Day 99

I got caught flat-footed on a big down move in SOFI. And tried to compensate by increasing my risk profile.

Market Recap

There was some volatility during the week, but both SPY and QQQ were both nearly flat for the week after the brief storm subsided.

SPY is at ~$690, and QQQ is on ~$620.

VIX is slightly elevated, at ~17.5.

Trading Update

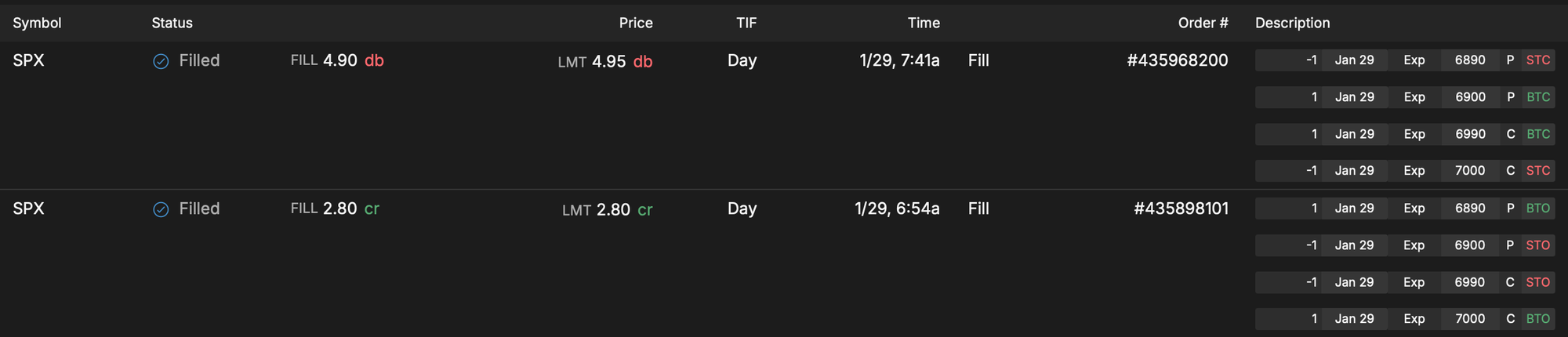

Last week, I made $285 on a Zero-DTE Iron Condor, this week I lost $210 on a similar setup. Although looking at the trade in hindsight, I entered at the right time, but exited at the wrong time - the trade would have given me the same amount of profit if I would have followed last week's exit timing.

I love trading Zero-DTEs on SPX, but the challenge is that it is hard to keep an eye out on it when you have a day job. So it is not the smartest trade for those like me trying to trade only in non-working hours. For me that typically is an hour just after market open, and an hour before market close. I am working on identifying a strategy to see if I can extend the Zero-DTE to a 1 or 2 DTE setup. And I want to place at least 1 such trade per week - typically I have only been risking a $1000 on the Iron Condors, so that should give me a long runway to try the experiment.

Because of the VIX spike, some of my positions moved around a lot. While most did not hit my close the trade threshold, I own 100 shares of SOFI and also have been trading on a range-bound thesis on SOFI, so all my SOFI trades turned red when SOFI went down.

But the rise in volatility led me to increase my risk profile - I entered a few additional trades counting on volatility to fall across the next 45 days. Let's see how that plays out.

Trade Ideas I am Thinking of For Next Week

I am out of buying power and all I can do is wait and watch.

