Day 64 - End of Week 16

Market Recap

Tech stocks tried to rally and the market remained bullish last week, with major indices ending positive for the third consecutive week:

- SPY: +0.62%

- QQQ: +1.08%

Year-over-year:

- SPY: +8.28%

- QQQ: +10.25%

Trading Update: May 5 – May 9, 2025

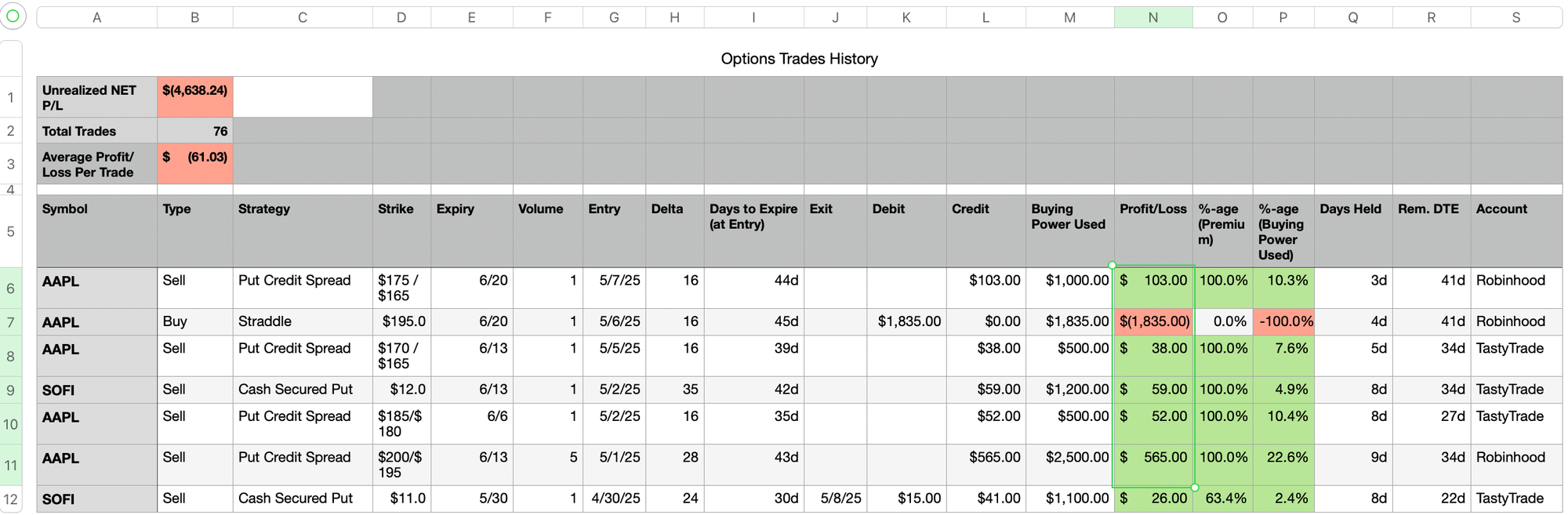

Here is a summary of all trades made during the week (details listed below).

- Unrealized Profit/Loss: -$1,018

- Realized Profit/Loss: +$26

- Buying Power Used: $7,535

- Buying Power Remaining: $5,800

In addition to my usual strategies, I entered an AAPL Straddle this week. I’d prefer to sell a straddle, but the required capital is significantly higher - so I opted to buy one instead.

AAPL $195 6/20 Straddle

- Break-even Range: $176.65 to $213.35

This means that if held all the way to expiration (June 20), I’d only profit if AAPL moves outside of that range. More realistically, I’m hoping for an earlier spike in volatility - ideally before 21 DTE - so I can close the position for a profit (targeting at least $100).

Here’s a simulation of outcomes at various price points and DTEs.

