Day 85

This was an extremely busy weekend for me personally, I am writing this late and am going to keep this short.

Market Recap

Both SPY and QQQ were bullish this week, ending over 1% higher as compared to previous week.

Last Week:

- SPY ($671.19): +$8.62 (+1.30%)

- QQQ ($605.50): +$8.44 (+1.41%)

Year-over-Year:

- SPY: +$98.84 (+17.27%)

- QQQ: +$118.05 (+24.22%)

Trading Update: September 29 - October 3, 2025

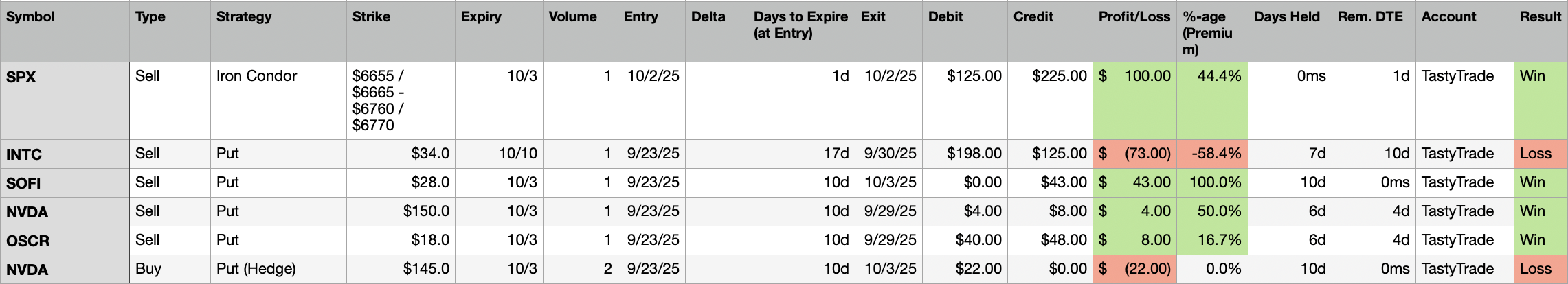

Here are the trades I closed this week. 2 losses and 4 wins.

The main trade on which I lost money was Intel. I was not sure if Intel would continue to rally, so I took the loss instead of an assignment or trying to roll my position. (Of course, it rallied right after I closed!).

I made a 1-DTE SPX trade, realizing $100 in profits and closing it on the same day, getting 1 day trade against me. The strategy was similar to what I did a couple of weeks ago, going slightly outside of the expected move and sell a spread. Except this time I sold in both directions (i.e., a Put as well as a Call) and opening an Iron Condor. 2 wins out of 2 SPX trades so far!

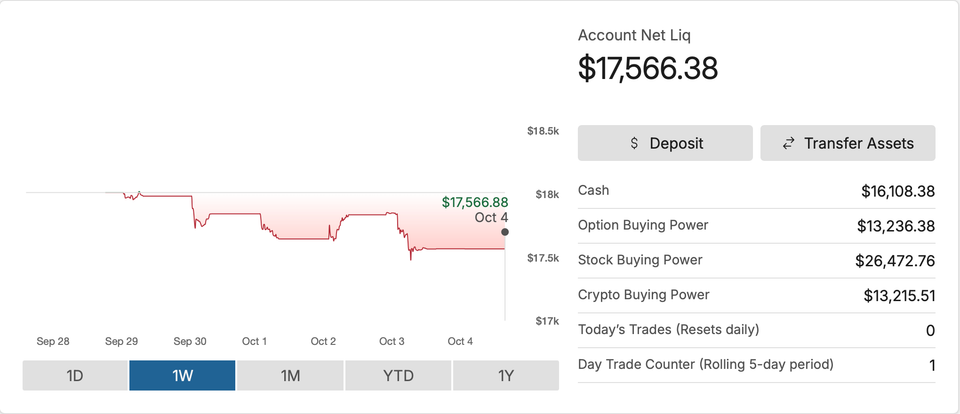

Portfolio Status

I made $60 this week. I finally got a winning week after multiple weeks of losses. Here is what I wrote last week.

Overall, I lost ~$54 this week. This is an improvement over my past two weeks of +$100 losses.

