Day 66 - End of Week 18

Market Recap

This is the first negative week in 5 weeks!

- SPY: -1.8%

- QQQ: -1.9%

Year-over-year:

- SPY: +8.64%

- QQQ: +10.38%

Trading Update: May 19 – May 23, 2025

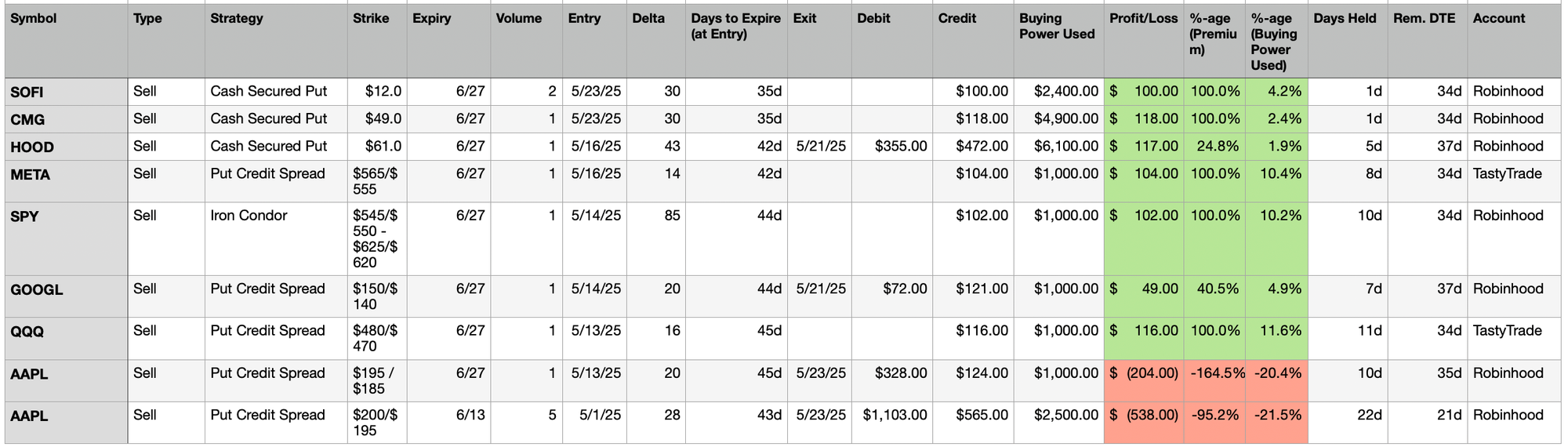

Here is a summary of all trades made during the week (details listed below).

- Unrealized Profit/Loss: +$1,604

- Realized Profit/Loss: -$576

- Buying Power Used: $10,300

- Buying Power Remaining: $2,737

Last Week, I wrote:

When the Spreads close, I will have some buying power, but until then, all I can do is wait unless some other market moves force me to manage any other position early.

Friday was 21 DTE for my 5 AAPL Put Credit Spreads. They were at a loss but I kept my discipline and closed them, at a ~95% loss of original premium. It hurt, especially because they were up ~35% at one point.

The main reason AAPL went down was another tariff related announcement. There is perhaps a lesson in here that no matter how sure and confident you are about a trade, there would be events beyond your imagination that can negatively affect your desired outcome.

So - never assume that you have found some formula - and can predict anything with certainty. The mechanics can broadly be described as:

- Build a hypothesis for a risk

- Find a stock and strategy well suited to the environment you are in

- Assume the risk

- Execute the trade

- Manage the risk

- Keep risk small

- Close position in a timely manner

- Either close at 21 DTE, or roll, or close for a desired profit target, or close for a loss.

To conclude last week's trades, my hypothesis on AAPL turned a bit negative, sensing a weakness in AAPL and so I thought I better close the other AAPL spread too. And so I did that.

