Day 91

Last week was quiet with no closing trades to report. This week was the opposite - volatility spiked and I jumped on several opportunities to scalp some wins.

Market Recap

Both SPY and QQQ went down this week with over 2% drop in SPY and over 3% drop in QQQ, despite NVDA posting another great quarter but with growth not matching last year's pace. This looks more like market saturation than an actual slowdown to me. Still, the VIX spike above 28 tells a different story - uncertainty is running high. As an option seller, I am counting on volatility to revert to its mean, let's see how long the elevated volatility lasts.

Last Week:

- SPY ($660.14): -$13.86 (-2.06%)

- QQQ ($592.06): -$19.84 (-3.24%)

Last 1 Year:

- SPY: +$66.48 (+11.20%)

- QQQ: +$87.64 (+17.37%)

Year To Date:

- SPY: +$70.75 (+12.00%)

- QQQ: +$77.76 (+15.12%)

VIX spiked above 28 and is still sitting decently high over 23. We are squarely in volatile territory now.

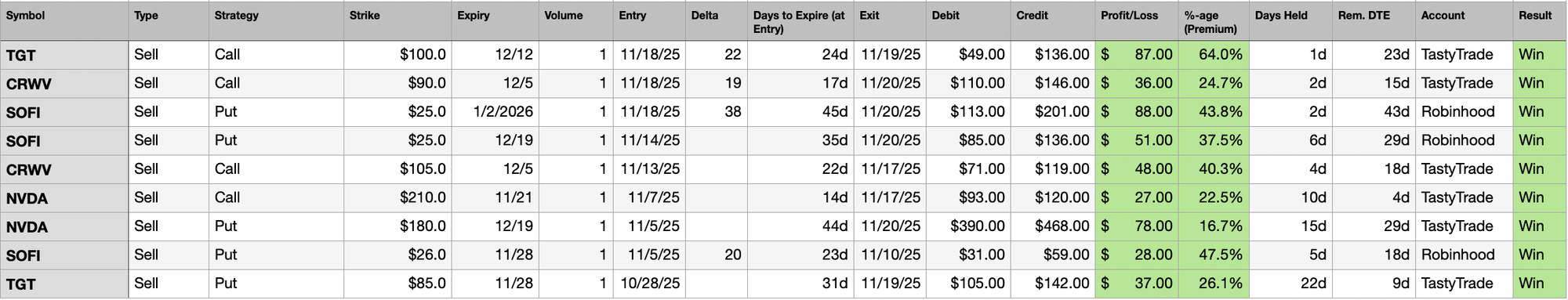

Trading Update: November 10 - November 21, 2025

I closed the following trades this week.

I made $480 across 9 trades (not counting the META diagonal trades I'm still managing). I closed 2 positions each in TGT, CRWV, and NVDA, and 3 in SOFI.

I caught some breaks by playing both sides of certain positions. Here is an example.

For TGT, 3 week before earnings, I had sold a Put against a price that was close to 1 Standard Deviation of the expected move, down and away from current price, with the speculation being TGT will not fall any further. And then as TGT was further close to earnings, I noticed TGT favorably moved away from my strike. At that point I sold a Call with a similar strategy, but on the other side, up and away 1 standard deviation from the current price, with the speculation being TGT wouldn't move that much to the upside. Then a day later as the sold call turned green, I closed both the positions, each at a profit. This is typically something I try during earnings, expecting that a crush in volatility would result in options losing their value and thus presenting some good candidates for selling options. Here is a view showing TGT's expected IV for the weeks following earnings - the screenshot was taken before earnings - see how IV is expected to drop from 127 to 55.

As another example, I also used the same strategy with NVDA. You may notice that I sold a Put for $180 and a little later, I sold a call for $210.

Anatomy of an Unfavorable Call Diagonal

Let me revisit the META Call Diagonal I opened at the start of the month.

Here is what I wrote back then.

Here is a theoretical profit range for the diagonal I have open on META. META is currently at ~$650, and looking at Nov 7, my profit zone starts at $665. My theoretical profit is ~$353 on Nov 7 if META is at ~$680 on that day.

Today, META is at $594. My speculation was completely off - META shed over a hundred points over where I expected it to be. So what has been my strategy? I'm very likely taking the loss here, but I've been working to reduce the damage.

Specifically, I've been scalping against META's decline.

