Day 97

I did not open any trades this week. While the VIX is still relatively low, geo-political tensions seem to be running high and I think that may lead to a spike in VIX.

Market Recap

SPY dropped ~0.75% (~$5) last week, ending the week on ~$691.

QQQ was slightly down as well, dropping by ~0.4% (~$2), ending the week on ~$621.

VIX is ~16.

It has been a relatively sedate start to the year for both SPY and QQQ.

Trading Update

I closed some positions to reduce my risk. I currently have 4 open positions across AAPL, NFLX, PLTR, and SOFI.

One of my AMZN Strangles got tested on the upside as AMZN saw some positive momentum. I took the loss, but not before I had rolled my Puts up, helping limit my net loss on AMZN to ~$191.

Here is the full series of trades on AMZN.

- I started out with a Feb 13 $200/$255 Strangle on Jan 2nd.

- As AMZN moved higher, it tested my $255 call, but since it moved away from the $200 Put, I closed that for a profit.

- Next day, I rolled the Put higher, at $220.

- A day later, I closed the call at $255, choosing not to find what happens at 21 DTE.

- And finally, I closed the $220 Put at a profit.

As I write this now, AMZN has moved back sharply and is now at ~$238. I guess I could have waited a bit longer, but who knows what future brings - it's kind of pointless to think what might have been.

| Date | Sub Type | Description | Value | Quantity | Average Price | Commissions | Fees | Multiplier | Expiration Date | Strike Price | Call or Put | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2026-01-12T10:53:55-0800 | Buy to Close | Bought 1 AMZN 02/13/26 Put 220.00 @ 2.10 | -210.00 | 1 | -210.00 | 0.00 | -0.12 | 100 | 2/13/26 | 220 | PUT | -210.12 |

| 2026-01-07T06:41:55-0800 | Buy to Close | Bought 1 AMZN 02/13/26 Call 255.00 @ 7.04 | -704.00 | 1 | -704.00 | 0.00 | -0.12 | 100 | 2/13/26 | 255 | CALL | -704.12 |

| 2026-01-06T08:16:04-0800 | Sell to Open | Sold 1 AMZN 02/13/26 Put 220.00 @ 4.05 | 405.00 | 1 | 405.00 | -1.00 | -0.12 | 100 | 2/13/26 | 220 | PUT | 403.88 |

| 2026-01-05T11:58:02-0800 | Buy to Close | Bought 1 AMZN 02/13/26 Put 200.00 @ 1.48 | -148.00 | 1 | -148.00 | 0.00 | -0.12 | 100 | 2/13/26 | 200 | PUT | -148.12 |

| 2026-01-02T12:20:26-0800 | Sell to Open | Sold 1 AMZN 02/13/26 Call 255.00 @ 2.38 | 238.00 | 1 | 238.00 | -1.00 | -0.12 | 100 | 2/13/26 | 255 | CALL | 236.88 |

| 2026-01-02T12:20:26-0800 | Sell to Open | Sold 1 AMZN 02/13/26 Put 200.00 @ 2.31 | 231.00 | 1 | 231.00 | -1.00 | -0.12 | 100 | 2/13/26 | 200 | PUT | 229.88 |

SOFI seems to be trading in a range.

Here is a 3-month chart - the ceiling seems to be ~$32 and the floor is ~$25.

I have been selling a ~30∆ Put when it has gotten close to $26 and selling a ~20∆ Call when it has gone over $28.5, between 30 to 45 DTEs, closing with a profit target anywhere between 30% - 50% of original premium received. This strategy has been profitable so far in this choppy market with low volatility. However, the premiums have gone down quite a bit so I may not continue this further until SOFI can breakout.

Trade Ideas I am Thinking of For Next Week

With earnings coming up for several stocks, due to position sizing on my existing positions, I am inclined to sit out this earnings season and not enter any new trades.

And with VIX being so low, I have been trying to get out of positions I am in so that I am better placed for going in when VIX rises. I managed to get out of AMZN but I still have others I am already tied in.

If I do manage to get out of some open trades and bring my available buying power to 90% (right now it is at a rather low ~56%) , I am thinking to start a weekly or twice a week spread on SPX. SPX being cash-settled seems to be a really strong motivator for me to begin trading spreads on. Cash settled means there is no risk of assignment, even if my trades are in the money, I would have foolproof guarantee of my maximum loss at the time I open the trade - which is something unavailable on the typical ETFs and Stocks I trade on.

NFLX and AAPL continue to lag and are almost trading like the market, with very little movement on the up, and continued downward turn since the start of the year (NFLX a little longer than that). I am long-term bullish on both, but my patience right now sure is being tested.

