Day 94

As the year end approaches, VIX has gone down to its lowest in the last 3 months. Theta was my friend as the slow burn of time gave me some profits.

Market Recap

SPY was slightly down while QQQ was slightly up.

Last Week:

- SPY ($681.45): -$1.37 (-0.20%)

- QQQ ($618.71): +$4.69 (+0.76%)

Last 1 Year:

- SPY: +$99.68 (+17.13%)

- QQQ: +$108.27 (+21.21%)

Year To Date:

- SPY: +$92.06 (+15.62%)

- QQQ: +$104.41 (+20.30%)

VIX is now less than 15!

Trading Update: December 15 - December 19, 2025

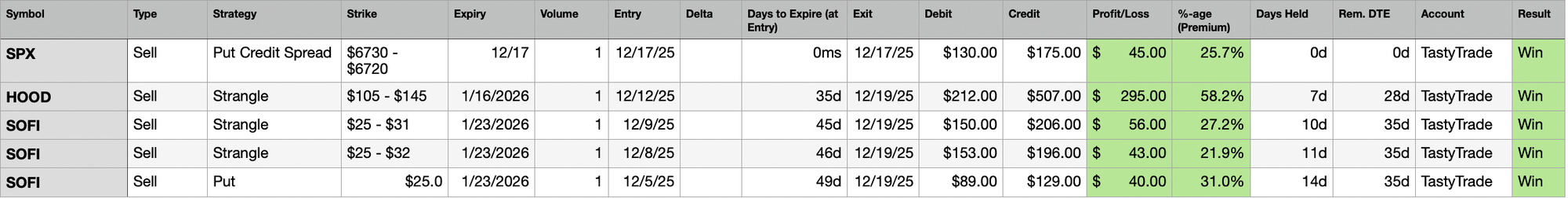

I closed the following trades last week.

I made $479 in the week.

Both HOOD and SOFI made small moves to the upside, and that was enough for me to close some of my positions. I got 58% of the possible premium on HOOD, and scalped between 27% to 31% on SOFI.