First, I closed the Call I sold as part of the calendar. Then I sold new ones whenever META showed signs of rallying toward the Call I bought, closing them for a profit when META reversed and dropped again.

Here is the series of trades to salvage what I could out of the eventual loss I will take.

- Trade 1: Opened Diagonal

- Sell Nov 21 $750 Call at $606 credit

- Buy Dec 19 $725 Call at $1988 debit

- Trade 2: Closed the Nov 21 $750 Call, locking in $546 in profit on the sold call

- Trades 3-4: After META moved further down, sold a new Dec 19 $715 Call with a lower strike. Closed at $137 profit.

- Trades 5-6: Adjusted downward again, selling and closing a 12/19 $660 strike, making another $108 in a day.

- Trade 7 and 8: META tried a brief bounce, so I entered the 12/19 $660 strike again, scalping another $103.

I have managed to cut the loss nearly in half, going from almost $2K in loss down to now ~$1K in loss.

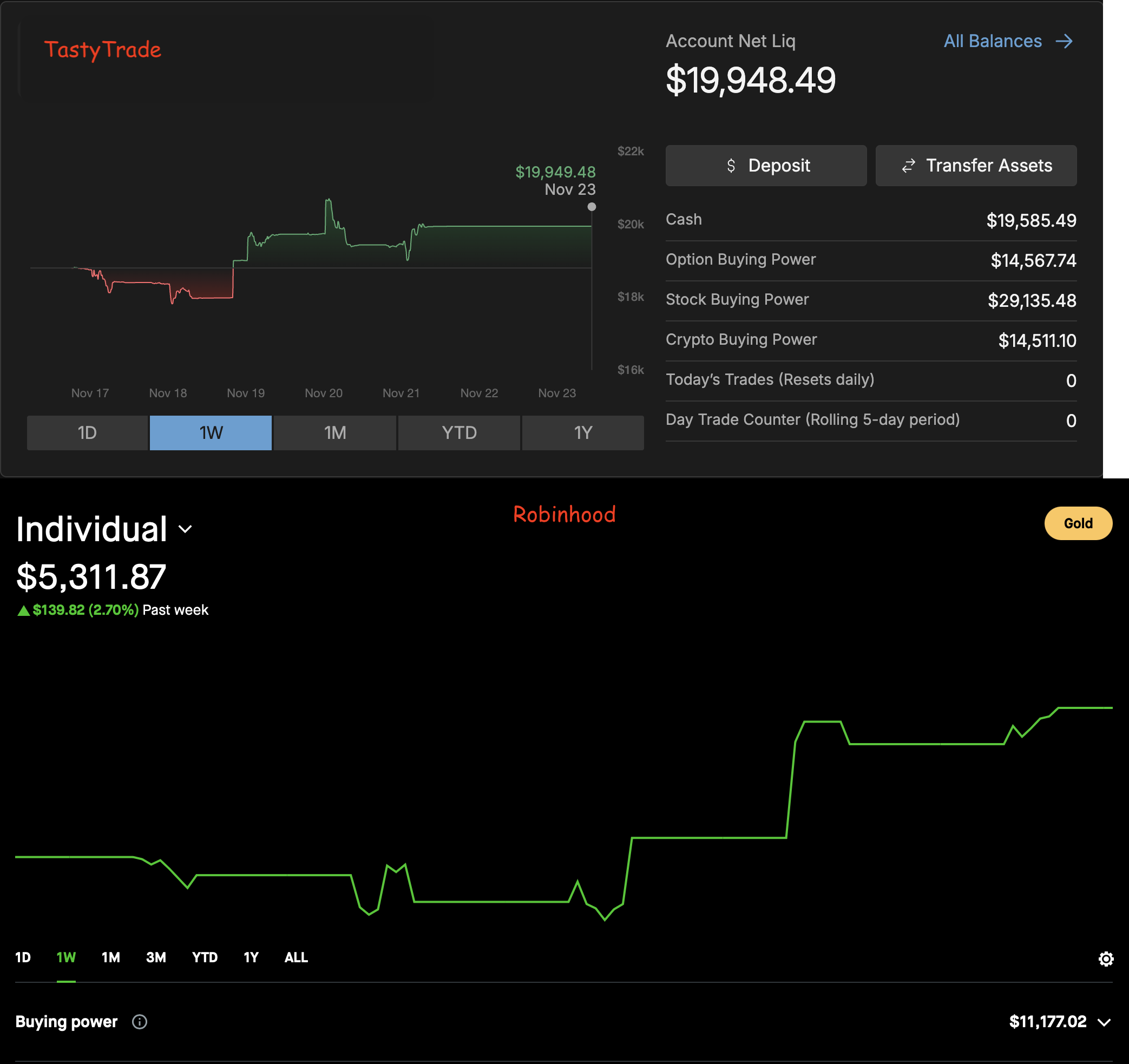

Portfolio Status

In terms of wins and losses, I again closed the week with just winning trades closed. As I said earlier, I made $480, excluding the trades I closed as part of the META diagonal I am managing.

My last five weeks (latest first): W-W-W-W-L.

Year-to-date realized P/L: –$2,537.

Here is the Profit/Loss trend for the year.

Portfolio

Here is a current snapshot of my TastyTrade and Robinhood portfolios.