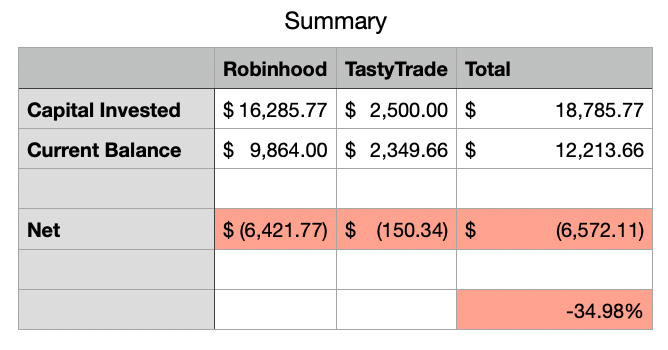

Portfolio Status

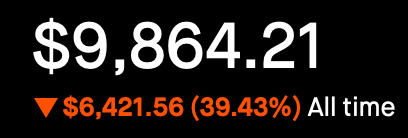

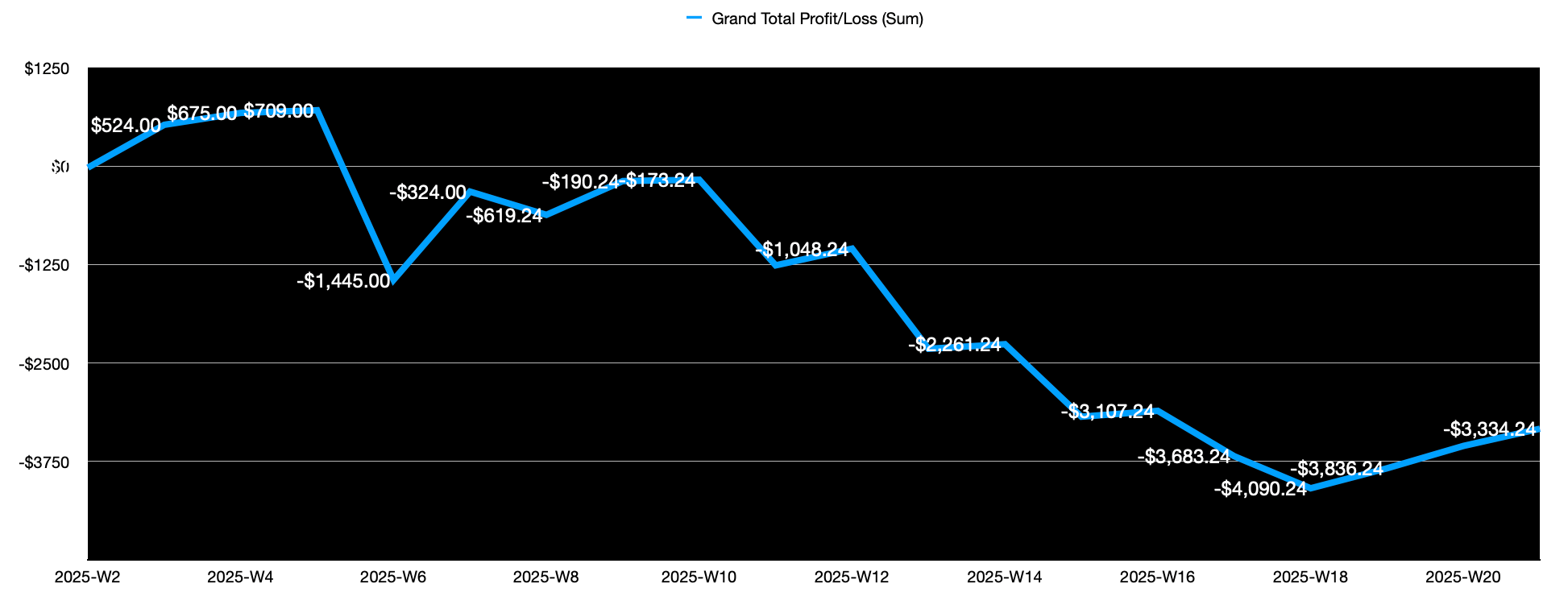

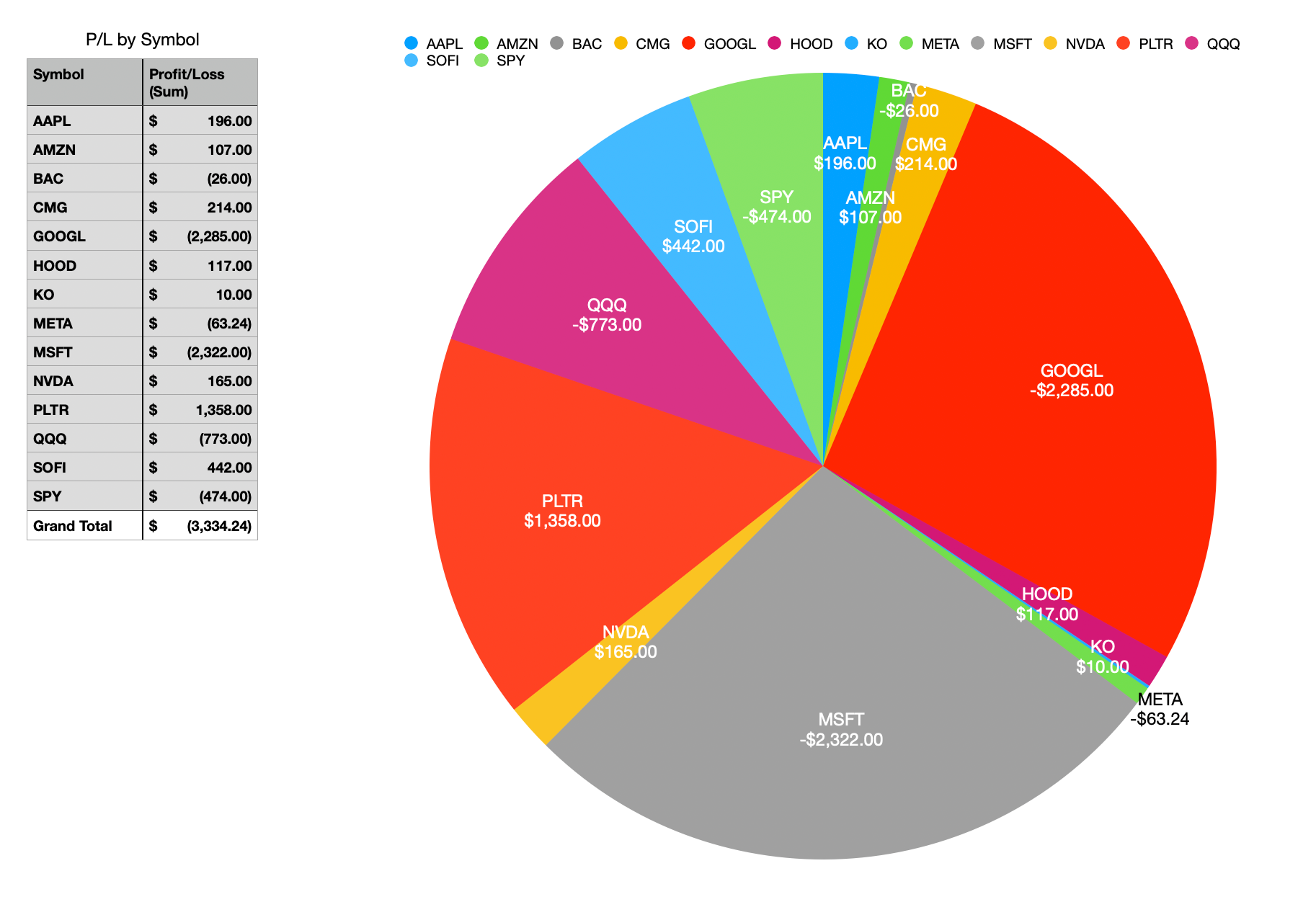

