Day 61

Market Recap

The market was fairly neutral today, with the major indices showing minor movement:

- SPY: +0.14%

- QQQ: -0.04%

Both SPY and QQQ are trading around the same levels as they were this time last year.

Trading Update

Today, I executed my first Zero DTE trade!

I sold 3 SOFI 4/17 $10.5 put credit spreads for a royally grand premium of... $15.

The market wasn’t moving much, so there weren’t any solid setups for my usual trades. But SOFI was slightly up, and I figured it was the perfect chance to dip my toes into the Zero DTE pool.

So, I sold the puts and took the tiny premium on offer. The sweet part? The options expired worthless at the end of the day - just the way we like it.

Now that I’ve tried it once, I’ll be keeping an eye out for more Zero DTE opportunities.

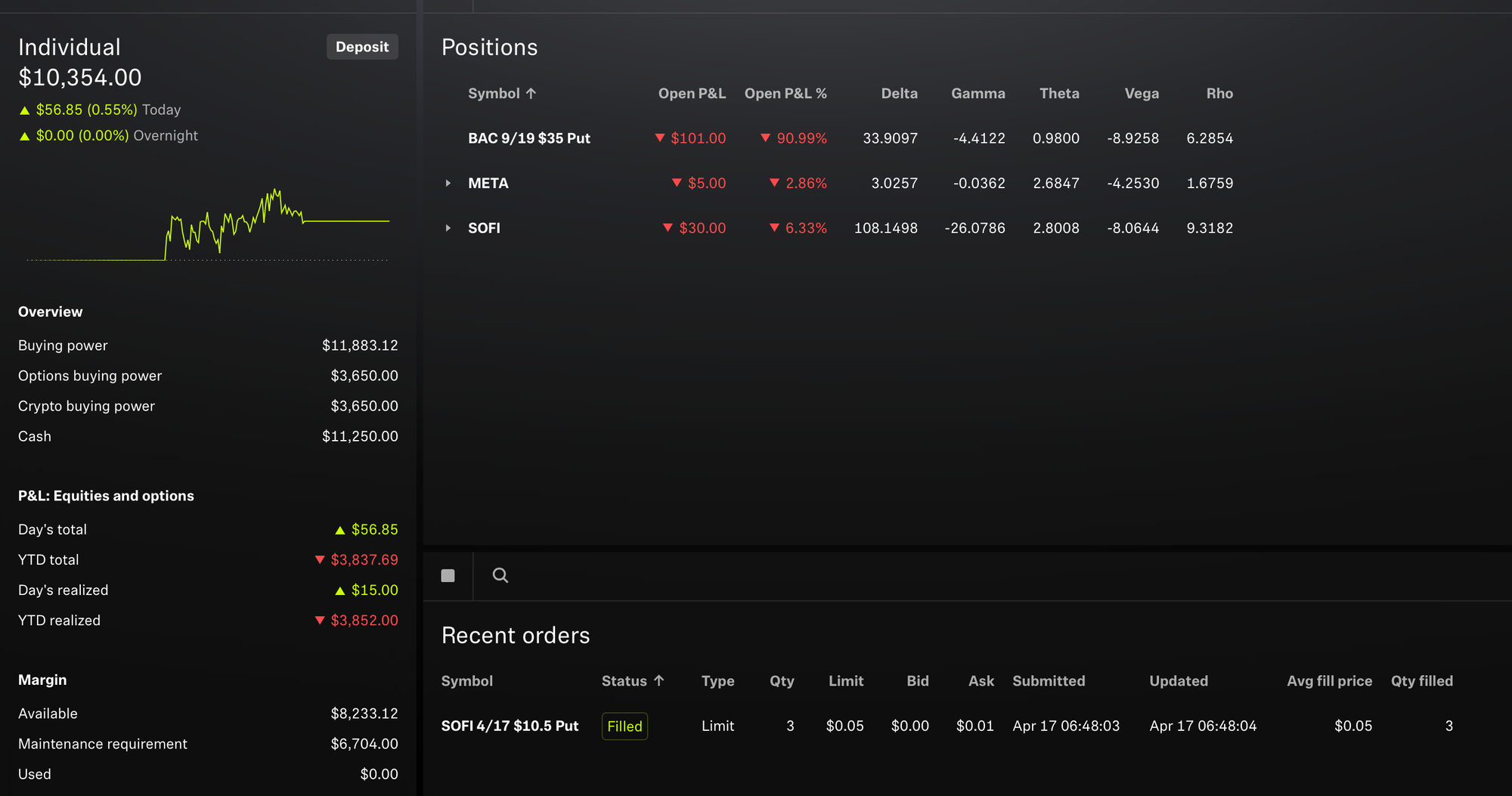

Portfolio Status

The portfolio was mostly neutral today:

- Today's Change: +0.55%

- Year-to-Date (YTD): -27.04%

- SPY (YTD): -10.58%

- All-Time: -36.46%

Here are the open positions.