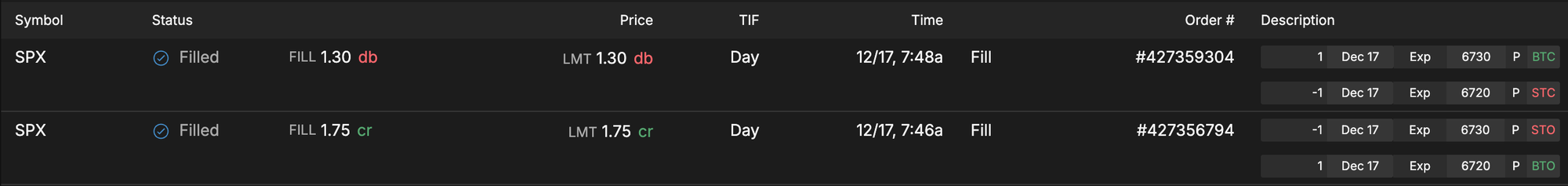

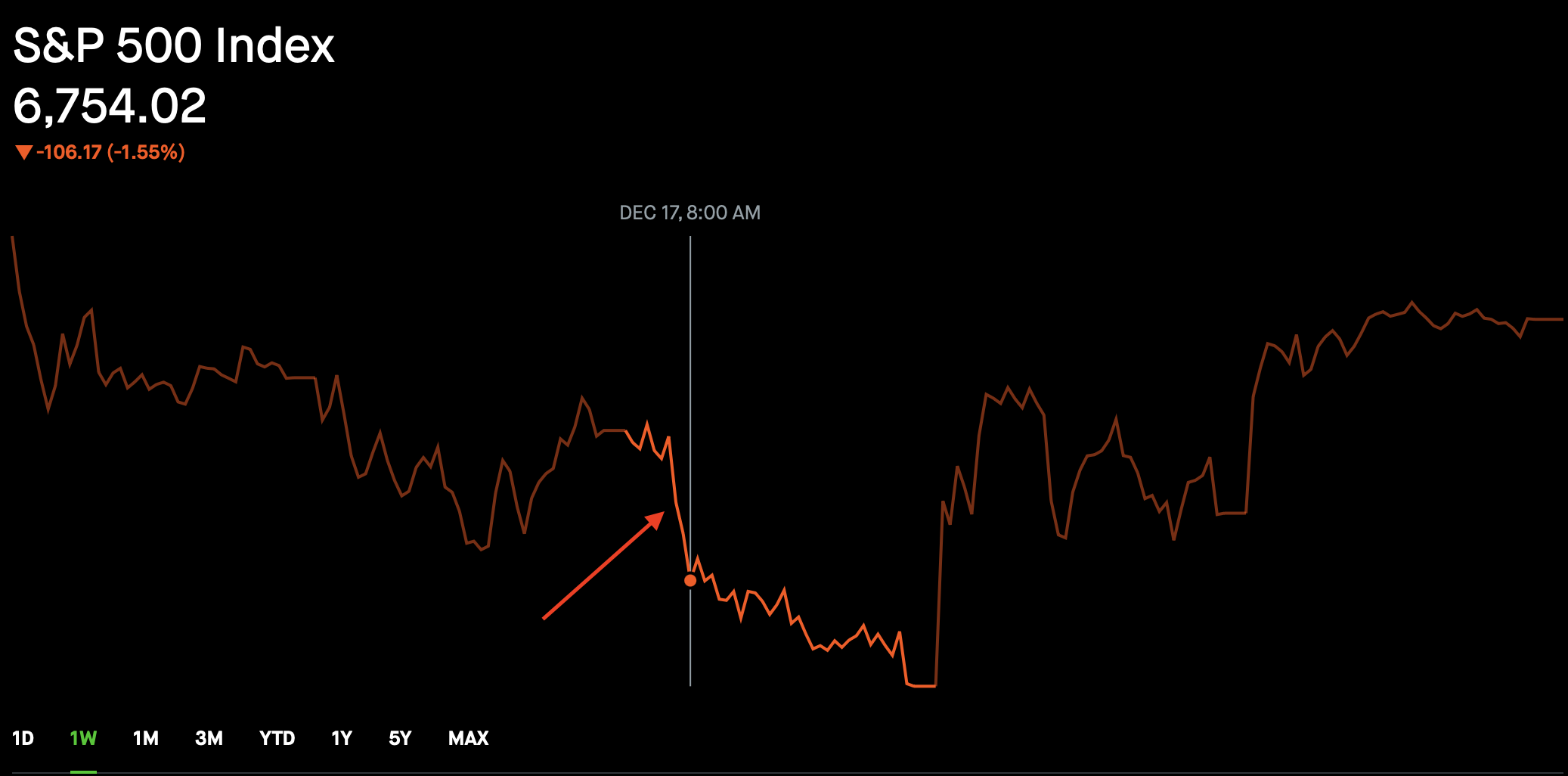

Now HOOD and SOFI were my boring, staple, 30/45 DTE trades. The exciting trade of the week was a SPX Zero DTE. With not much going on through the week, on Wednesday, I watched SPX go down by half a percent and speculated it would likely not drop another half percent based on the expected move.

The bet proved right and it resulted in me scalping $45 in a 2 minute window.

And now as I am looking at it, that was a $1000 risk to make a possible $175, with the success hinging on catching a falling knife. See the time I was trading - right in the free fall window of 7:30 AM - 8 AM.

How did I decide what prices to pick and what profit target to set? Well, I don't quite have that figured out for Zero DTE, so I did what I do for my longer timeline trades, just with more sensitivity to risk. I looked at the expected move, went a couple of deltas further out of the money, and chose to settle on a 15% win target instead of my usual 30% to 50%.

Is it repeatable? No - I was just lucky here. I can't assume this is going to work again. Here lies a trader's dilemma - in the moment, you do not know where the price will go in the next moment. Despite what all the gurus and indicators tell you, that kind of prediction is just not possible - everything you see is a trailing indicator - and as the saying goes - everyone is wiser in hindsight.

