Day 83

Bad trades on ORCL caused another couple of hundred dollars of loss. I tried a ticker I had never traded before, and more on another week where indices moved up while I moved down.

Market Recap

Both SPY and QQQ were bullish again this week.

Last Week:

- SPY ($663.38): +5.98 (+0.91%)

- QQQ ($599.40): +$12.57 (+2.14%)

Year-over-Year:

- SPY: +$95.54 (+16.83%)

- QQQ: +$116.91 (+24.23%)

Trading Update: September 15 - September 19, 2025

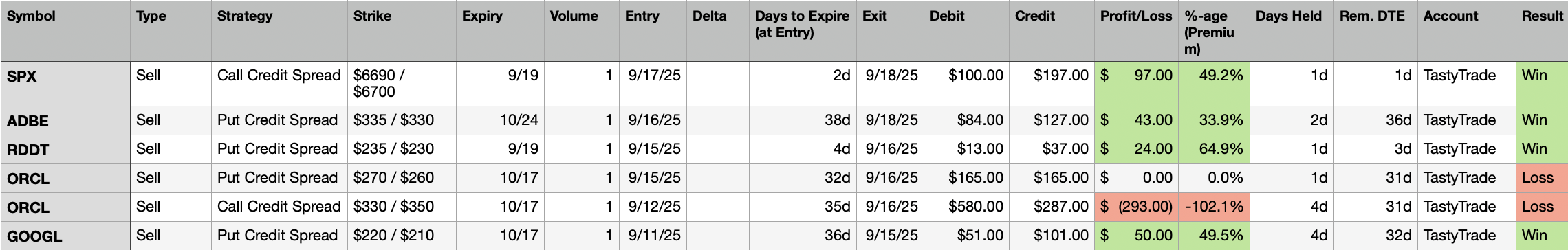

Here are the trades I closed this week. 2 losses and 4 wins.

I tried to salvage ORCL but that was a minor disaster, had 4 other wins offsetting some of the ORCL loss.

I made a few winning bullish bets on ADBE, GOOGL, and RDDT.

However the trade I enjoyed most this week was a 2-DTE trade in SPX.

- I opened a Call Credit Spread slightly outside the expected move, but still within 1 Standard Deviation.

- Within an hour, it had already gained 50% of my original premium.

- Afraid of getting stuck in a day trade, I waited until the next morning and closed it within five minutes of the market open - locking in my target profit.

