Day 89

Another week with a 100% of personal wins. But more importantly, another week with a net profit!

Market Recap

Both SPY and QQQ went up this week.

Last Week:

- SPY ($681.75): +$7.95 (+1.18%)

- QQQ ($629.05): +$15.70 (+2.56%)

Year-over-Year:

- SPY: +$106.19 (+18.45%)

- QQQ: +$136.67 (+27.76%)

Tech stocks had great earnings causing a big move up in QQQ.

Trading Update: October 27 - October 31, 2025

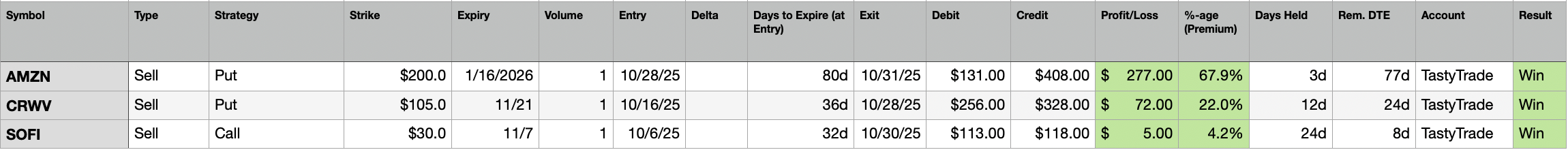

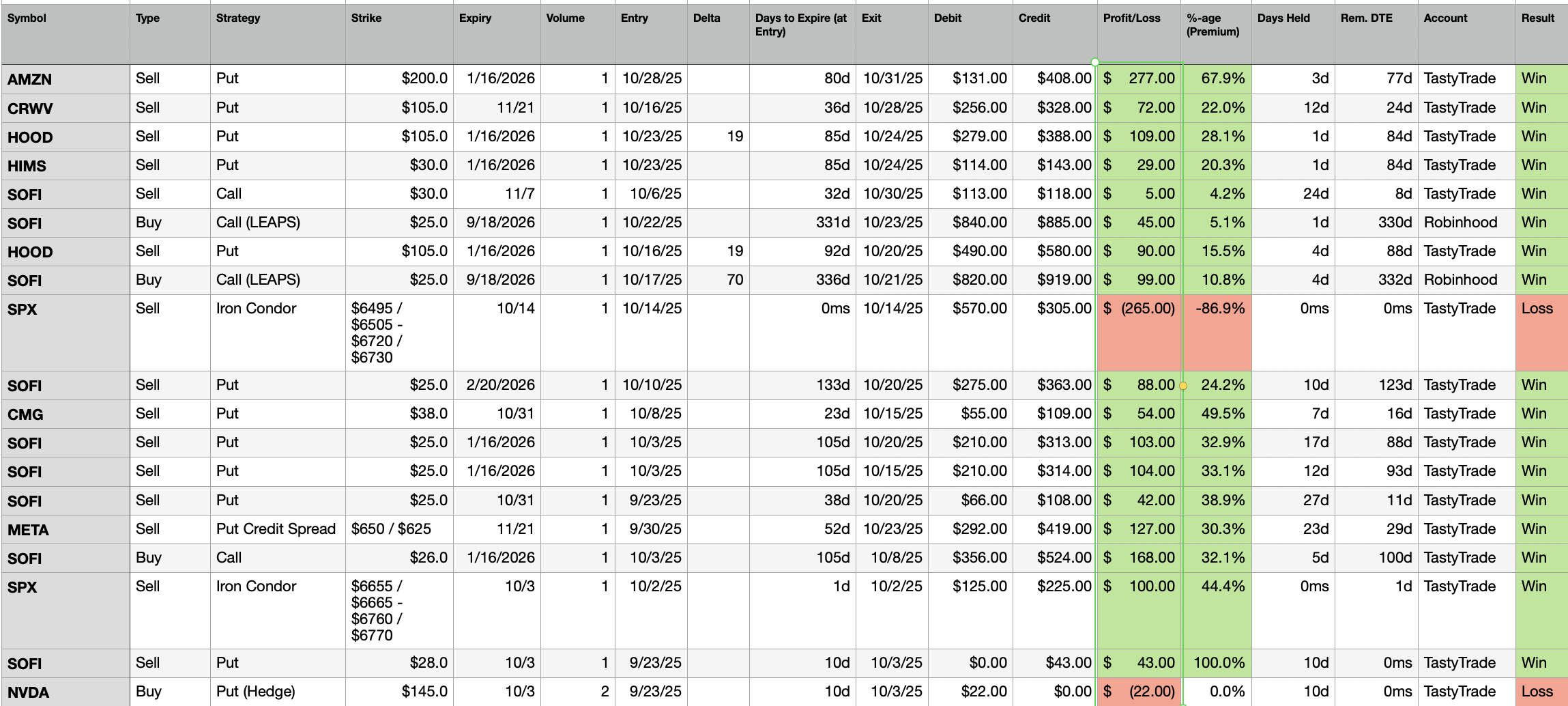

I closed the following trades this week.

