Day 82

An up and down week for me with trades for both opportunities as well as headwinds resulting in the account ending nearly flat for the week.

The Red Queen Effect - "It takes all the running you can do, to keep in the same place.".

Market Recap

Both SPY and QQQ were bullish this week, reversing last few weeks' bearish-to-neutral moves.

Last Week:

- SPY ($657.25): +8.71 (+1.34%)

- QQQ ($586.63): +$8.62 (+1.49%)

Year-over-Year:

- SPY: +$97.54 (+17.43%)

- QQQ: +$114.15 (+24.16%)

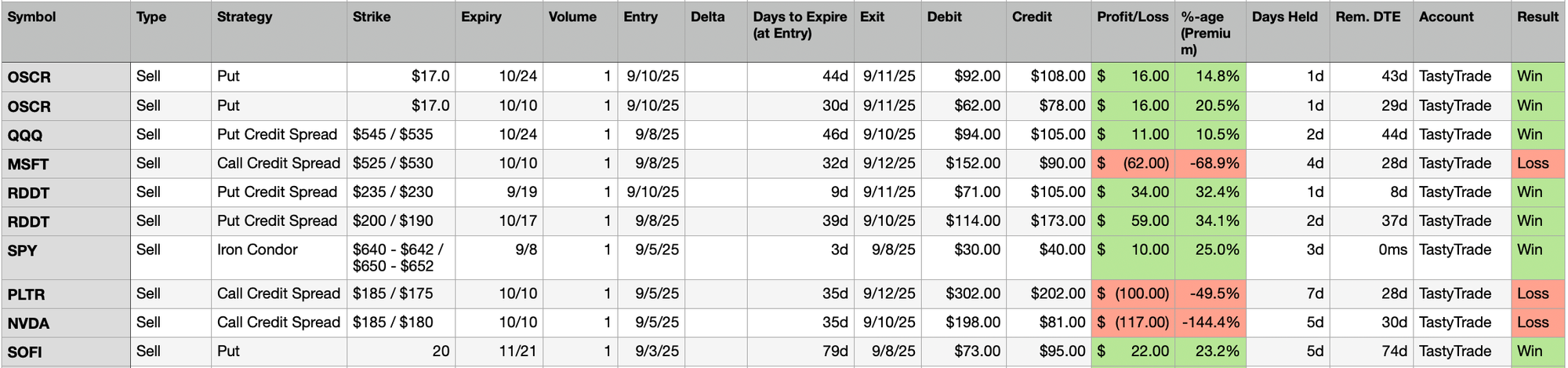

Trading Update: September 8 - September 12, 2025

Here are the trades I closed this week. 3 trades closed at a loss, 7 with a profit, with a net Loss of $111.

Alright, so a few losses this week, but I think I did not let them get big on me. I was bearish on PLTR, NVDA, and MSFT, was wrong, so I cut my losses and moved on.

