Day 63 - End of Week 15

Market Recap

The market remained bullish last week, with major indices posting strong gains for the second week in a row:

- SPY: +2.99%

- QQQ: +3.83%

Year-over-year, SPY is up +12.43% and QQQ is up +14.96%.

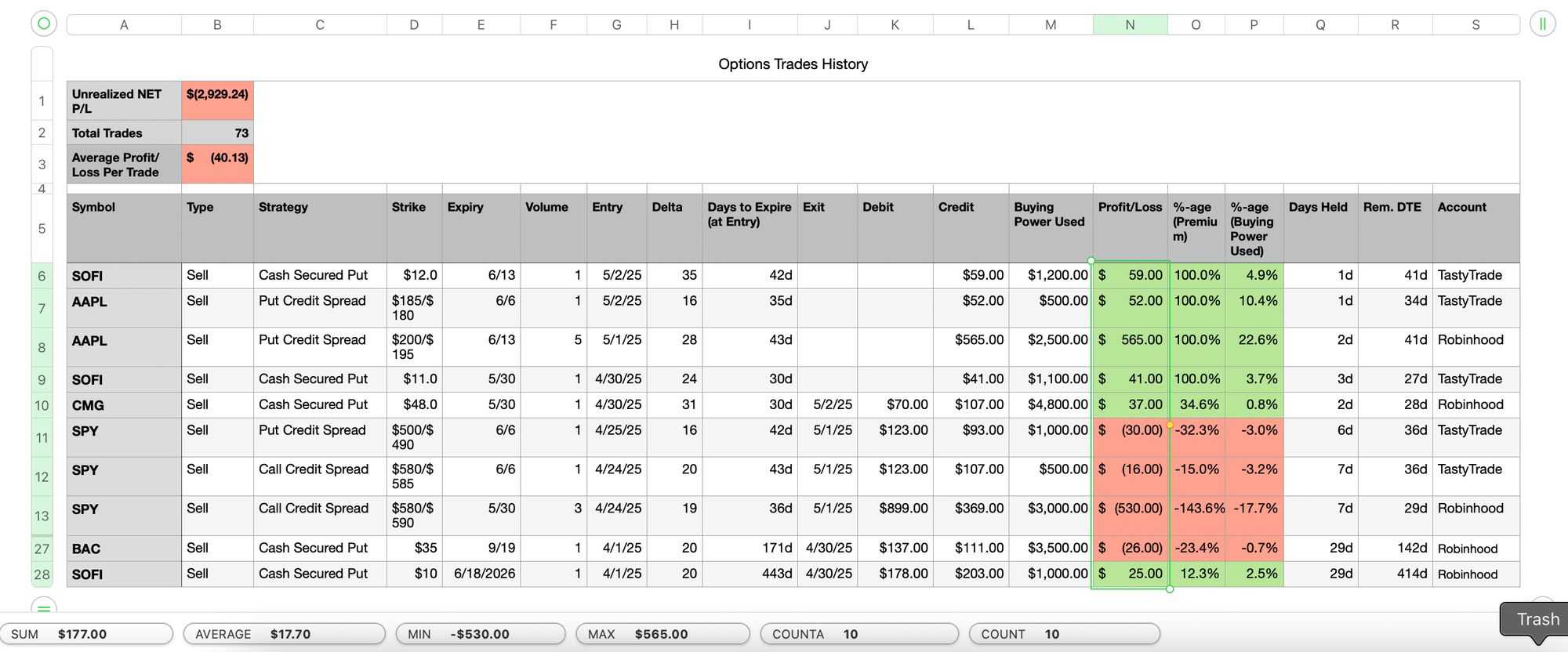

Trading Update: April 28 – May 2, 2025

Here is a summary of all trades made during the week (details listed below).

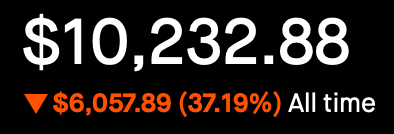

- Unrealized Profit/Loss: +$177

- Realized Profit/Loss: -$540

Lines 11 and 12 are for a couple of SPY spreads that ended up creating an Iron Condor for me. The Call Spread got tested by the market's upward move, the Put Spread helped mitigate the impact.

