Day 87

VIX spiked up, going over 28 from around 19, an over 45% increase in volatility. As I write this, VIX has calmed back down to 20.78. I deployed some more cash over the week in line with the volatility spike.

Market Recap

Both SPY and QQQ ended red this week, again.

Last Week:

- SPY ($665.28): -$6.41 (-0.95%)

- QQQ ($604.99): -$6.29 (-1.03%)

Year-over-Year:

- SPY: +$81.21 (+13.90%)

- QQQ: +$110.93 (+22.45%)

Trading Update: October 13 - October 17, 2025

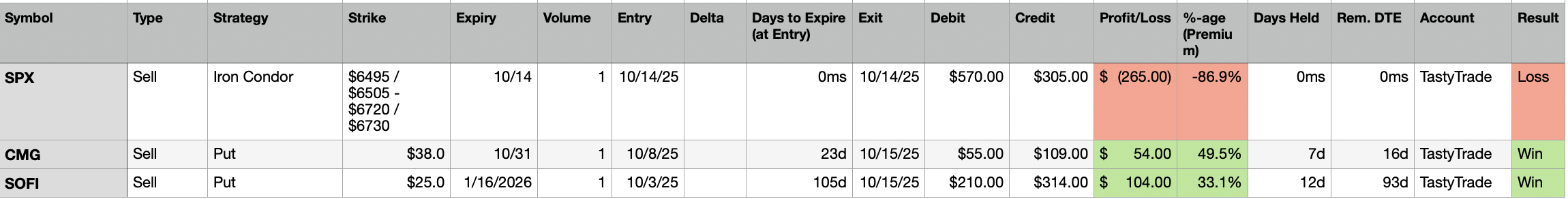

I closed the following trades this week.

I tried another SPX trade, a Zero-DTE (Days to Expire) Iron Condor slightly outside of the expected move range in either direction.

During the day, the price kept going up and down, but at one point my Calls were In the Money (ITM). Generally, traders recommend that you take profits on the untested side and roll that untested side up, leaving the tested side as-is. But I did not want to make any more day trades since I did not want to get flagged as a pattern day trader. Trading platforms typically allow 3 day trades in a rolling 5 day window before marking you as a pattern day trader as required by SEC, which would require me to keep above $25K in the account - I am not there yet.

So, I took the loss on the call spread and then a few minutes later, the profit on the put spread, eventually losing $265 overall on the trade.

I also closed a couple of earnings related bets - one each on CMG and SOFI - resulting in a net profit of $158.

Portfolio Status

Overall, for the week, I lost $107. My 2-week streak of wins broke! Here is my last 5 weeks in terms of Wins and Losses (latest first): L-W-W-L-L.

