Day 65 - End of Week 17

Market Recap

Both major indices I have been tracking ended positive for the fourth consecutive week:

- SPY: +4.02%

- QQQ: +5.18%

Year-over-year:

- SPY: +11.02%

- QQQ: +13.68%

Trading Update: May 12 – May 16, 2025

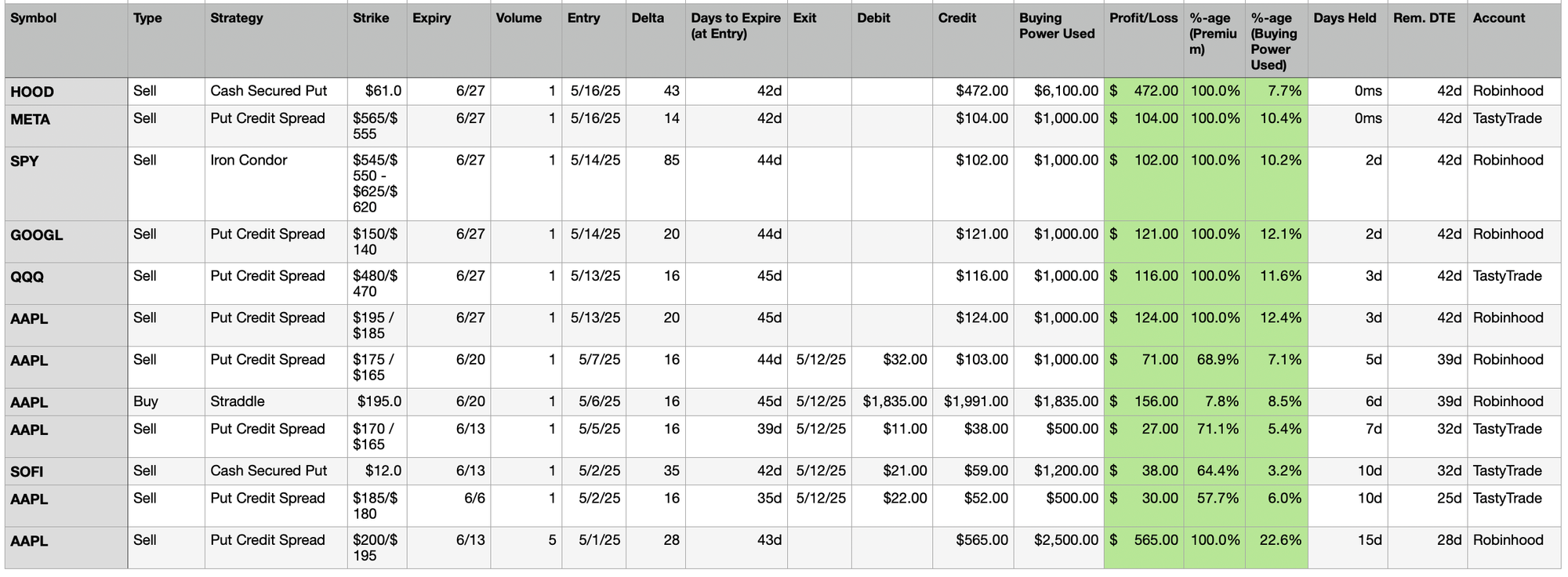

Here is a summary of all trades made during the week (details listed below).

- Unrealized Profit/Loss: +$1,604

- Realized Profit/Loss: +$322

- Buying Power Used: $13,600

- Buying Power Remaining: $713

AAPL Straddle

Last week, I wrote:

AAPL $195 6/20 Straddle

Break-even Range: $176.65 to $213.35

This means that if held all the way to expiration (June 20), I’d only profit if AAPL moves outside of that range. More realistically, I’m hoping for an earlier spike in volatility - ideally before 21 DTE - so I can close the position for a profit (targeting at least $100).

I closed the Straddle at a 7.8% Profit ($156) in 6 days.

If you see the Active Trades above for this week, every single trade looks green. But don't be fooled by that, the unrealized profits are perhaps painting too rosy a picture. Most of the trades will be closed either at 50% profit or rolled out further. So the week was good but I am not out of the woods yet.