But still, it should be possible to use the law of large numbers and tilt the odds in your favor - that is - if you play enough times with trades that have a higher probability of win - you might just win.

The profitability of short option strategies depends on having a large number of occurrences to reach positive statistical averages. At minimum, approximately 200 occurrences are needed for the average P/L of a strategy to converge to long-term profit targets and more is better.

- The Unlucky Investor's Guide to Options Trading (by Julia Spina and others)

Don't take catastrophic risks, take on smaller sized positions, and if needed take your ball and go home when there is lightning.

Portfolio Status

A winning week. I closed some wins in SOFI and HOOD, and lucked out on a Zero DTE (Days to Expire) trade in SPX.

My last five weeks (latest first): W-L-L-W-W.

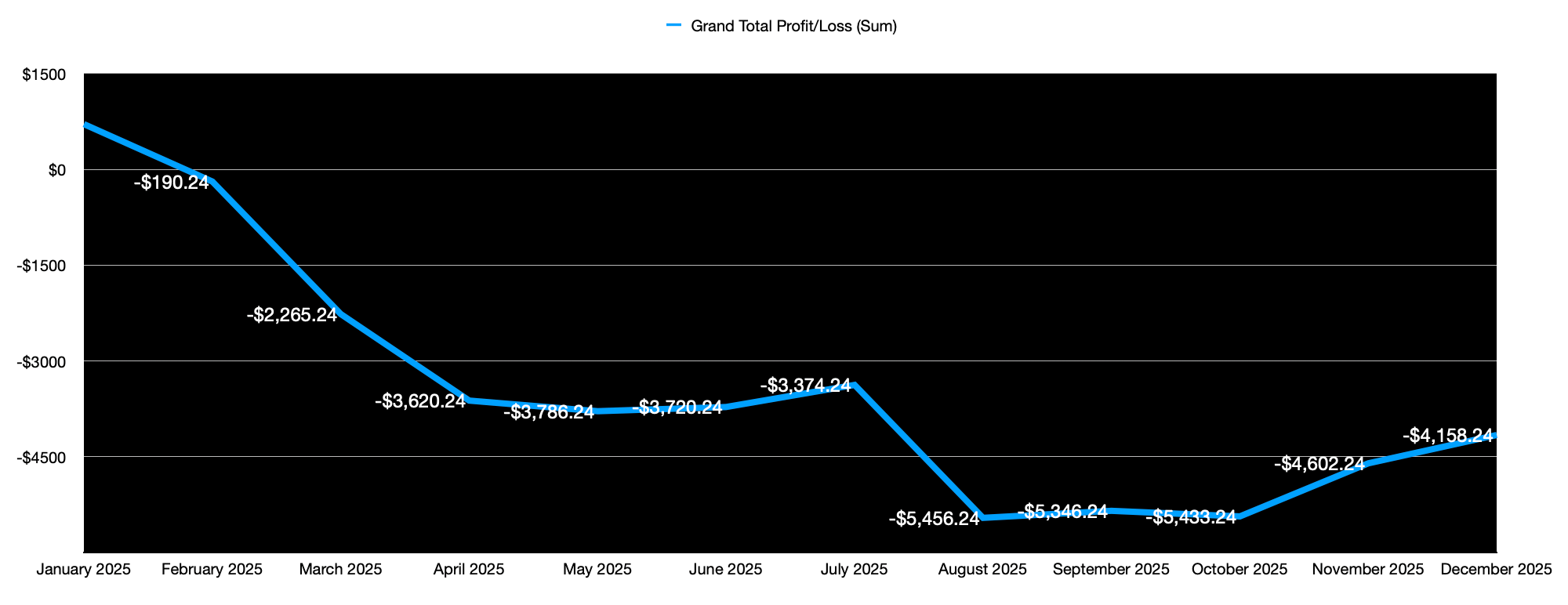

Year-to-date realized P/L: –$4,158.

Here is the Profit/Loss trend for the year.