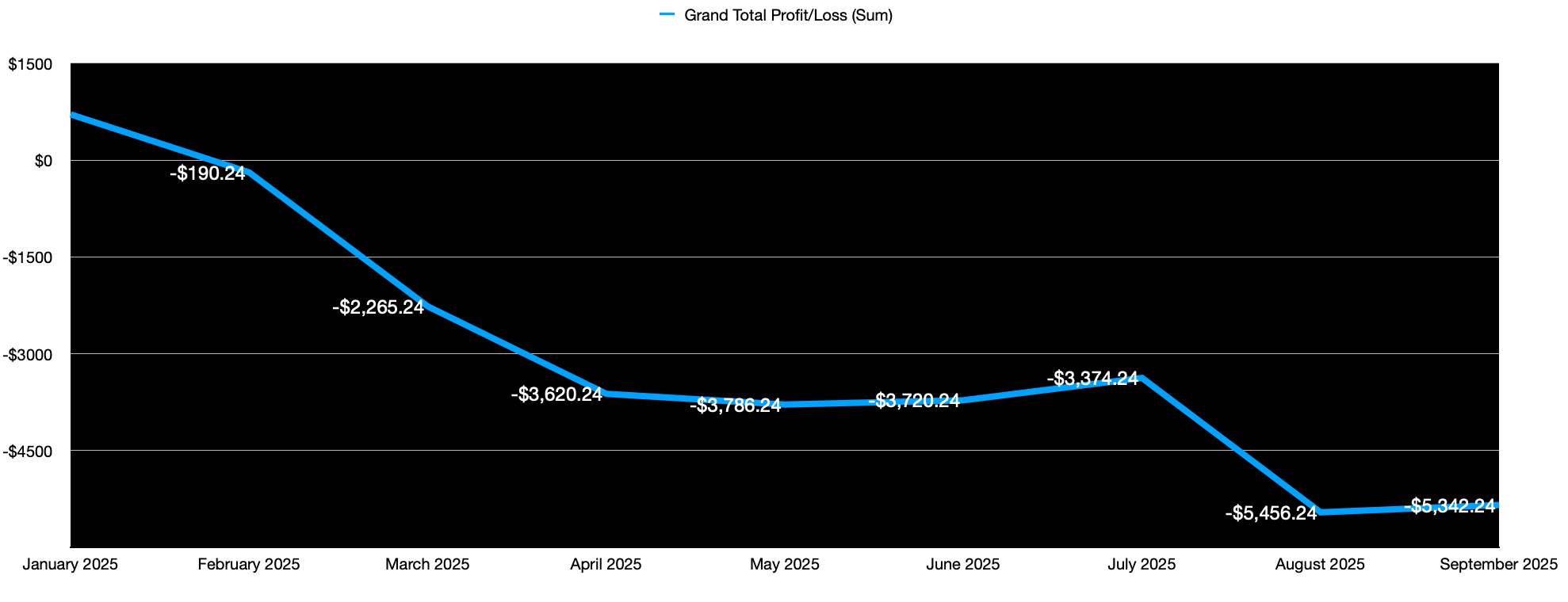

Now, year-to-date, even with the market at all time highs, I have managed to lose money here. Note that this is just a small amount I am playing with - I am mostly invested in indices (S&P 500) - but the contrast of profits in those large accounts and losses in this small account - is quite obvious.

So why keep doing this? A few things: options trading and writing about it is fun for me, there are worse ways to lose money than trading options with a limited capital, and then the last one - what if I don't lose?

