Day 73

Market Recap

The market was generally flat last week. Both SPY and QQQ saw some upward movement during the week but settled down in the week at less than half a point.

- SPY: -0.09%

- QQQ: -0.21%

Year-over-year:

- SPY: +10.96%

- QQQ: +10.03%

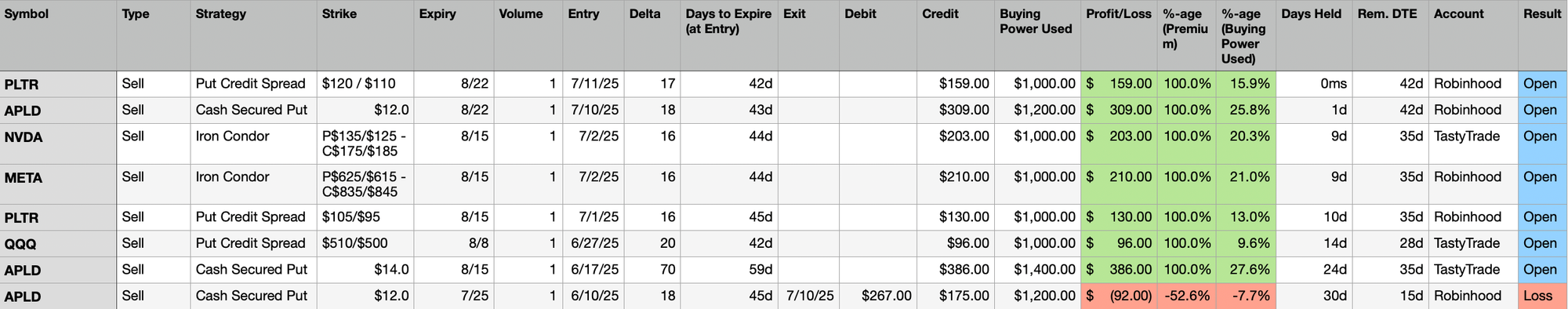

Trading Update: July 7 – July 11, 2025

Here is a summary of all trades I made during the week (details listed below).

- Unrealized Profit/Loss: +$1.5K

- Realized Profit/Loss: -$92

- Buying Power Used: $7.6K

- Buying Power Remaining: $5.5K

Closing Trades

I rolled APLD $12 7/25 Cash Secured Put out to 8/22, receiving a credit of $42.

New Trades

- Sold PLTR 8/22 $10 Wide Put Credit Spread

- Sold $120 Put, Bought $110 Put

- 42 DTE

- Risk: $1000

- Premium/Credit Received: $159

I rolled APLD out but am wondering if it would have been better to eat the $92 loss and not rolled it out for the $42 premium. I am unsure if rolling out is helpful for non-standard bets on tickers like APLD. The only reason I entered these trades was because APLD was trending due to a contract with an AI company, and I kinda/sorta broke my method to pick that trade up. And logically, when the bet went sideways, I should have stopped the bleeding.

Anyway, I am going to maybe cut my losses in APLD in the next 4-6 weeks regardless of upward or downward move in it.

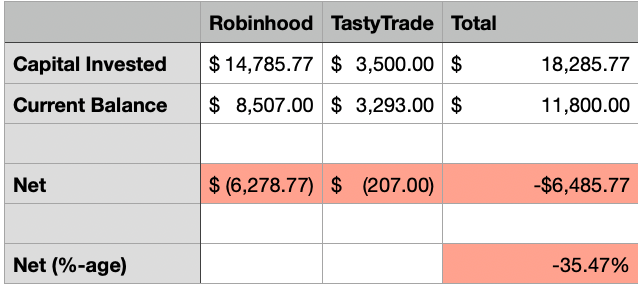

Portfolio Status

No new gains or losses to show this week. All current trades are waiting to be managed or closed.

