Day 95

1 more week to go before the year ends. Very little activity from me.

Market Recap

With VIX in low teens, SPY and QQQ both rallied up, with SPY hitting its all time high and QQQ getting close as well.

Last Week:

- SPY ($690.00): +$14.17 (+2.10%)

- QQQ ($623.30): +$11.40 (+1.86%)

Last 1 Year:

- SPY: +$90.50 (+15.10%)

- QQQ: +$94.88 (+17.96%)

Year To Date:

- SPY: +$100.61 (+17.07%)

- QQQ: +$108.90 (+21.17%)

VIX is now less than 14!

Trading Update: December 22 - December 26, 2025

With VIX being so low and it being the week of Christmas, I chose to take it easy and only looked for opportunities to close existing open trades, and choosing not to open any new trades.

I closed a single trade during the week - a SOFI $27 1/16/2026 Put, realizing a $89 in profit (closed at ~43% of possible profit).

Portfolio Status

Not a whole lot of movement in my portfolio.

My last five weeks (latest first): W-W-L-L-W.

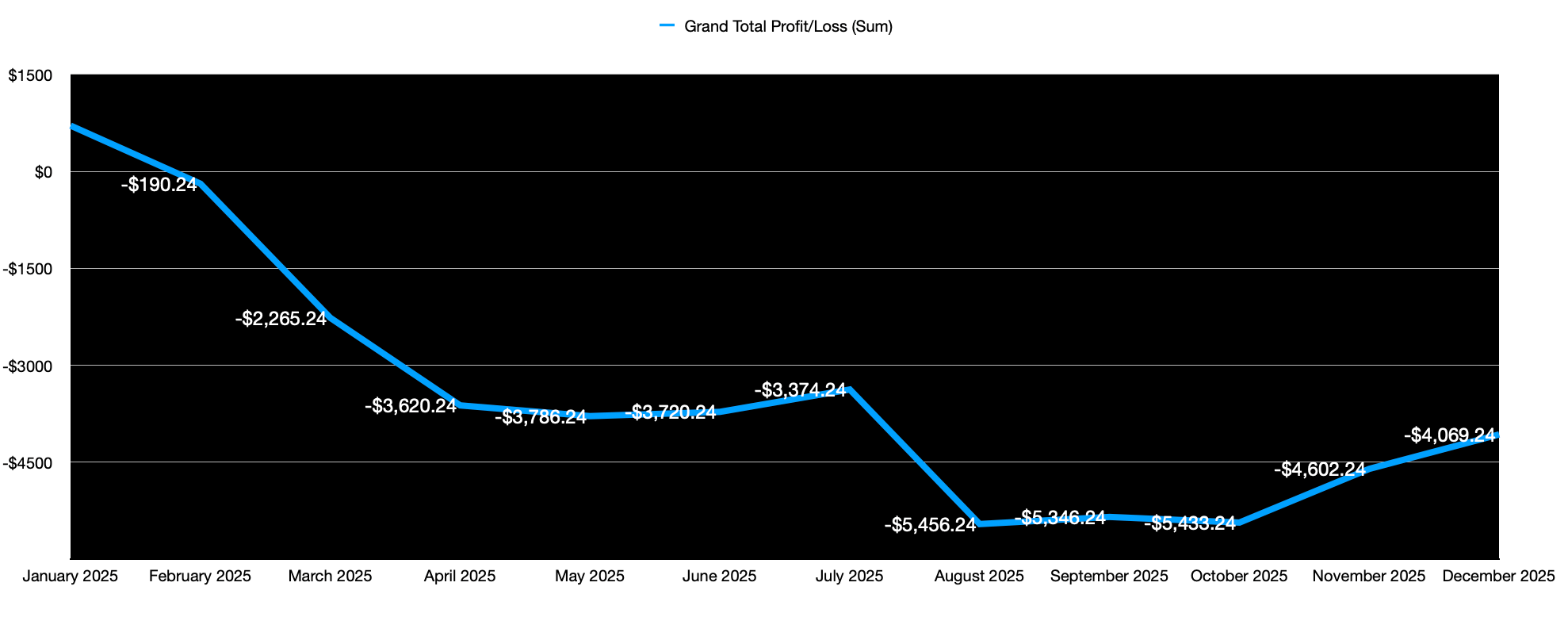

Year-to-date realized P/L: –$4,069.

