Day 88 - When Everything Clicks

A rare week where every trade worked - and a reminder that even a good week doesn’t erase the grind.

Making Money Is Hard

It hasn’t been easy to forget how tough this game is - I’ve been reminded of it often this year.

That’s why this past week felt special. Not because I made a fortune, but because, for once, everything lined up. Every decision landed right, and I could finally close trades in the green instead of cutting losses.

Market Recap

Both SPY and QQQ went up this week.

Last Week:

- SPY ($677): +$21.73 (+3.32%)

- QQQ ($604.99): +$23.17 (+3.90%)

Year-over-Year:

- SPY: +$97.00 (+16.72%)

- QQQ: +$125.01 (+25.40%)

A strong continuation of the general uptrend this year - but as always, strength brings fewer bargains.

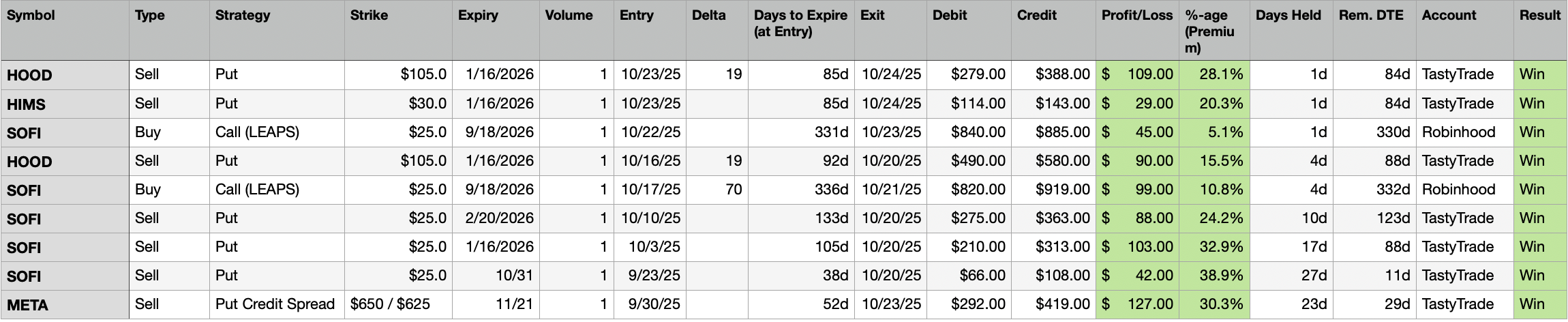

Trading Update: October 20 - October 24, 2025

I closed the following trades this week.

Every single trade I closed this week was a winner - that’s probably a first!

I made $732 across 9 trades, with 5 of them held for less than a week.

Surely not a fluke? Maybe. But markets have a way of humbling you fast.

Here is a short breakdown of how the trades were placed:

- Sold 6 Puts

- When VIX spiked, several Put-selling opportunities opened up. I took a few and was only limited by available cash. With more capital, I’d have taken more of these setups.

- Bought 2 LEAPS

- SOFI oscillated between $25 and $29. I entered and exited LEAPS twice, buying around $26 and selling above $28 each time.

- Sold 1 Put Credit Spread

- A few weeks ago, META had pulled back slightly in its rally, so I had opened a 52-DTE (Days to Expire) Put Credit Spread.

