Day 98

This is what I said last week:

I did not open any trades this week. While the VIX is still relatively low, geo-political tensions seem to be running high and I think that may lead to a spike in VIX.

And I was spot on - volatility spiked, causing VIX to shoot past 20 and stay there for a couple of days before coming down to last week's levels.

Market Recap

SPY and QQQ were both rollercoasters. They each slid over 2.5% early on before clawing back some ground.

SPY dropped ~0.9% (~$6), ending the week on ~$688.

QQQ dropped as well, dropping by ~0.5% (~$3), ending the week on ~$621.

Trading Update

I made some quick profits because of the volatility spike, entering and exiting following trades within the week.

- +$51 on a 3/20 $560/$550 QQQ Bull Put Spread.

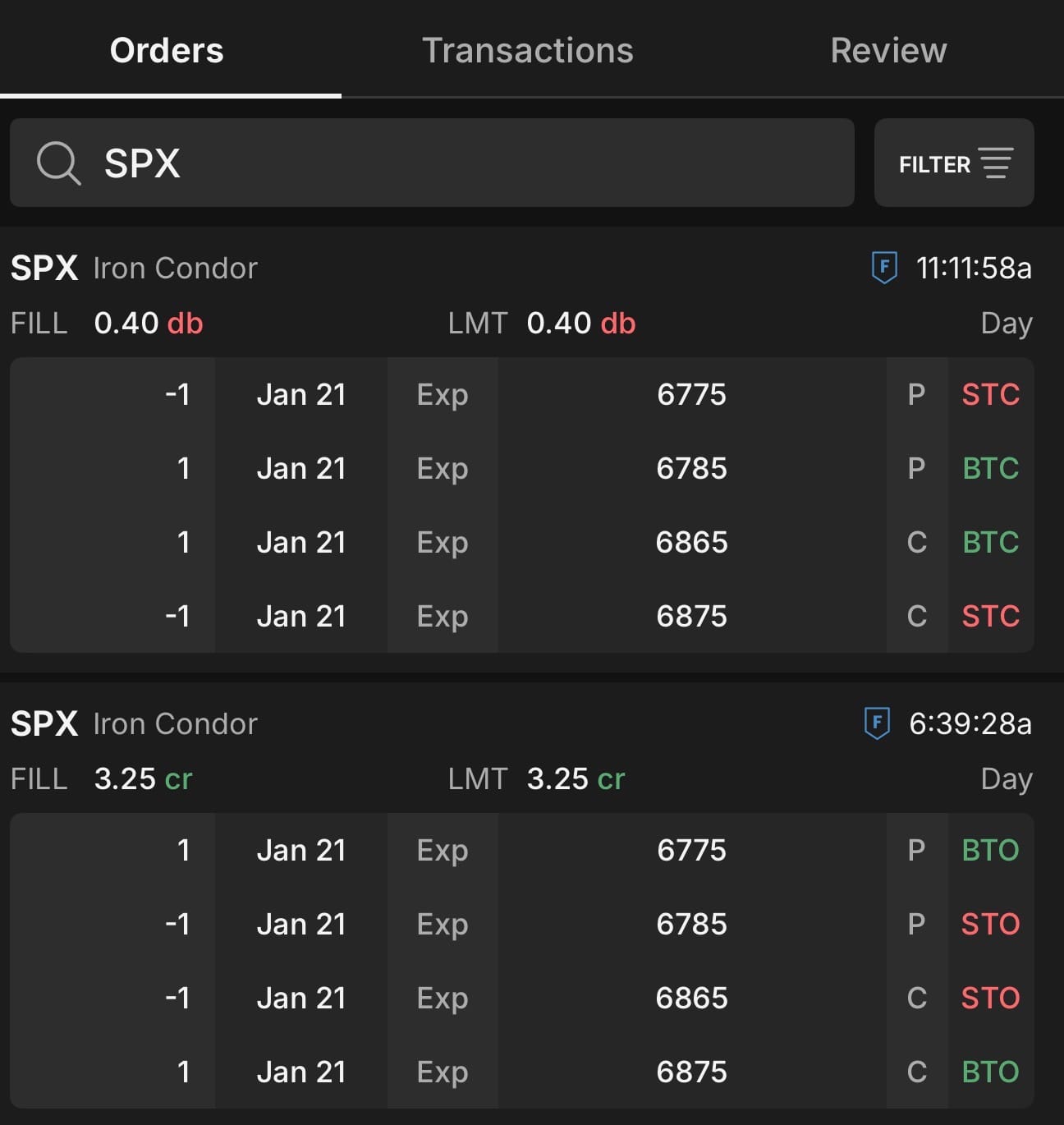

- +$285 on a Zero DTE (Days to Expire) $10-wide SPX Iron Condor

- +$30 on a 2/20 $195 PLTR Call

The SPX Zero-DTE was a lucky trade. I am not sure if that is repeatable. But here is the thought process I had. Volatility was high, so even far out of the money prices were showing great premiums.

And the market was in recovery. This felt like the classic case of market takes an elevator down, but goes up by stairs - and trading based on this adage paid off.

I sold a $10-wide Iron Condor receiving $325 as the premium. I speculated market would not fall any further, and it would not shoot up any higher as well, specifically it won't go back to the immediate last high it was at. I waited maybe 10 minutes after market open to open the trade with the assumption that I will be out of the trade in half-an hour.

However, the price didn't move a lot after I sold, and as volatility started falling, I looked good to collect all of my premium. By the time I closed the trade, I had collected ~87% of the original premium. That has to be the fastest I’ve ever collected over 80% of a premium.