Portfolio Status

- 2025 Net P&L: –$2,929.24

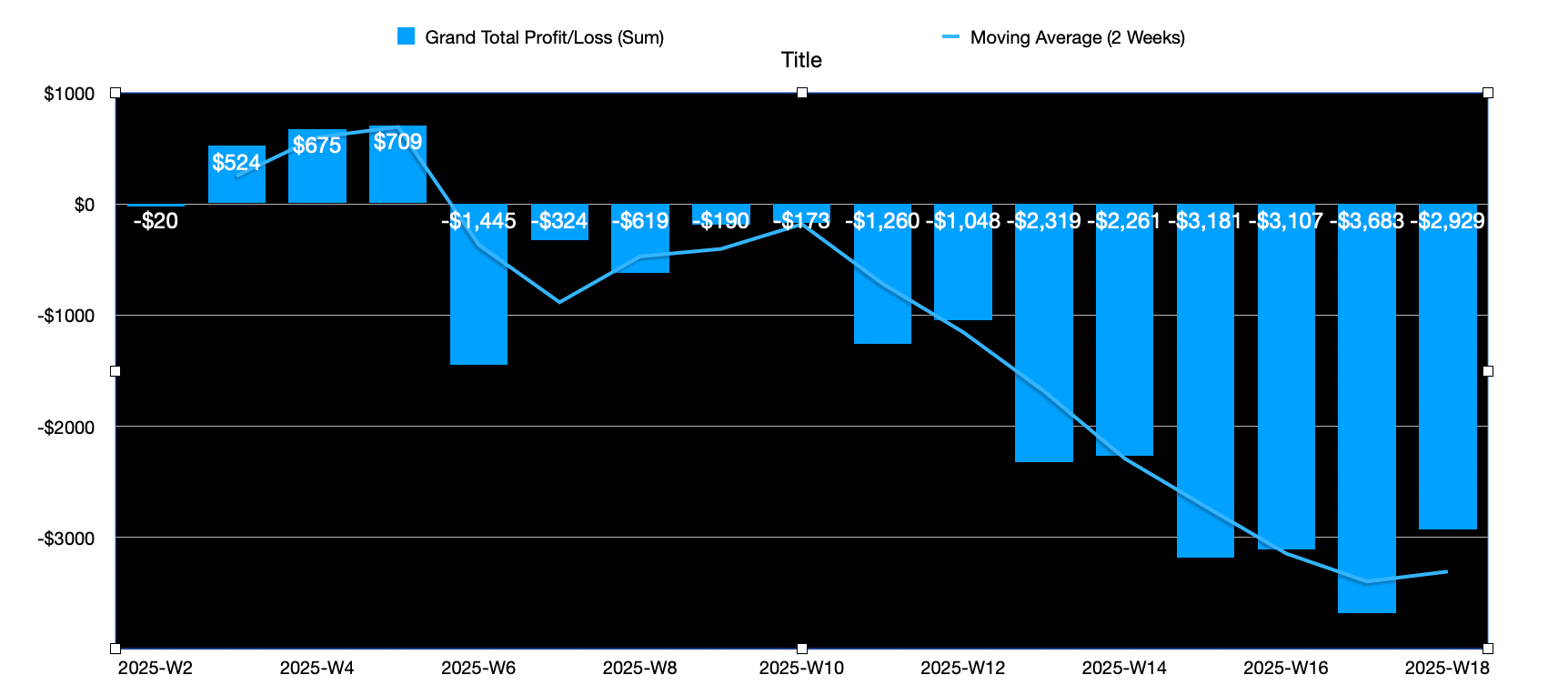

Portfolio Trend - Weekly

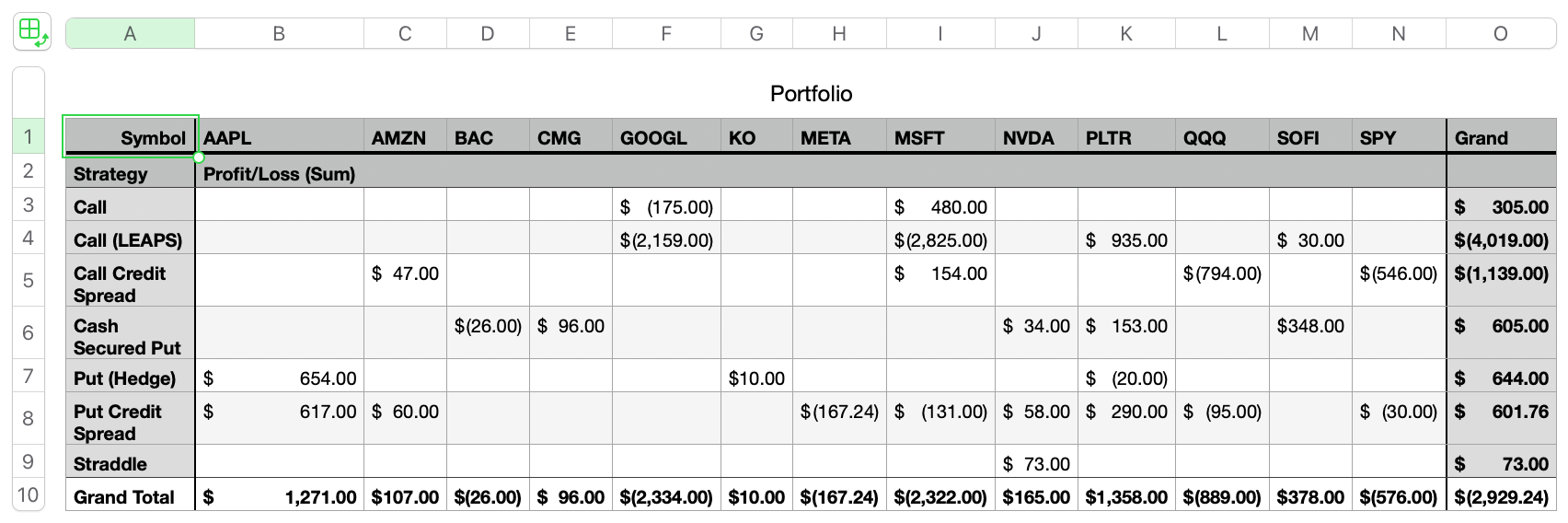

Portfolio Strategy Breakdown

A snapshot of how my trades are currently allocated across strategies and tickers.

Plan for Next Week

Last week, one of my ideas was to:

PLTR has earnings coming up — I'm tempted to bet a little buying power there.

However, PLTR moved too far up on the call side, and I didn’t feel there was sufficient upside left to justify the risk.

Instead, I turned my attention to AAPL, which also had earnings coming up. I sold 6 credit put spreads based on the assumption that AAPL would hold above $205. These spreads represent approximately $3,000 in buying power — you can find the specifics in the Trading Update section above.

Commentary

One mindset I’ve tried to maintain is avoiding the illusion of having an "edge" just because I hold an opinion about a stock. Do I have thoughts about specific companies? Sure. But I don't trade based on those opinions alone.

Ideally, I’d only trade the indices - more stable and predictable. But they don’t offer enough variety to keep me engaged. If I wanted boring, I’d just move this money into index funds and forget about options altogether. But where’s the fun in that?

So how do I choose what stocks to trade?

Honestly, I haven’t nailed it down completely. The general idea is this: sell volatility, buy back stability.

What's Next?

This marks the 13th consecutive week my account has been in the red. Looking at my weekly performance, I’ve only had three weeks in positive territory.

The portfolio is still alive, but maintaining discipline has been tough — especially with limited buying power. Right now, the goal isn’t to scale up. It’s simple: get back to break-even.

Why does buying power matter?