Here is the Profit/Loss trend for the year.

Portfolio

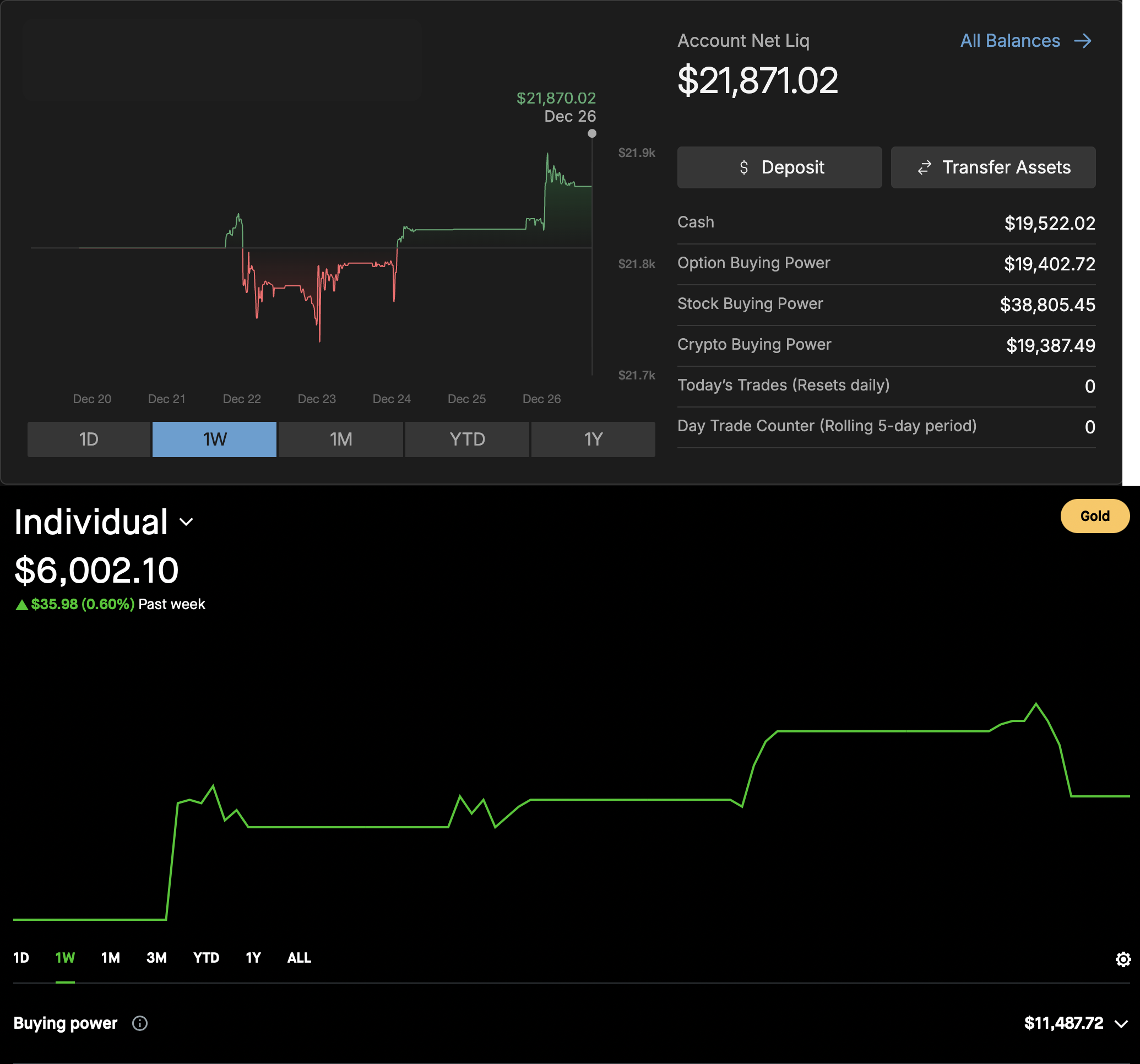

Here is a current snapshot of my TastyTrade and Robinhood portfolios, with total net liquidity at $27,873.

