Day 100

I am back after a break. Wow - the market has been in a slow decline since the last few months now!

Market Recap

Another week of volatility, and this time there is over a percent drop in both SPY and QQQ.

SPY is at ~$681, and QQQ is on ~$601.

VIX is elevated, at ~20.6.

Trading Update

Continuing my experiments with Zero-DTE trades, I placed two more of these this week, making $155 while risking $1000 on each day.

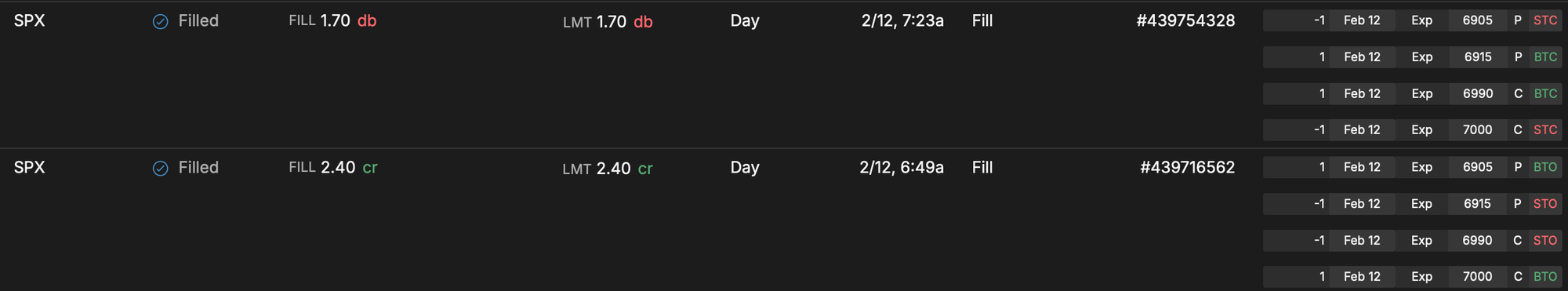

The first one was on Feb 12th - an Iron Condor netting me $70 in 34 minutes.

And the second one was on Feb 13th - another Iron Condor netting me $85 in 53 minutes.

Here is how the two trades stand in comparison.

Like I said in my previous post, since I must keep an eye on it, I managed both trades in under an hour at the start of trading hours, before starting my regular daily office job.

I love trading Zero-DTEs on SPX, but the challenge is that it is hard to keep an eye out on it when you have a day job. So it is not the smartest trade for those like me trying to trade only in non-working hours. For me that typically is an hour just after market open, and an hour before market close.

It is still quite tricky - these are the trades I love to place - but these are the ones that are harder to do daily. One because of my day job, and two because I don't really have the capital necessary to do these trades daily - note the 5 day Pattern Day Trading (PDT) rule from SEC requiring $25K in a trader's account (see here).

Trade Ideas I am Thinking of For Next Week

I will try to keep it simple. I am going to do more of SPX 45-DTE or 0-DTE Iron Condor or Short Spread trades!

How do I decide whether or not to enter a Zero-DTE? There are a few factors. Here is how I think about them.

First, do I have any more trades available to place before I get flagged for PDT? See following snippets from the link I shared earlier.

[A "day trader" is any customer whose trading shows a pattern of day trading.] The term "pattern day trader" means any customer who executes four (4) or more day trades within five (5) business days. However, if the number of day trades is 6% or less of total trades for the five (5) business day period, the customer will no longer be considered a pattern day trader and the special requirements under paragraph (f)(8)(B)(iv) of this Rule will not apply.

The minimum equity requirement for a "pattern day trader" is $25,000

There is some talks about this rule getting relaxed this year, let's see if it happens. But if the rule doesn't get relaxed, I am confident I can save some more this year and even with losses (or hopefully with profits), I will close the year above $25K in at least one account.

Alright, so that's the first thing - make sure I have executed less than 4 day trades.

The next thing I check is volatility. Higher VIX typically implies juicy premiums. I typically trade Iron Condors and I have noticed VIX above 17 usually is a good green signal.

Next is to identify what strikes/prices/deltas to use.

For every $1000 I risk, I intend to make about $100. When trading Iron Condors or Spreads, my profit target is between 20 to 50% of original premium. With that logic, I look for trades that can give me $250 to $350 in premiums - since that means I can try and find a move that gets me close to a $100 in realized gain.

When VIX is elevated, this is typically available around 16 to 18 deltas at around 30 minutes after market open.

I enter the trade, then wait for any where between 15 minutes to an hour, close the trade, and move on to my regular day and regular job.

This week was a good week in that both of my zero DTEs made money.

The net effect of these SPX trades so far has been that Year to Date, I have been net profitable on my Zero DTEs. I have place 5 Zero-DTE trades, and been profitable on 4 of them, making $265 so far.

