Day 70

Market Recap

For the second consecutive week, both SPY and QQQ were mostly flat, ending the week slightly lower than where they started.

- SPY: -0.39%

- QQQ: -0.03%

Year-over-year:

- SPY: +9.35%

- QQQ: +9.64%

Trading Update: June 16 – June 20, 2025

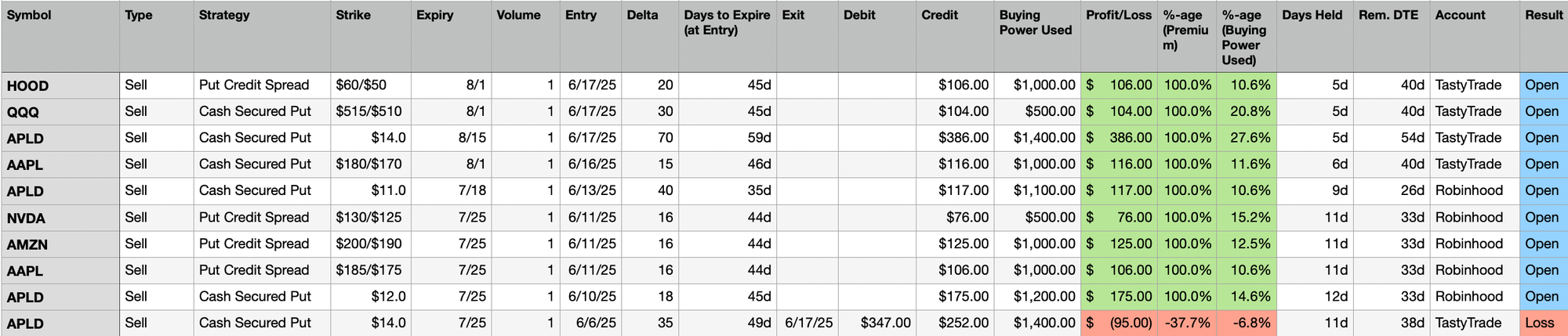

Here is a summary of all trades I made during the week (details listed below).

- Unrealized Profit/Loss: +$964

- Realized Profit/Loss: -$95

- Buying Power Used: $8.7K

- Buying Power Remaining: $4.8K

Closing Trades

I rolled the 7/25 $14 Cash Secured Put trade out to 8/1. This trade was tested, and I've been forced to defend it. Clearly, I misjudged the direction. I had anticipated that volatility would help APLD sustain its price for another week or two, but the momentum fizzled out sooner than I expected.

For now, rolling this position out in time netted me an additional $41. My goal isn't to own the stock, so I'll continue to roll it as long as feasible to avoid realizing a loss.

New Trades

This week I leaned some more into Credit Spreads.

