Day 8

Foolish Trader Journal, Day 8

I had no good ideas to act on today. Yet, I executed one since it felt dull keeping all this capital not under any sort of risk.

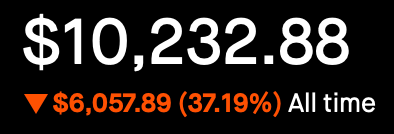

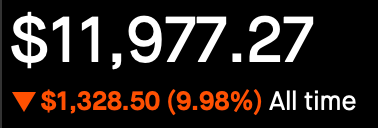

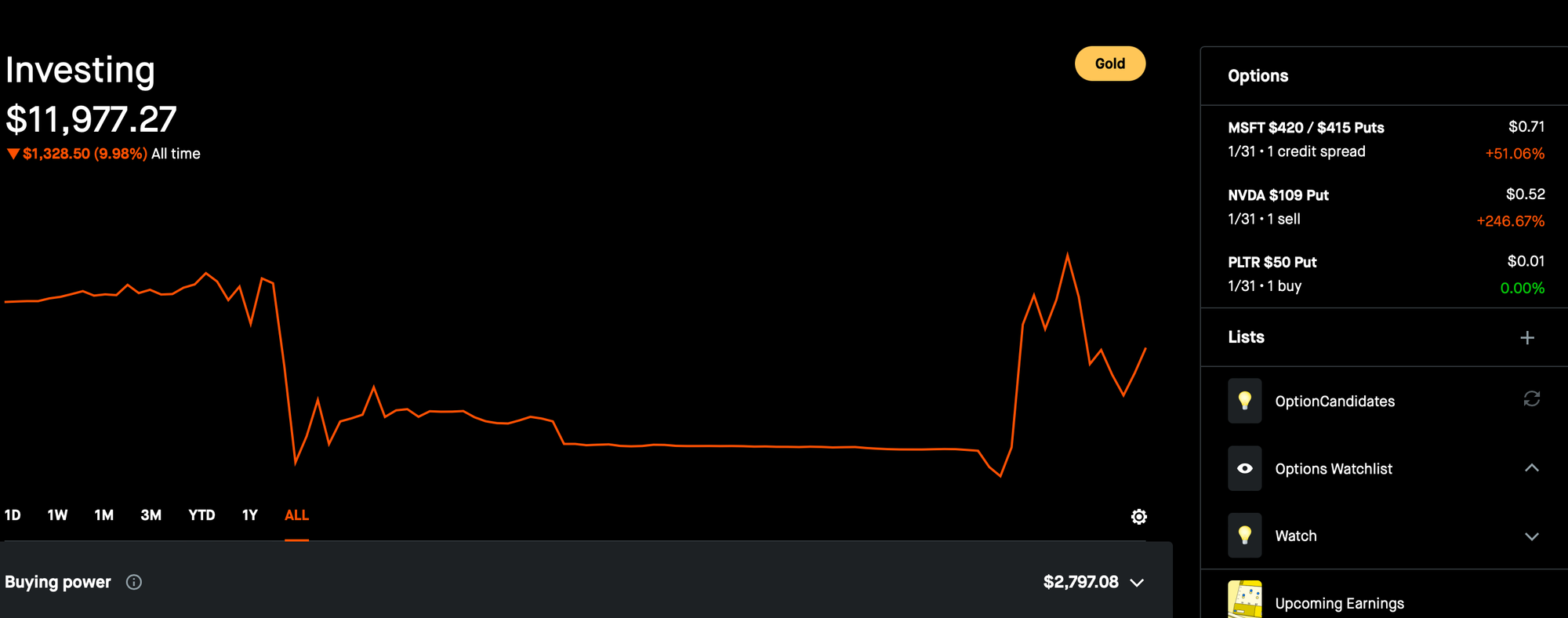

Portfolio Overview

- Market Value: $11,900

- Cash: $500

- Options Collateral: $11,400

Today's Trades

- Sold NVDA $109 Put

- NVDA seems to have maybe temporarily found itself in a pullback.

- NVDA has fallen ~14% in the past week, I bet 11K that it will not fall > 5% in 3 days (it absolutely can!) since it is already down quite a lot.