I have risked a $1000 each time - this turns out to a 26.5% return on my Zero-DTE SPX trades. When compared to the rest of my account, which is right now all in unrealized losses, this is an insane return.

But this is a very small sample, and if you have been a long enough reader here, you will know that my reasonable sample size for any trading strategy is about 200 trades in total - and that's not going to happen in an year unless I get $25K in one account.

But as I write this - every ounce of my trading mind tells me this is the way to go - and stop chasing everything else.

Portfolio Status

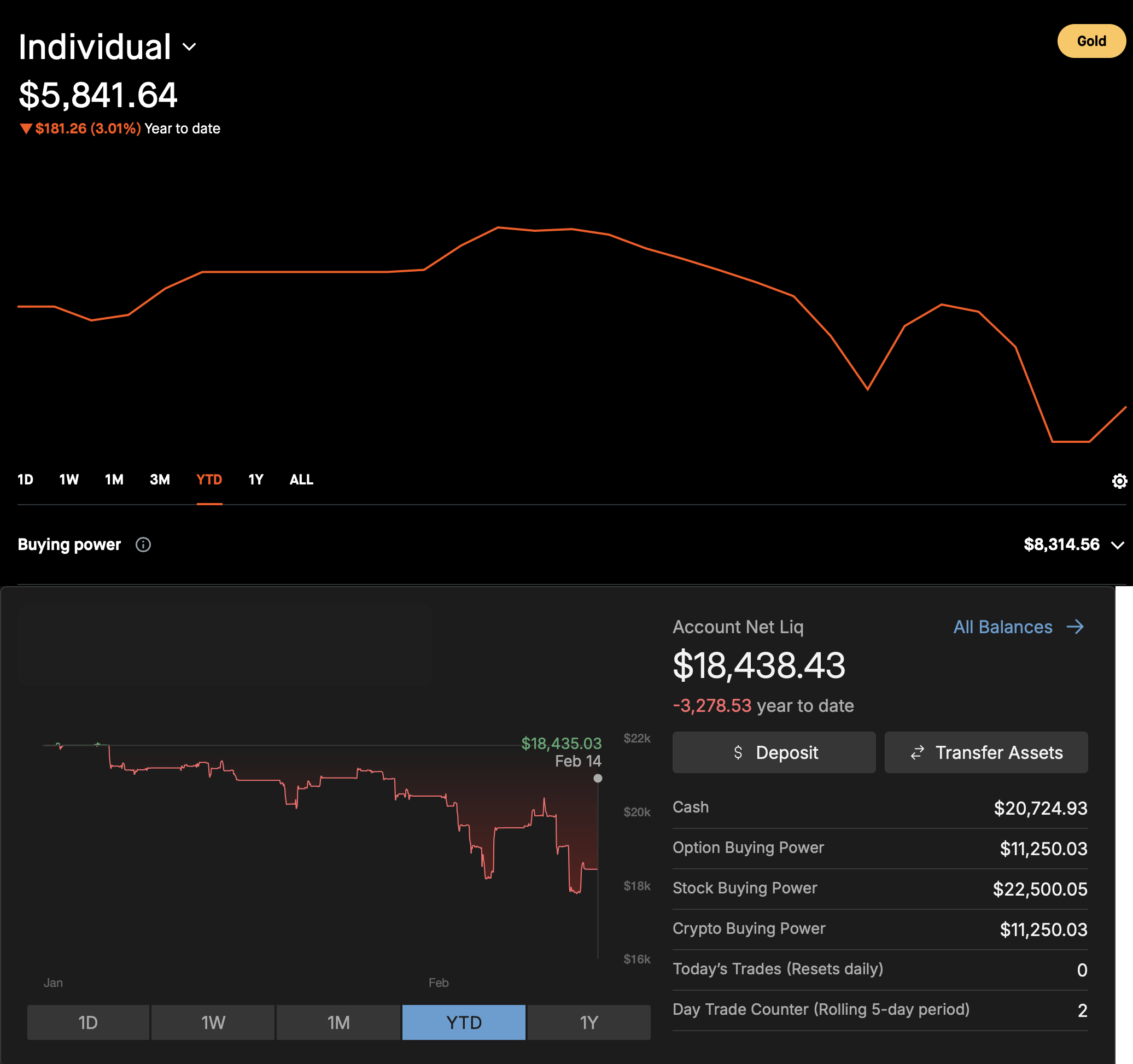

Since I have left my other open trades unchanged, because of the down market move, those positions are sitting with unrealized loss. I currently have ~$24K across TastyTrade and Robinhood.

Here is the current status, including unrealized P/L.

I have about ~19.5K of Option Buying Power available across both accounts.

I am not sure if this is going to be a prolonged downturn or not, but if it is, we might be in for a very long and painful time. I am trying to keep my trades small, and not going beyond 50% in buying power usage, in order to keep my risk exposure small. Wonder what other traders are up to in these times.

Anyway, thanks for following along. See you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.