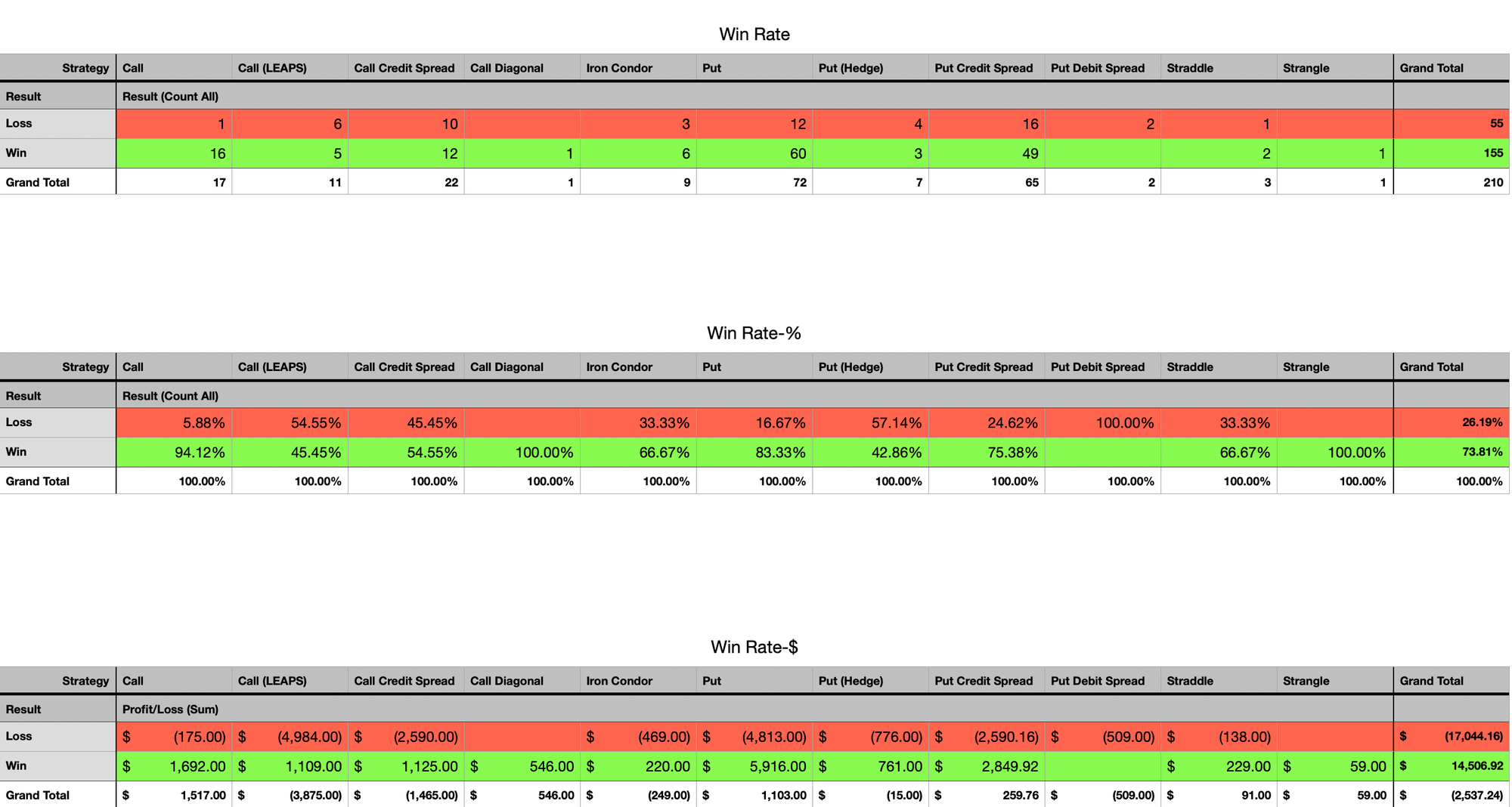

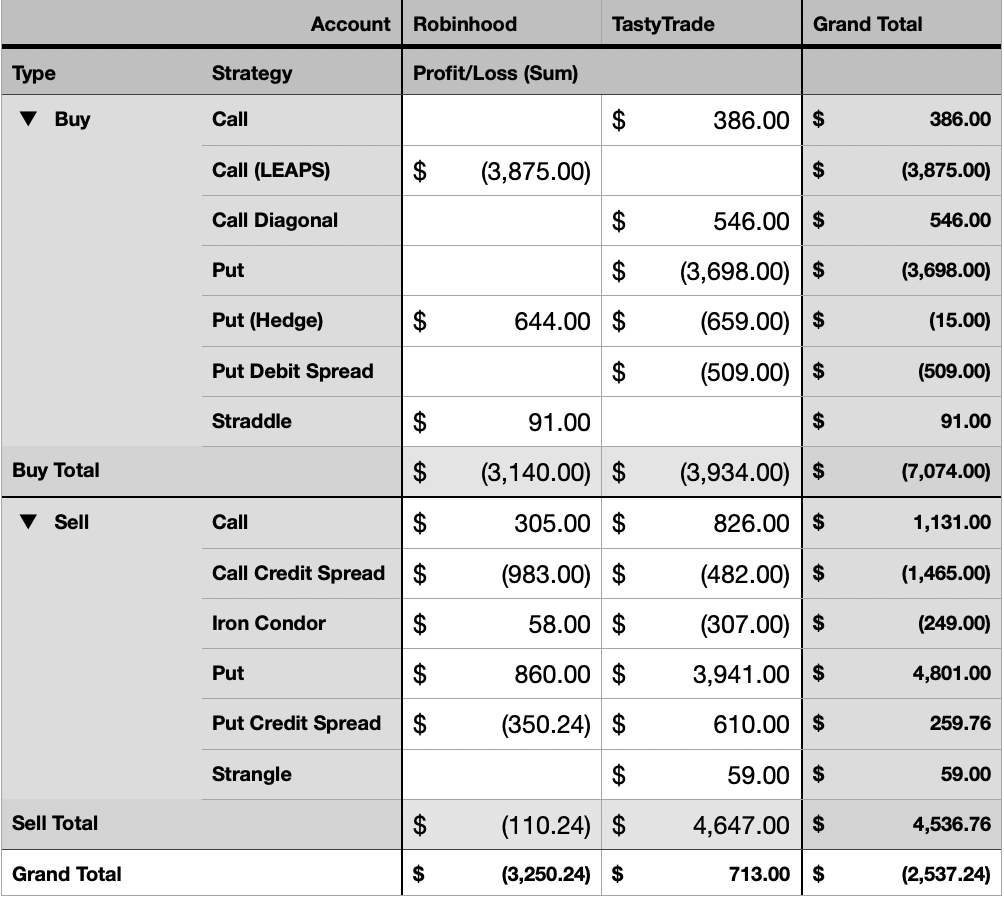

Portfolio Strategy Breakdown

Here's a view showing my Win Rate breakdown by strategy deployed.

Here is a breakdown of P/L by Buy v/s Sell strategies I have used so far.

Plan for Next Week

It is going to be a short trading week next week. I will continue to look for small and quick wins.

The two main trades that I have ongoing are in CRWV and META. I already wrote about META above. For CRWV, I am likely looking at assignment if there is continued downward pressure on AI stocks.

I also have open positions in NVDA and SOFI.

Looking at the broader picture, IV is still reasonably high and historically market does not like uncertainty to last this long. So eventually when volatility calms down, I am expecting at least half of my existing positions to turn positive.

If VIX continues to remain high, I might add some more risk and add new positions. And thus, continue to bet the VIX will return to its mean.

Thanks for following along. See you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.