Portfolio Status

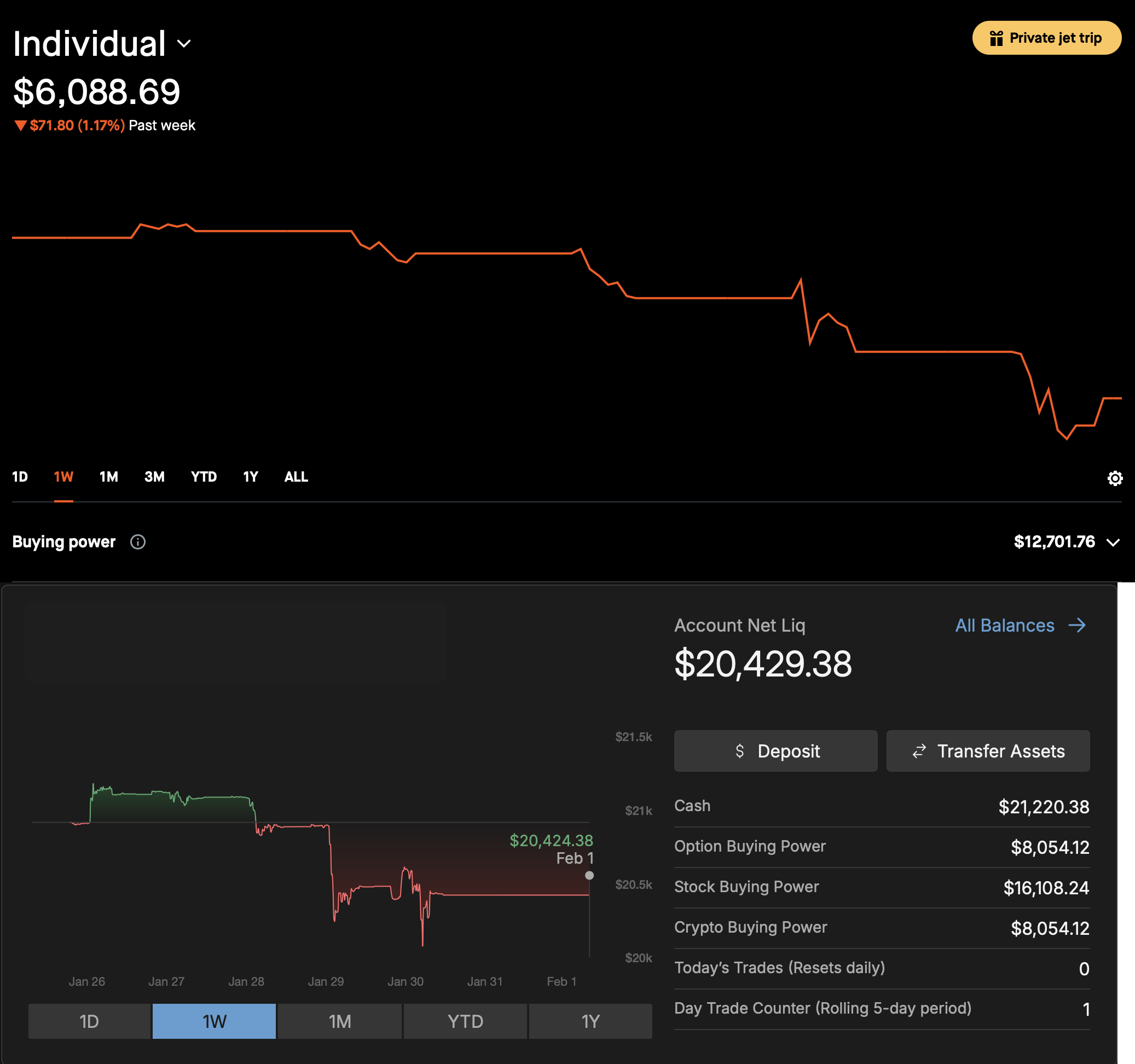

This week, my portfolio went a bit down and now I have ~$26K across TastyTrade and Robinhood.

Here is the current status, including unrealized P/L.

I have about ~20K of Option Buying Power available across both accounts. That is over 50% of my buying power working right now. That means I am out of any more new trades unless I end up rolling current positions to continue to maintain the Buying Power limits I have set for myself. I don't have a hard rule but I try to keep Buying Power utilization between 10 to 30 percent when VIX is 16 or below.

Thanks for following along. See you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.