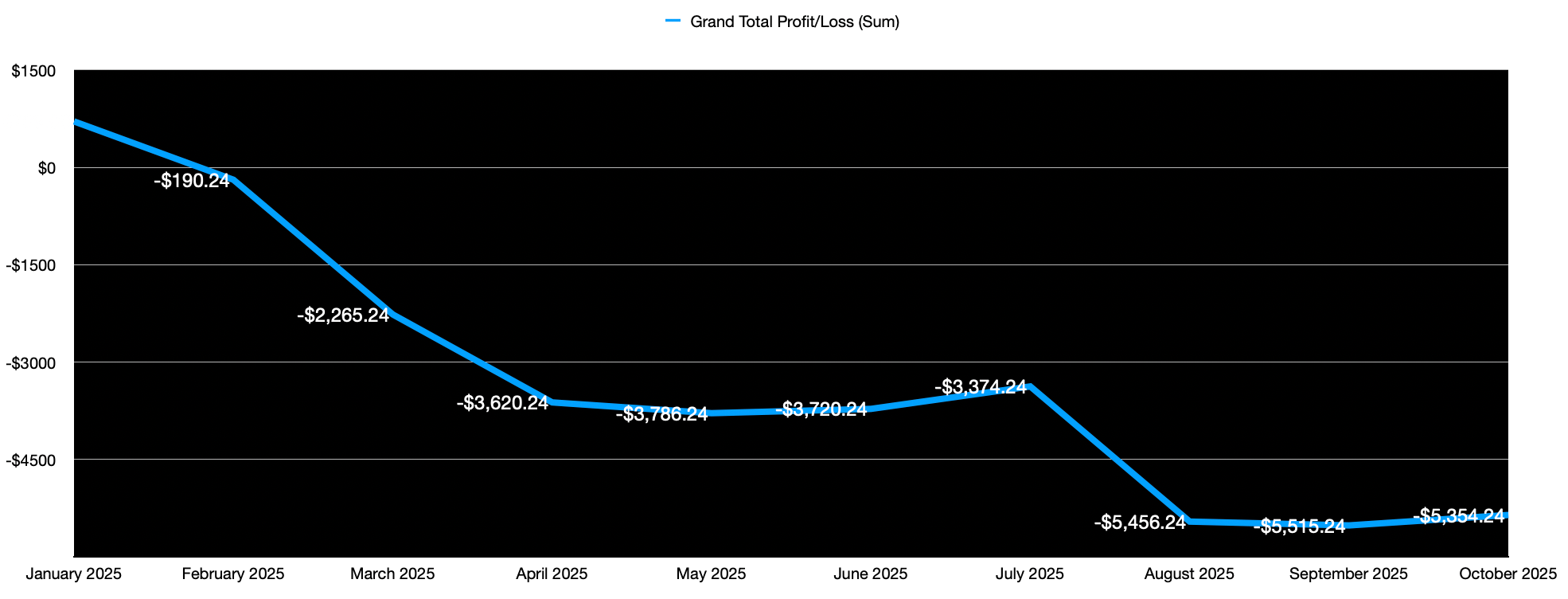

The total Realized Profit/Loss for the year currently stands at -$5,354.

Here is the Profit/Loss trend for the year.

