Day 9

Foolish Trader Journal, Day 9

I had my first (unintended) loss of the year in this experiment. Out of my two earnings bets, one of them went south.

I think I did not suffer a lot of damage due to following reasons:

- The position was a PUT credit spread with a defined risk (Max Risk: $500, final loss: $170),

- I typically trade small positions for spreads,

- The loss was offset quite a bit by a CALL credit spread (net profit +$154) I had closed a day before for the same underlying stock and the other earning bet I had made (that gave me +$167) on a different stock.

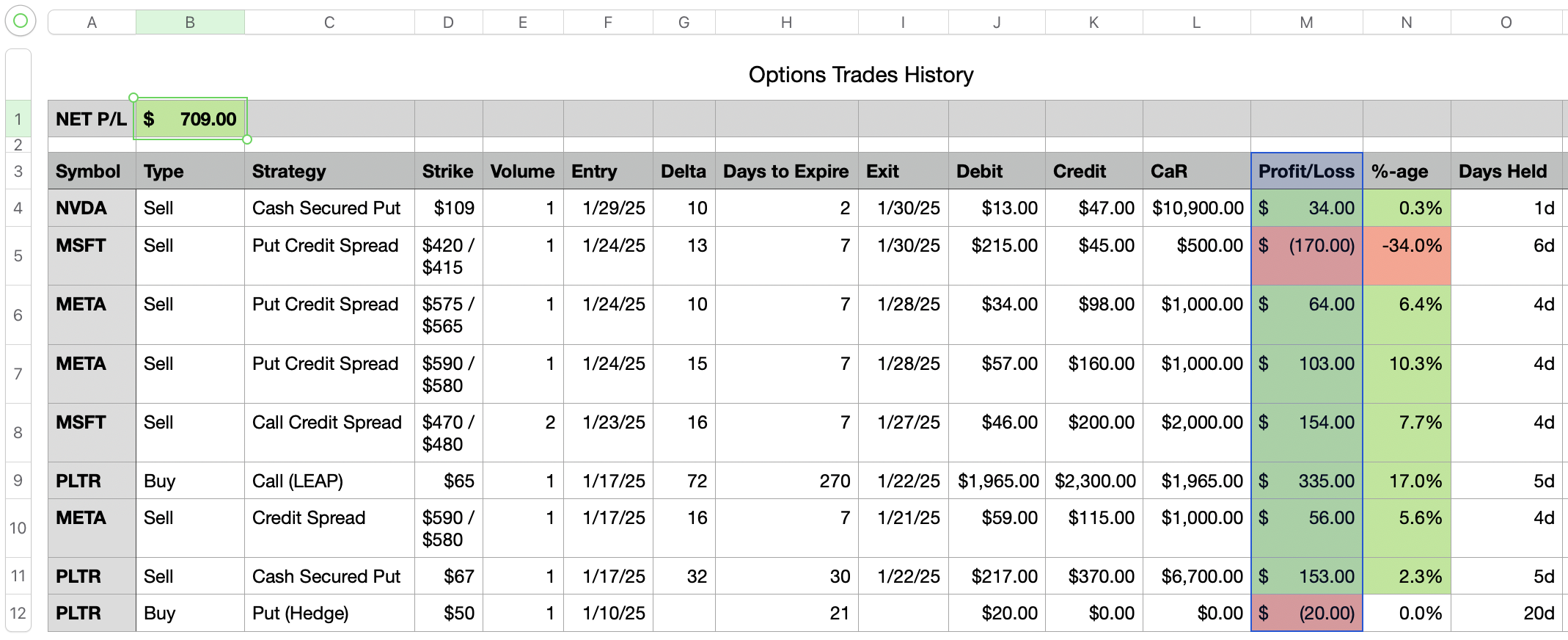

Here are some key stats for the overall experiment:

- Net Profit is $709 across 9 total trades.

- Average profit per trade is $78.78

- I have 7 winners and 2 non-winners, so a near 77% win rate.

These numbers look small, I am hoping to inject additional capital to this account if I can keep the numbers up.

For tomorrow, I will most likely enter a new position, but I don't know what that would be.

