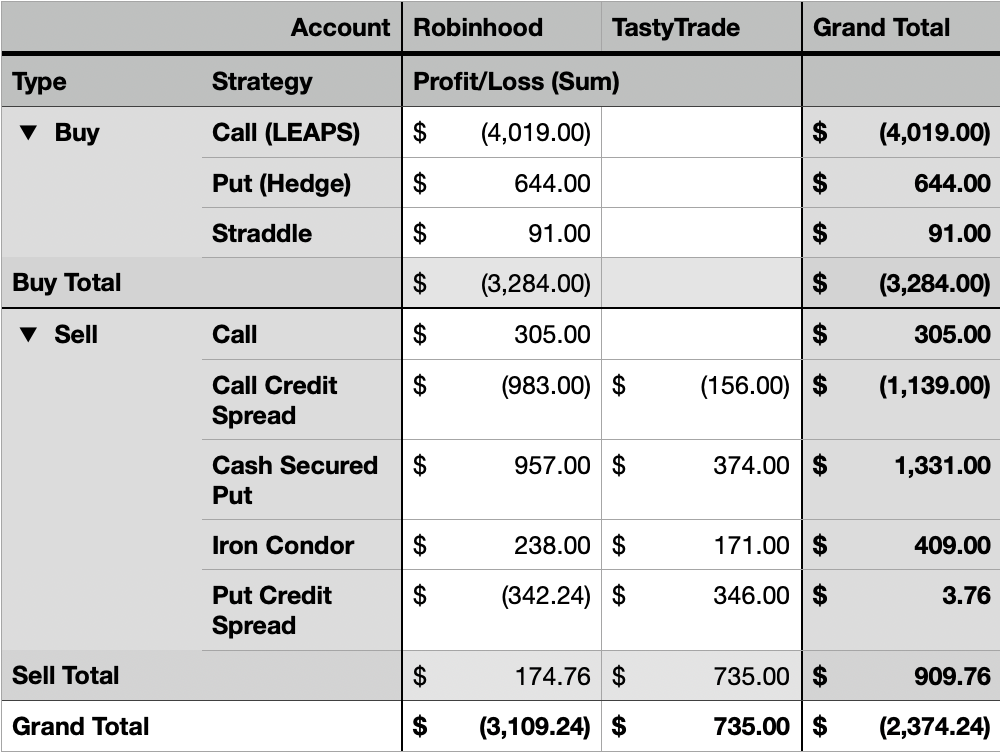

- 2025 Net P&L: Down $2.37K

- All Time: Down $6.38K

Profit and Loss Trend - Monthly - Year to Date

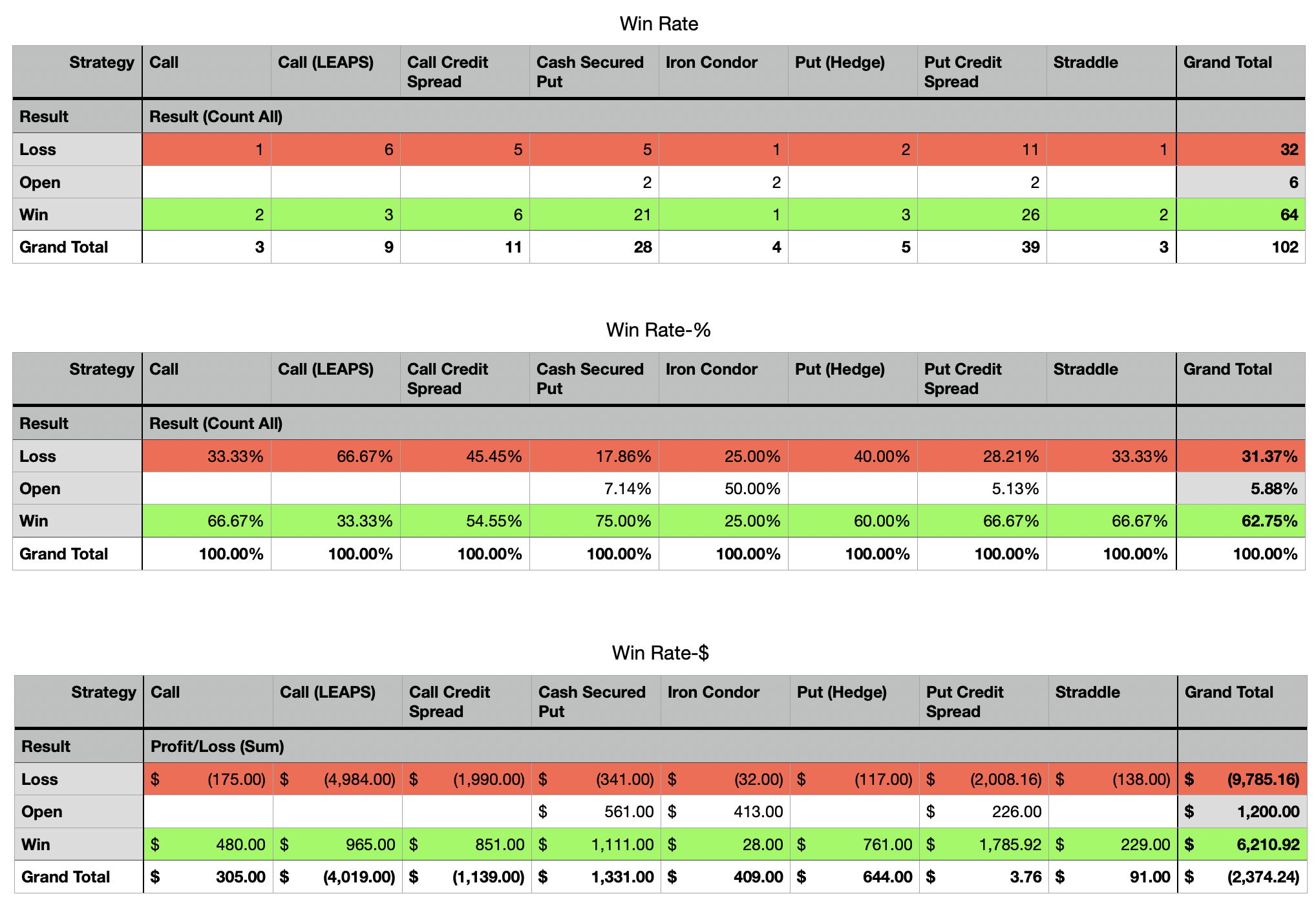

Portfolio Strategy Breakdown

Here's a view showing my Win Rate breakdown by strategy deployed. Although I have now crossed 100 trades, the sample size is still small and it is still too early to draw definitive statistical conclusions.

Here is a breakdown of P/L by strategies I have used so far.

- Best Performing Strategy: Cash Secured Put

- Worst Performing Strategy: Call (LEAPS)

Plan for Next Week

It has been 6 months now on this journey. And while it seems like I have learnt some things, I still know nothing.

It is quite humbling to stumble through this process. But I love a challenge and this is something I want to crack.

I am traveling a lot next week, so what I want to focus on is manage existing positions. I am also nearly 50% invested right now, so will likely only open new trades if I manage to close some out.

Thanks for following along - see you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.

New to Options Trading? A Quick Primer for Terms used Today!

Put Credit Spread (also known as Bull Put Spread, or Short Put Vertical Spread)

This is a very capital efficient way to be bullish on a ticker.