The big win was provided by an earnings play on AMZN. I was in and out in 3 days, making ~68% of the original premium.

CRWV was also an earnings play, but that was a more classic sell and close in the sense that I opened the trade at ~35 DTE and managed it at ~21 DTE.

I got disillusioned by my SOFI sell so I closed it the moment I was net positive on the trade. I am likely going to open a Sell Call trade again if SOFI moves beyond $30.

Portfolio Status

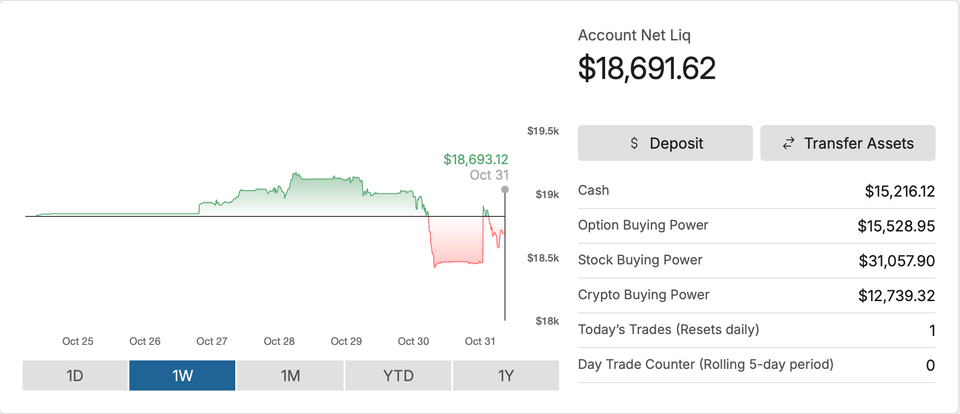

Another win in the books, with a $354 profit.

My last five weeks (latest first): W-W-L-W-W.

