Day 81

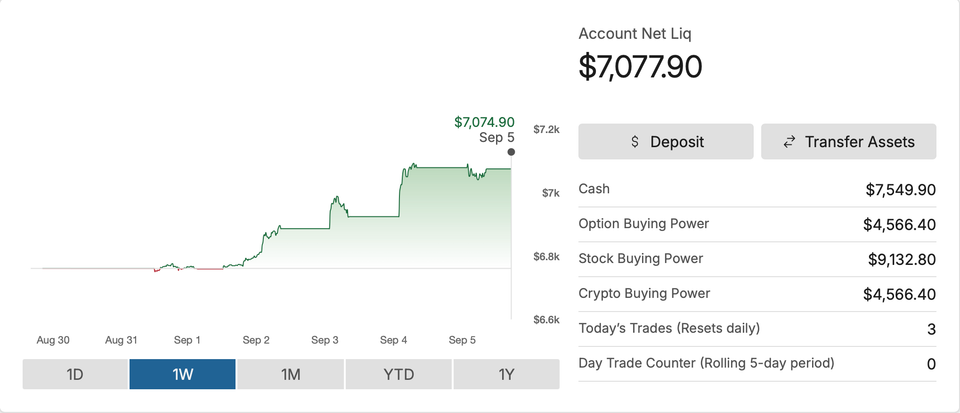

Marching onwards! Last week: +$247 (+3.65%).

Market Recap

Both SPY and QQQ started the week quite bearish, dropping over 2% by Tuesday morning. However, both indices recaptured some of the losses, ending the week with relatively modest declines.

Last Week:

- SPY ($645.96): -$2.56 (-0.39%)

- QQQ ($574.93): -$1.29 (-0.22%)

Year-over-Year:

- SPY: +$95.07 (+17.26%)

- QQQ: +$115.96 (+25.27%)

Even thought both SPY and QQQ were down, after 3 straight weeks of underperforming SPY, QQQ eked out a narrow win this week, falling less over the week compared to SPY which declined more.

Trading Update: September 2 - September 5, 2025

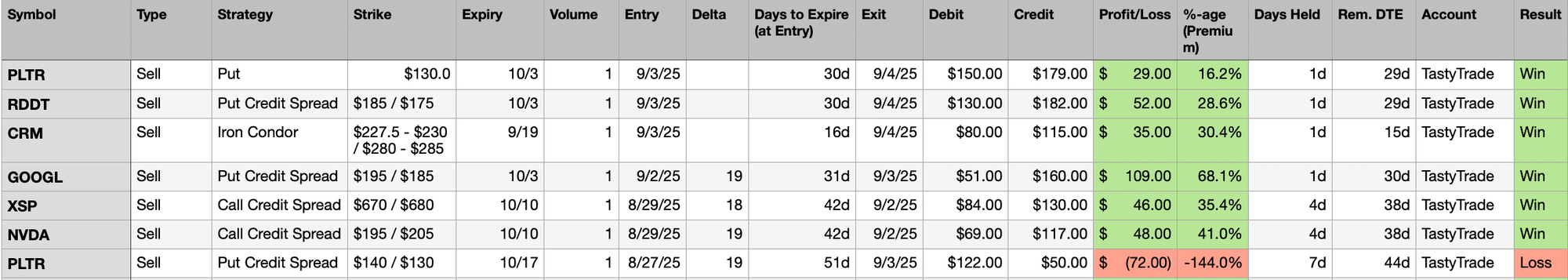

Here are the trades I closed this week. 1 trade closed at a loss, 6 with a profit, with a net Gain of $247.

Last week, I said:

I will likely continue to bet on Spreads.

As you can see above in my screenshot, apart from one Naked Put, every other trade is a Spread.

- Bullish on RDDT and GOOGL

- Earnings play on CRM

- Bearish on XSP and NVDA

- Started bullish on PLTR, but as the market turned bearish on it, I too moved out and closed PLTR trades.