Essentially, the trade is comprised of:

- Selling a Put at a Higher Strike Price

- Buying a Put at a Lower Strike Price

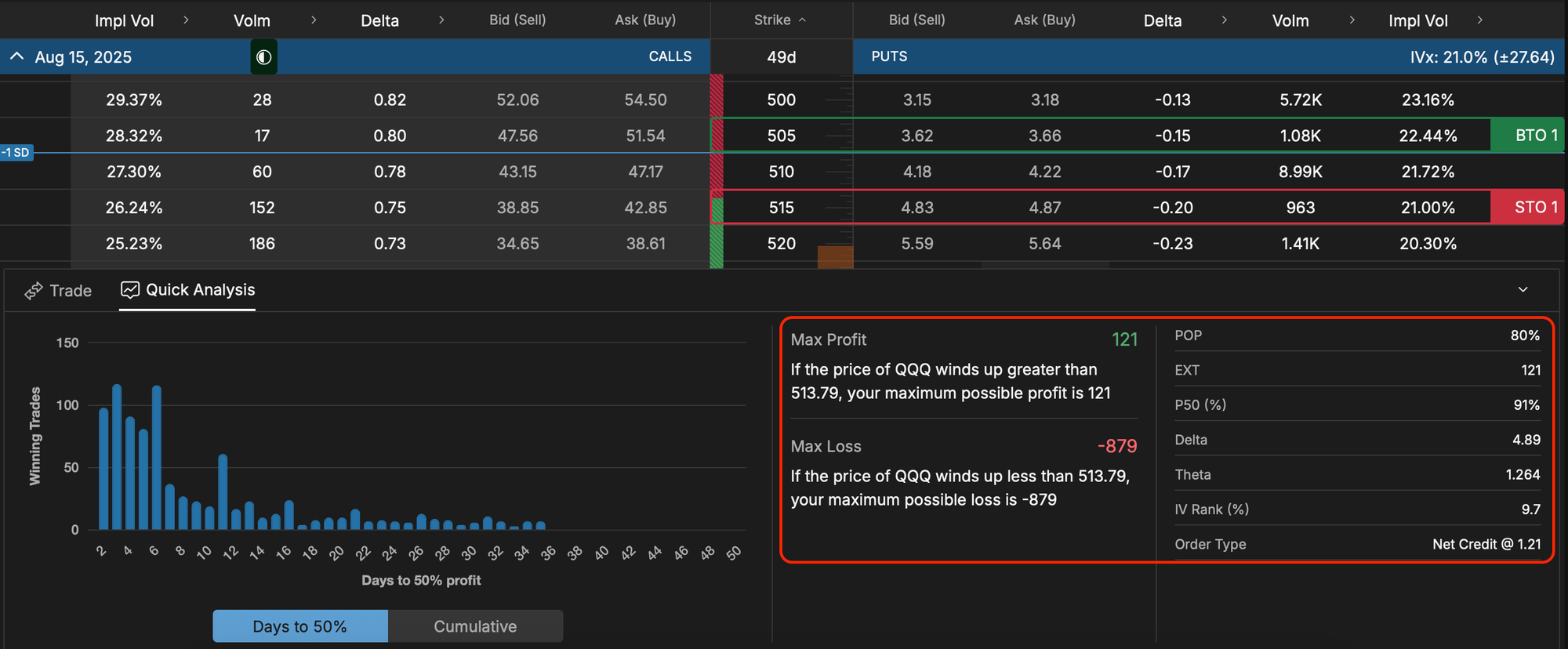

Here is how the trade setup looks based on last week's QQQ option prices.

Pay attention to some of the information shared in the analysis I highlighted.

- The extrinsic value of the Option trade is $121. This is the time value of the option.

- I am risking $879 to make a profit of $121. That is a near 13.77% gain, if I am right.

- My probability of being right is 80%, see POP.

- My probability of the trade reaching at least a 50% of $121 is 91%.

When I put such a trade up, to increase my odds of success, I typically close the trade at a 50% profit, and sometimes even lower at 30%, if the trade becomes profitable in less than a week of opening. That way my capital is released without me having to wait longer.

And if the trade moves against me, I am prepared to manage it at 21 DTE. This might involve rolling or just plainly closing the trade.

Here is some additional reading from the pros at TastyTrade: https://tastytrade.com/learn/trading-products/options/short-put-vertical-spread/