Check out the Zero-DTE SPX Iron Condor orders below.

Trade Ideas I am Thinking of For Next Week

I have managed to bring my available buying power back to ~90% across both accounts.

Next week, there are quite a few earnings announcements coming up. And during earnings, usually there are a few opportunities that show up. I am inclined to keep out of earnings trades this time round, but if a setup looks good, I might take a shot.

The typical way I trade earnings is by either buying a calendar spread or selling a credit spread, both bullish, and both defined risk, but never both at the same time. The target price is 1-standard deviation out, on a 30-60 DTE time.

Additionally, I also need to manage my open positions in AAPL and NFLX. As well as my range-bound trade in SOFI - I placed another one this week. I'm sticking with the same SOFI thesis from last week - SOFI has been bouncing around within $25 - $32 for quite a while now.

Portfolio Status

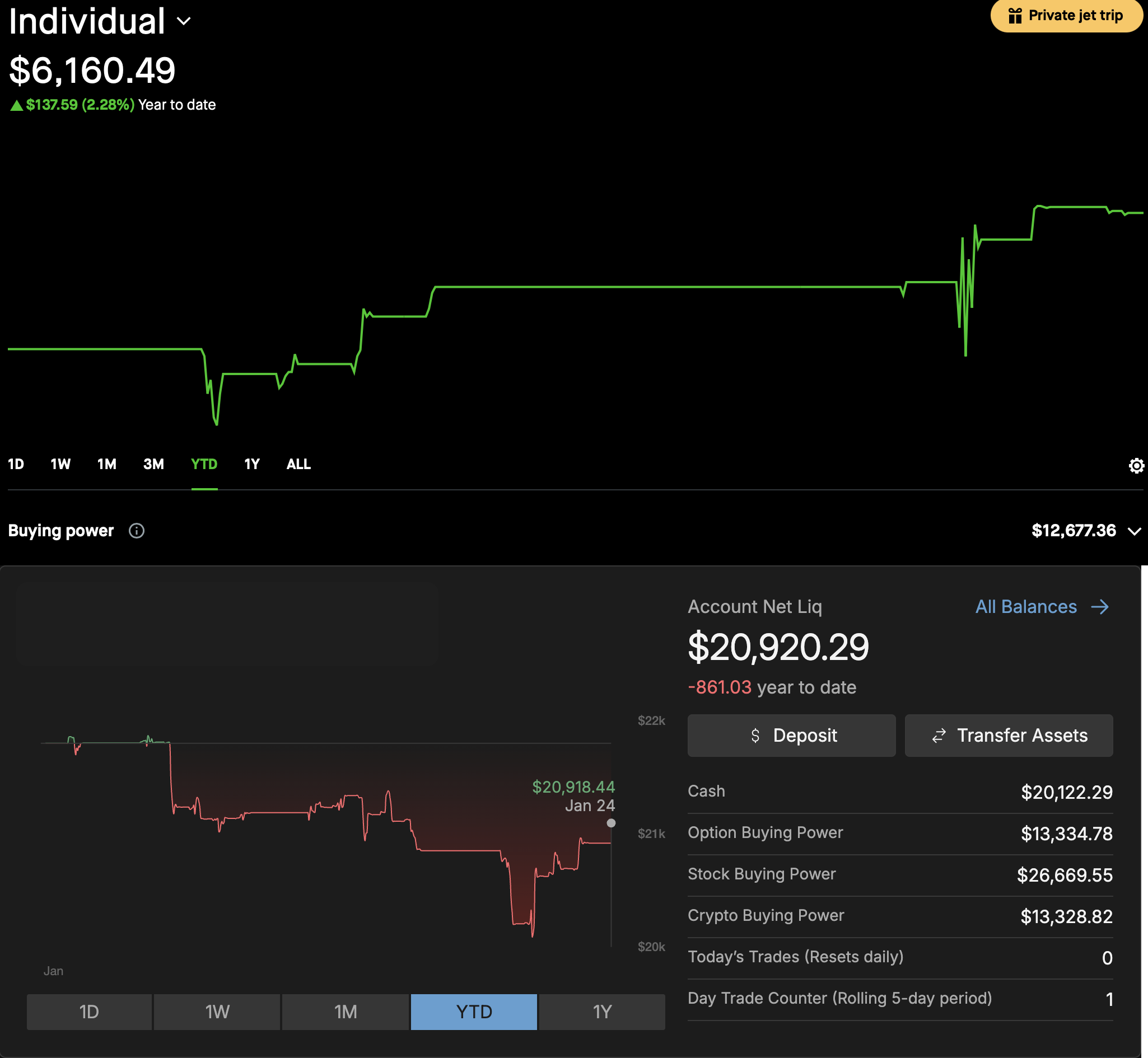

There are no major Portfolio level moves, I continue to have ~$27K across TastyTrade and Robinhood.

Here is the current status, including unrealized P/L.

I have about ~25K of Option Buying Power available across both accounts.

The 1-Day Trade Counter in TastyTrade is the SPX Zero-DTE I placed. I would love to place more Zero DTEs, but I don't have $25K and don't want to risk being flagged as a Pattern Day Trader by the SEC.

I am really hoping they do away with the constraint of limiting day trading for retail traders. Retail traders shouldn't be "protected" by rules that actually limit our ability to manage risk just because we don't have $25k in a single account. Anyway that's a rant for another day.

Thanks for following along. See you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.