Day 84

Read on as I attempt to slowdown my losses while the market continues to rally. You will not see a better exercise in hubris!

Market Recap

Both SPY and QQQ were slightly bearish this week, ending nearly flat as compared to previous week.

Last Week:

- SPY ($662.11): -0.89 (-0.13%)

- QQQ ($596.15): -2.56 (-0.43%)

Year-over-Year:

- SPY: +$88.72 (+15.47%)

- QQQ: +$105.65 (+21.54%)

Trading Update: September 22 - September 26, 2025

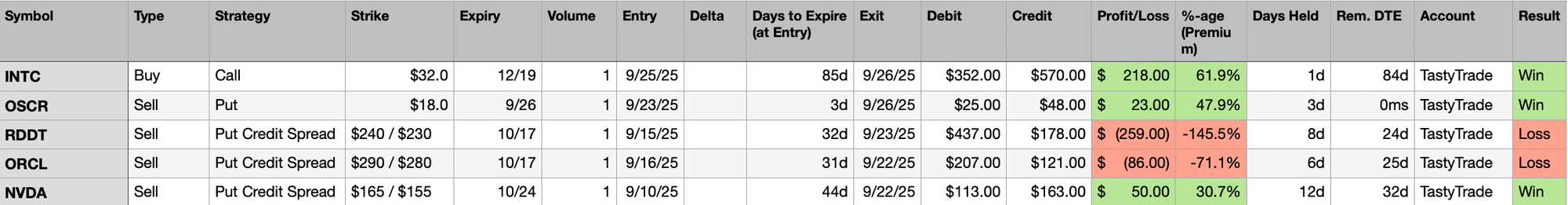

Here are the trades I closed this week. 2 losses and 3 wins.

Here is what I said about my ORCL trades last week, but one of those trades was still open, which I corrected and got out of this week.

I tried to salvage ORCL but that was a minor disaster, had 4 other wins offsetting some of the ORCL loss.

A Put Spread on RDDT went past my loss threshold, so I closed that out. For spreads, I am beginning to close them out when I lose a 100% of my premium - but since I am doing it manually, I sometimes miss the exact time that happens. Note that as I have said before, I still have a day job and do not trade continuously, just an hour in the morning before work, and maybe an hour during my lunch break if I am not working through lunch.

I made a bet on INTL this week, buying into INTL's rally. I entered and exited a Call for a nice $218 profit, risking $350. That is nearly 62% profit in a single day. This should count as a guilty pleasure, since this was not my typical premium selling strategy.

Portfolio Status

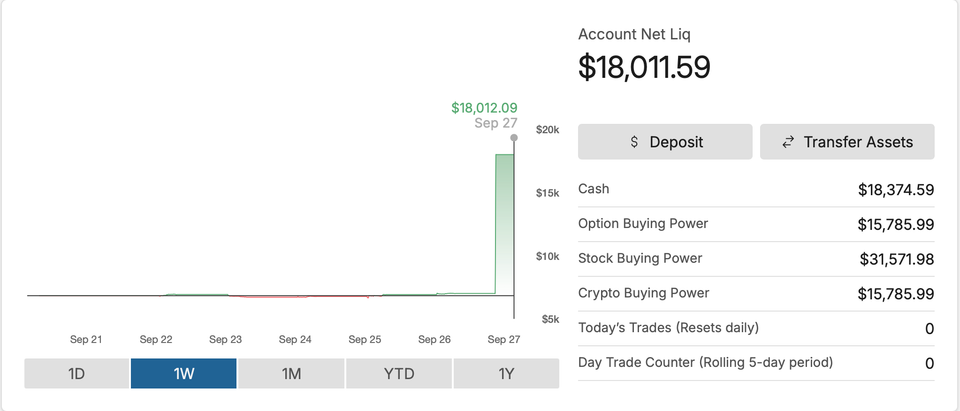

Overall, I lost ~$54 this week. This is an improvement over my past two weeks of +$100 losses.