SPY Iron Condor

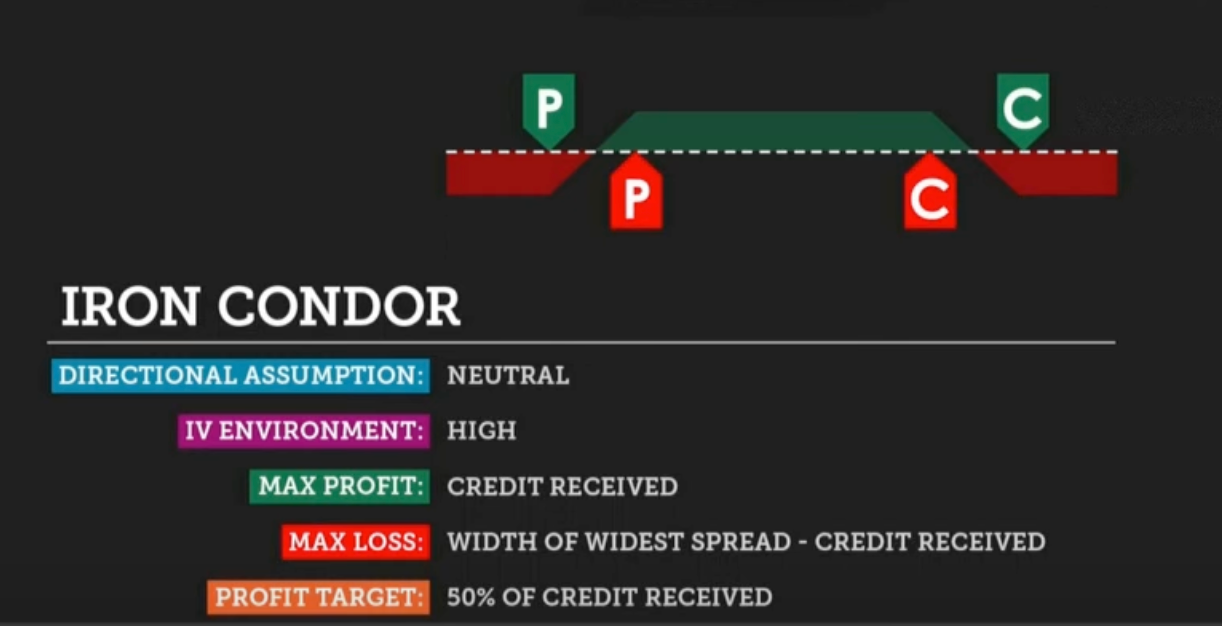

I was trying to research a bit more on the conditions for Iron Condor, when to enter, how to manage winners, losers, and side-ways moves, and realized I misjudged how wide I should have opened the SPY Iron Condor.

Here are the conditions I got for Iron Condor from a TastyTrade explanation.

I am neutral to bullish on SPY for the next 45 days, so directionally for me, the trade does make sense.