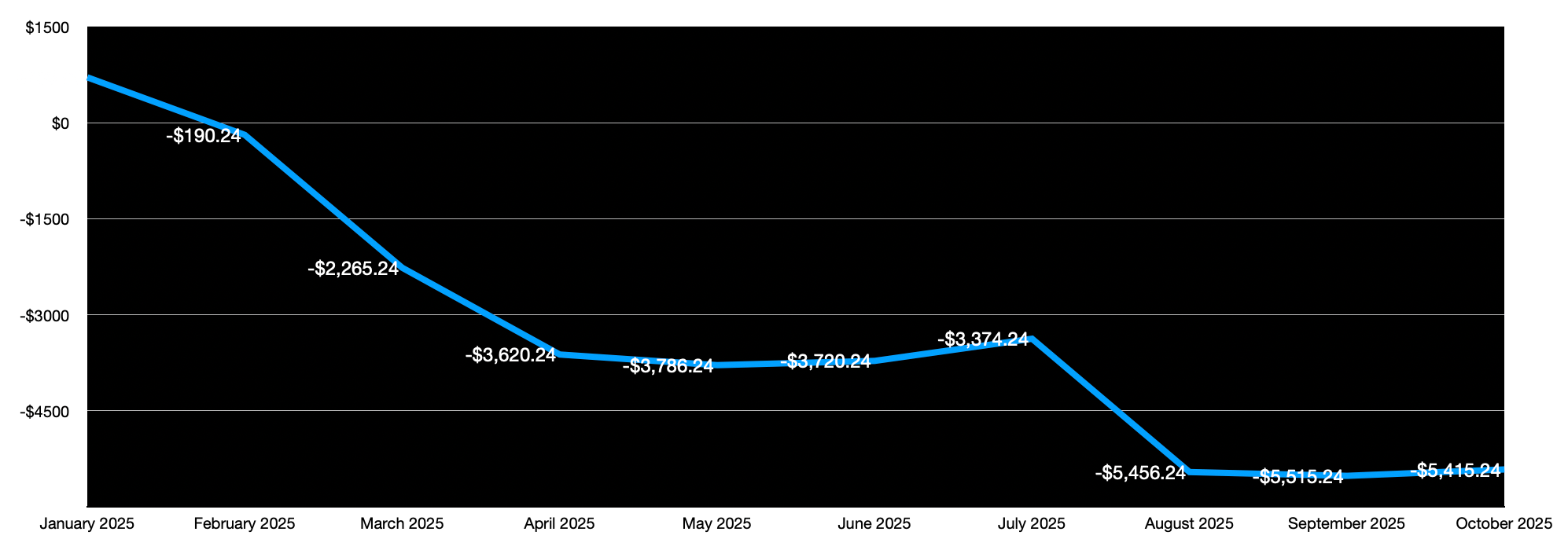

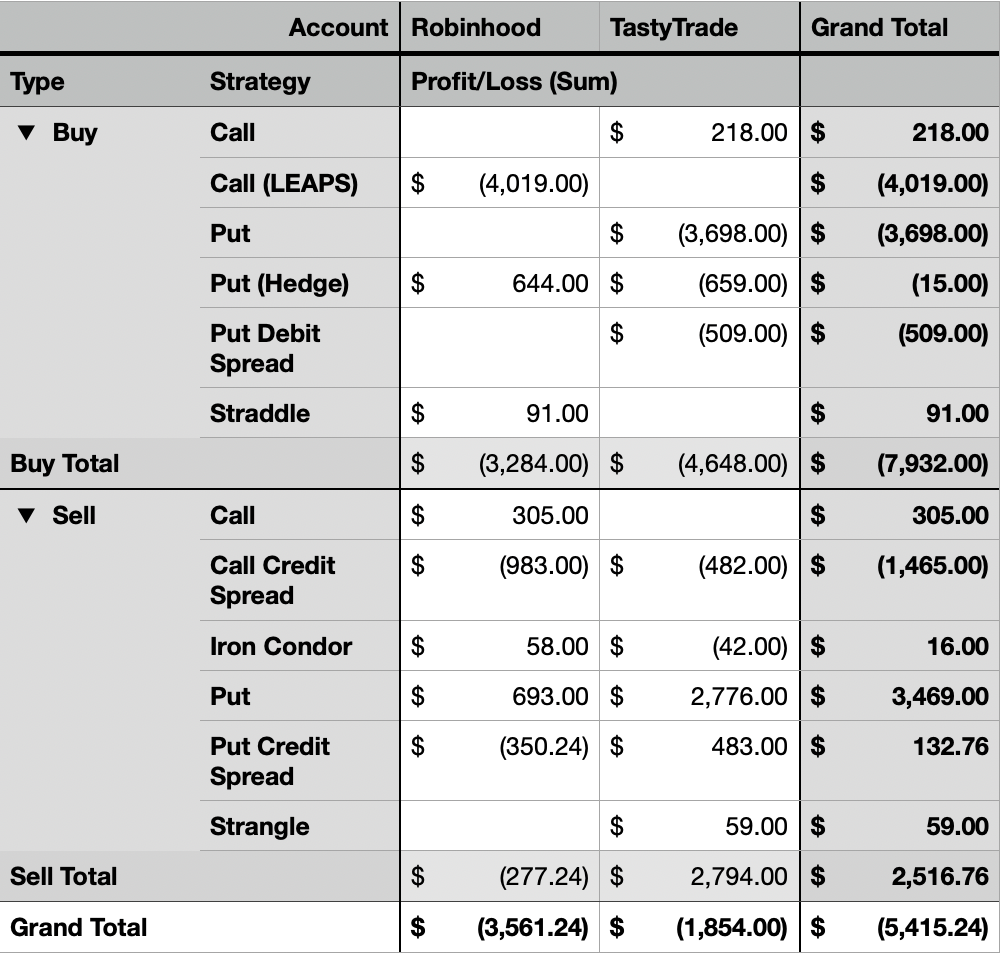

The total Realized Profit/Loss for the year currently stands at -$5,415.

Here is the Profit/Loss trend for the year.

