Day 48

Foolish Trader Journal, Day 48.

Market Recap

The market moved down today.

- SPY declined by ~.19%.

- QQQ declined by ~.16%.

Trading Update

Yesterday, I wrote that:

I need to wait

I did not wait!

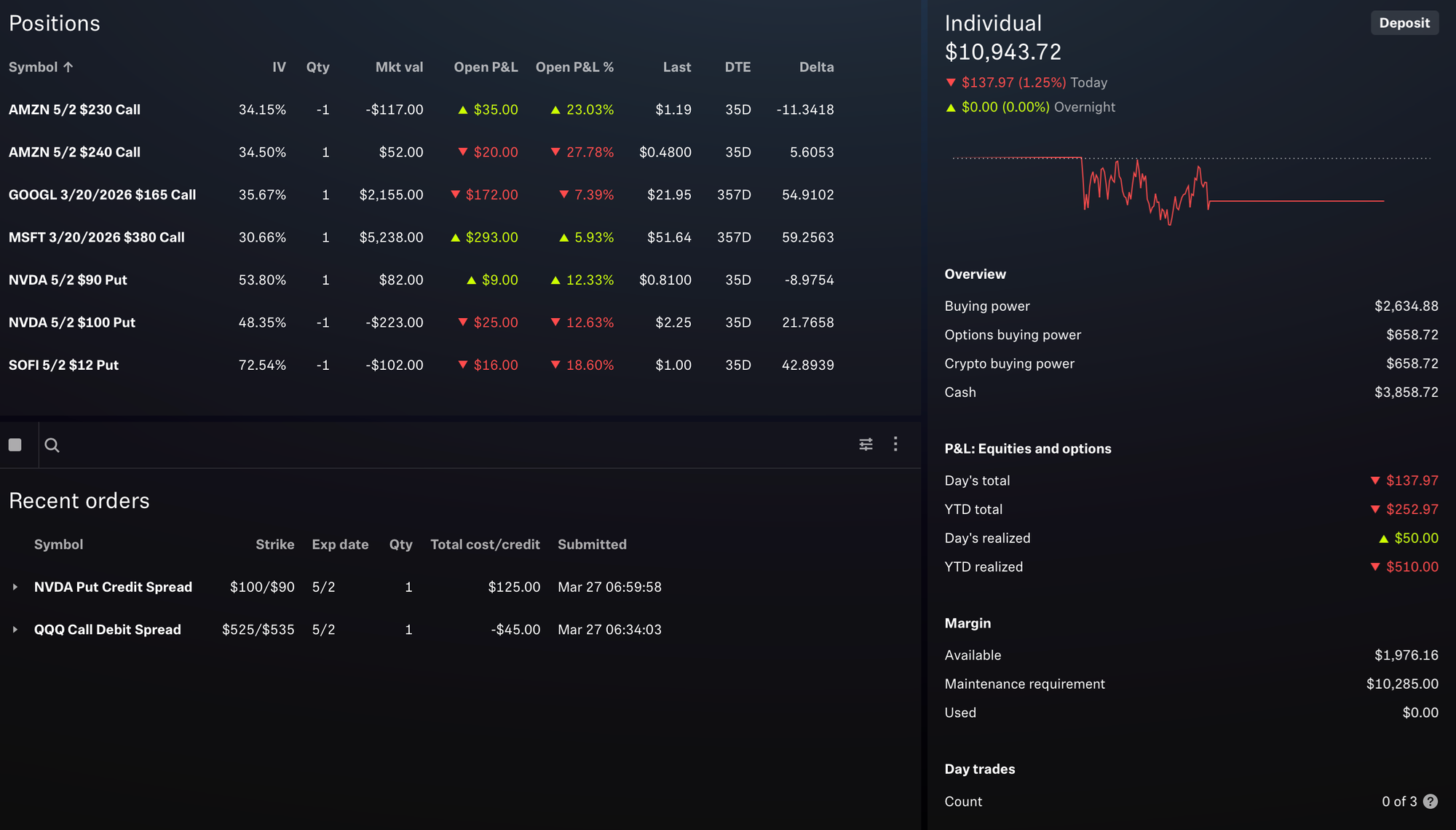

I made a couple of trades:

- Closed: QQQ 5/2 $525/$535 Call Credit Spread for a net 5% gain in 3 days.

- Reason: The trade showed an unrealized gain of over 40% of the original premium in just under 2 days.

- Opened: NVDA 5/2 $100/$90 Put Credit Spread at 18Δ, receiving $125 in premium.

Portfolio Status

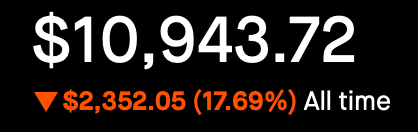

- Today's Change: -1.25%

- Year-to-Date (YTD): -2.26%

- All-Time: -17.69%

- YTD Comparison:

- SPY: -3.72%

- My Portfolio: -2.26%

I am barely ahead of SPY. One more down day, and I could fall behind.