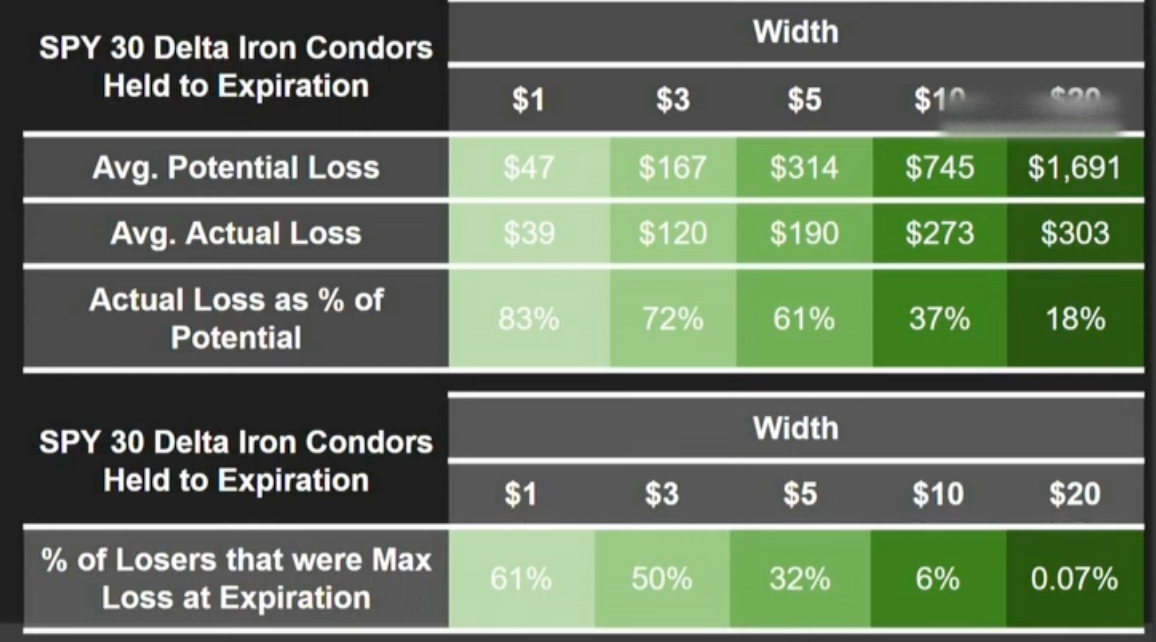

From the same TastyTrade source, here is the next bit of information that would have been useful before I entered the trade.

The higher the width, the lower the actual loss. And the higher the width, the more options (pun intended!) you have to manage either legs should the market move against you.

So, I entered a $5 wide IC but it seems like a $10 or $20 width for SPY makes more sense from a loss management point of view.

Here are the videos I referenced:

Before Trading Iron Condors, Understand These 3 Concepts

Exploring Iron Condor's Wingspan

HOOD Cash Secured Put

Another thing I wrote last week was:

Ways to Increase Premium Collected

Trade higher delta positions

Use wider spreads (e.g., $5–$7 width)

Focus on underlyings with naturally higher premiums

This week I entered a Cash Secured Put on HOOD because I noticed the Intrinsic Volatility was high (in 60s) and so the premium looked really good.

And as if on cue, HOOD went down after-market, most likely because Robinhood CFO sold 50000 Class A shares at a price of $61.9756. Robinhood is currently at $58.93, a drop of -4.55% in after-hours trading. Considering his total compensation for the previous year was above $10 Million, I am not sure what caused him to liquidate this position, but I guess it could be hard to resist a $3 Million payday on a Friday.