Portfolio

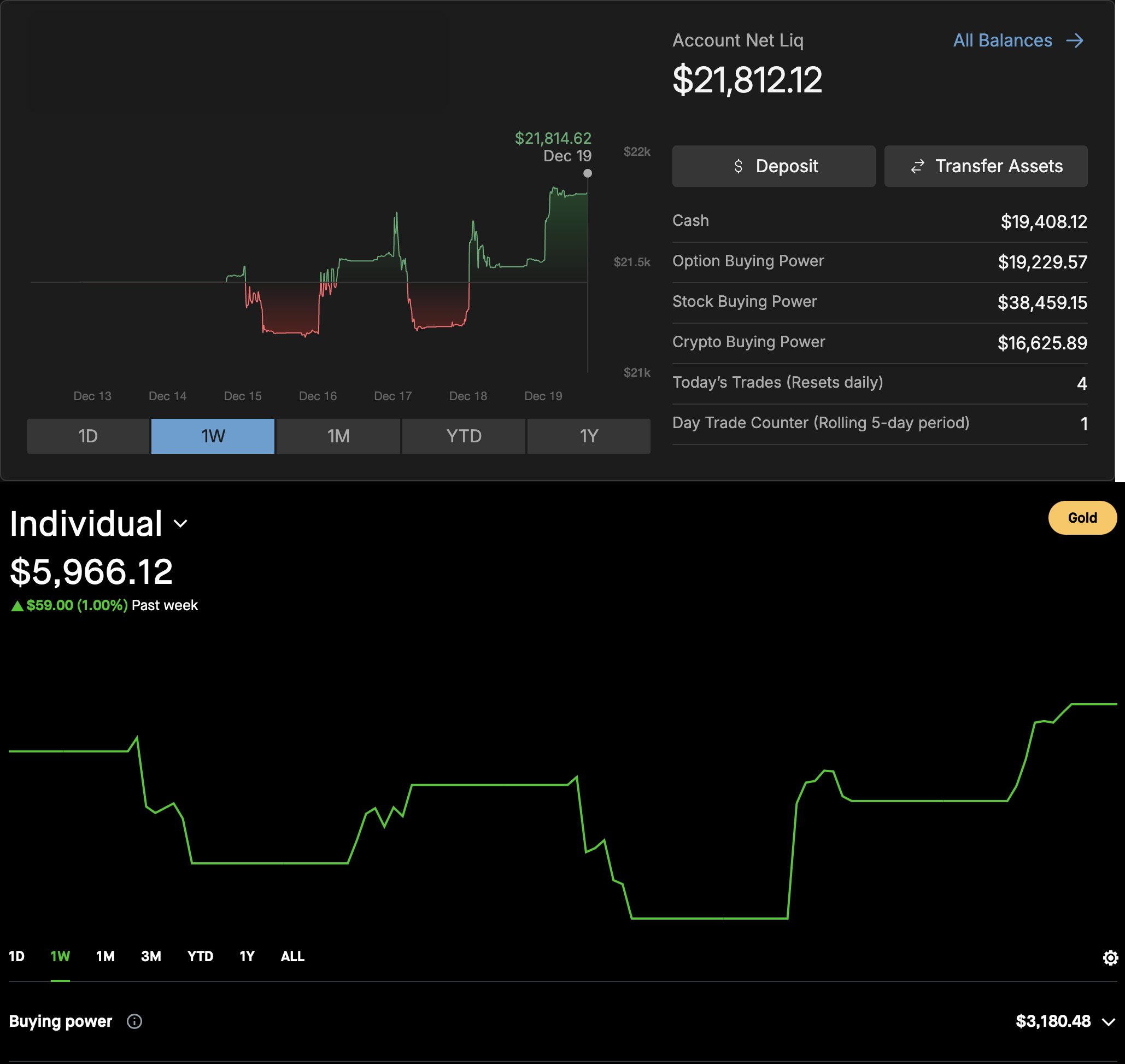

Here is a current snapshot of my TastyTrade and Robinhood portfolios, with total net liquidity at $27,778.

