Day 86

Another roller coaster week! Both SPY and QQQ were bullish this week, all the way until Friday when they crashed due to a potential tariff news by US against China.

Market Recap

Both SPY and QQQ ended red this week.

Last Week:

- SPY ($652.15): -$18.44 (-2.75%)

- QQQ ($589.93): -$14.96 (-2.47%)

Year-over-Year:

- SPY: +$76.10 (+13.21%)

- QQQ: +$99.19 (+20.21%)

Trading Update: October 6 - October 10, 2025

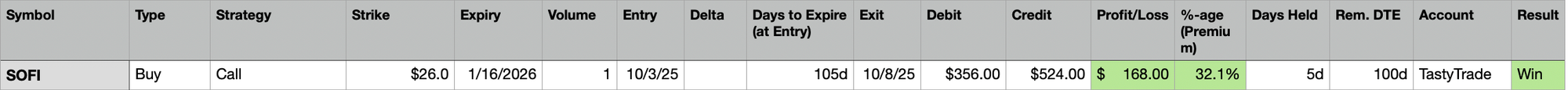

I closed only one trade this week.

SOFI has its earnings due in a couple of weeks. I made a bet that post-earnings there might be a rally in SOFI, with price potentially going above $30.

The way I structured the trade was - I sold two Cash Secured Puts (CSP) on SOFI, and used a portion of the resulting received premium to sponsor and buy a Call, thus not really using any of my capital. Of course, I still have the capital necessary to buy the shares outright should I be assigned the put.

The rally came sooner than I expected - so I closed the call and took a neat $168 profit within 5 days.

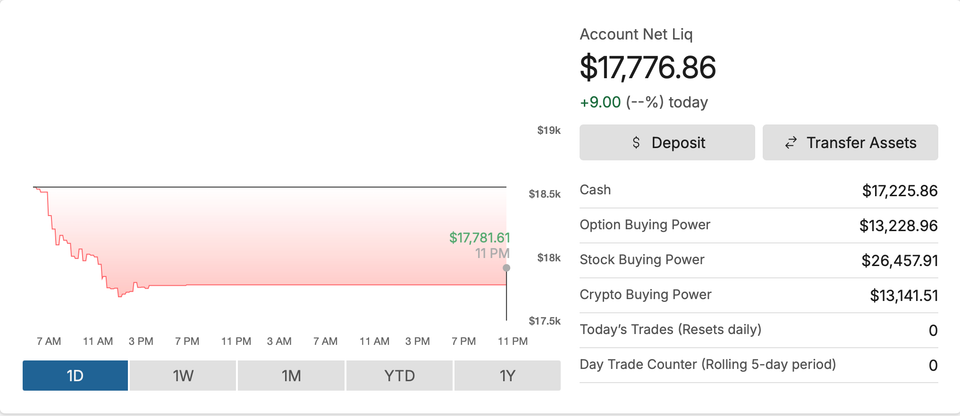

Portfolio Status

I made $168 this week. This takes my score to two consecutive week of wins.