Portfolio Status

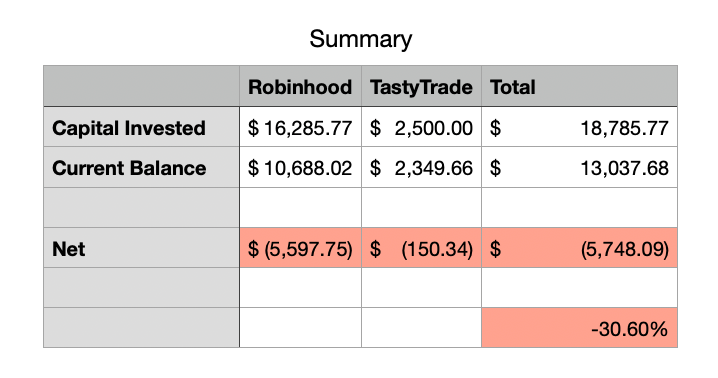

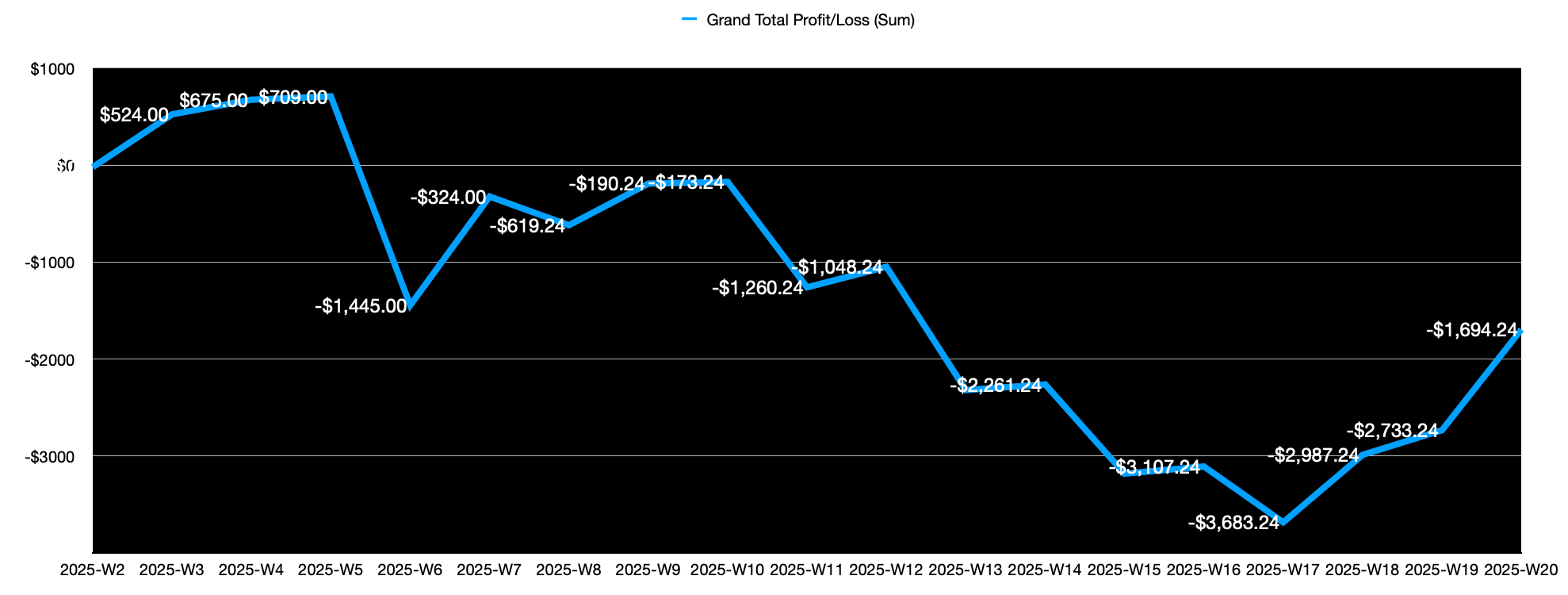