Theme: Be in the herd! You have always heard the cliche: Avoid herd mentality. Well, this week, trying to really focus and understand where the herd was headed, and going with them, actually helped me earn some money. Let's see what happens next week.

Portfolio Status

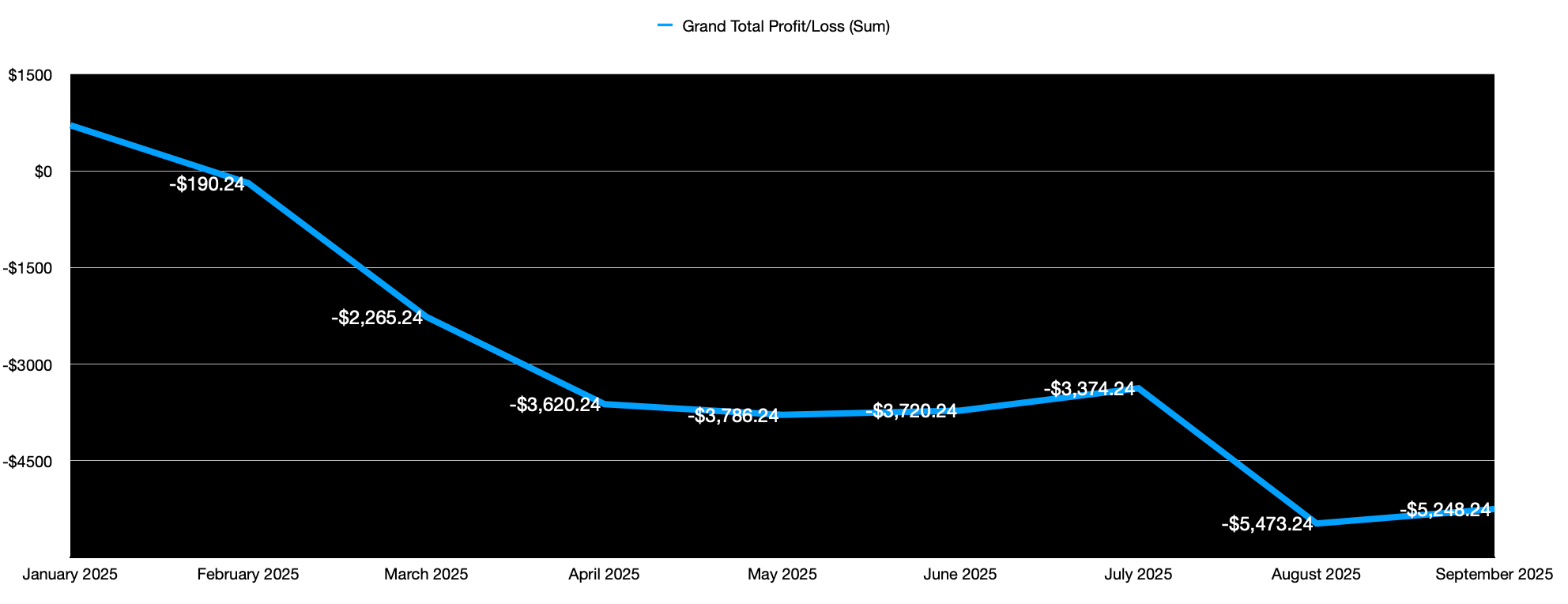

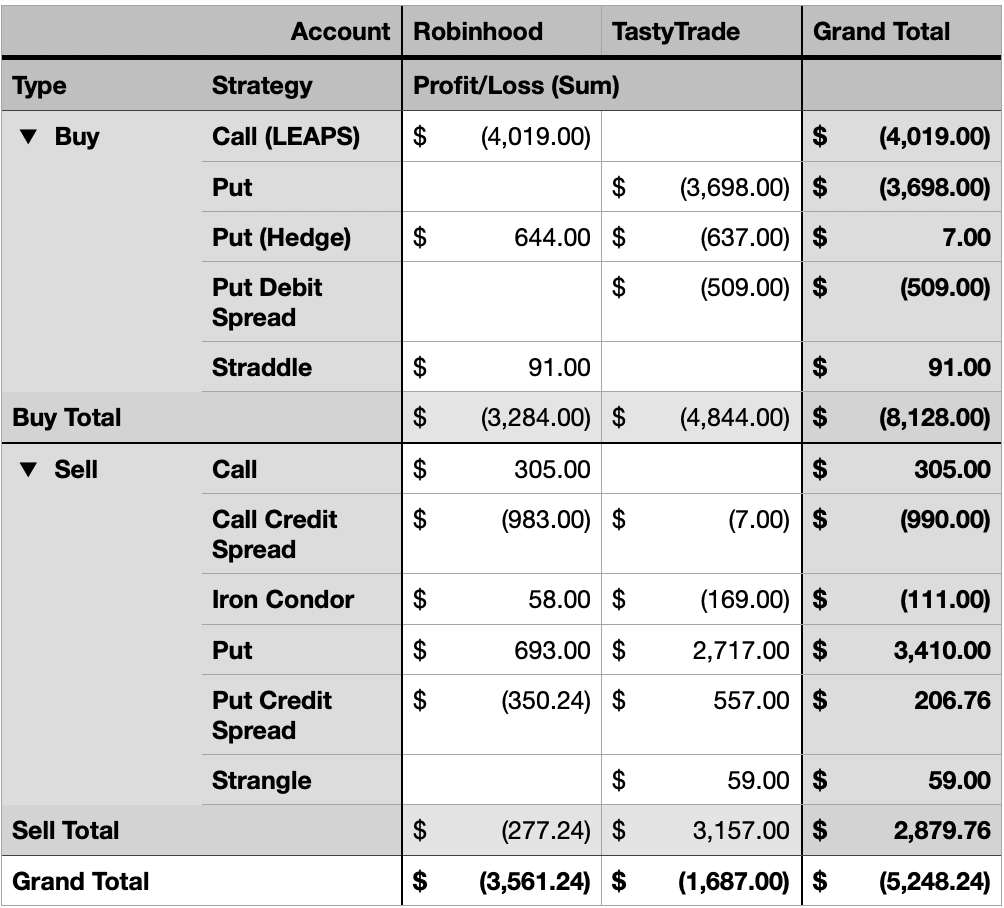

The total Realized Profit/Loss for the year currently stands at -$5,248.

I made ~$250 this week. My used buying power varied between 15% to 50% this week.

Here is the Profit/Loss trend for the year.