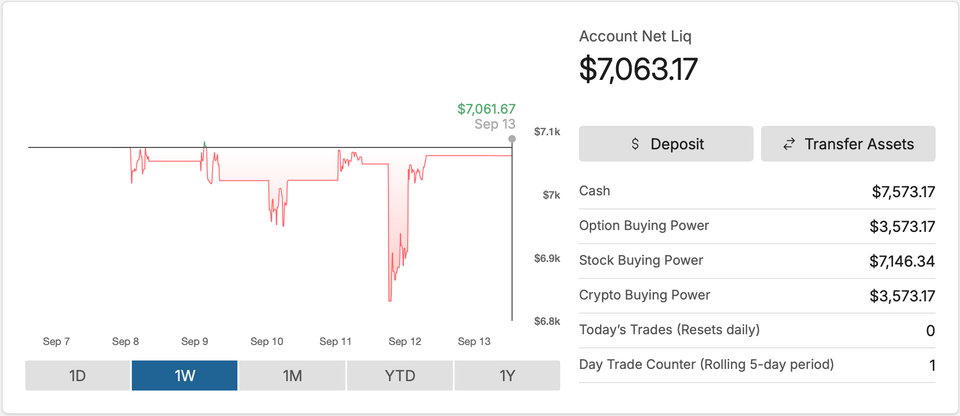

Portfolio Status

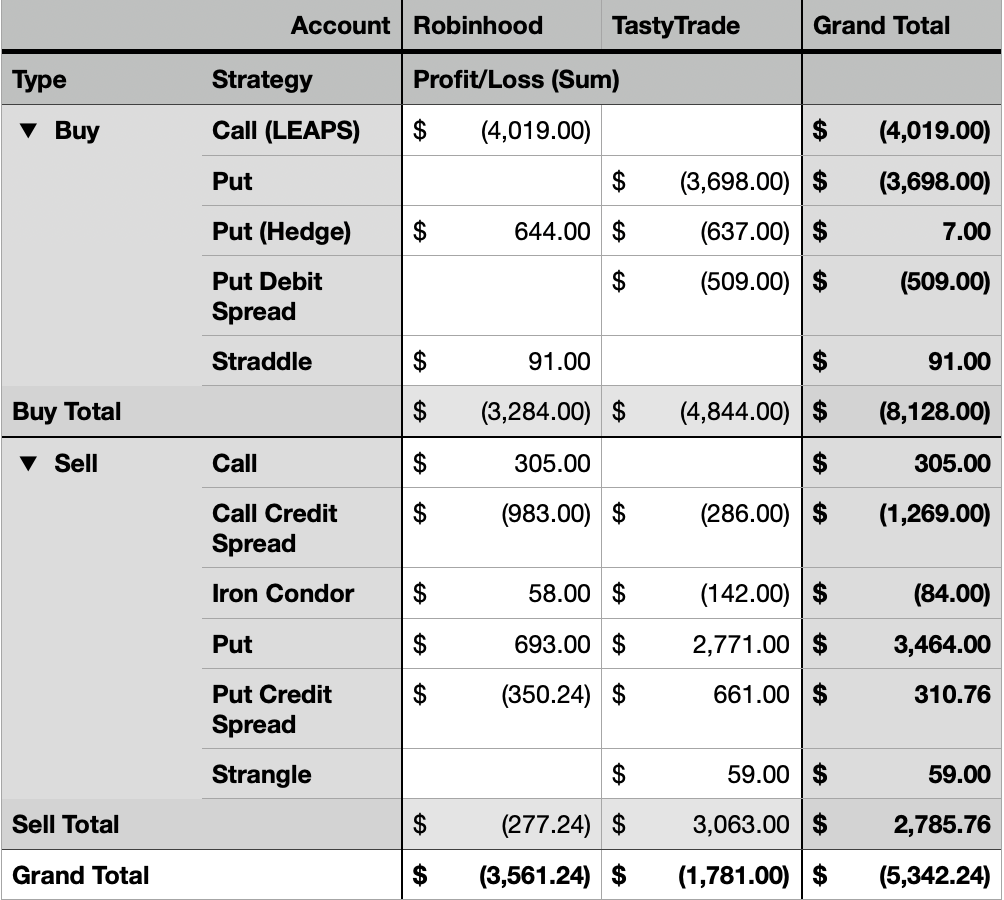

The total Realized Profit/Loss for the year currently stands at -$5,342.

I lost ~$110 this week. My used buying power varied between 10% to 60% this week.

Here is the Profit/Loss trend for the year.