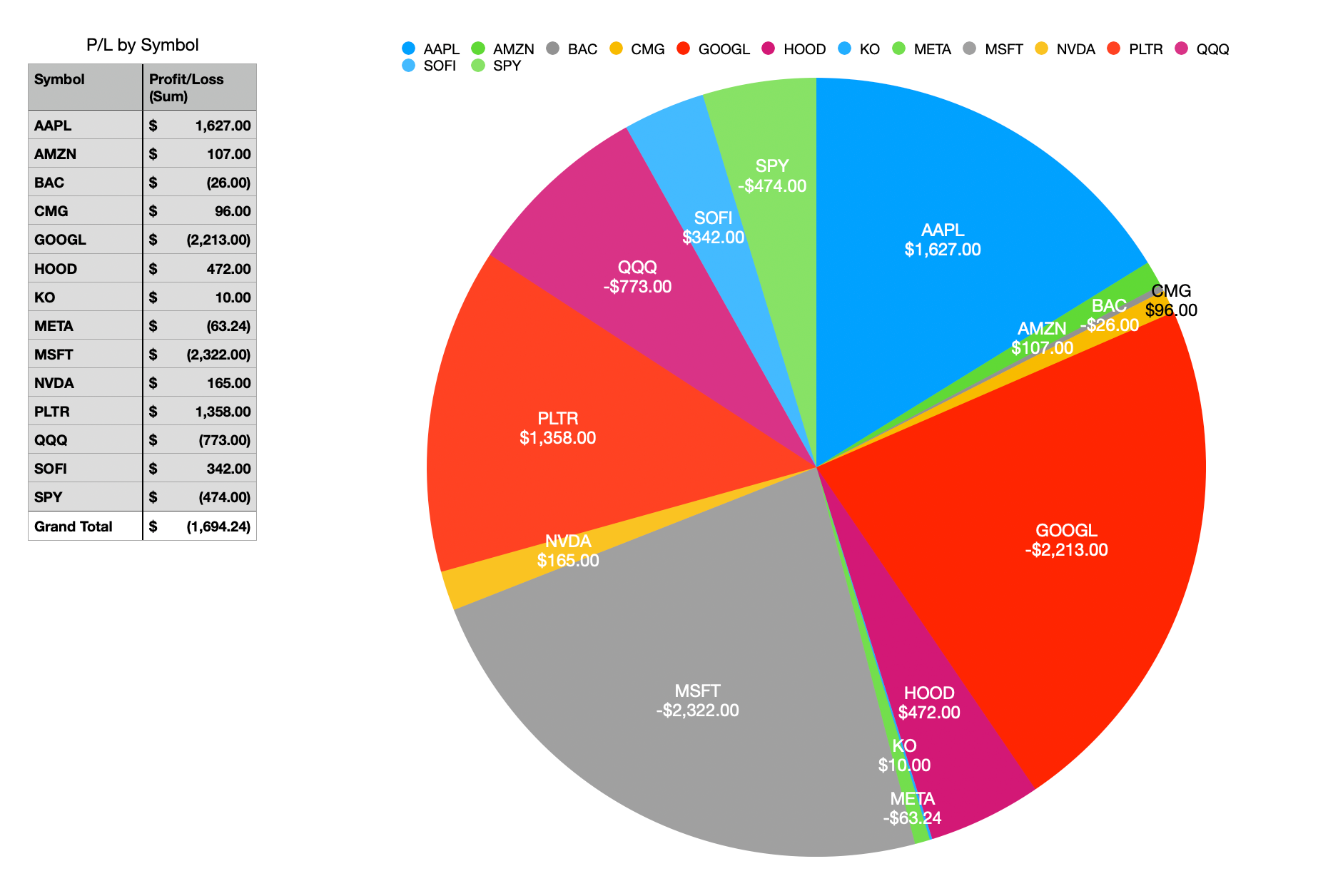

- 2025 Net P&L: Down $1,694

- All Time: Down ~5.7K (~31%)