Portfolio Status

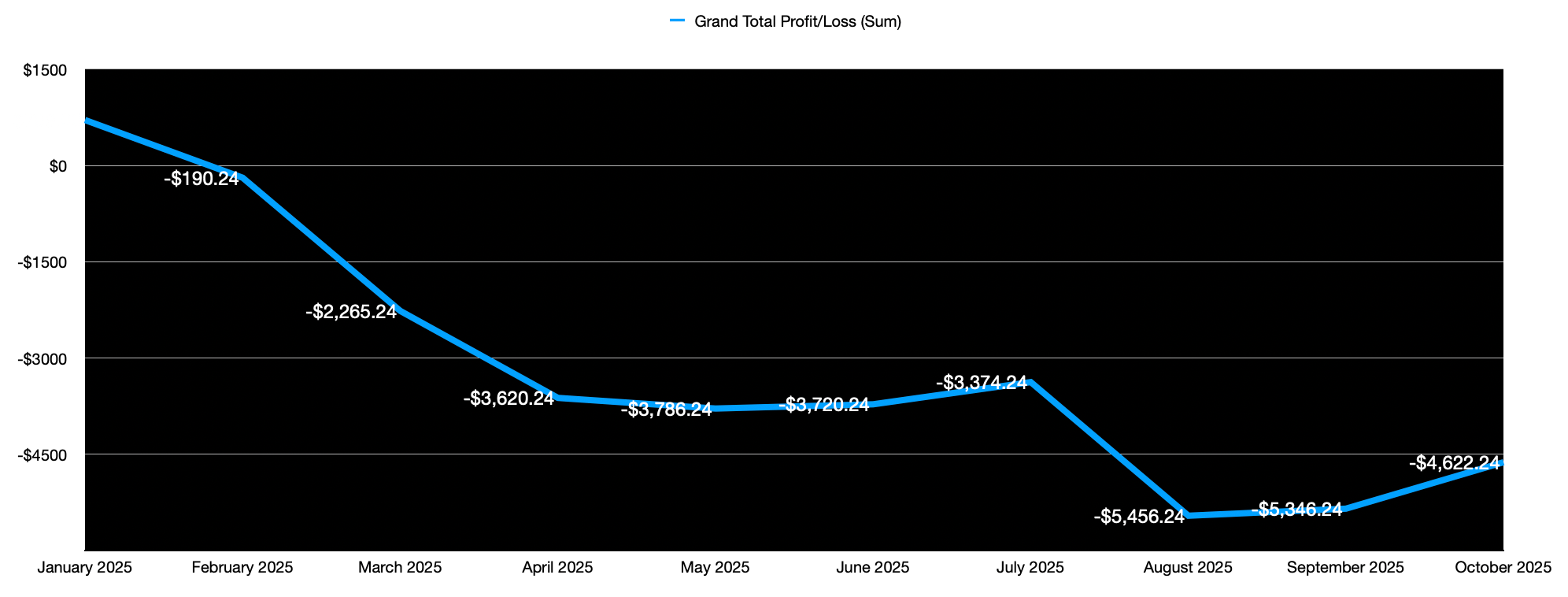

This was my best week of the year, with a $732 profit.

My last five weeks (latest first): W-L-W-W-L.

Year-to-date realized P/L: –$4,622.

Here is the Profit/Loss trend for the year.

Portfolio Strategy Breakdown

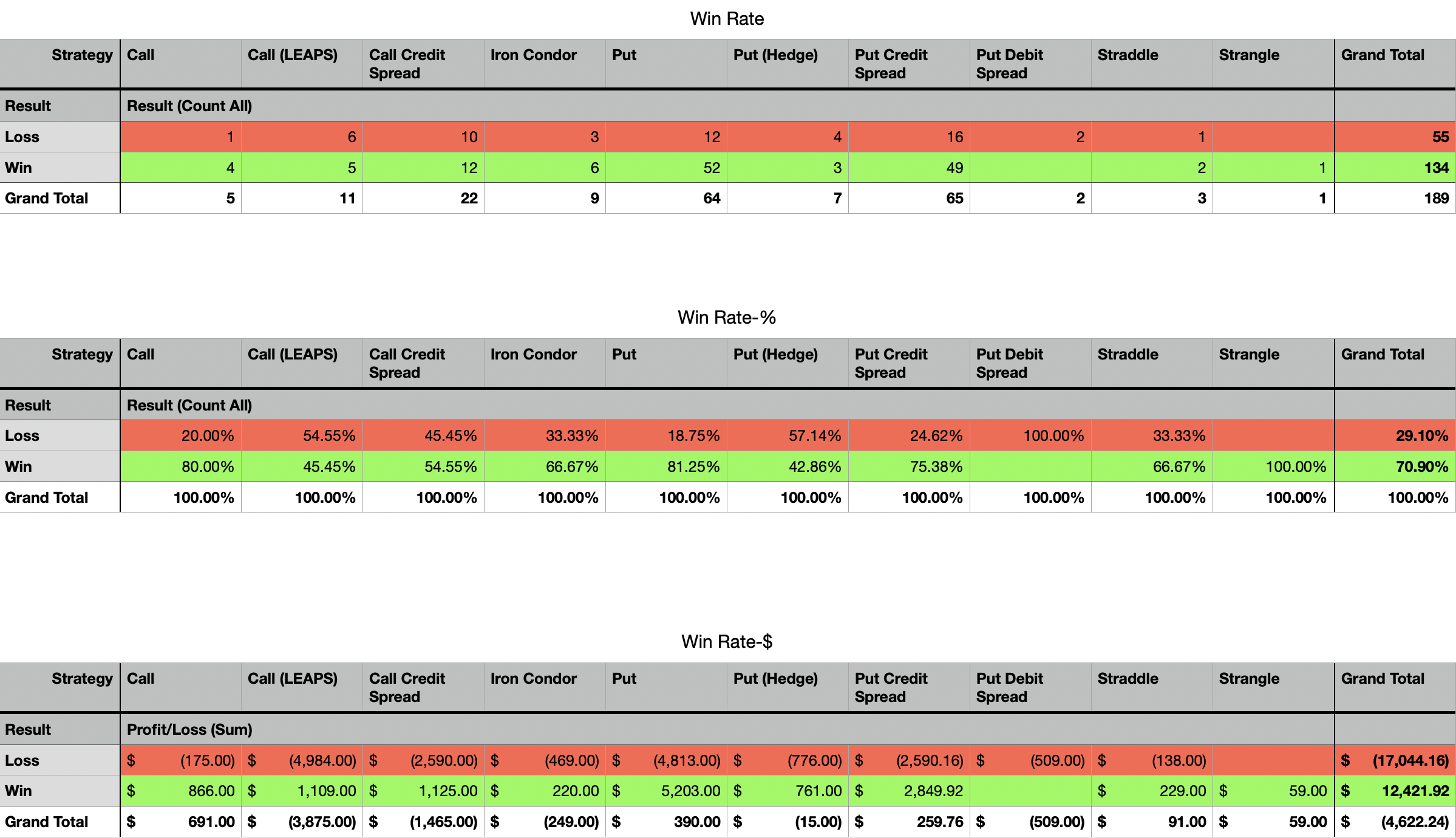

Here's a view showing my Win Rate breakdown by strategy deployed.