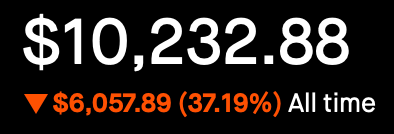

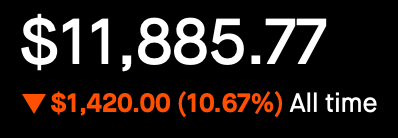

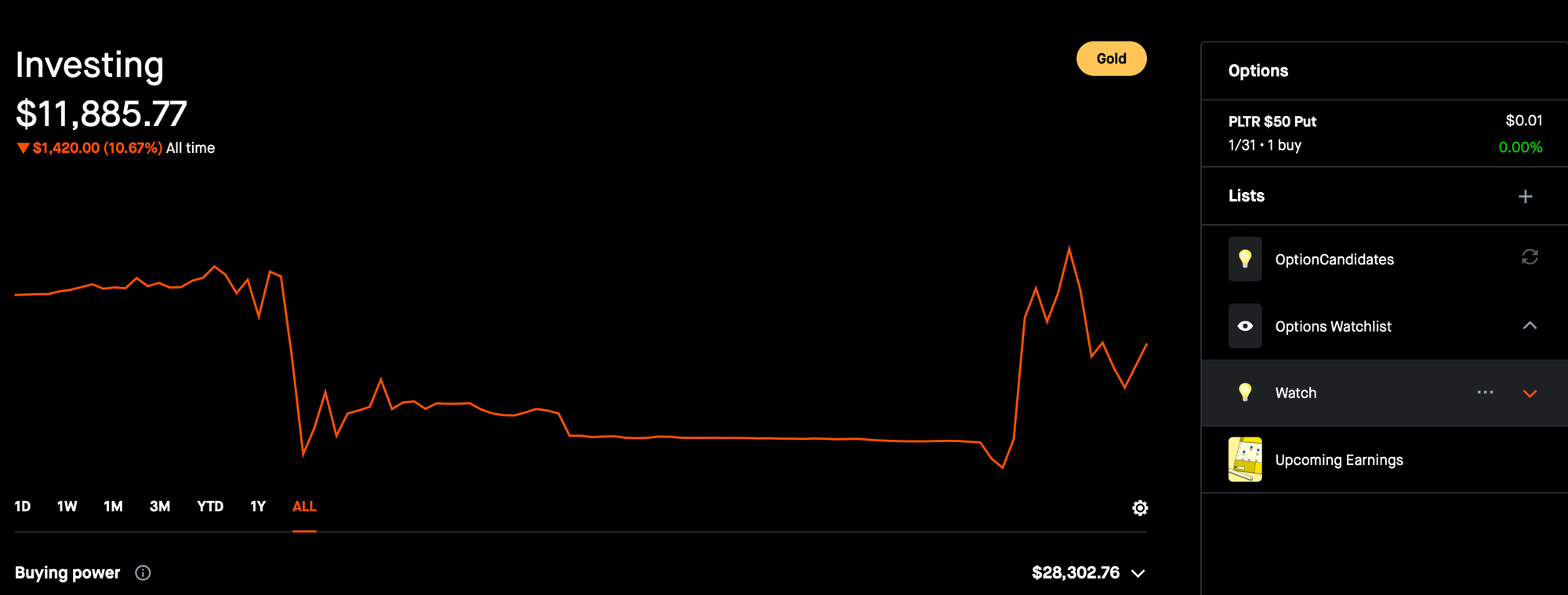

Portfolio Overview

- Market Value: $11,800

- Cash: $11,800

- Options Collateral: None

Today's Trades

- Closed MSFT $415/$420 Put Credit Spread

- MSFT started the day in Red. I thought I will wait an hour to see which way it goes. It traded sideways for a bit, at which point I had seen enough and closed my open Put Credit Spread position at a loss.

- Net loss: $170 (or 34% of capital at risk, which was $500).

- Closed NVIDIA $109 Cash Secured Put

- NVIDIA was trading sideways. I closed my Cash Secured Put since it had moved over 50% of original premium already. The trade was open for less than 24 hours.

- Here is my entry log:

- Sold NVDA $109 Put

- NVDA seems to have maybe temporarily found itself in a pullback.

- NVDA has fallen ~14% in the past week, I bet 11K that it will not fall > 5% in 3 days (it absolutely can!) since it is already down quite a lot.

- I would want to exit this position in 1 day if possible. I have a strong feeling that if NVDA does get down to $109 and I get assignment, I would think it just keeps falling further down, and possibly reach $80. In fact, I may look to buy some Feb 28 Puts.

- Sold NVDA $109 Put

- Here is my entry log:

- NVIDIA was trading sideways. I closed my Cash Secured Put since it had moved over 50% of original premium already. The trade was open for less than 24 hours.

Ongoing Positions

Palantir (PLTR) Trades

- PLTR $50 Put, Expiring 1/31

- Hedge

- Potential Strategy: Let it expire, or roll for another month if I own a CSP or get assignment

History View

Here are my most recent trades reflecting the above positions in a spreadsheet format.

- Net Profit/Loss up to today: $709

- Tracking since: January 10, 2025

- Number of trades: 9