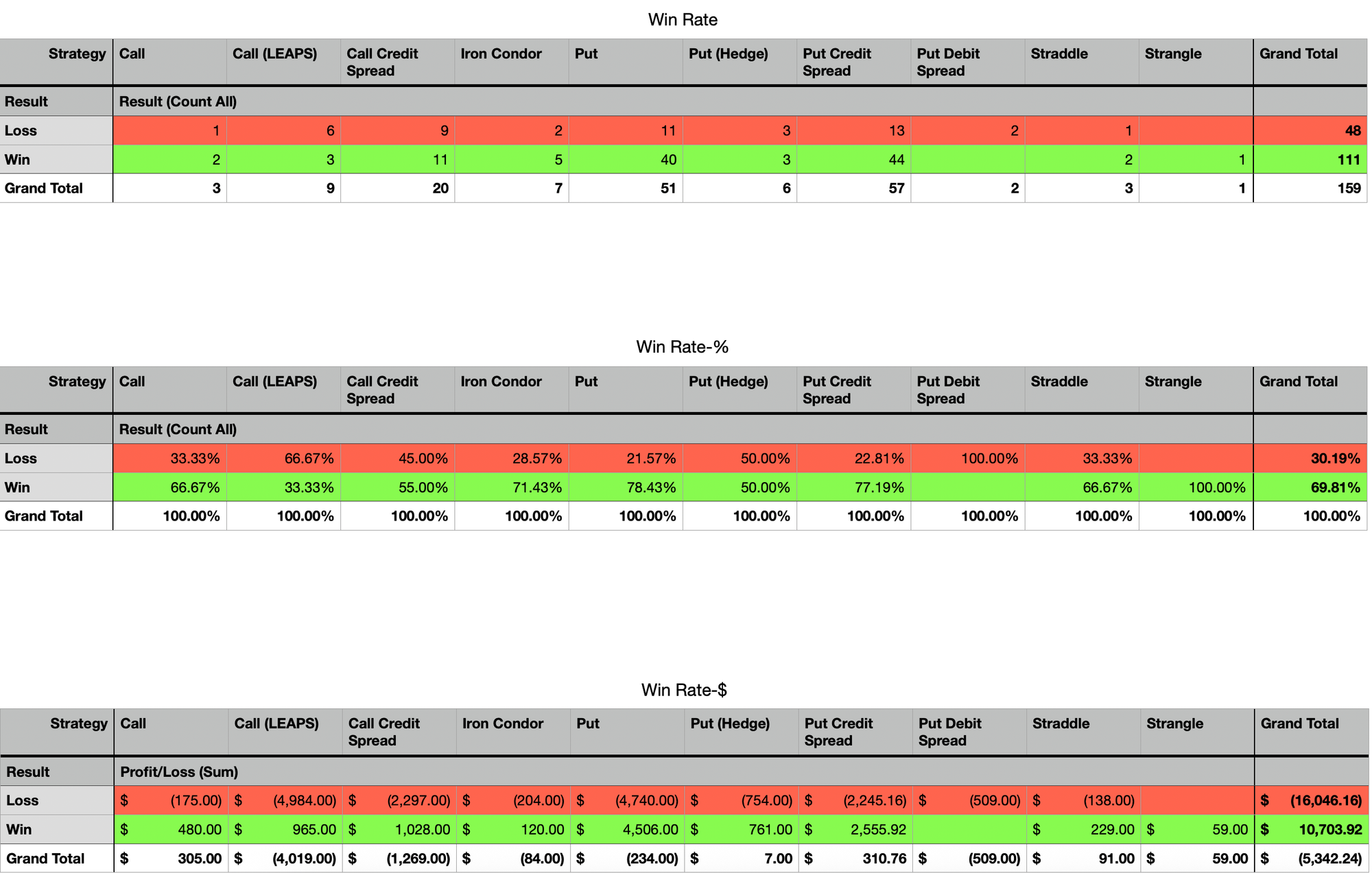

Portfolio Strategy Breakdown

Here's a view showing my Win Rate breakdown by strategy deployed.

Here is a breakdown of P/L by Buy v/s Sell strategies I have used so far.

Win rate and P/L by strategy remain skewed by oversized losses.

Plan for Next Week

This week, even though I did not make much money, I was happy with how mechanical I was with getting out of losing trades.

Having a full time job and trading for an hour in the morning and an hour during lunch is driving a lot of my strategies - I cannot monitor my trades the whole time market is open. This is a reality for anyone in the current economy - I am not sure how you can pay your rent or mortgage and put food on the table without a primary job that is not trading options, unless you already have enough and started off with a large capital.

I am going to continue with my plan I had previous week, which is:

Find trades with a decent theta, i.e., dollars per day that option loses value, and since I mostly sell options, that would be dollar per day my trade makes.

Ensure the trades themselves or overall as part of the portfolio do not create too much directional risk for me.

Keep positions small. Learn to stay mechanical with entry and exit of trades.

As someone who loves a challenge - this is something I am looking forward to crack one day. I am very optimistic I will not blow my account up this year, been about 9 months I have managed to keep my head, not going to lose it in the next 2 and a half months now!

Purely looking at overall numbers, I made ~$10.7K in the last 9 and a half months, and lost ~$16K across ~160 trades. And no assignments. So I know how to make money with the capital I have - just need to fine-tune how I double down on winners.

I don't think the right way to approach trading with a strategy and situation like mine is to minimize losses, it is more about adding to winners. Winning is a habit just like any other habit, and the more I continue to win, I don't see how I will stay under-water for long. At some point, the trend of overall losing position to an overall winning position is going to happen.

Thanks for following along - see you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.