Profit and Loss Trend - Weekly

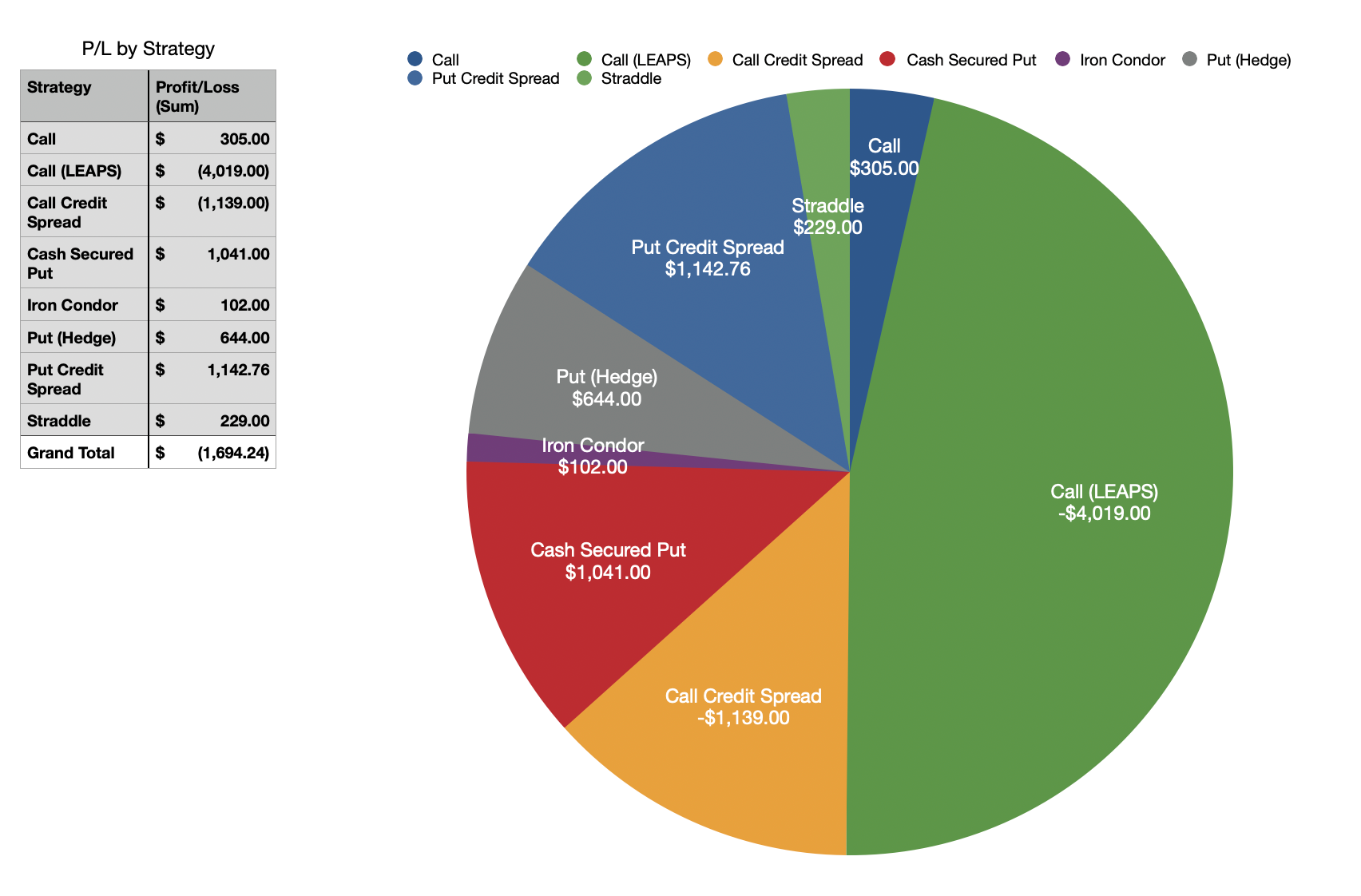

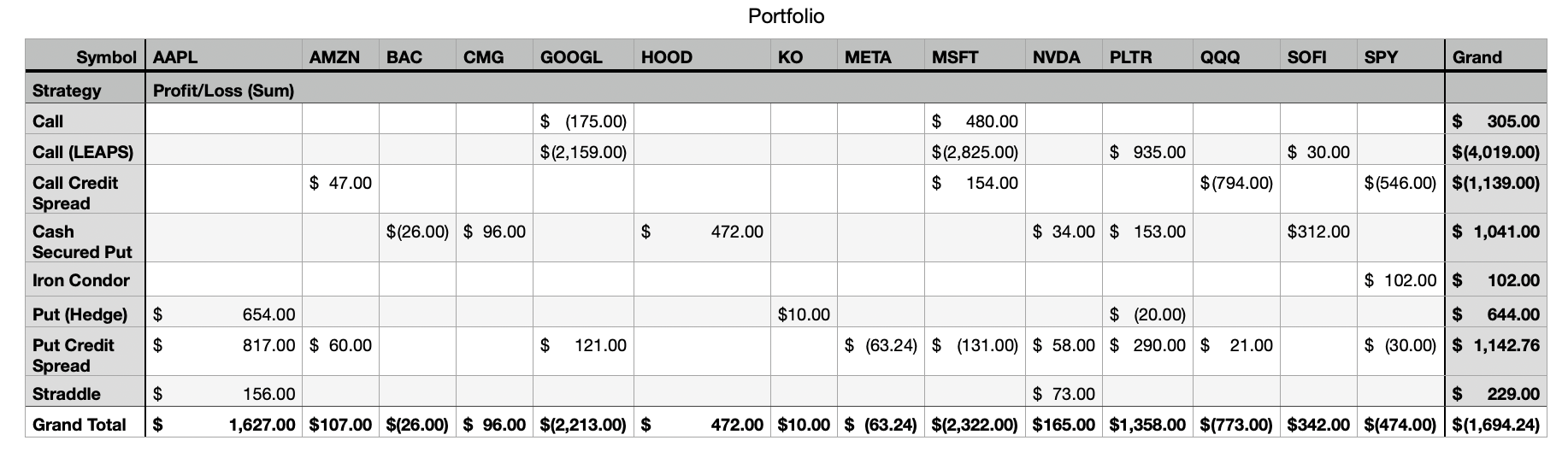

Portfolio Strategy Breakdown

Here is the latest snapshot of how my trades have performed across strategies and tickers:

Plan for Next Week

The AAPL $200/$195 Put Credit Spreads will reach the 21 DTE mark next week, so I plan to close or roll them out depending on what value they are at.

Most other trades have at least another week to go, but the GOOGL $150/$140 Put Credit Spread might reach 50% if GOOGL continues to try and reverse some of its losses. And so I might close that one out.

When the Spreads close, I will have some buying power, but until then, all I can do is wait unless some other market moves force me to manage any other position early.

Concluding Thoughts

There are so many more strategies remaining to try before I find a comfortable set to trade in. While some strategies (such as Cash Secured Put) are easy to put on and manage, where I want to be is to be directionally insensitive, and have a strategy for each market condition.

This journey has been a roller coaster so far. Managing my emotional state while working a full time job as well as straddling the Options world has not been easy. But it has been liberating in the sense that I do not need to blame anyone for my success or failure here, it is all on me.

Thanks for following along - see you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.