Portfolio Strategy Breakdown

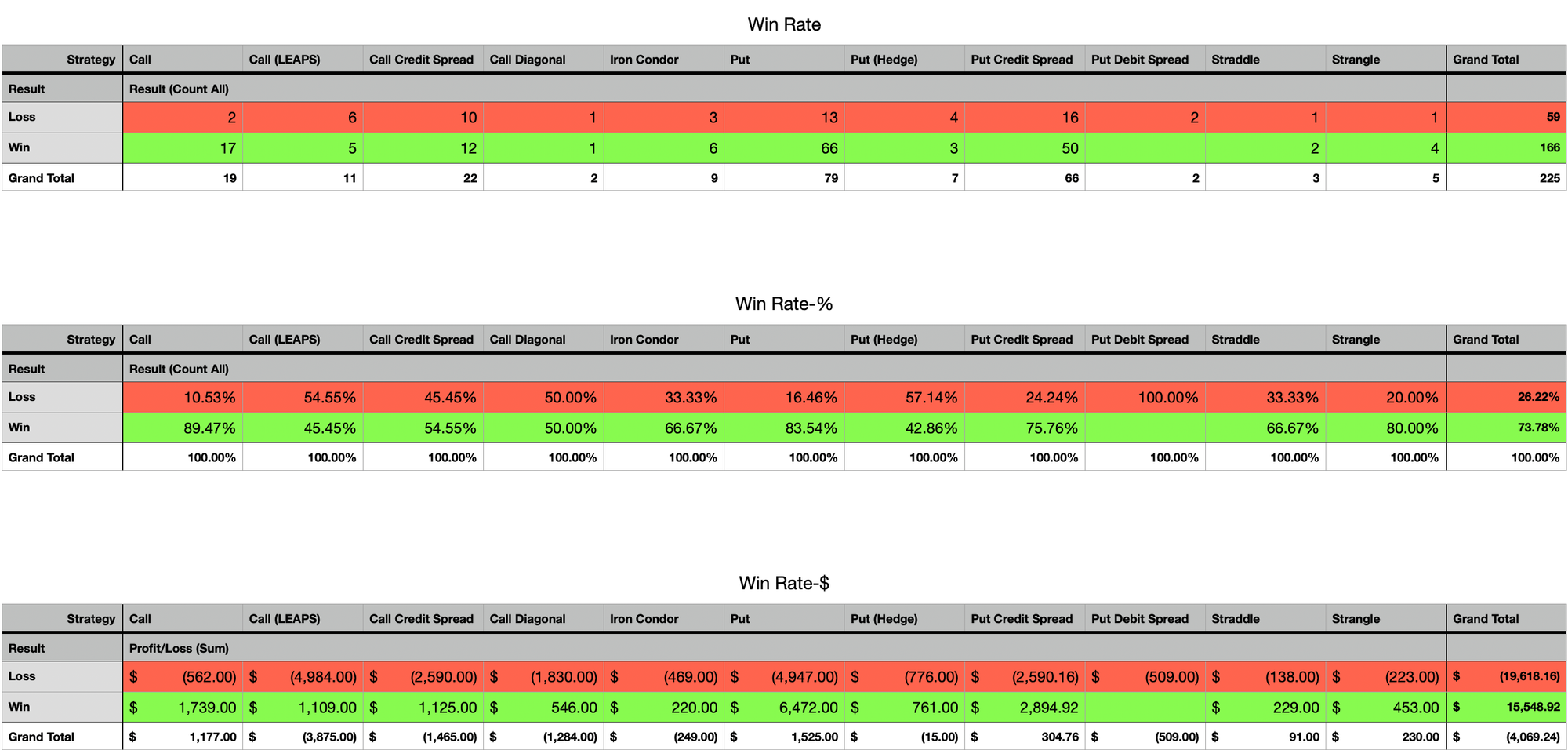

Here's a view showing my Win Rate breakdown by strategy deployed.