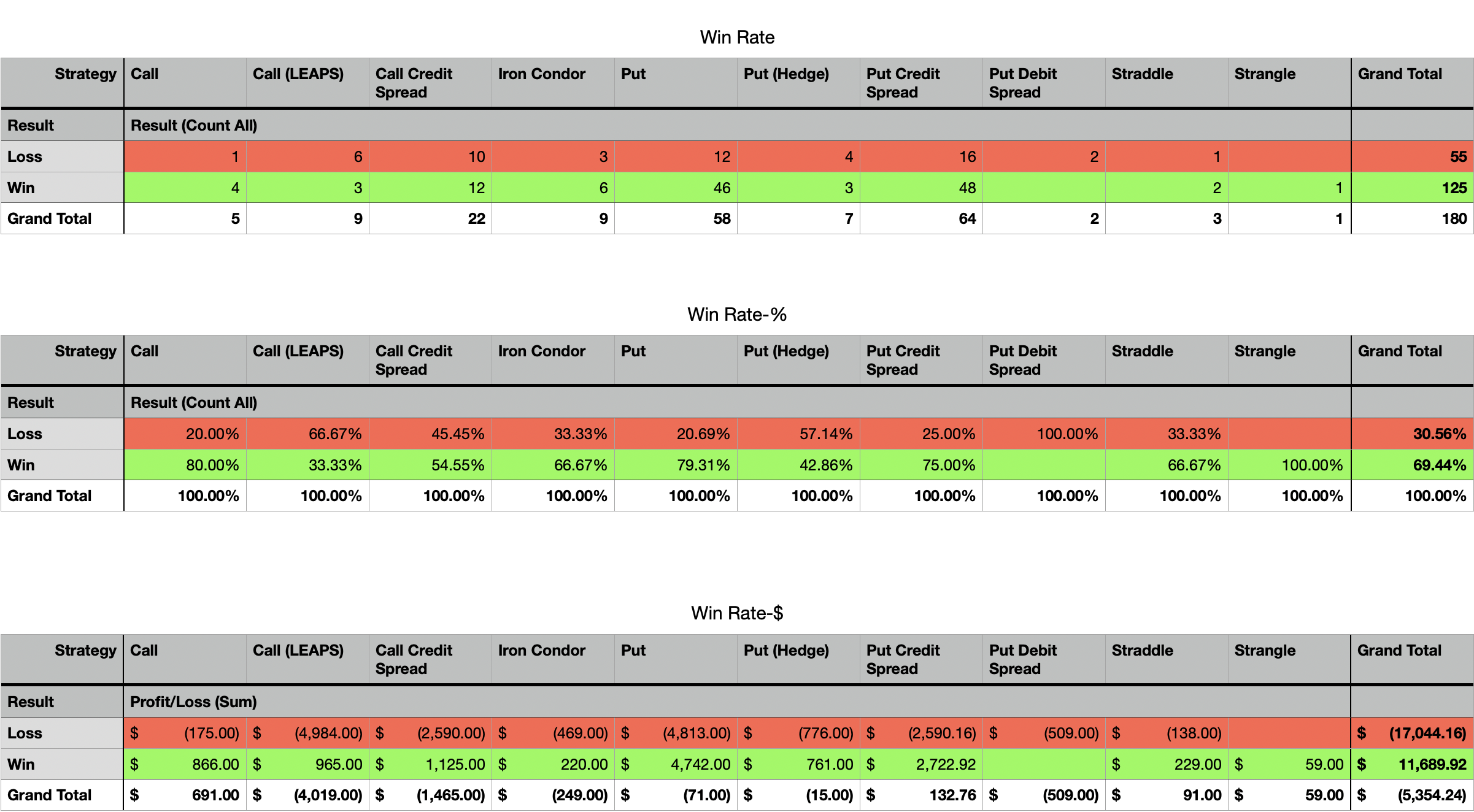

Portfolio Strategy Breakdown

Here's a view showing my Win Rate breakdown by strategy deployed.

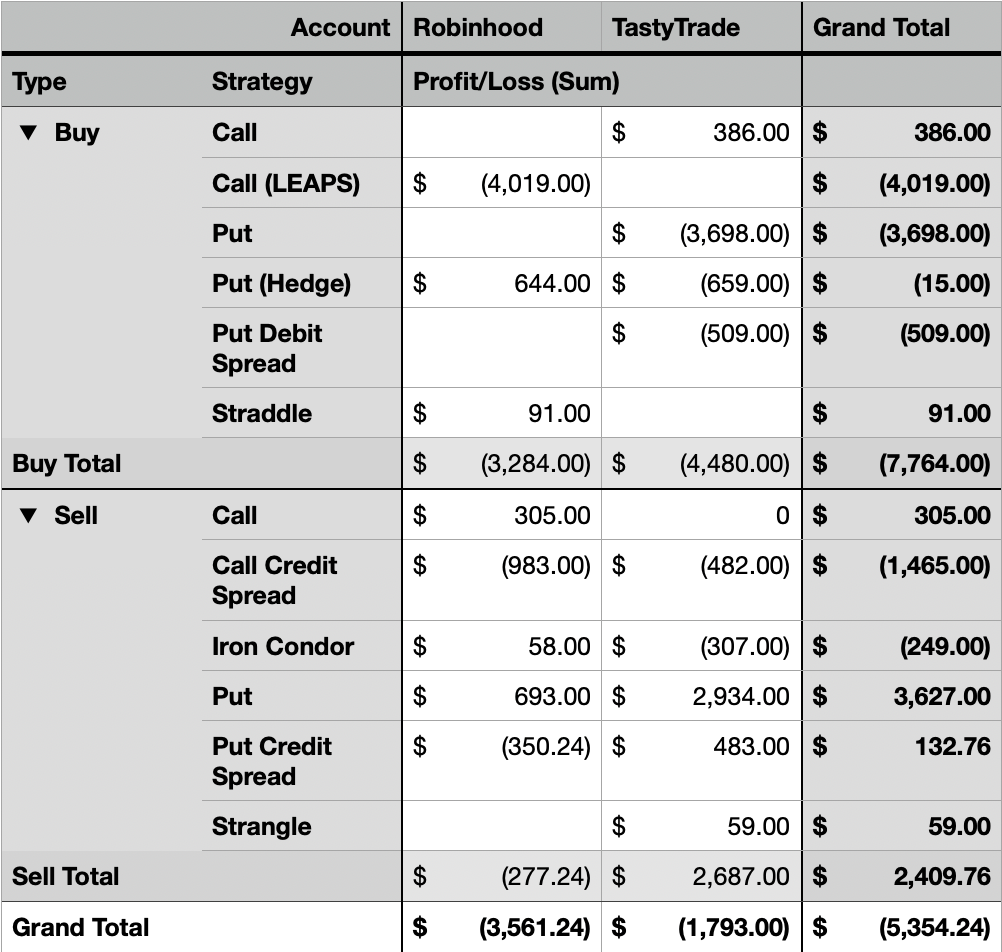

Here is a breakdown of P/L by Buy v/s Sell strategies I have used so far.

Last week, I wrote about doing some backtests on SPY and QQQ LEAPS.

No change in my analysis since last week. However I am a little more hopeful about LEAPS, having spent some time doing backtests on SPY and QQQ. I will publish results for my tests in a future post.

And I did. Here are the results: https://www.foolishtrader.com/backtesting-leaps-on-spy-and-qqq/

The blog shows a few scenarios in which SPY and QQQ LEAPS were profitable.

Plan for Next Week

Most of my open positions right now have more than 21 DTE, so they may not need much active management next week.

Maybe if some open positions give an opportunity to close early, I will take them and re-deploy capital, but all the opportunities I see right now need just a little more than the free cash I have to deploy.

Thanks for following along - see you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.