Portfolio Strategy Breakdown

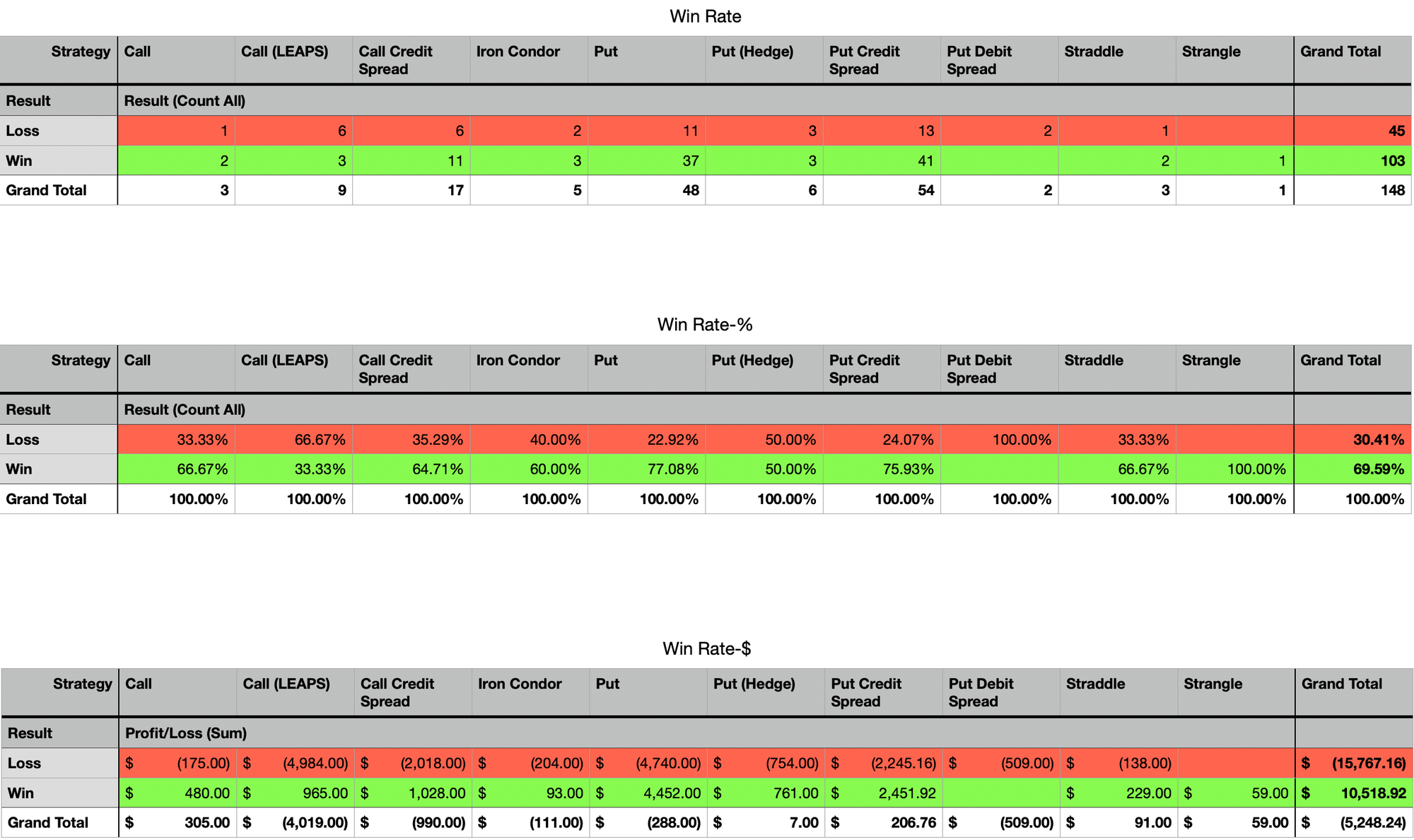

Here's a view showing my Win Rate breakdown by strategy deployed.

Here is a breakdown of P/L by Buy v/s Sell strategies I have used so far.

Win rate and P/L by strategy remain skewed by oversized losses.

Plan for Next Week

More than likely, I will look to trade more spreads, and maybe learn some other new techniques.

I am also starting to look less at the delta of a trade and more at the expected move range for the stock. For example, for my spreads or Iron Condors, I look at the expected range, then trade a $10 wide spread in either or both directions, depending on how bullish, bearish, or neutral I think the stock has been for past few weeks.

The most profitable trade last week was a GOOGL Put Credit Spread. GOOGL had been gently moving into a bullish position these past few weeks, so my bet was that it will continue to do so for the next few weeks as well. I looked at the expected move, and placed a $10 wide bull put spread exactly outside of that range.

The intent now is to learn to do three things:

- Find trades with a decent theta, i.e., dollars per day that option loses value, and since I mostly sell options, that would be dollar per day my trade makes.

- Ensure the trades themselves or overall as part of the portfolio do not create too much directional risk for me.

- Keep positions small. Learn to stay mechanical with entry and exit of trades.

Thanks for following along - see you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.