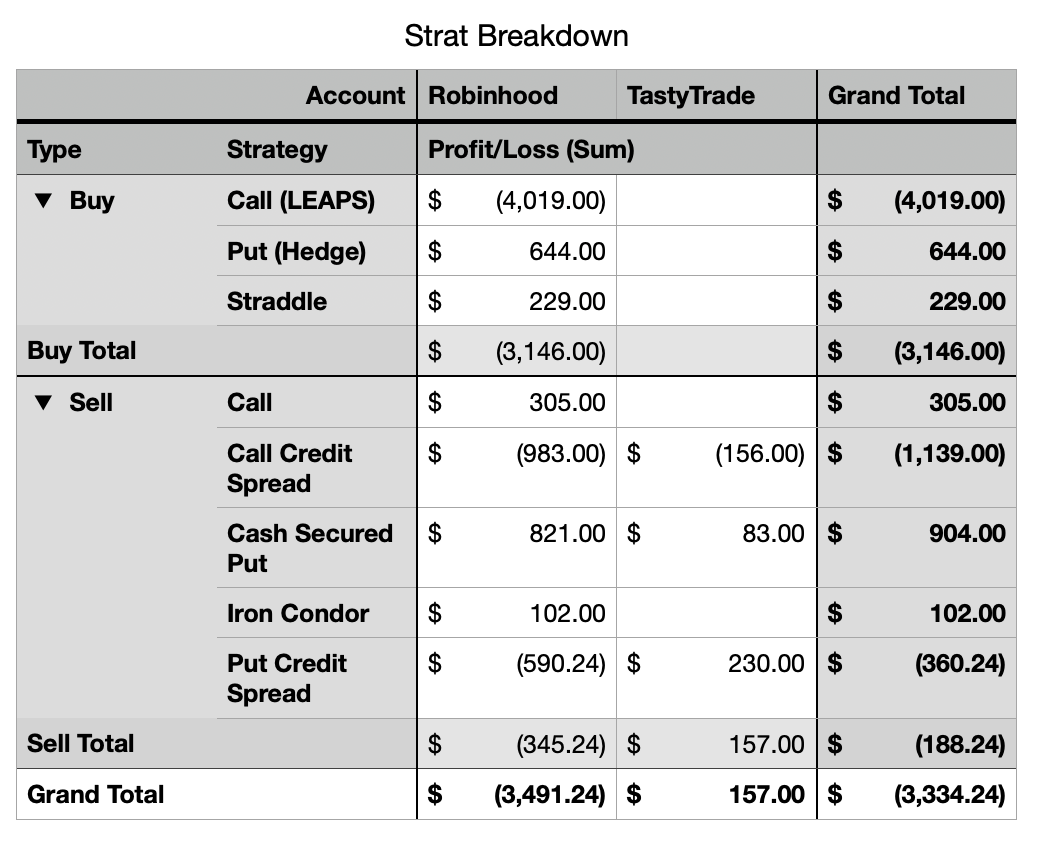

- 2025 Net P&L: Down $3,334

- All Time: Down ~6.6K (~35%)