- I would want to exit this position in 1 day if possible. I have a strong feeling that if NVDA does get down to $109 and I get assignment, I would think it just keeps falling further down, and possibly reach $80. In fact, I may look to buy some Feb 28 Puts.

Ongoing Positions

Microsoft (MSFT) Trades

- I had not expected this trade to have lasted for so long. The trade has now been open for 5 days, I don't think this level will be tested again so I am holding on. Let's see if I can get out tomorrow.

- $420 / $415 Put Credit Spread

- 13 delta option

- Received $45 premium

- Potential 9% return if trade succeeds

- Maximum risk: $500

Palantir (PLTR) Trades

- PLTR $50 Put, Expiring 1/31

- Hedge

- Potential Strategy: Let it expire, or roll for another month if I own a CSP or get assignment

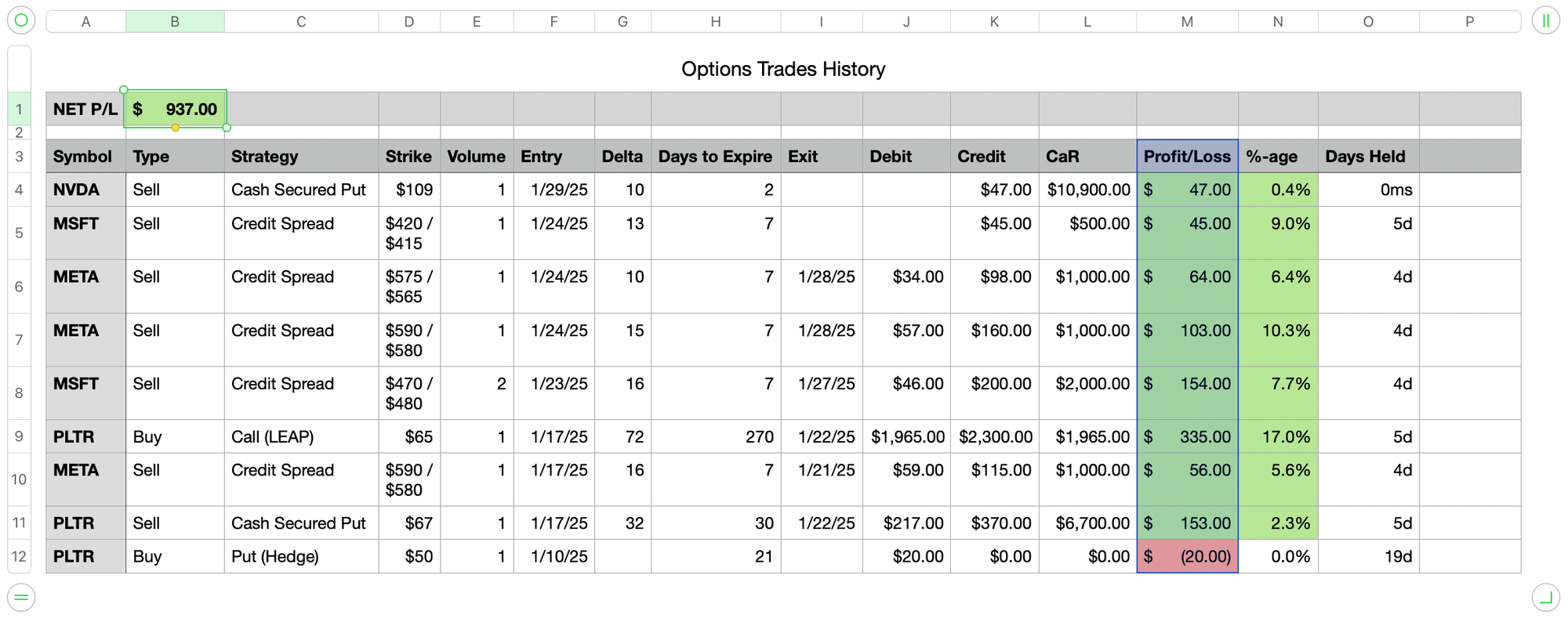

History View

Here are my most recent trades reflecting the above positions in a spreadsheet format.