Portfolio Status

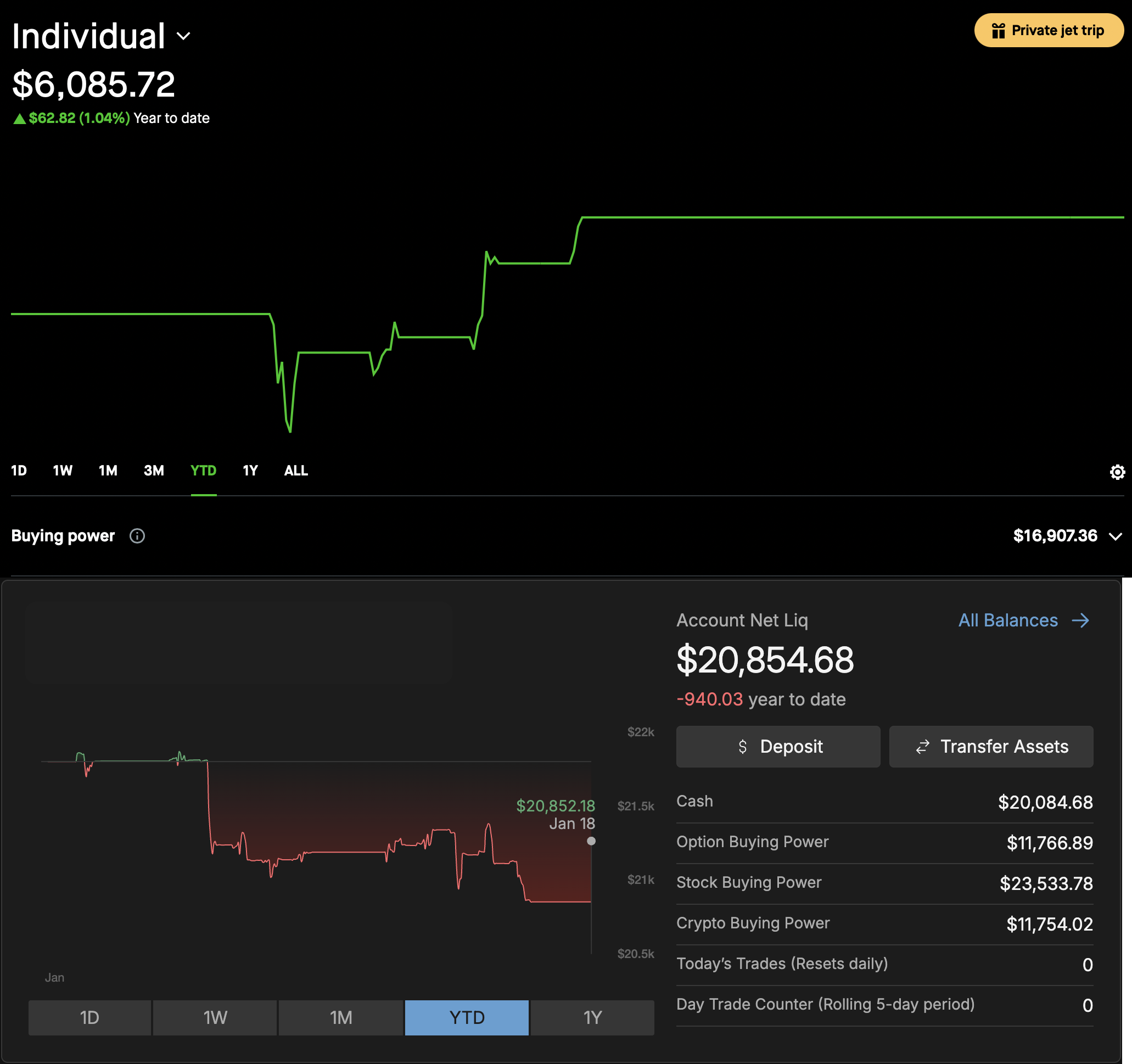

I continue to have ~$27K across TastyTrade and Robinhood. There hasn't been any major movement for the positions I am in.

Here is the current status, including unrealized P/L.

One clear behavioral difference between last year and this year for me is the intentional choice to trade more intentionally. Last year, just a few bad panicked sessions set me back for the entire year. This year, I am trying to better regulate my emotions.

For accounts, so far this year, I have used the Robinhood account only for SOFI trades I mentioned above. As you can see, that account is ~1% up Year to Date.

On the other hand, I have got my bets wrong in the TastyTrade account. None of AMZN, AAPL, NFLX, or PLTR moved as I expected them to. Let's see what next week brings.

Thanks for following along. See you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.