Profit and Loss Trend - Weekly

Portfolio Strategy Breakdown

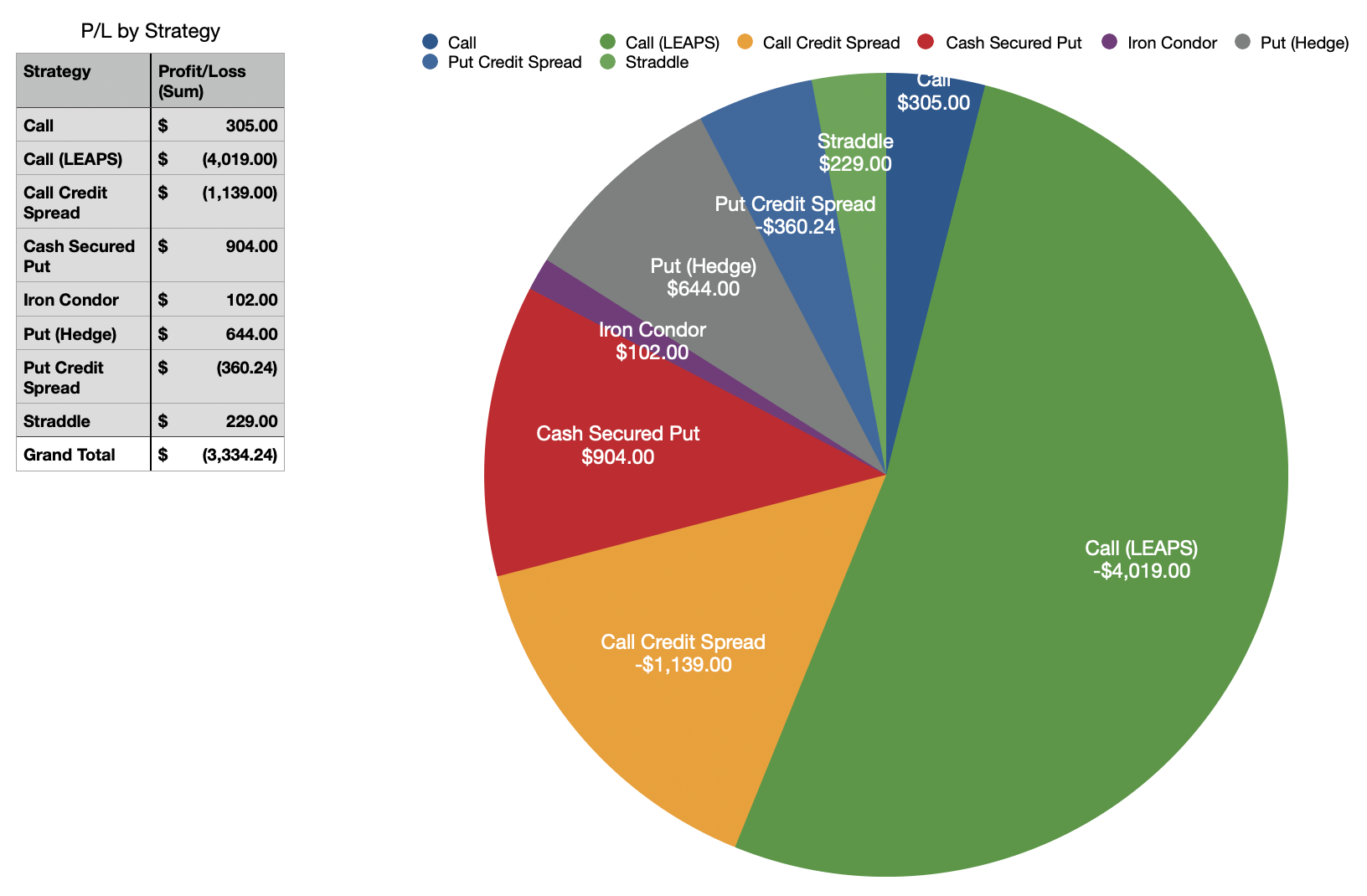

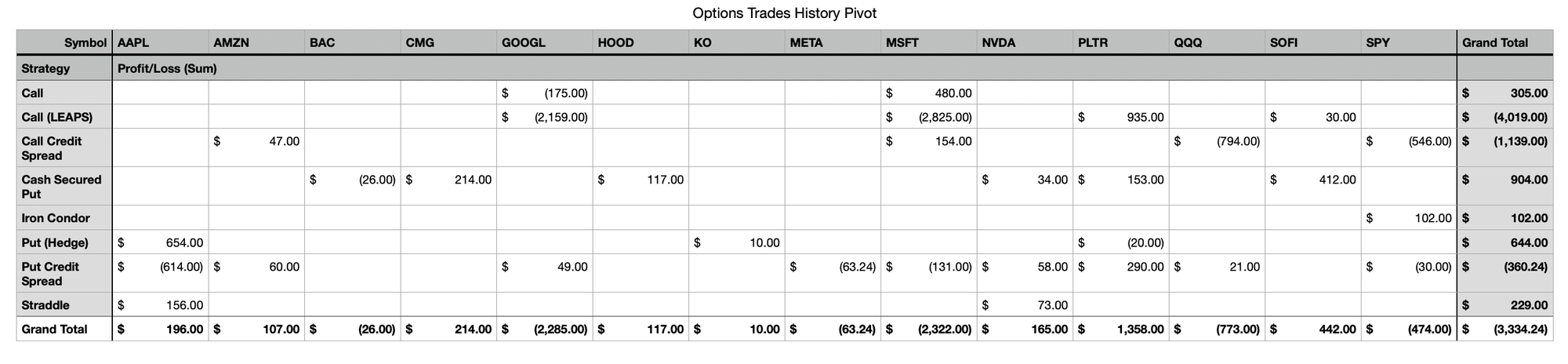

Here is the latest snapshot of how my trades have performed across strategies and tickers:

Plan for Next Week

A tricky thing with Spreads have been that when market has moved against my position, I have not been able to roll them out when in Robinhood. Or at least Robinhood has not been very intuitive to me.

Now, I am not going to stop trading spreads, but I will try to execute those in TastyTrade.

The more I use TastyTrade, the more I like their platform and their Options worldview. I am leaning towards moving more of my trading to Tasty even though they are more expensive than Robinhood per option trade. This might change in future as Robinhood evolves but that does not seem to be the case today.

From a long term perspective, I need to increase the volume of my trades so hopefully the law of large numbers start to work in my favor. So far, I have been able to open 3 or 4 trades in a week, that too if I close one down.

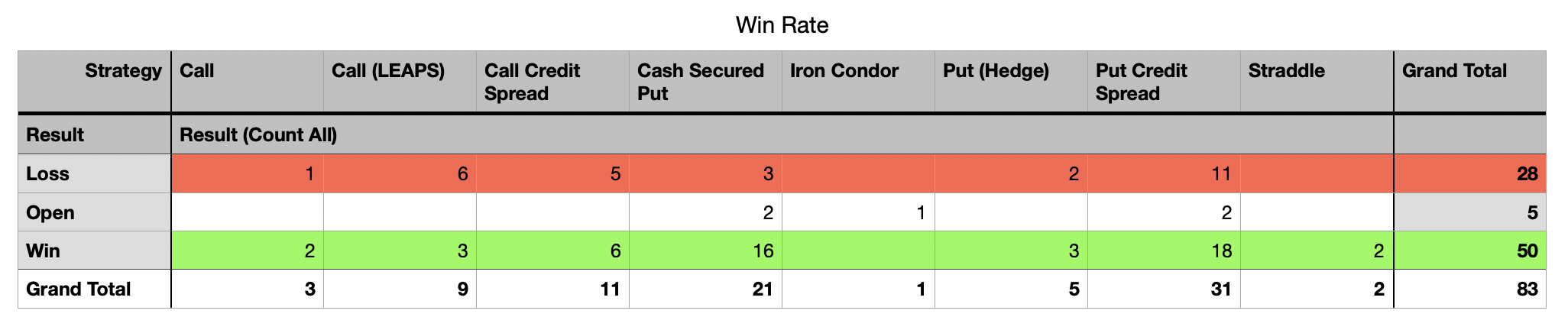

Here is a view of the number of trades I have put on (by Strategy). Ideally, I would put on 10000 trades to know if I can be successful, but that's a destination too far. So my goal is to look at the percentage of winners once I have at least 100 trades in each strategy.

Here are the number of trades I have tracked so far.

Right now, my overall winning percentage is ~60%. If you wonder why my account is still net negative, well it was the LEAPS that have led to over ~90% of my losses. The Sell strategies have done okay. So I am optimistic I can turn the portfolio around by focusing on increasing my Sell volume. I will still attempt some Buys here and there but they are likely going to be way lower than Sells.

Here is a table showing Buys have contributed to ~94% of my losses so far.

Now, specifically for next week, there is a bunch of earnings lined up. I look forward to taking some risks on these earnings events, although my luck with earnings speculation has been mixed in the past.

For earnings, I expect to be able to find stocks with high IV, and I would look to outright Sell Cash Secured Put maybe a couple of months out. Then when IV crush hits post earnings, I expect to close out the trade at ~50% of original premium.

Thanks for following along - see you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.