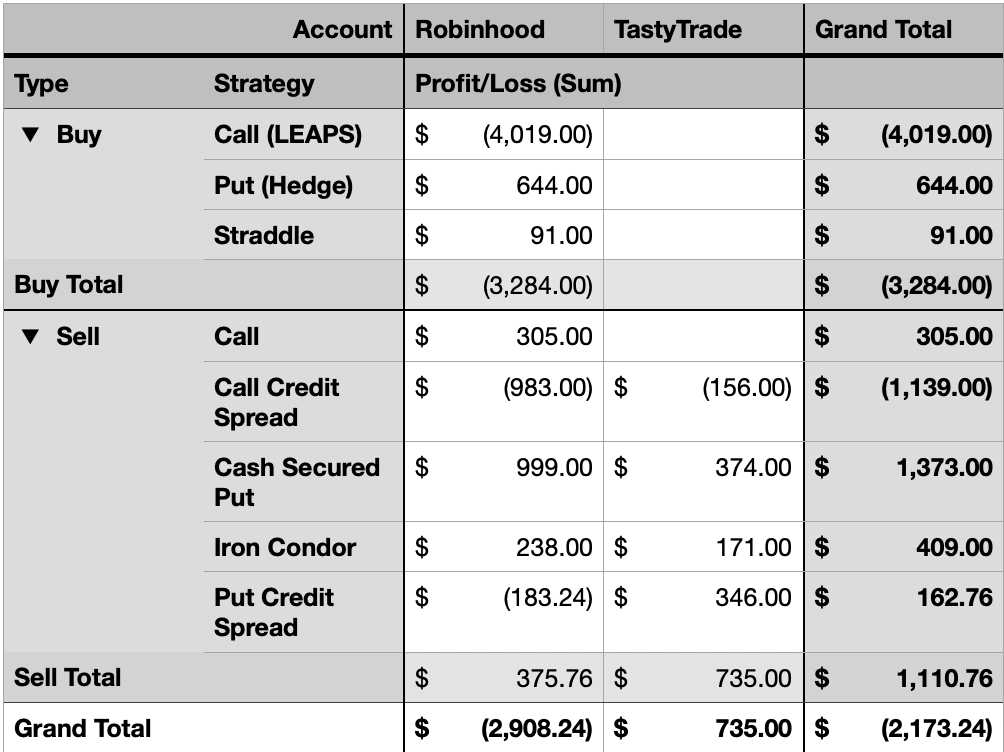

- 2025 Net P&L: Down $2.17K

- All Time: Down $6.49K

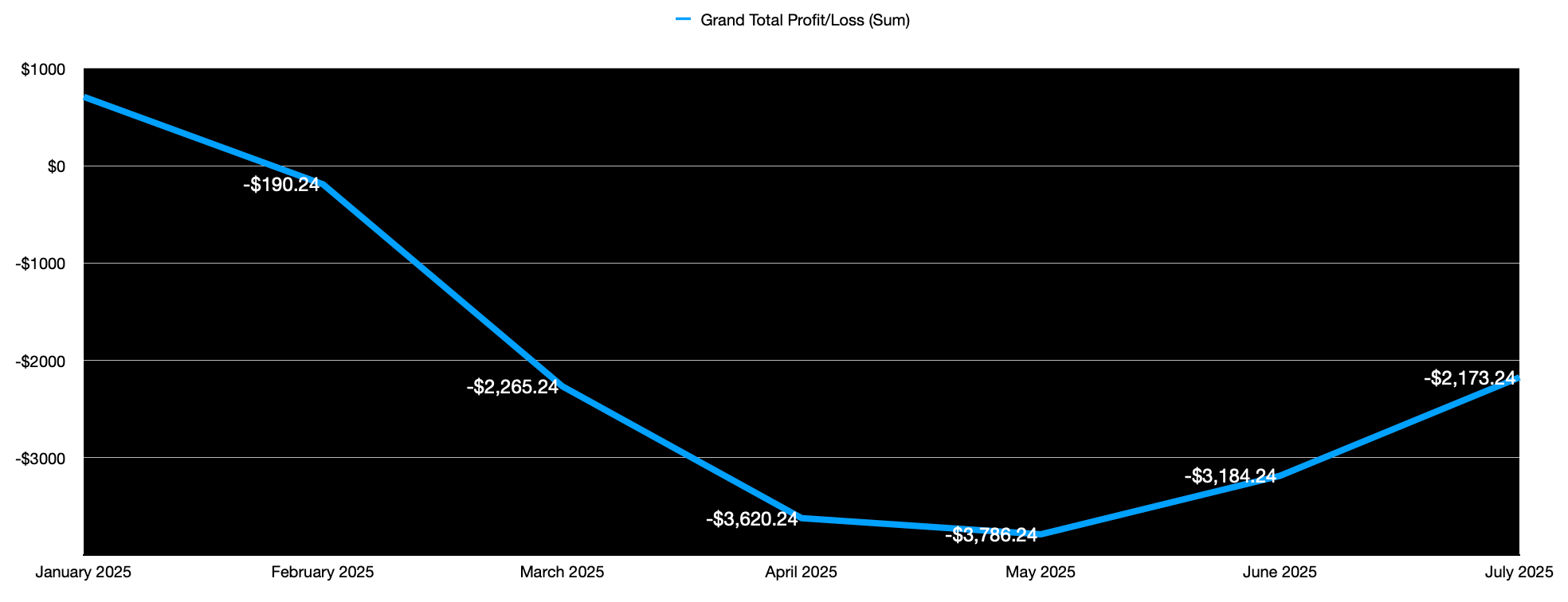

Profit and Loss Trend - Monthly - Year to Date

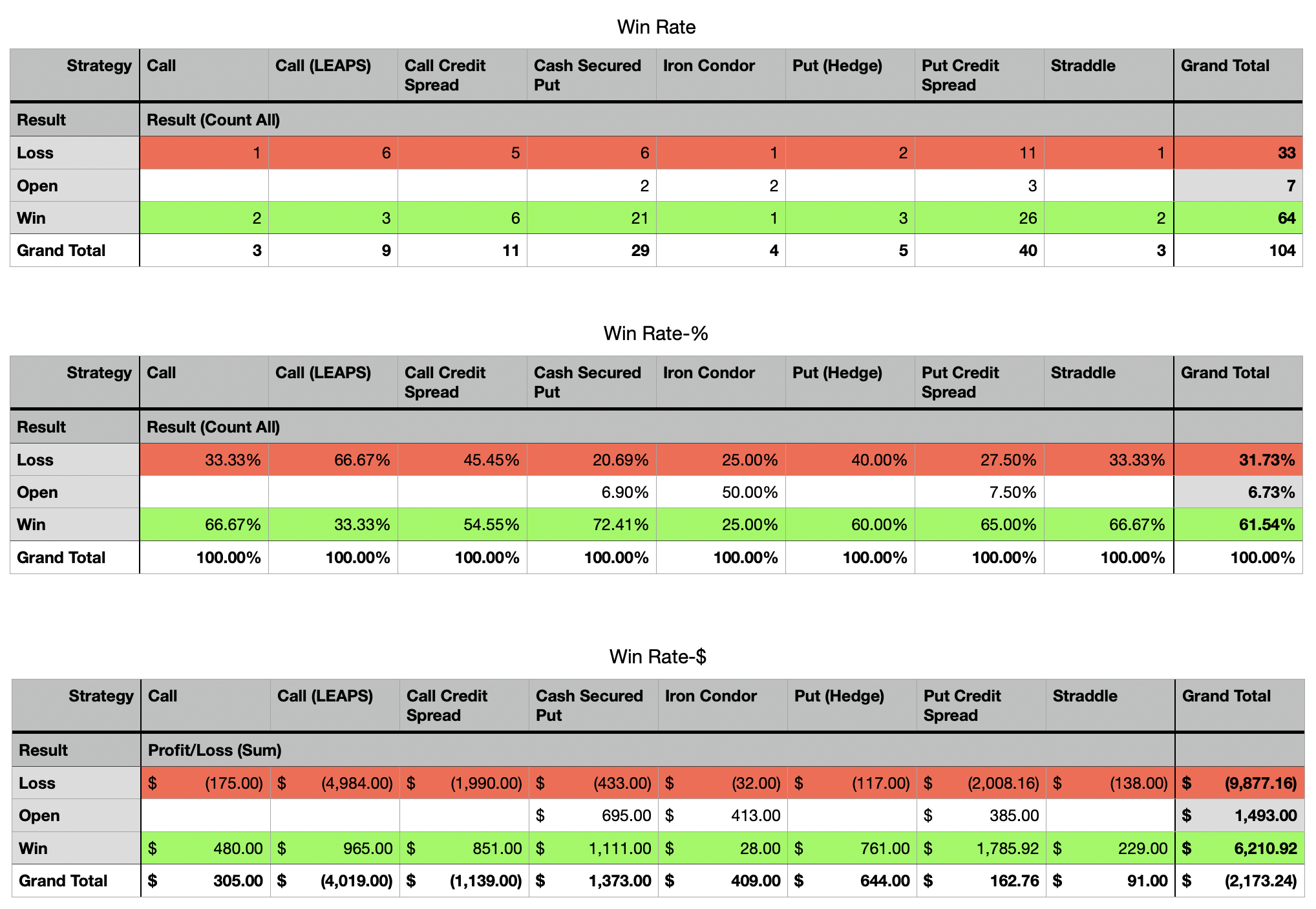

Portfolio Strategy Breakdown

Here's a view showing my Win Rate breakdown by strategy deployed.

Here is a breakdown of P/L by strategies I have used so far.

- Best Performing Strategy: Cash Secured Put

- Worst Performing Strategy: Call (LEAPS)

Plan for Next Week

I am traveling this and the next couple of weeks so it may be quite likely that all I do is manage existing positions.

I do not quite have a plan otherwise, and would like to stay disengaged, which is hard to do considering how much I have started to like this game.

Perhaps I will write a post and share a picture from my travels. Not much else to write about today.

Thanks for following along - see you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.