- HOOD

- Sold 1 Put Credit Spread, Strikes $60/$50, Expires 8/1

- QQQ

- Sold 1 Put Credit Spread, Strikes $515/$510, Expires 8/1

- AAPL

- Sold 1 Put Credit Spread, Strikes $180/$170, Expires 8/1

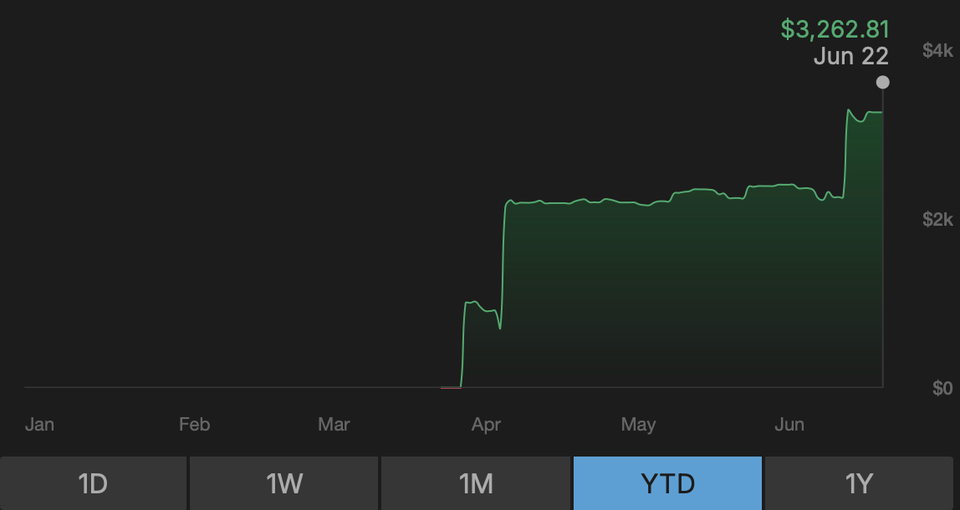

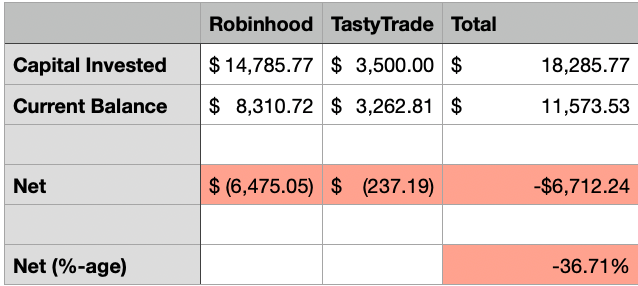

Portfolio Status

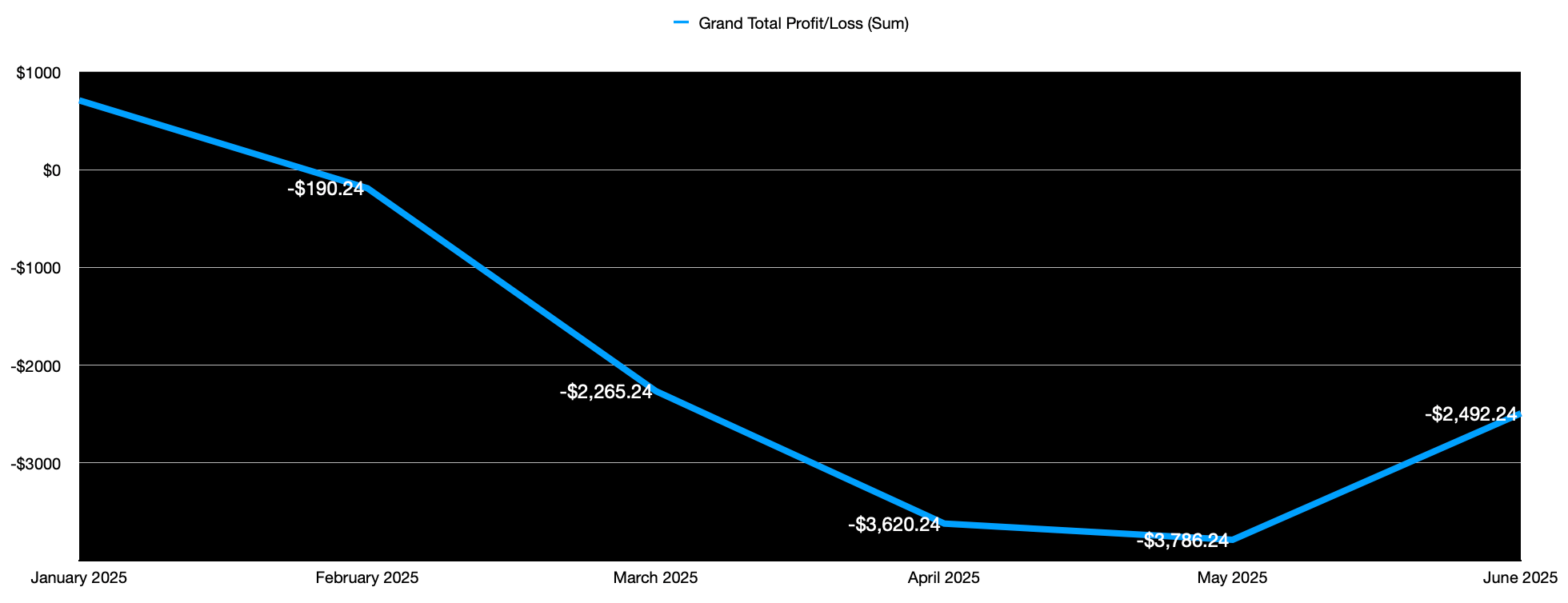

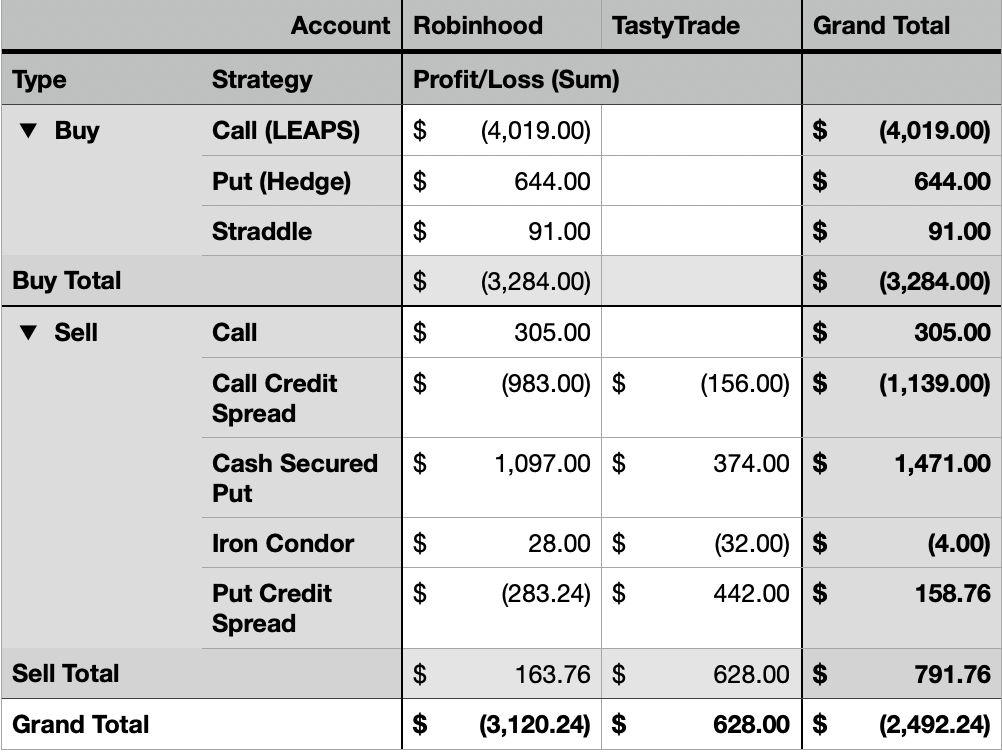

- 2025 Net P&L: Down $2.49K

- All Time: Down $6.71K

Profit and Loss Trend - Monthly - Year to Date

Portfolio Strategy Breakdown

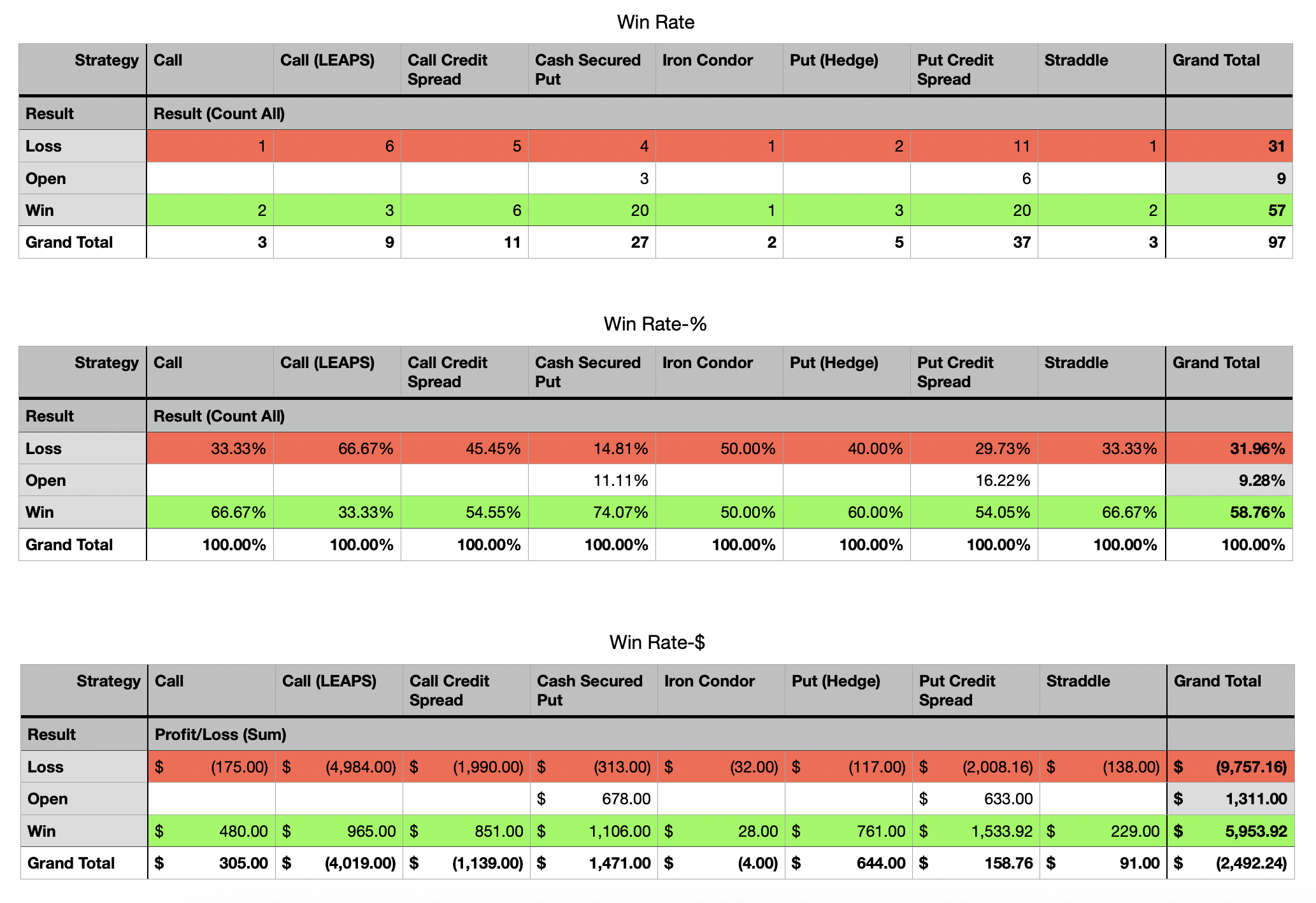

Here's a view showing my Win Rate breakdown by strategy deployed. While the sample size is still small and it's too early to draw definitive statistical conclusions, it provides an initial glimpse into performance.

Here is a breakdown of P/L by strategies I have used so far.

- Best Performing Strategy: Cash Secured Put

- Worst Performing Strategy: Call (LEAPS)

Plan for Next Week

Last week, I noted:

The thing that has stuck me as odd is how my Put Credit Spreads have resulted in losses, but my Cash Secured Put have not. They are both bullish strategies so they should both be reasonably aligned in their trajectory. Perhaps they will eventually, when I have stacked enough trades to get a statistical alignment in the two strategies.

As you may have noticed, I put on some more credit spreads to get more trades in. Right now, they are all open, so I do not have any learnings to share yet.