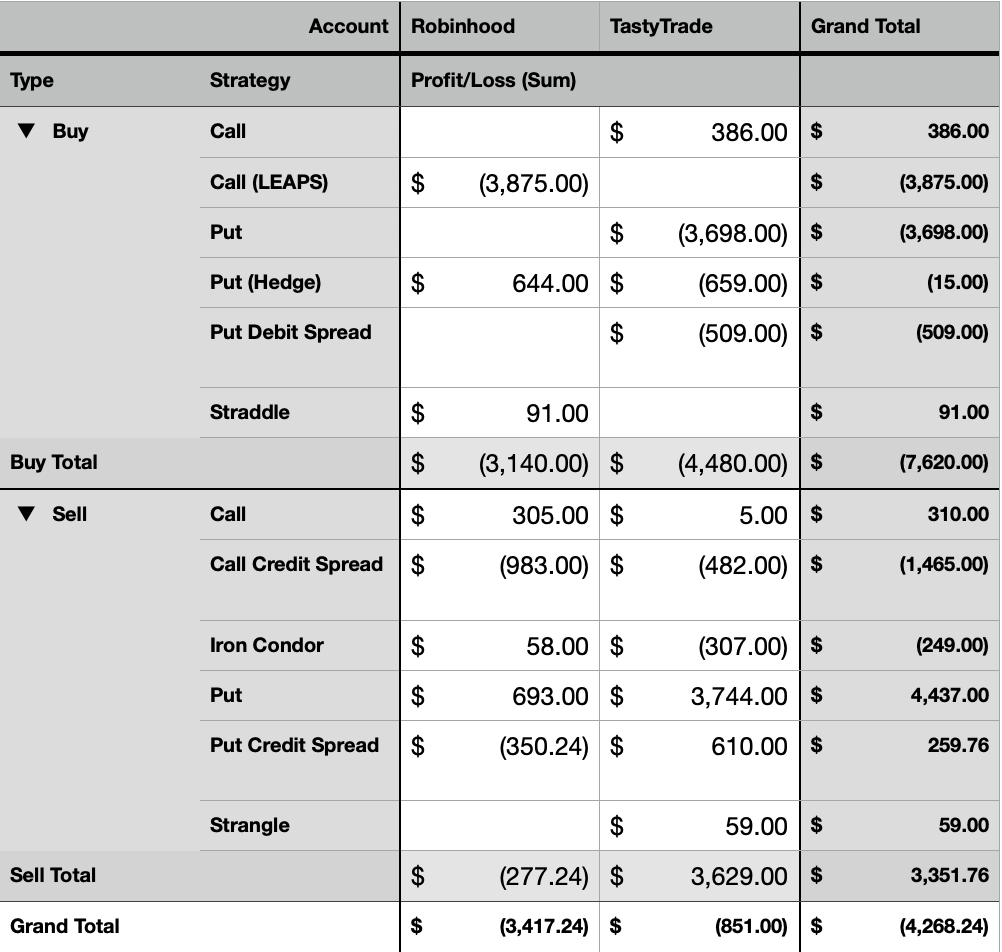

Year-to-date realized P/L: –$4,268.

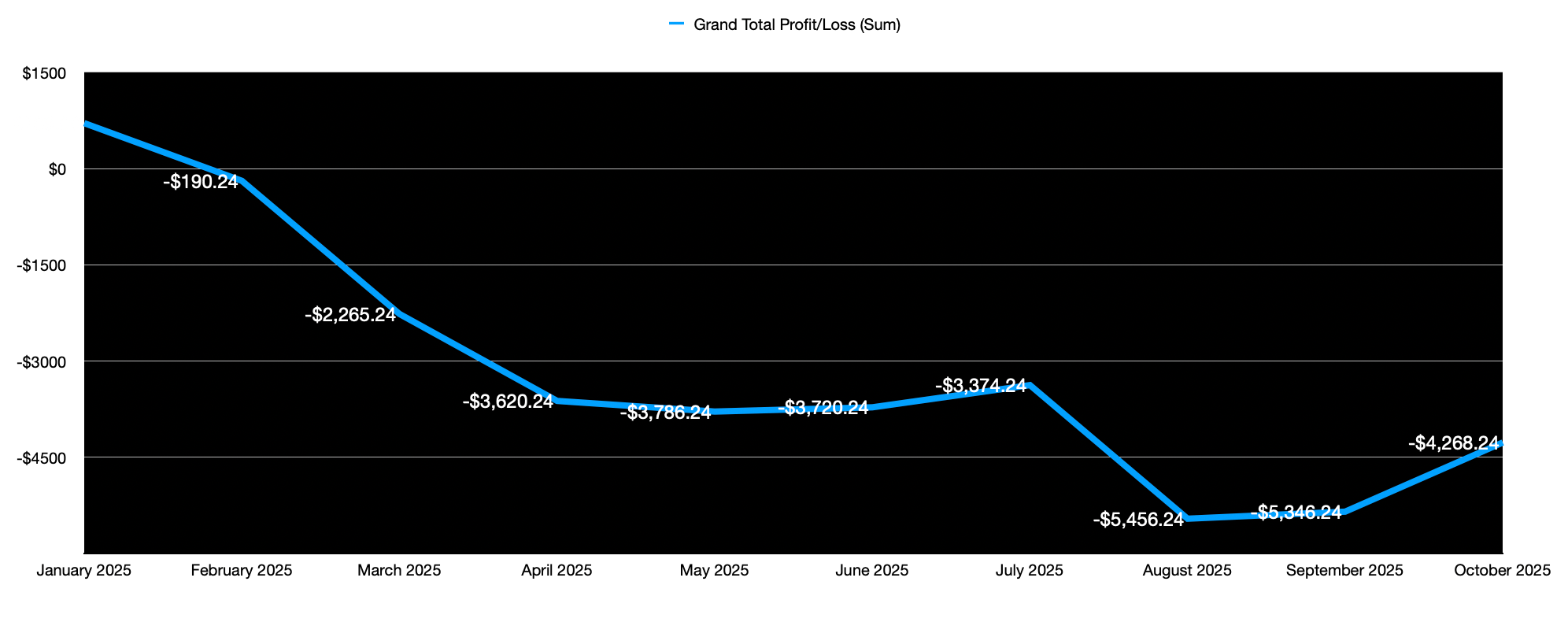

Here is the Profit/Loss trend for the year.