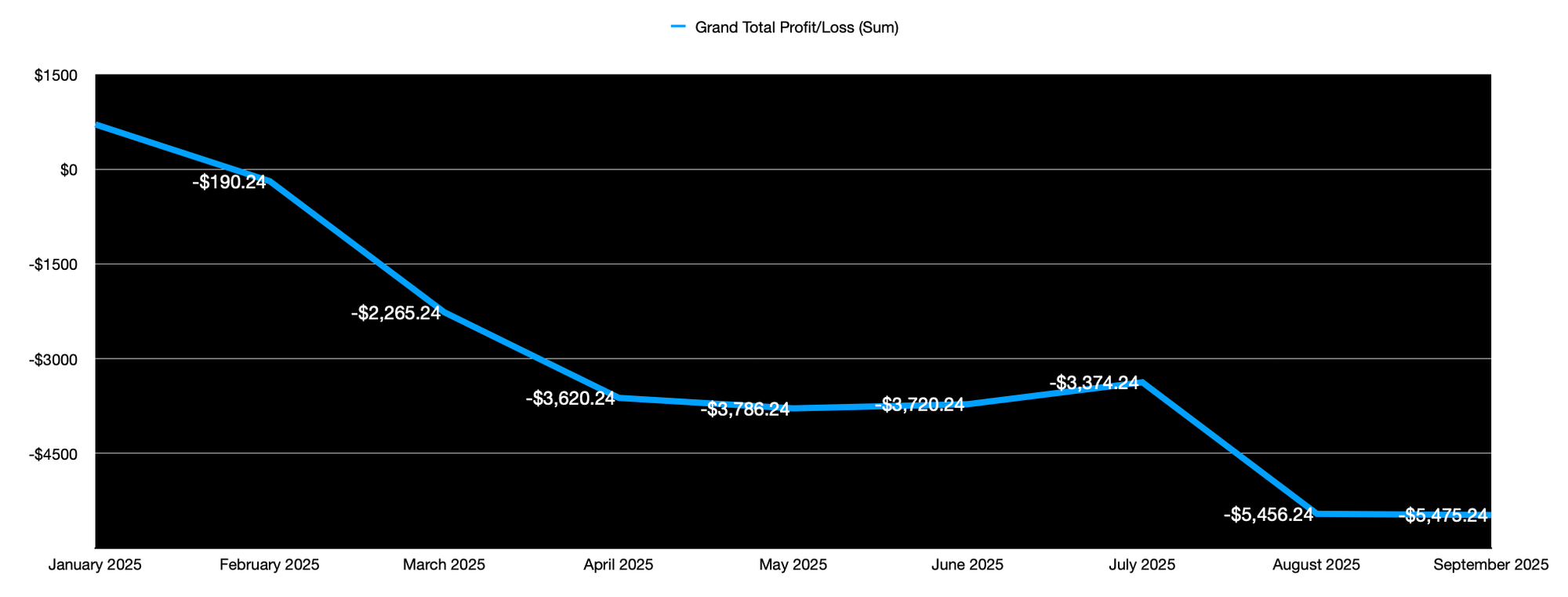

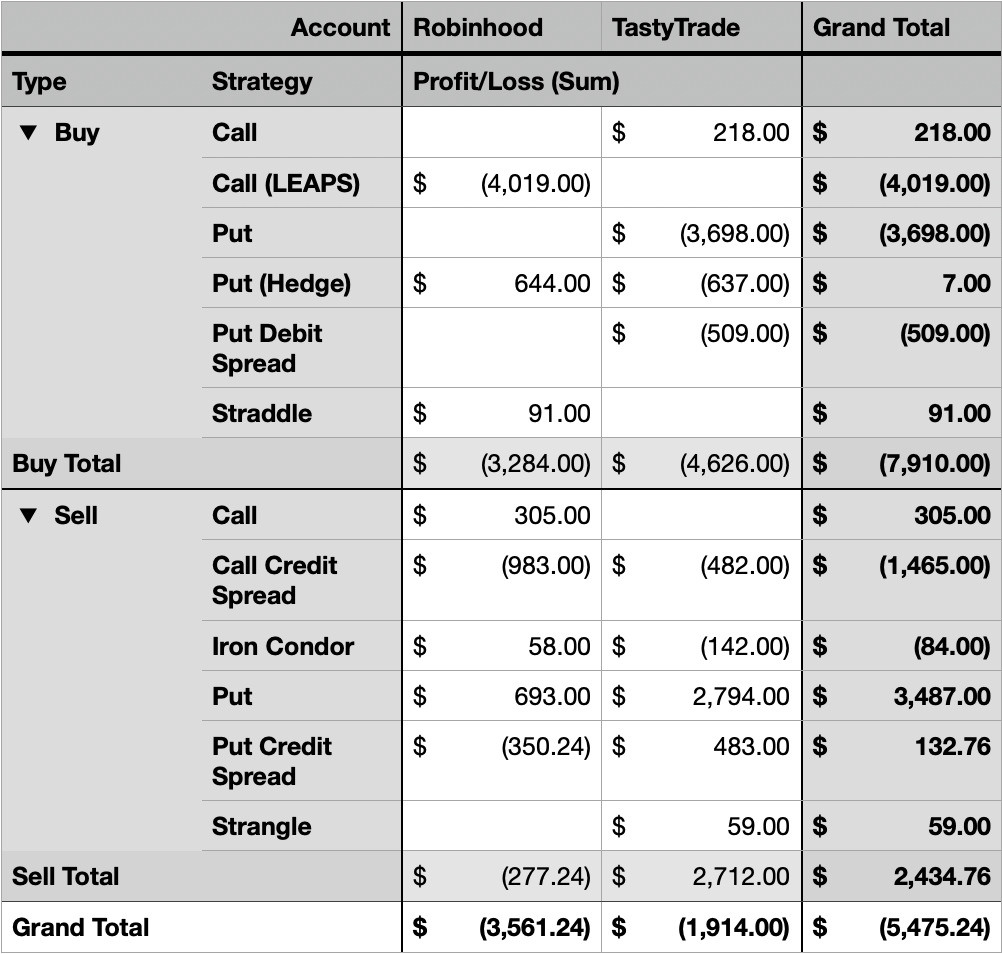

The total Realized Profit/Loss for the year currently stands at -$5,475.

Here is the Profit/Loss trend for the year.