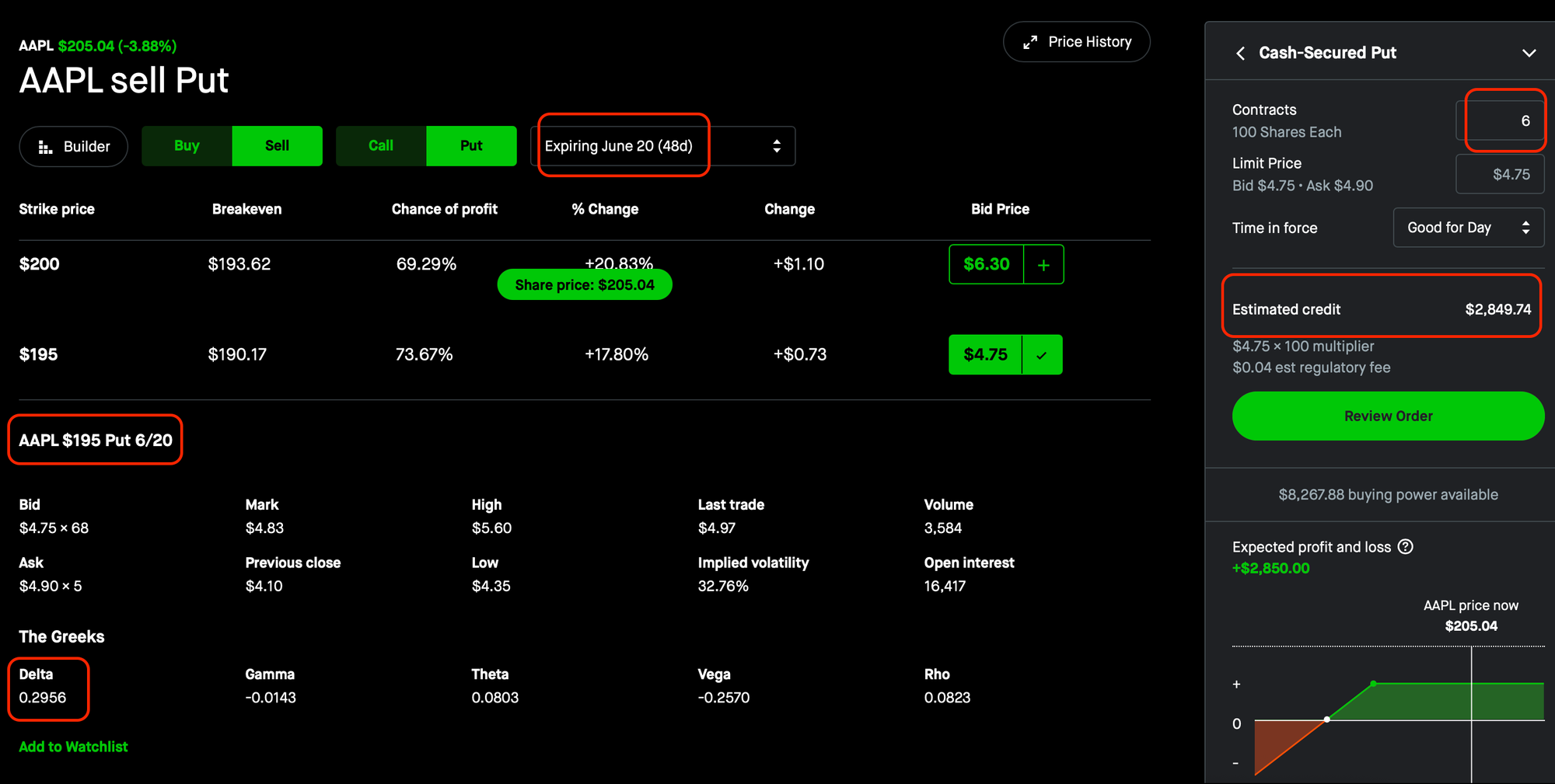

Let’s say I want to recover the ~$3K drawdown with a single trade using a strategy I’ve been profitable with - the Cash-Secured Put.

If I wanted to collect ~$3K in premium, I’d need enough buying power to sell that much risk. Last week, I sold AAPL put credit spreads instead, because I didn’t have the capital for CSPs. And frankly, I’d be happy to own AAPL at current prices (I outright bought some AAPL shares in another account today - not being tracked on Foolish Trader) .

Now, how much capital would it take to generate ~$3K with Cash Secured Puts?

Looking at current pricing:

Selling six 48 DTE AAPL CSPs at ~29.5 delta would yield around $2.8K in premium.

To place that trade, I’d need: $195 x 100 x 6 = $117,000 in buying power.

Not quite an insane number, but certainly not pocket change either.

Final Thoughts

With that last bit of math, I’ll wrap it up for the week. Thanks for following along - I’ll check back in next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.