Portfolio Status

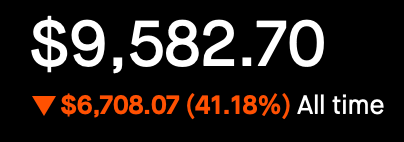

- 2025 Net P&L: –$4,638.24

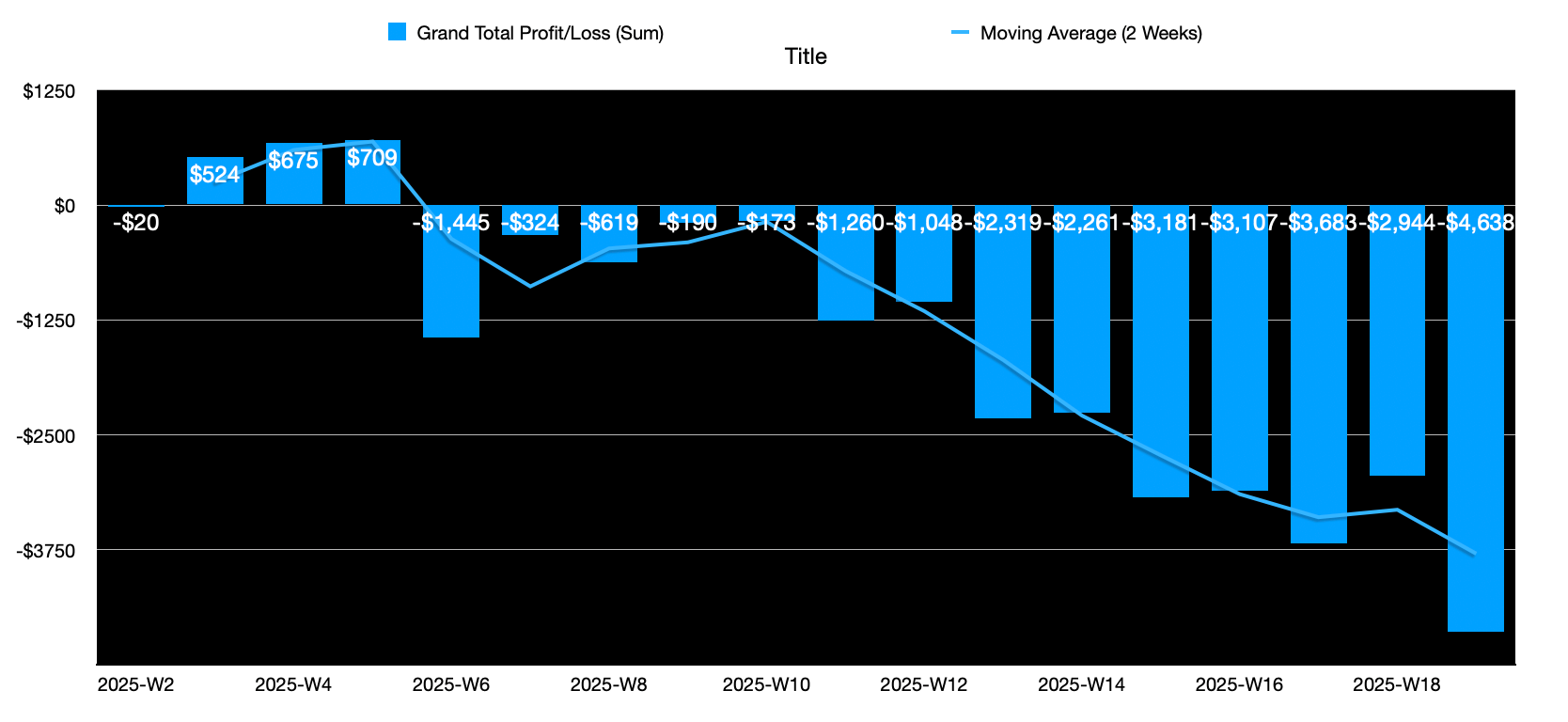

Portfolio Trend - Weekly

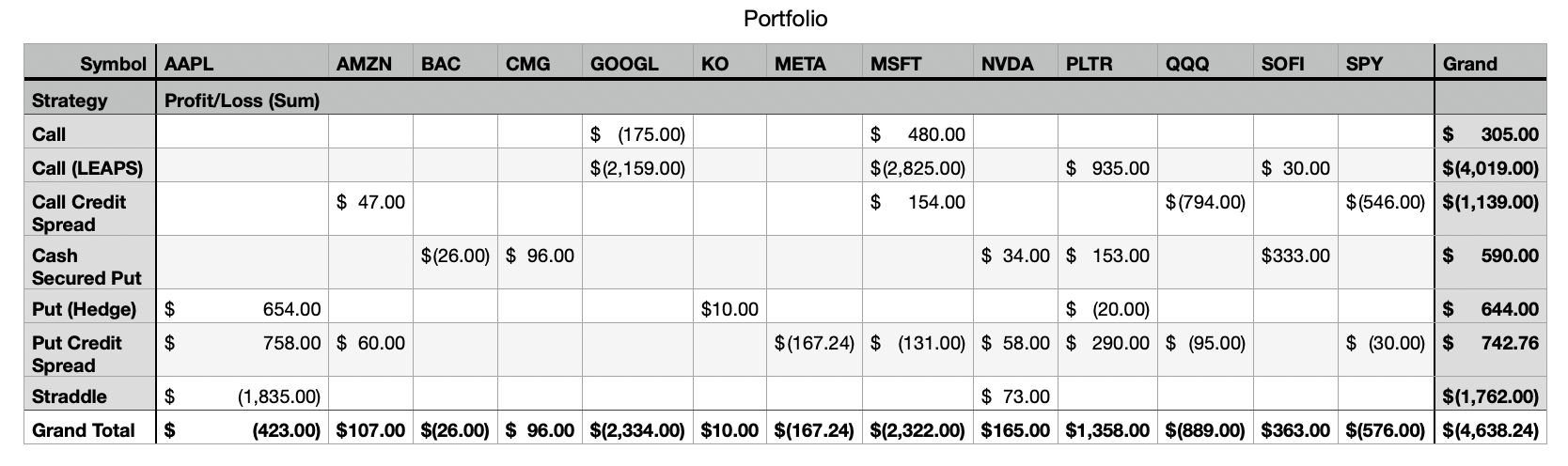

Portfolio Strategy Breakdown

This week's snapshot of how my trades have performed across strategies and tickers:

Plan for Next Week

Last week, one of my ideas was:

The portfolio is still alive, but maintaining discipline has been tough — especially with limited buying power.

I was exploring strategies better suited for small accounts. This remains a priority as maintaining discipline with limited buying power has been increasingly challenging.

This week marks the 14th consecutive week in the red. My goal now is to stretch the remaining ~$6K as efficiently as possible while gradually working on bringing in new capital.

While capital infusion is the faster path, I’m also experimenting with strategies that might help smaller accounts stay in the game longer. If you’re starting out with under $10K, here are some takeaways I found helpful from recent material I reviewed:

Ideas to trade with a $10,000 Account

Trading a $10,000 Account – Key Lessons

Challenges for Small Accounts

- Capital Constraints: Limited room for error or flexibility.

- Underlying Selection: Naked strategies often restrict you to cheaper stocks (e.g., AAL, INTC, ROKU, RIVN).

- Premium Collection: Many lower-priced stocks offer cheap option premiums, limiting profitability.

- Position Sizing: Smaller accounts often need larger allocations per position, increasing volatility.

Recommended Strategies

- Prioritize Risk-Defined Trades:

Use calendar spreads, iron condors, or vertical spreads. These allow access to pricier stocks like AMZN, SPY, or SBUX, which offer better premiums and diversification. - Adjust Position Sizing Thoughtfully:

You may need to use up to 5% of account value per trade, but be cautious - this raises portfolio volatility. - Maintain Diversification:

Aim for 5-10 open positions to balance risk and apply the law of large numbers. - Experiment Before You Specialize:

Try various strategies early on to find your style. Eventually, narrow down your focus to a few preferred setups. - Don’t Abandon Naked Strategies Entirely:

Use them selectively on inexpensive, liquid stocks. They help build awareness of risk and how to manage adjustments.

Ways to Increase Premium Collected

- Trade higher delta positions

- Use wider spreads (e.g., $5–$7 width)

- Focus on underlyings with naturally higher premiums

Concluding Thoughts

Still remaining foolish. Still in the game.

I have about ~$6K left before I need to inject new capital to keep this experiment going. Meanwhile, I’m adapting my approach using some of the Tastytrade insights above, and continuing to learn how to trade with a constrained account.

Thanks for following along - see you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.