Here are the open positions.

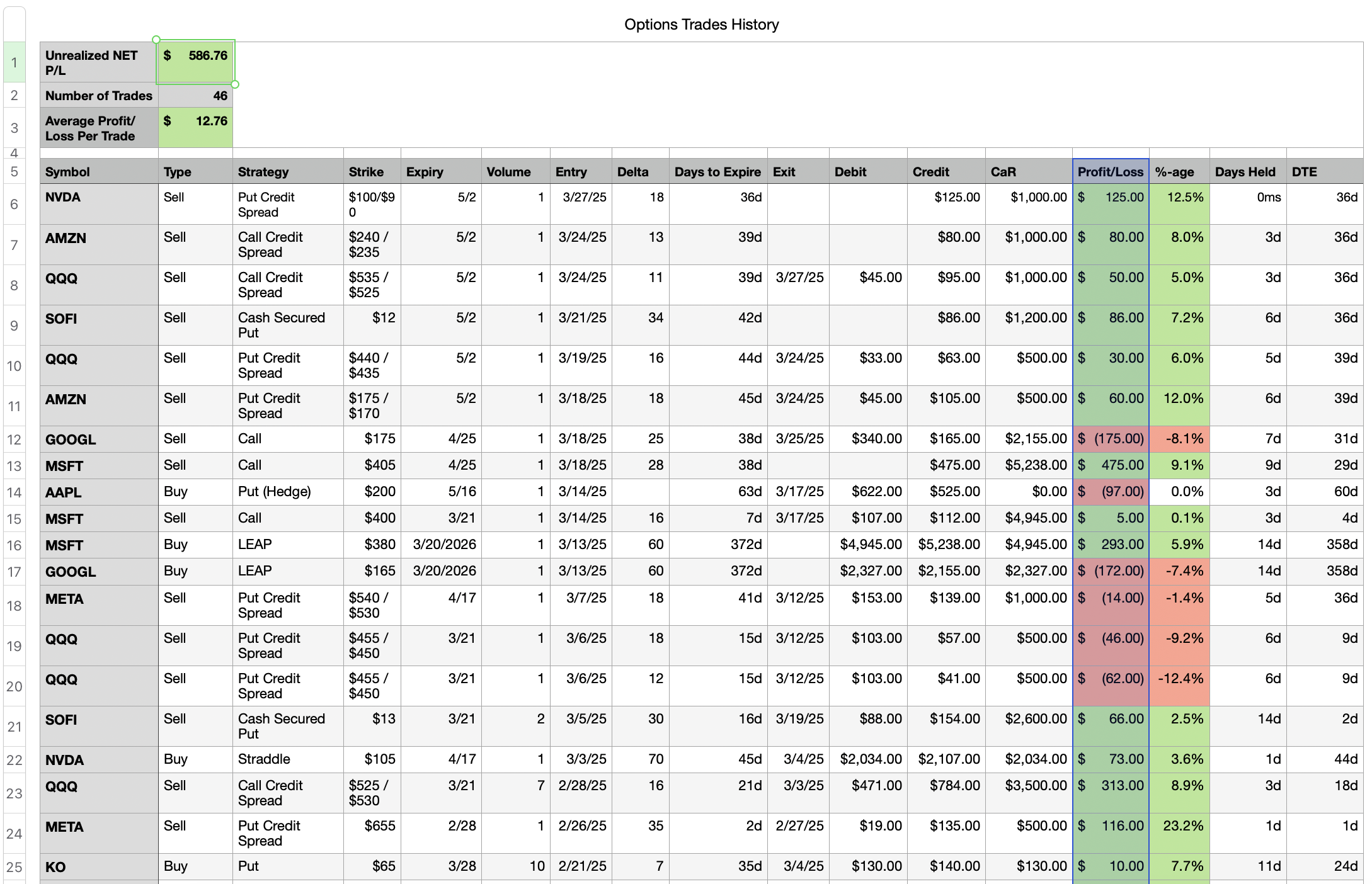

Trade History

Here are my last 20 trades:

Plan for Tomorrow

I reviewed my trade history and found some key insights:

- Overall Performance:

- Excluding all Buys, LEAPS, and Hedges, I’ve realized a total profit of $1,359.76.

- That’s an average of $52.30 per trade across 26 trades, with 80% success (5 losses).

- Performance of 21+ DTE Trades:

- Filtering for trades entered at 21+ DTE, I had 8 trades.

- Total profit: $925 ($115.63 per trade).

- Only 1 loss, which was well-managed - closed when the loss as a percentage of premium received breached 100%.

🔍 Next Step:

Tomorrow, I will evaluate whether I can double down on my winning tactics or if these results are just a function of my overall trading personality. In other words, would I have needed to take all the other trades anyway to get these results?

📌 Disclaimer: Nothing on this site is financial advice—I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.