I also tried running some backtests using a tool provided by TastyTrade, based on my usual trade setup. Unfortunately, I didn't find the tool particularly useful. It lacks features to simulate the basic mechanics I employ, primarily offering only default settings. While defaults might have some limited use, they don't significantly help my specific analysis.

It would be incredibly beneficial if trading platforms adopted more machine learning to provide personalized, scalable feedback based on individual trading styles. Perhaps such quant tools are already in-house at firms like Renaissance Technologies, and it will take another couple of decades for them to become widely commoditized. Until then, we continue to test the waters ourselves.

Tactical Plan for Next Week

Tactically, I anticipate a minor volatility spike in the near term due to geopolitical tensions, though I expect the volatility to settle down within two to three weeks. I have some spare cash available this time and plan to start deploying more capital as volatility increases, continuing until I either run out of cash or volatility begins to subside.

Thanks for following along - see you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.

New to Options Trading? A Quick Primer!

If some of the terms here sound like a foreign language, don't worry! Options trading can seem complex at first, but it's essentially about contracts that give you the right, but not the obligation, to buy or sell an asset (like a stock) at a specific price (strike price) by a certain date (expiration date).

- Call Options: Give you the right to buy the stock. You typically buy calls if you think the stock price will go up.

- Put Options: Give you the right to sell the stock. You typically buy puts if you think the stock price will go down.

- Selling Options: When you sell an option, you collect a premium (money) upfront, but you take on an obligation to buy or sell the stock if the option is exercised by the buyer. Strategies like Credit Spreads (which I often use) involve selling options to collect this premium while also buying another option to limit your risk.

I'm sharing my journey and learnings as I navigate these strategies. Always remember that options trading involves significant risk and is not suitable for all investors. It's crucial to do your own research and understand the risks before trading.

Another strong advice I would provide is you should completely avoid Options if trading in the most loose sense, i.e., buying and selling, does not sound interesting to you - doing something you do not like, when that something has high stakes, is the surest recipe for disaster. I do it because I love the risk associated with it, or more so, I love how I feel better about being able to manage risks because I am exposed to this world of options trading.

I learn from various sources but my favorite currently are the folks at TastyTrade - they have a huge amount of media - including blog posts, backtests, and hundreds of videos if you are curious. Here is a starting point: https://tastytrade.com/learn/trading-products/options/how-to-trade-options/