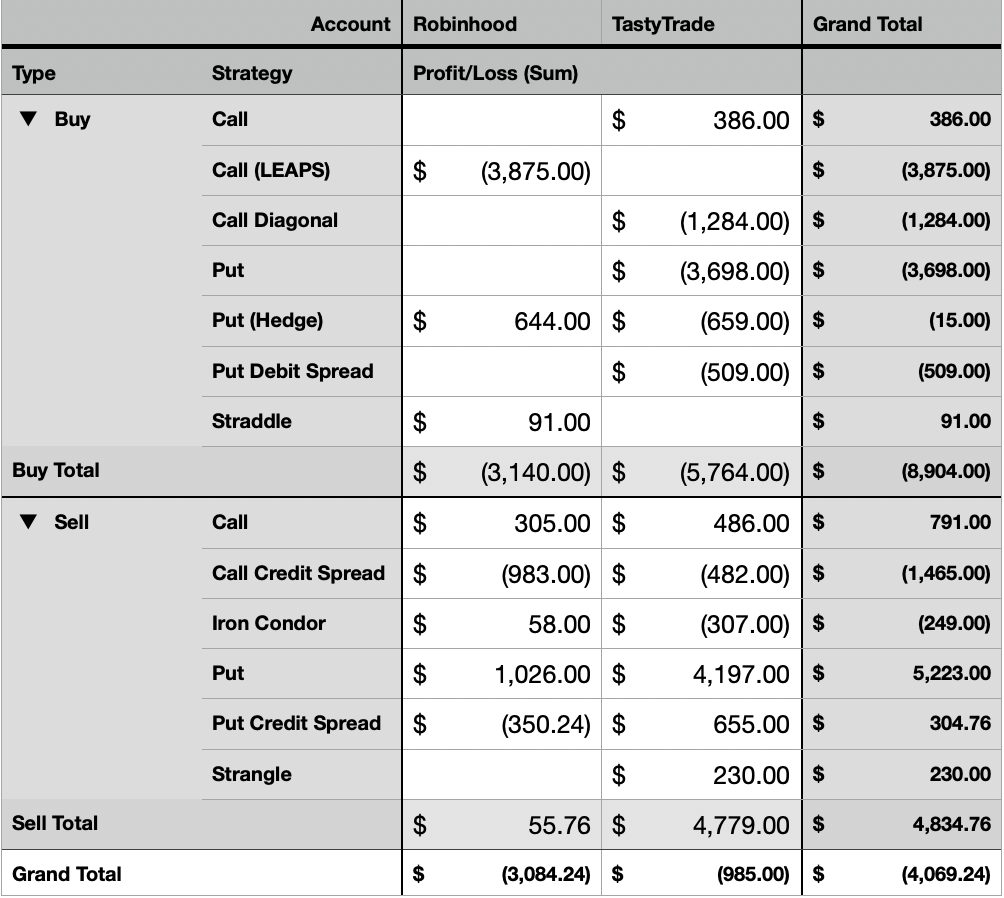

Here is a breakdown of P/L by Buy v/s Sell strategies I have used so far.

Plan for Next Week

I have 2 trades open now, 1 in SOFI and 1 in NFLX.

1 of my SOFI and the open NFLX both reached their 21-DTE mark this week, I closed SOFI and left NFLX open, I might look to roll it next week - with IV being so low I am betting I can extract some more theta out of it before I manage the trade.

I am not looking to be very active next week, but I will have an end of year review for his I did in my first year of intentional options trading.

Thanks for following along. See you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.