Portfolio Strategy Breakdown

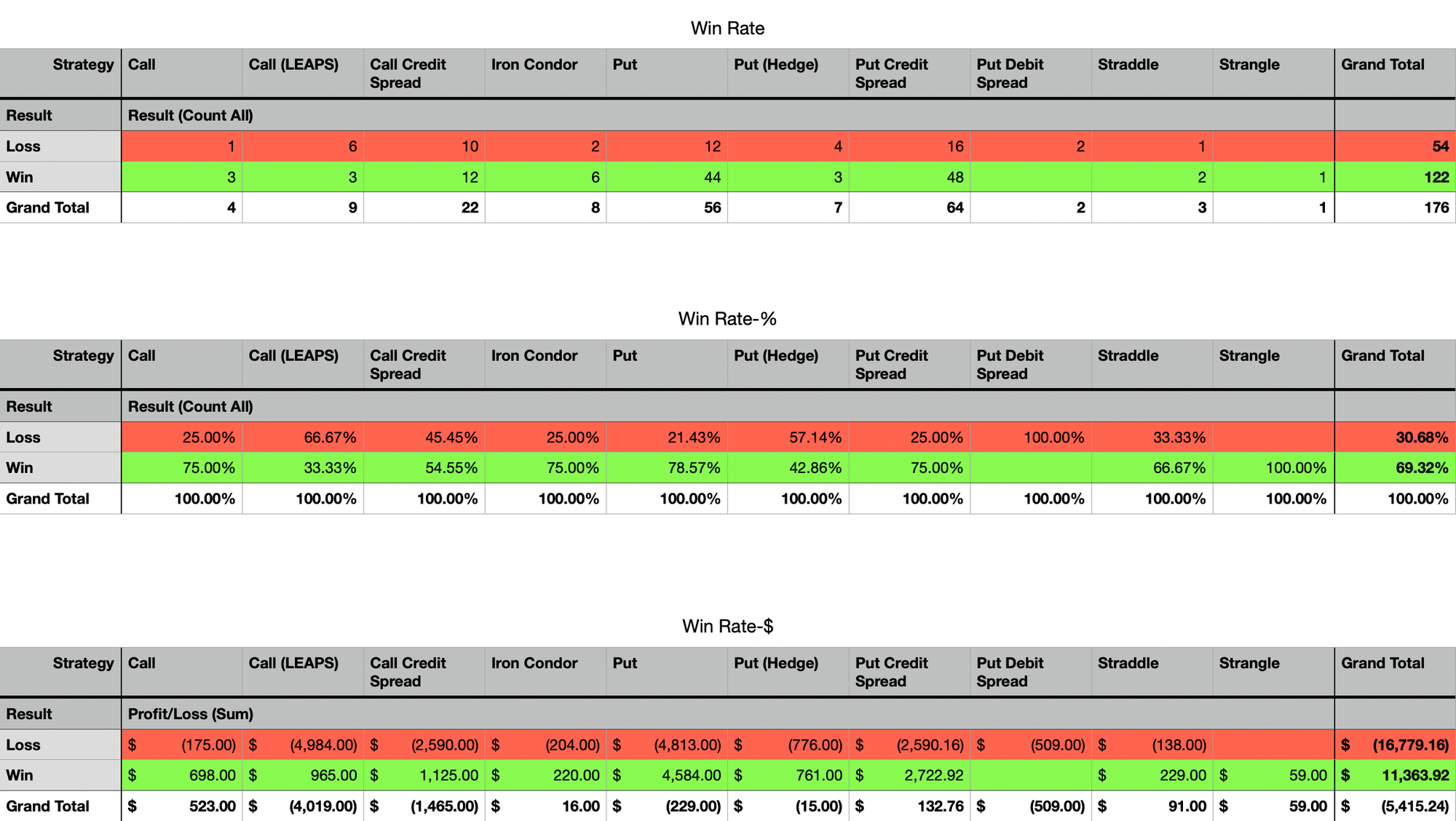

Here's a view showing my Win Rate breakdown by strategy deployed.

Here is a breakdown of P/L by Buy v/s Sell strategies I have used so far.

While win rate and P/L by strategy remain skewed by oversized losses, there is enough data points now for me to say the following:

- Call Credit Spreads have resulted in losses, mainly because I think the market has been bullish and so the ranges I have traded in have gotten tested quite frequently.

- LEAPS have resulted in losses. In hindsight, LEAPS in general would have been profitable or at least even had I held on to them. But I did not quite get either entry or the exit right.

- Buying Puts to cancel out the margin-enabled selling of Puts have brought losses.

The key learning from each:

- Go slightly more out of the expected move when selling spreads.

- Read more on LEAPS to understand their right setup.

- Only sell Puts on real cash, even in a margin account.

Plan for Next Week

Considering I have a 100% success rate with SPX (alright, it's been only two trades, so I am no genius). I am hoping to bet another $1K on a SPX setup after my day trade counter resets to zero.

I got assigned a SOFI Put, so will look to sell a covered call against it.

And I will scavenge for more opportunities for a $3k to $4k bet amount.

Thanks for following along - see you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.