Day 68

Market Recap

Both SPY and QQQ were up last week.

- SPY: +1.78%

- QQQ: +2.29%

Year-over-year:

- SPY: +11.97%

- QQQ: +14.21%

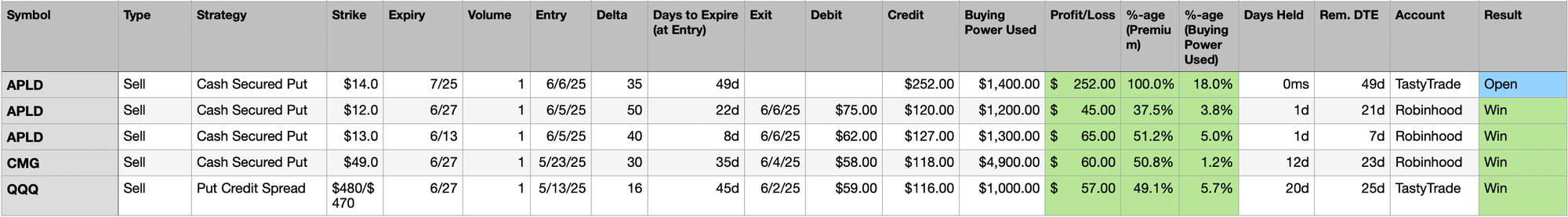

Trading Update: June 2 – June 6, 2025

Here is a summary of all trades made during the week (details listed below).

- Unrealized Profit/Loss: +$252

- Realized Profit/Loss: +$227

- Buying Power Used: $1.4K

- Buying Power Remaining: $6.5K

It was as good a week in terms of success rate as it can be. All of the trades I closed were profitable.

I had the following two open trades from previous week:

- CMG 6/27 $49 Cash Secured Put

- Closed when I received 50% of my original premium

- QQQ 6/27 $480/$470 Put Credit Spread

- Closed when I received 49% of my original premium

I noticed high volatility in APLD, and made some trades between yesterday and today:

- Opened yesterday and closed today:

- 6/13 $13 Cash Secured Put, closed at 51% of original premium received,

- 6/27 $13 Cash Secured Put, closed at 37% of original premium received

- Opened a 7/25 $14 Cash Secured Put today

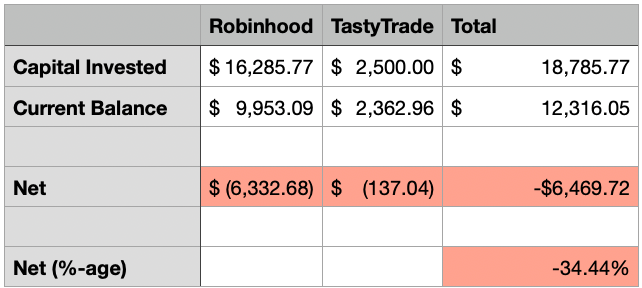

Portfolio Status

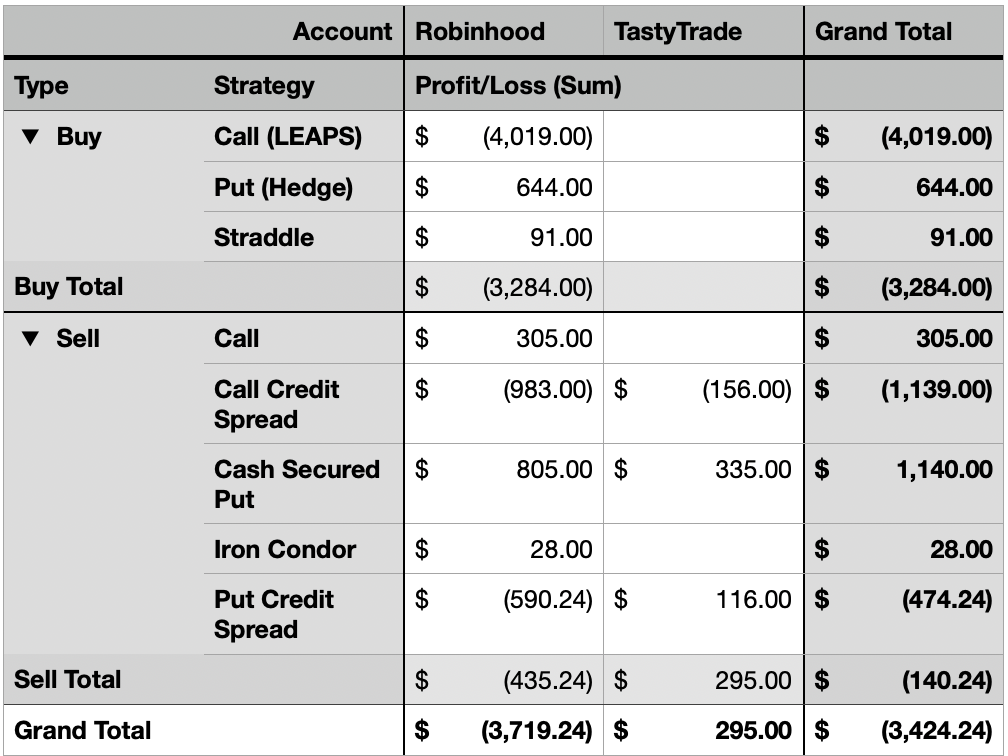

- 2025 Net P&L: Down $3.42K

- All Time: Down $6.47K

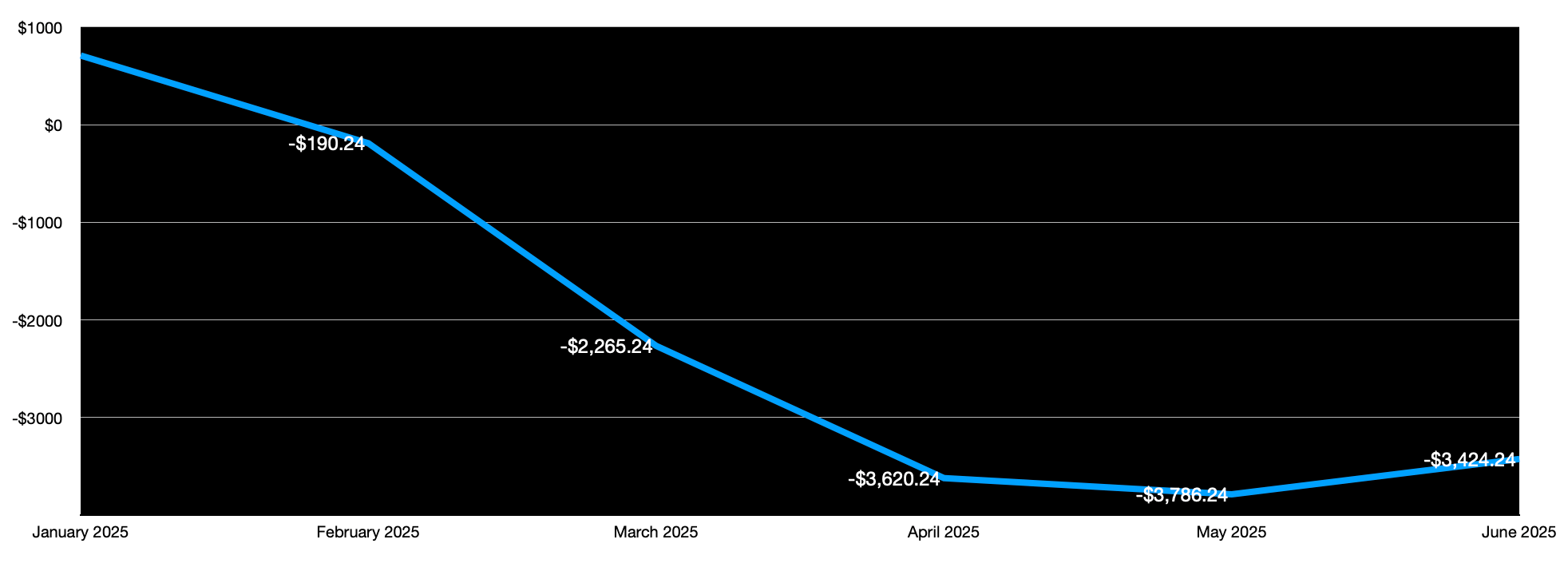

Profit and Loss Trend - Monthly

Portfolio Strategy Breakdown

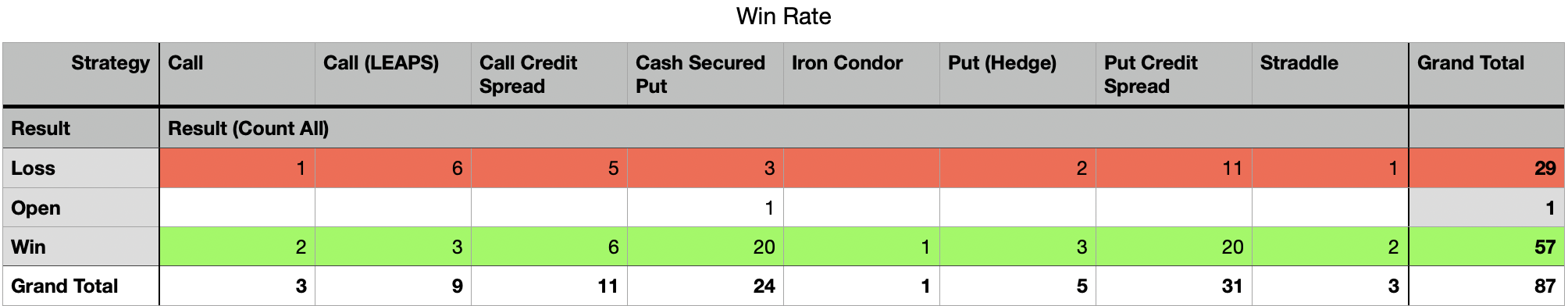

Here is a table showing my Win Rate by Strategy.

Here is a breakdown of P/L by strategies I have used so far.

- Best Performing Strategy: Cash Secured Put

- Worse Performing Strategy: Call (LEAPS)

Plan for Next Week

I have only one open trade right now, and a small one at that. Which means I have room to open some more trades next week.

One way to look at this week's routine trades that closed is that I planted an idea and waited for it to sprout in a couple of weeks.

Statistically, if I plant more such ideas, most will be fine, and some would be bad. As long as you weed and prune the bad ones out, they end up not hurting the good ones. Now, stack more good ones, and you end up making some decent money.

Thanks for following along - see you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.