Portfolio Strategy Breakdown

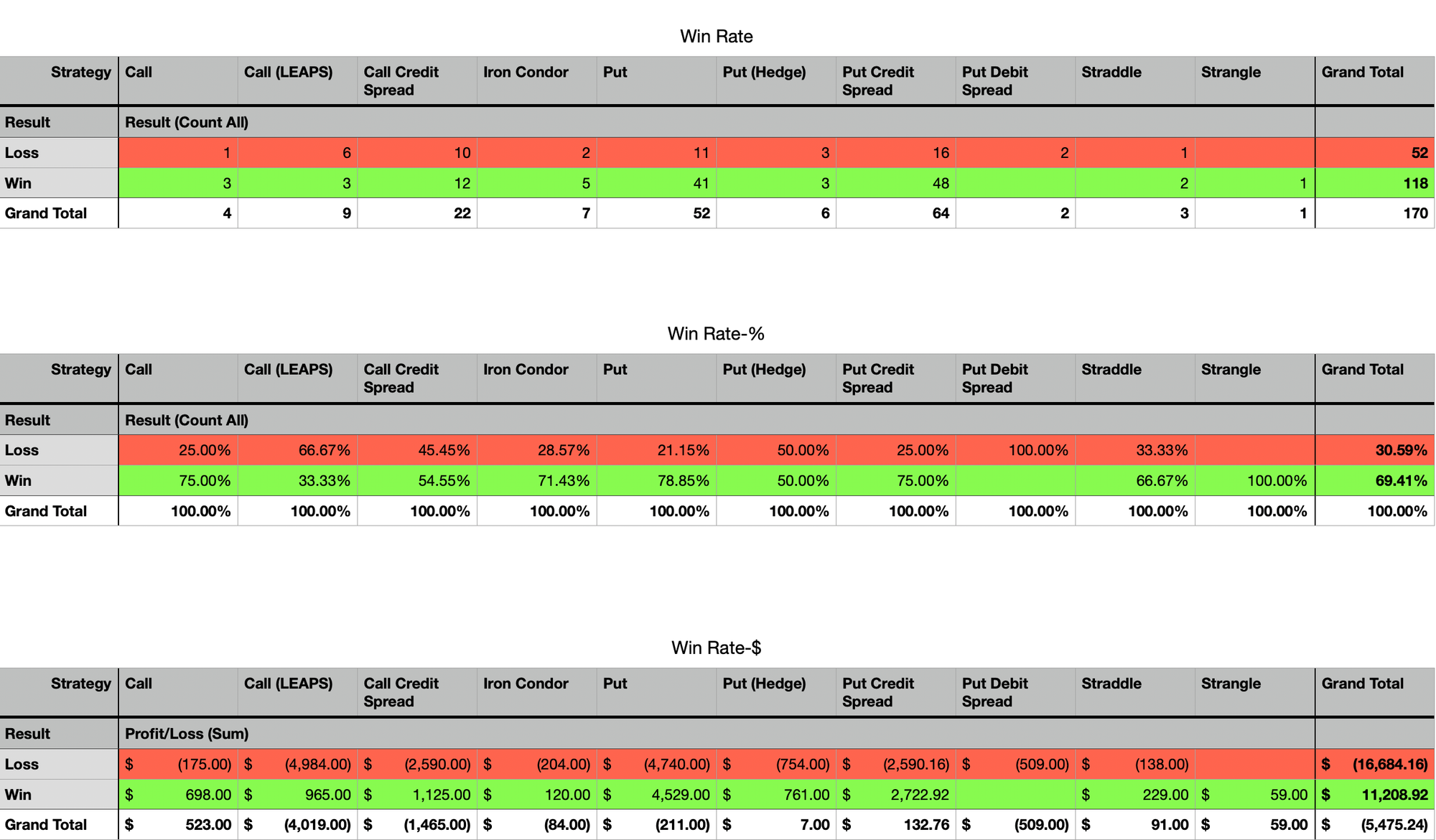

Here's a view showing my Win Rate breakdown by strategy deployed.

Here is a breakdown of P/L by Buy v/s Sell strategies I have used so far.

Win rate and P/L by strategy remain skewed by oversized losses.

However, it has become increasingly clear that even when I have done zero business or macro analysis for any trade I entered, the only thing that seems to have really made money is selling Puts or Calls. For example, as you see above, I made $305 in selling calls, and $3487 in selling Puts.

Plan for Next Week

With 9 months of my data data revealing that the best path in current market is to increase my bets on selling Puts and Calls, I have decided to bring in additional savings from my regular job to double-down on the winning strategies.

In the past few weeks, my trades skewed heavily towards spreads, a representation of my account size being <$10K. I am bringing in additional $10K now, which brings my total invested capital this year nearly to $20K. And my next goal is to save and increase my betting pool to ~$25K. Or use the existing invested capital to get there.

The intent behind bringing additional capital is to reduce my dependence on spreads for making my bets. The challenge with spreads is the hard loss of capital when they don't go your way. And in my case, those losses have cumulatively been larger than what a string of wins have provided in cumulative gains.

I will still be trading spreads and condors but will likely keep it to <5% of my trading capital now on.

I am also thinking of bringing back some hedges considering the market is so overheated in my opinion.

Looking forward to another week of reduced losses or perhaps a winning week.

Thanks for following along - see you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.