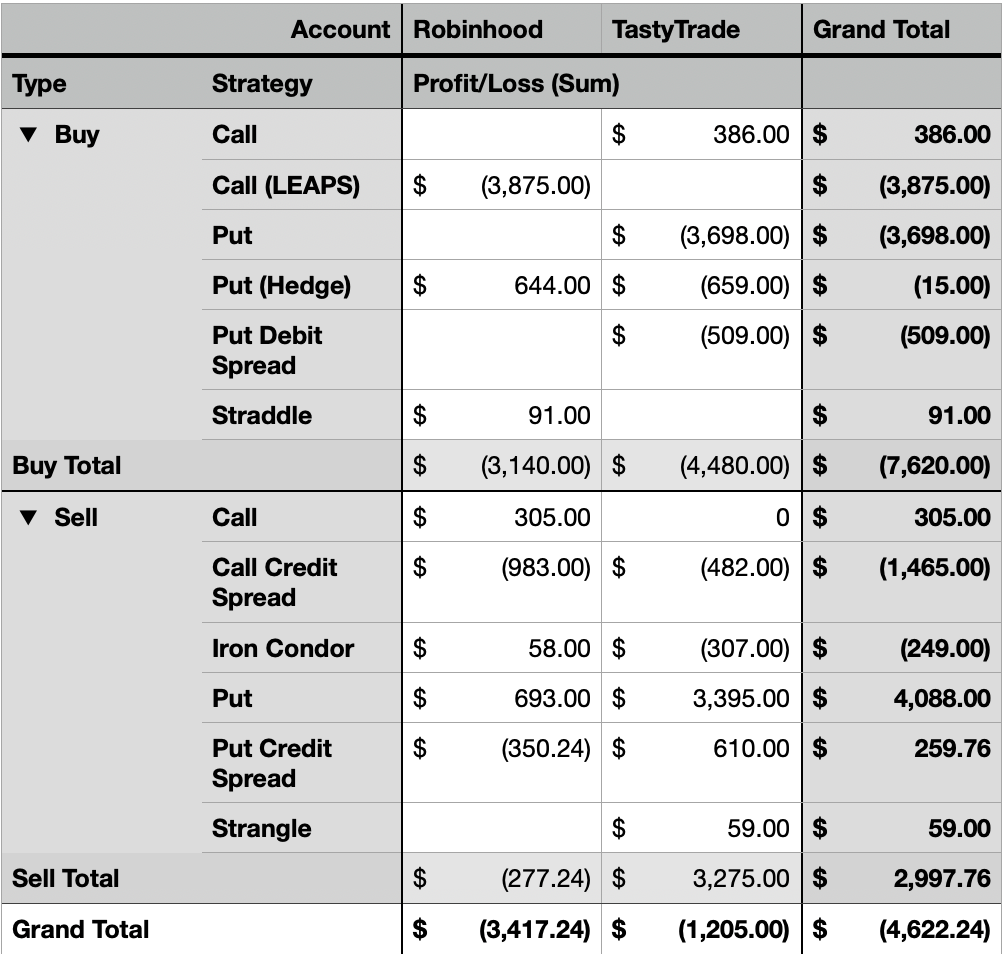

Here is a breakdown of P/L by Buy v/s Sell strategies I have used so far.

I’ve made 191 trade entries this year across my Robinhood and TastyTrade (margin) accounts. The current total account value across both accounts is ~$20K.

My overall win rate is approaching 70%, but based on my approach, I’d expect around 80–85%, which aligns with expected-move deltas (~16).

The bright spot: my Put-selling strategy shows an 81% win rate and is currently profitable. If I stay consistent, the results should start reflecting statistical expectations within the next quarter or two.

Plan for Next Week

If I can get five or six weeks like this a year, that’s enough to make this whole experiment worthwhile.

With VIX now under 17, I’m holding cash and staying patient - open trades currently use only 8.6% of my buying power in TastyTrade.

This week reminded me that progress in options trading doesn’t come in straight lines - it comes in cycles of frustration, patience, and small breakthroughs.

One green week doesn’t erase months of red, but it does rebuild something harder to measure: confidence. The kind that only returns when you’ve stayed in the fight long enough to earn it back.

Thanks for reading. And here’s to staying disciplined when things are good, and grounded when they’re not.

See you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.