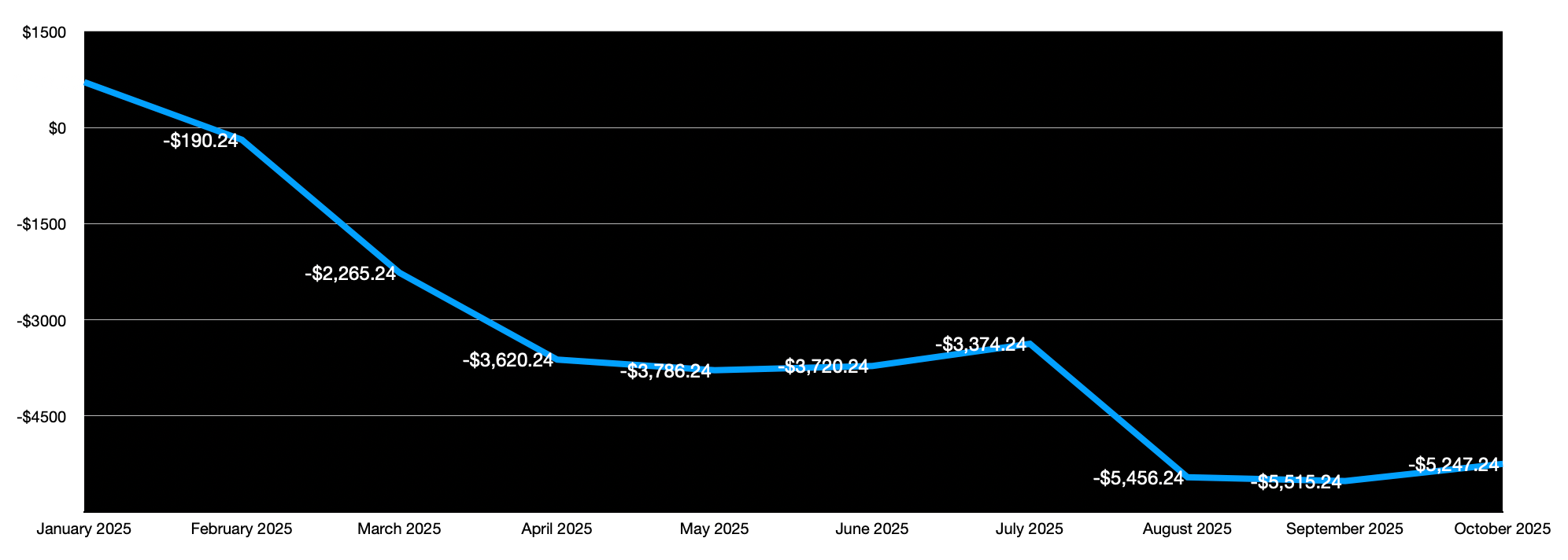

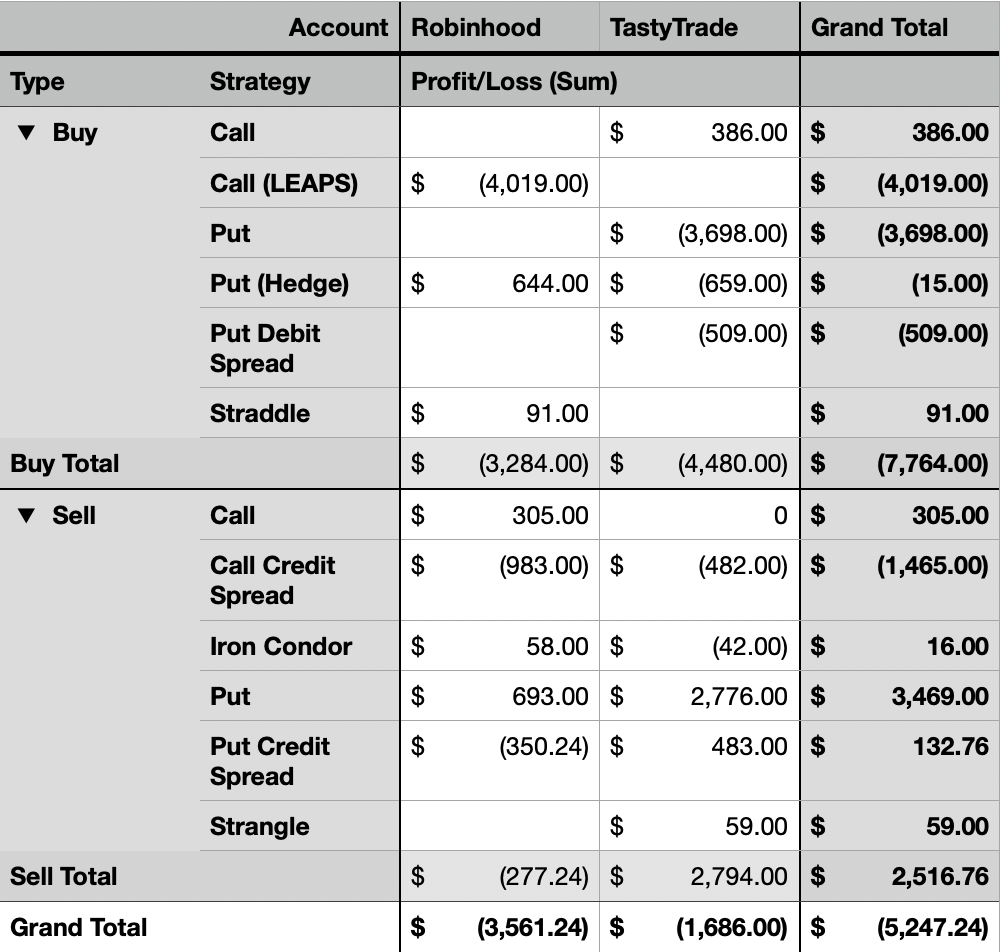

The total Realized Profit/Loss for the year currently stands at -$5,247.

Here is the Profit/Loss trend for the year.