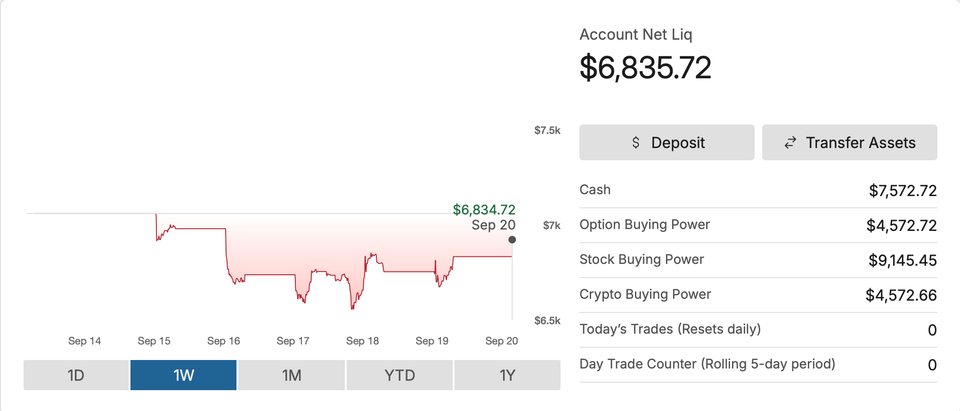

Portfolio Status

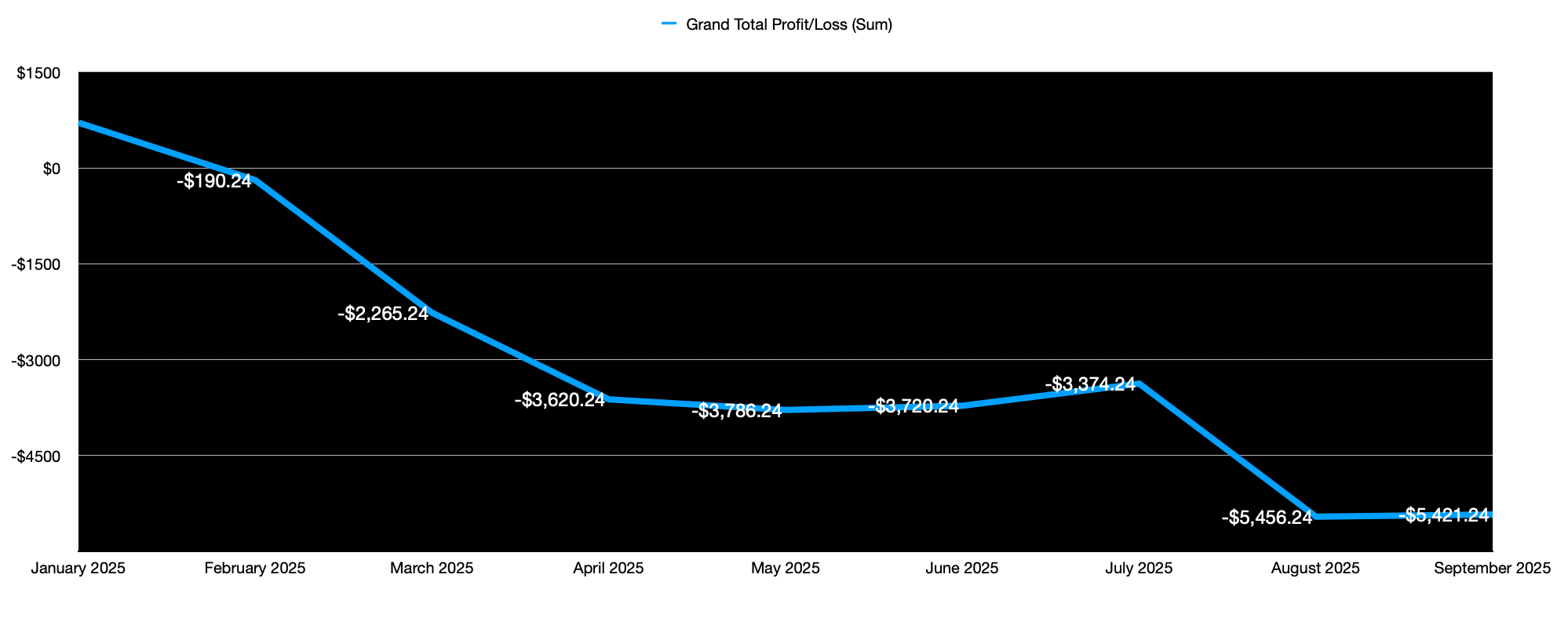

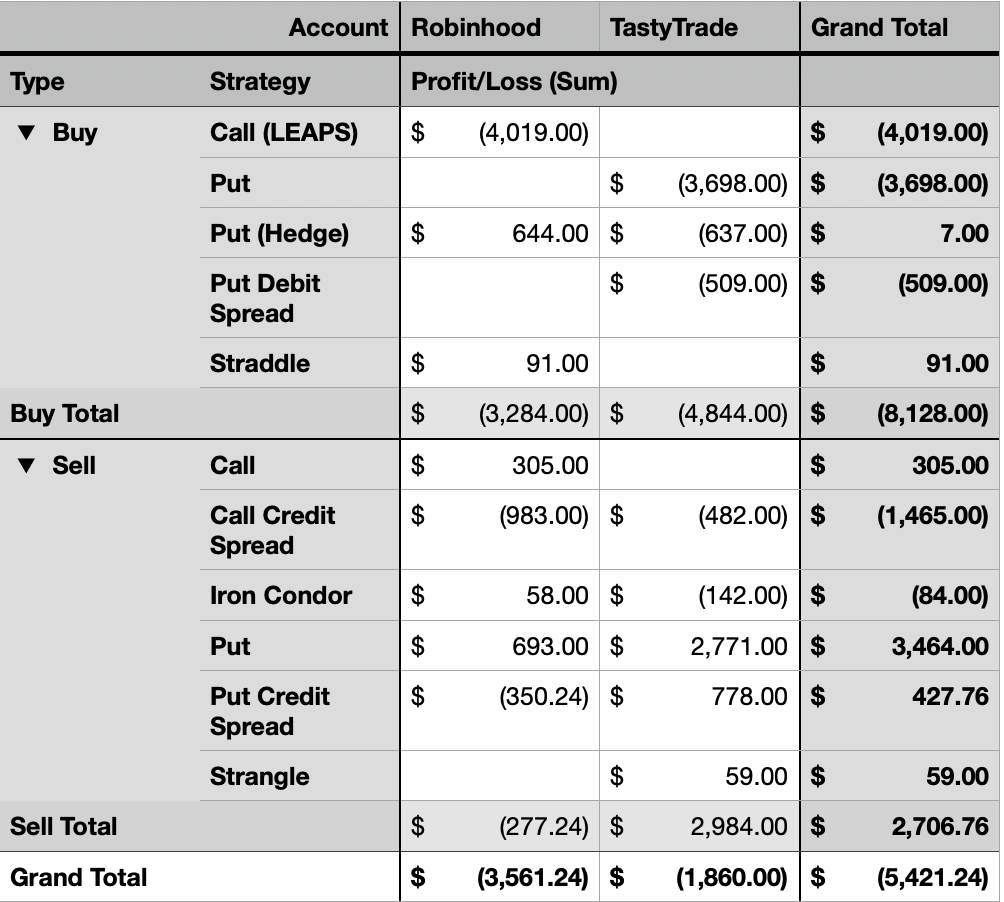

I lost another ~$130 this week. The total Realized Profit/Loss for the year currently stands at -$5,421.