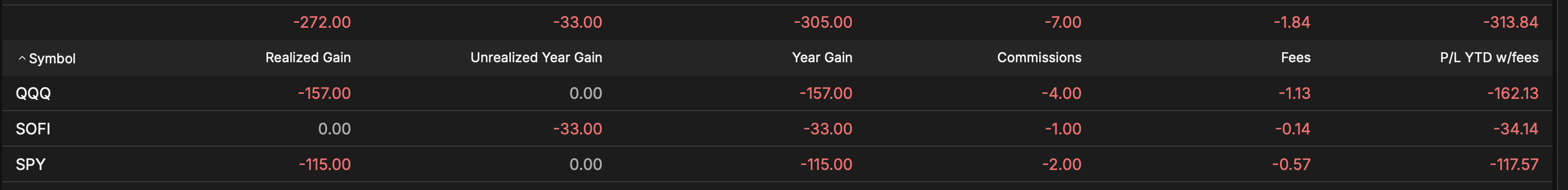

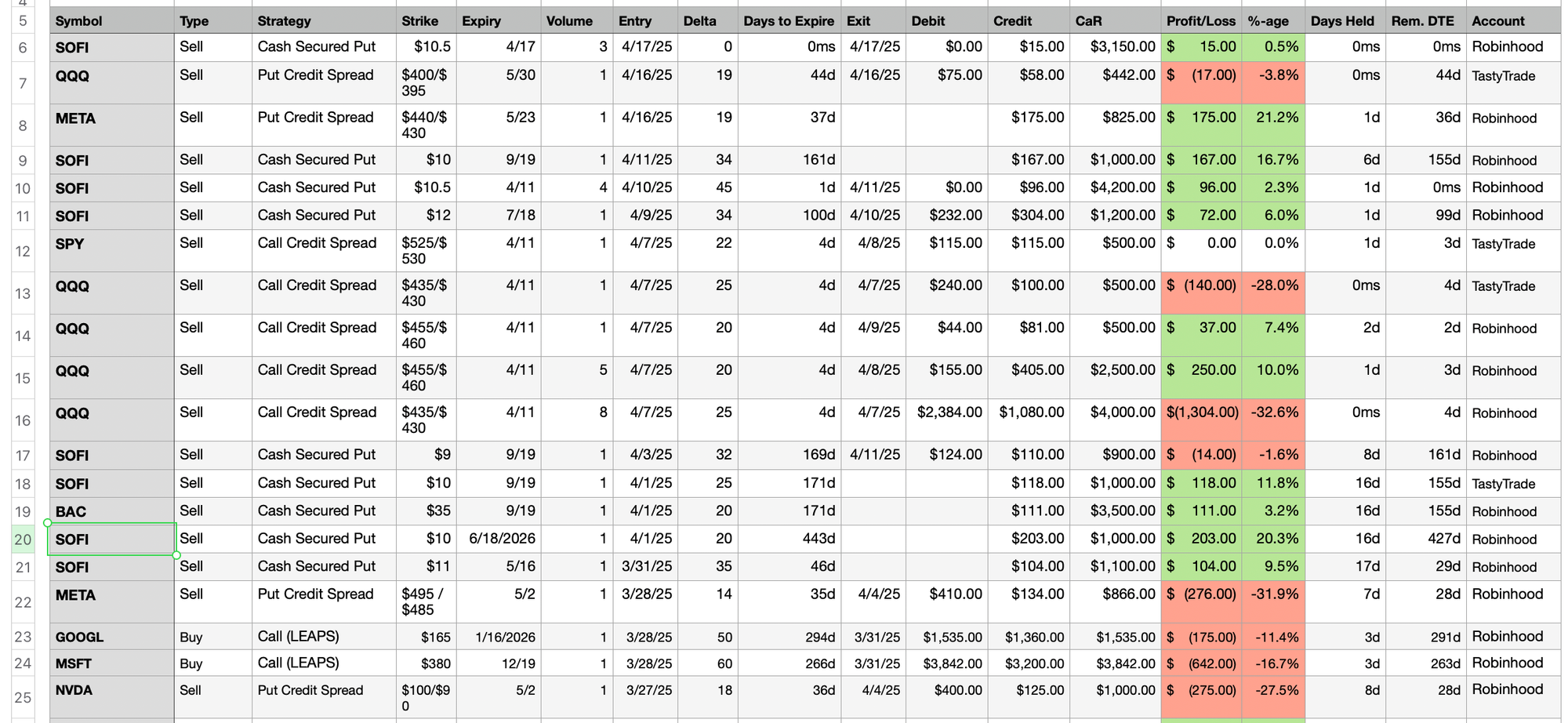

Trade History

Here are my last 20 trades:

Plan for Next Week

Keeping it simple:

- Risk up to $2000 for selling vertical spreads.

- Risk up to $2000 for selling puts.

See you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.