Portfolio Strategy Breakdown

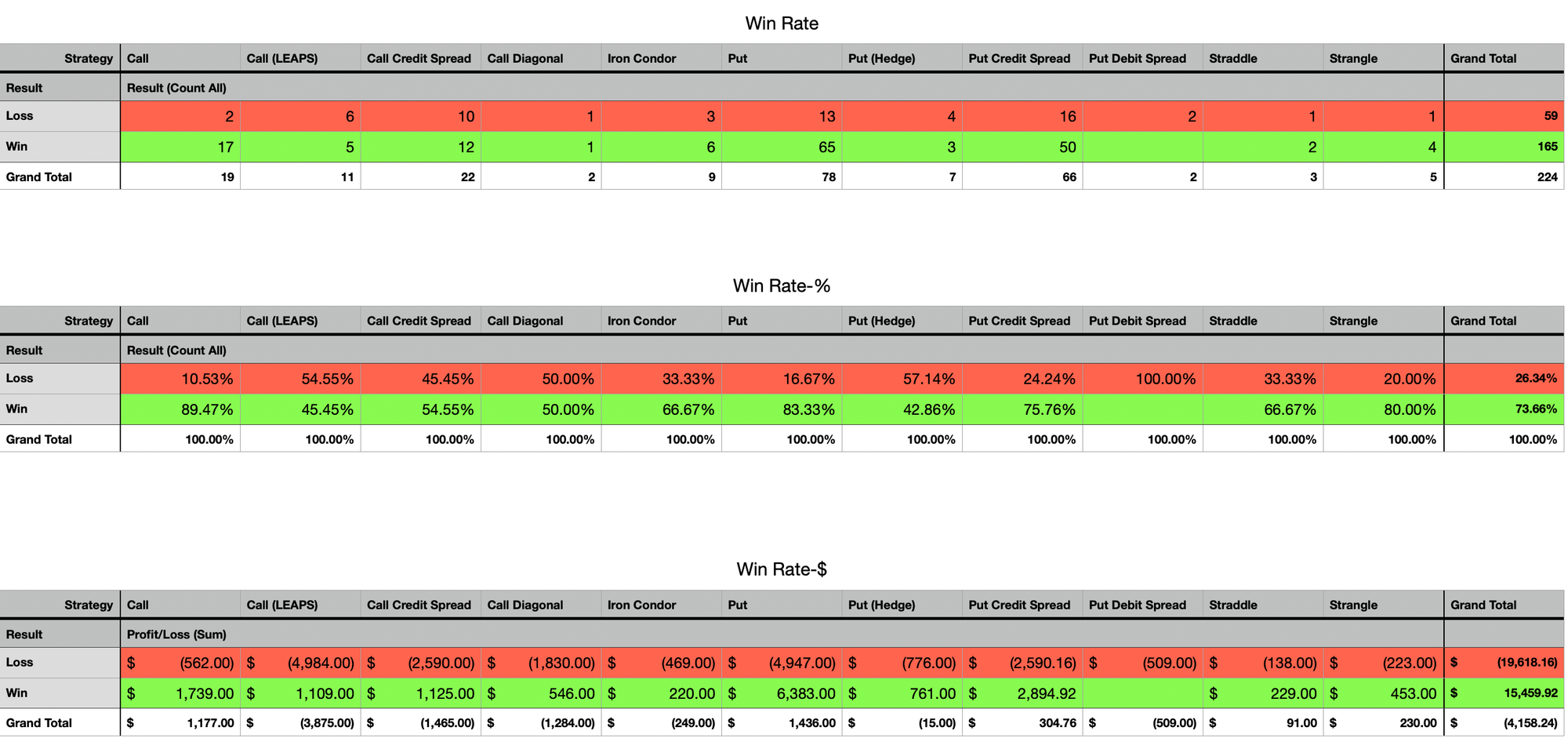

Here's a view showing my Win Rate breakdown by strategy deployed.