Portfolio Strategy Breakdown

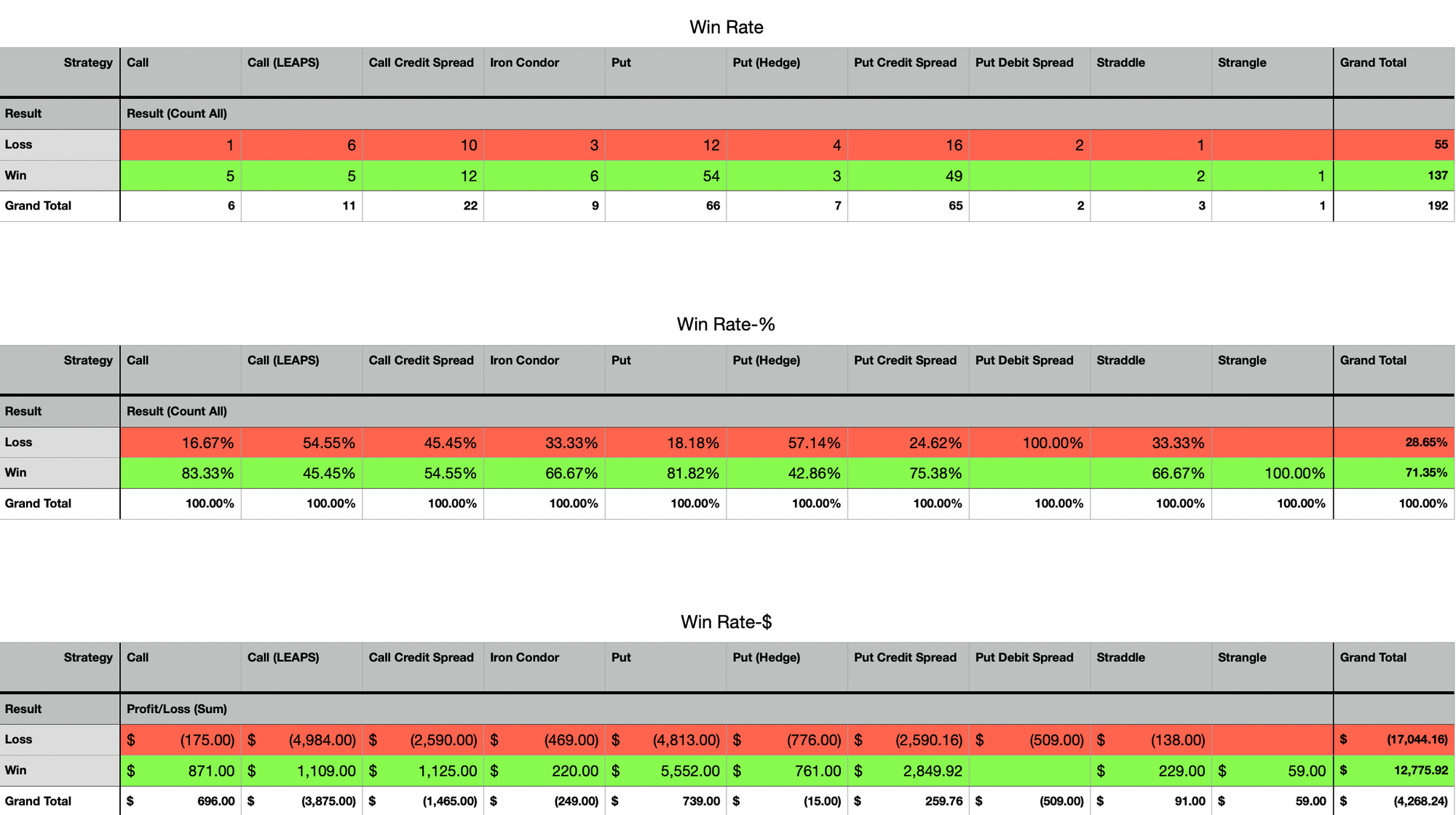

Here's a view showing my Win Rate breakdown by strategy deployed.

Here is a breakdown of P/L by Buy v/s Sell strategies I have used so far.

Selling Puts continues to make money in this bullish market.

The LEAPS that cost me big money at the start of the year would almost be net positive now - but I do not have a future magic ball to look at so I think I would do the same thing again if I owned something and it began falling down.

I think where I am better at now is deciding whether or not to enter that trade. I was not even aware of the concept of expected moves when I placed those trades. And that is why it is said - a little knowledge is a dangerous thing.

October 2025 Month End Summary

October was a profitable month. I made $1268.

This represents a ~7% net gain on deployed capital. Awesome, right? Not so quick.

Looking at previous months this year, this is the first time since January that I have been profitable over a whole month. So after my beginner's luck died, things are perhaps on the mend now. Hoping for a great November!