Here is the Profit/Loss trend for the year.

Portfolio Strategy Breakdown

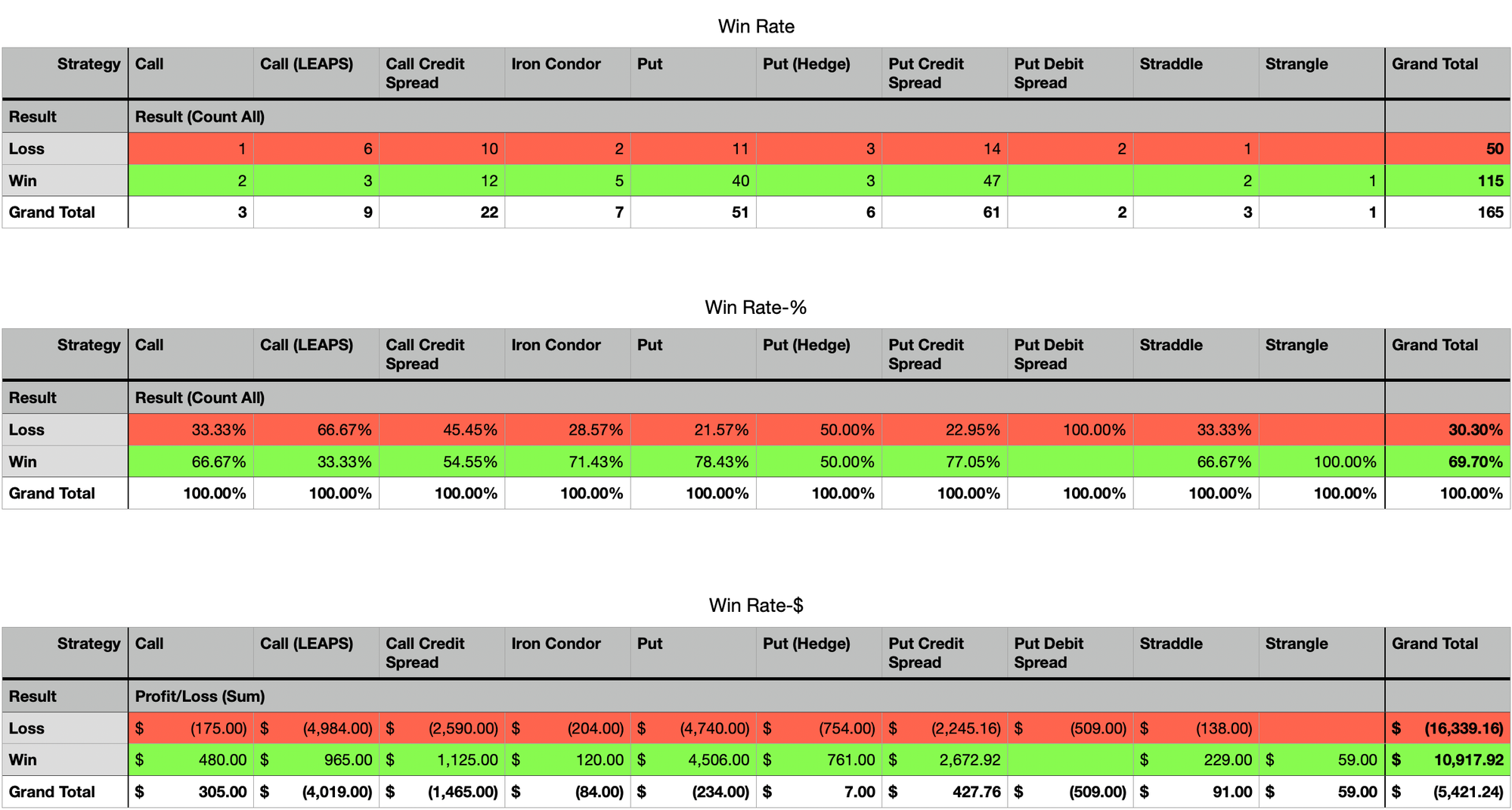

Here's a view showing my Win Rate breakdown by strategy deployed.

Here is a breakdown of P/L by Buy v/s Sell strategies I have used so far.

Win rate and P/L by strategy remain skewed by oversized losses.

Plan for Next Week

I’m likely going to try another Credit Spread on SPX, risking about $1,000.

The inspiration for this week’s SPX trade wasn’t a brilliant insight on my part - I was influenced by a couple of TastyTrade traders.

- I heard a Rising Star trader explain how he mostly sold Calls on zero-DTE trades.

- Later, I noticed a couple of other traders doing something similar.

That gave me enough confidence to copy the idea. My reasoning for picking this trade:

- I could collect a premium nearly one-third of the capital at risk.

- I speculated that SPX’s bullish momentum was slowing, so selling slightly outside the expected move seemed like a reasonable play.

Key takeaway:

Have a clear speculation, and act on it only when the premium is juicy enough to justify the risk.

Thanks for following along - see you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.