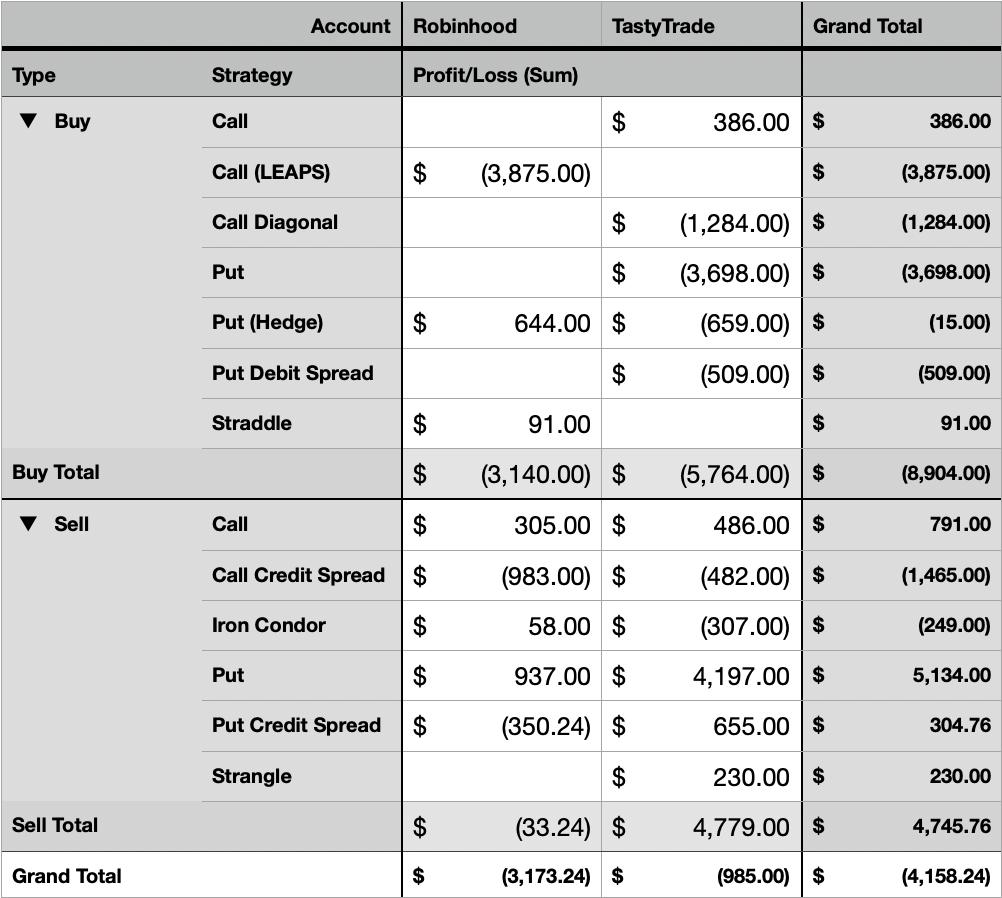

Here is a breakdown of P/L by Buy v/s Sell strategies I have used so far.

Plan for Next Week

I have 3 trades open now, 2 in SOFI and 1 in NFLX.

1 each of SOFI and NFLX will reach their 21-DTE mark next week, which means I need to manage them. I am not expecting a lot of volume next week with Christmas and end of year just round the corner, so will see what the market looks like.

Mostly, I will look to consolidate an annual report of my own activities and understand how far I have come from having started this journey in January this year. While you might think that I have lost money even when not doing anything would have given a 15% return (i.e., buy and hold SPY), I do not think of it that way. I have definitely become different.

No man ever steps in the same river twice, for it's not the same river and he's not the same man.

- Heraclitus

Since October, I have had more winning weeks than losing weeks, my portfolio seems to be on the mend, and a downward move on any given symbol can no longer cause my account to suffer a catastrophic loss.

For example, at one point in the year, I had sold 10 $5 wide Put Credit Spreads (so, a $5000 defined risk trade) when my account had ~13K in capital. That was a stupid amount of defined risk on a single underlying. I learnt nothing, because I made money on that trade (https://www.foolishtrader.com/day-14/). Will I ever risk ~40% of my available capital on a speculation like that again? Nope. Never. And what taught me that? It was certainly not the wins, it was the various losses in this journey I have been sharing here every week.

Thanks for following along. See you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.