Plan for Next Week

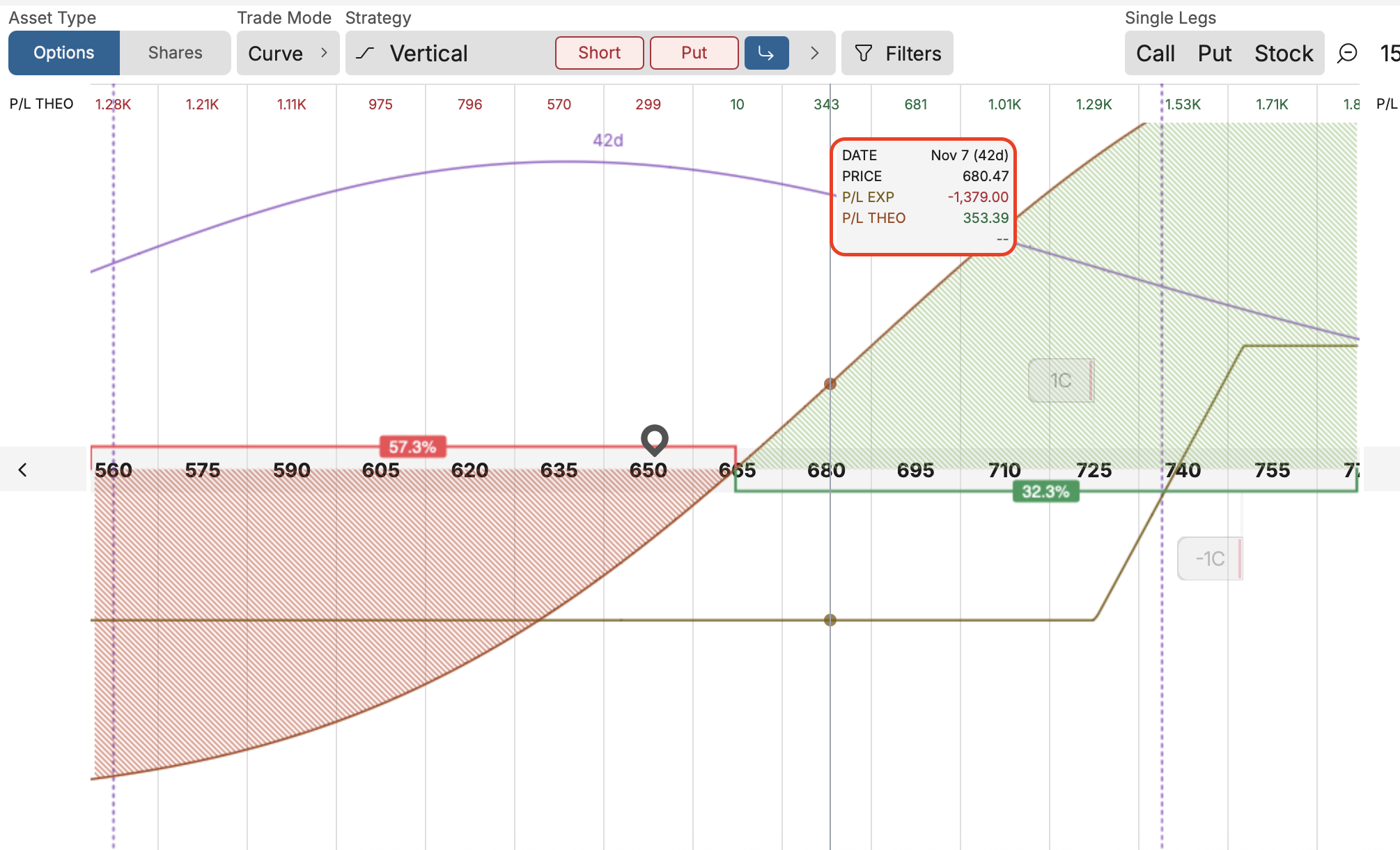

META has seen a massive drawdown and has opportunities. I have an open Call Diagonal position on META.

A Call Diagonal is formed like a Call Spread, except the date of the Call being bought is further out in time.

Call Spread = Sell a near-the-money Call for Date d + Buy an out-of-the-money Call for Date d

Call Diagonal = Sell a near-the-money Call for Date d + Buy an out-of-the-money Call for Date d+t, where t is further ahead than d in time

Here is a theoretical profit range for the diagonal I have open on META. META is currently at ~$650, and looking at Nov 7, my profit zone starts at $665. My theoretical profit is ~$353 on Nov 7 if META is at ~$680 on that day.

Let's see how this plays out.

Thanks for following along. See you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.