Portfolio Strategy Breakdown

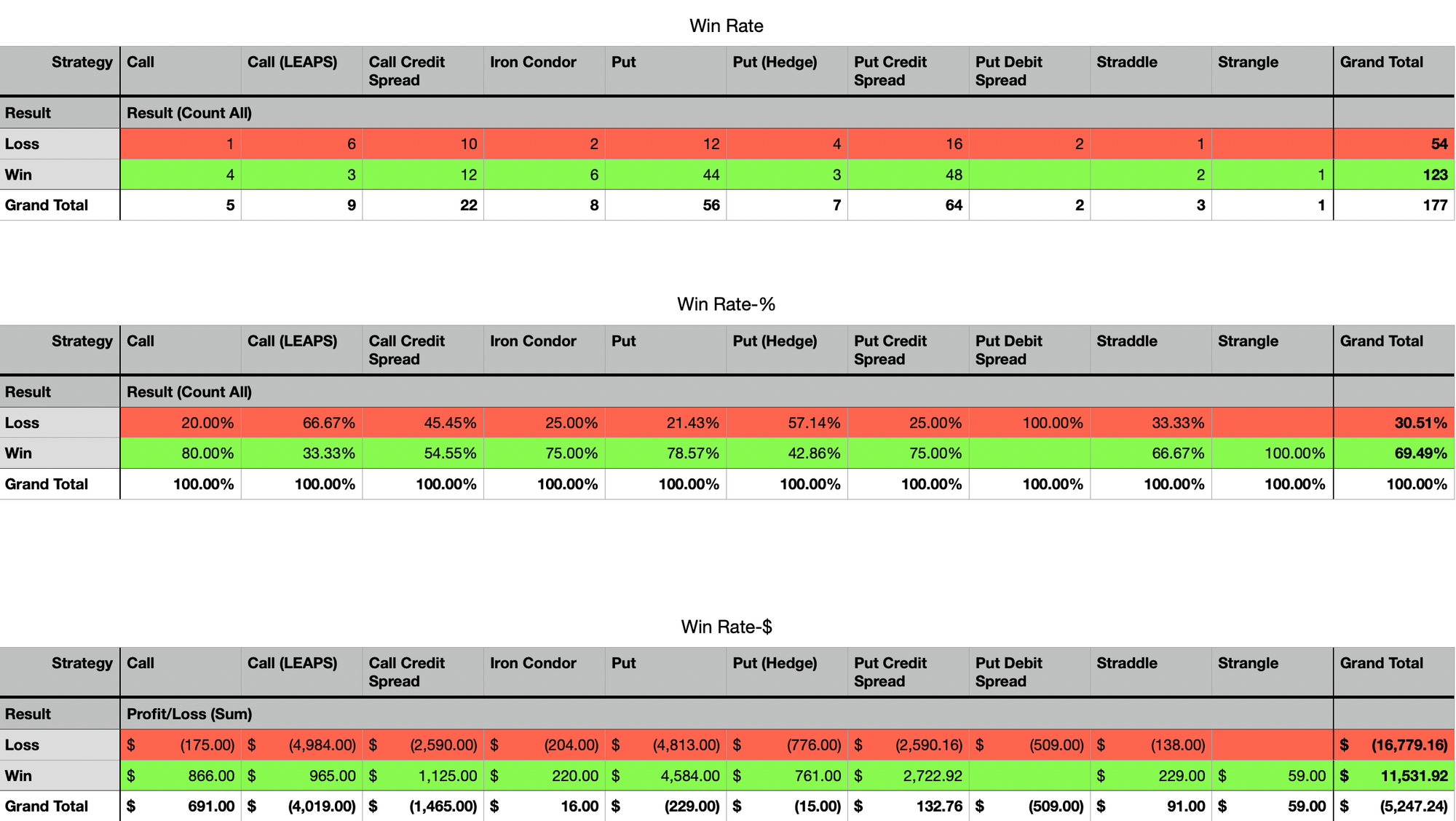

Here's a view showing my Win Rate breakdown by strategy deployed.

Here is a breakdown of P/L by Buy v/s Sell strategies I have used so far.

No change in my analysis since last week. However I am a little more hopeful about LEAPS, having spent some time doing backtests on SPY and QQQ. I will publish results for my tests in a future post.

Plan for Next Week

Considering the markets have been trending upwards without much on-the-ground improvement in day-to-day living, I do not expect the market to keep tanking (famous last words!). In other words, the market is already divorced from reality, so my speculation is the market will either stay neutral or rise just a bit next week.

I do not have any direct plays based on that speculation although if SPX rises over a percent on any given day, it will be highly likely I open a Call Credit Spread on SPX the following day.

Additionally, I will look for more binary events like earnings to make some more speculative moves.

Thanks for following along - see you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.