Day 62 - End of Week 14

I did not have a write-up on any day in the past week. I did have some trades. Here is the story.

Market Recap

The market was bullish last week, with major indices posting big gains:

- SPY: +5%

- QQQ: +6.72%

Compared to a year ago, SPY is up +8.86%, and QQQ is up +10.61%.

Trading Update

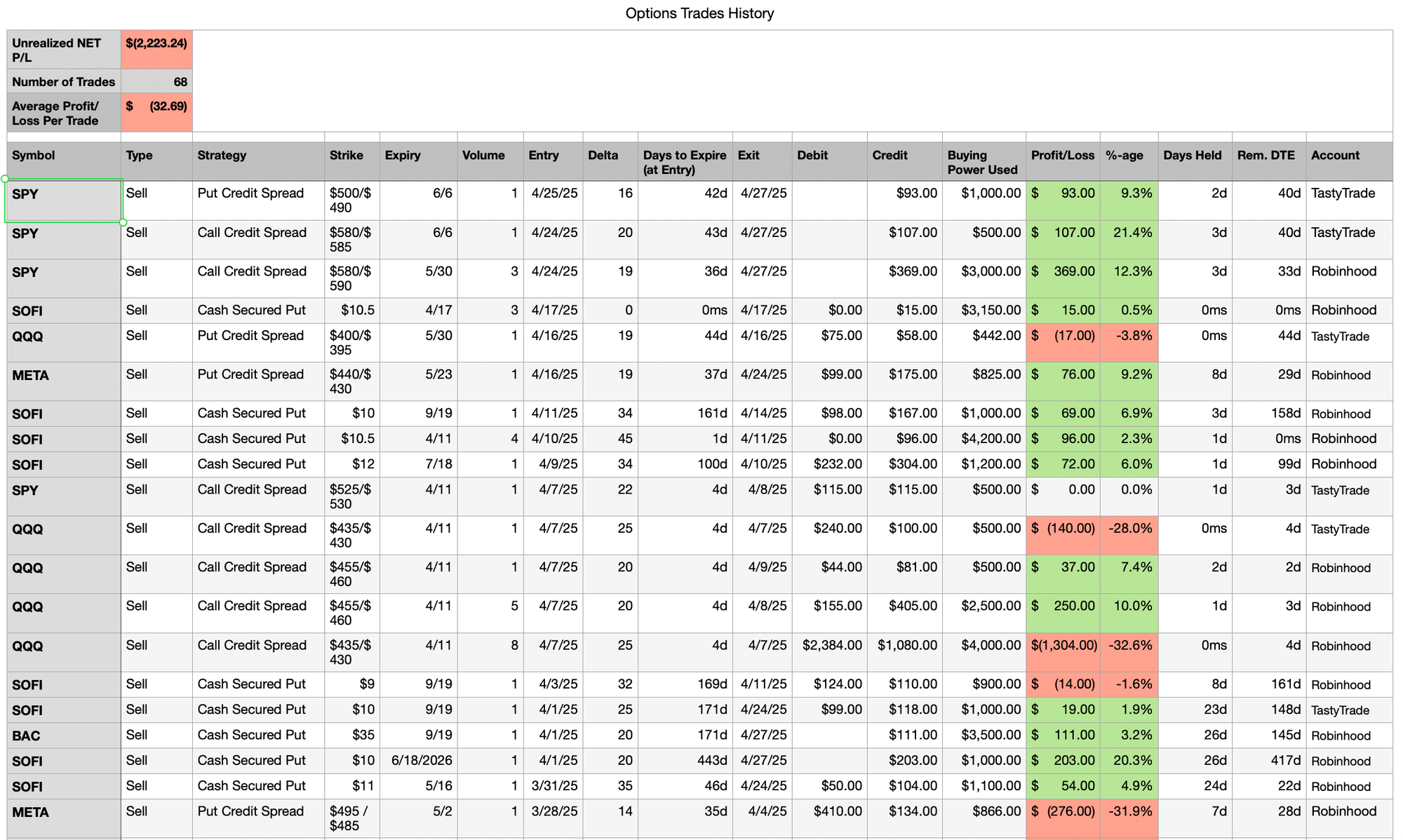

4/25/25

- [Open] SPY - 6/6 expiration - 1 Put Credit Spread ($500/$490) - 42 DTE - 16∆ - Premium Received: $93

4/24/25

- [Open] SPY - 6/6 expiration - 1 Call Credit Spread ($580/$585) - 43 DTE - 20∆ - Premium Received: $107

- [Open] SPY - 6/6 expiration - 3 Call Credit Spreads ($580/$590) - 43 DTE - 19∆ - Premium Received: $369

- [Closed] META - 5/23 expiration - 1 Put Credit Spread ($440/$430) - Closed at 29 DTE, at 43% of premium received.

- [Closed] SOFI - 9/19 expiration - 1 Cash-Secured Put ($10 strike) - Trade closed after +1.9% profit in 23 days (not moving fast enough).

Portfolio Status

I am tracking two accounts, Robinhood and TastyTrade, here on Foolish Trader.

It is getting harder to produce clean, summarized visuals because there is no consolidated view.

Here is what I pieced together today using my Numbers spreadsheet (shared in the Trade History view):

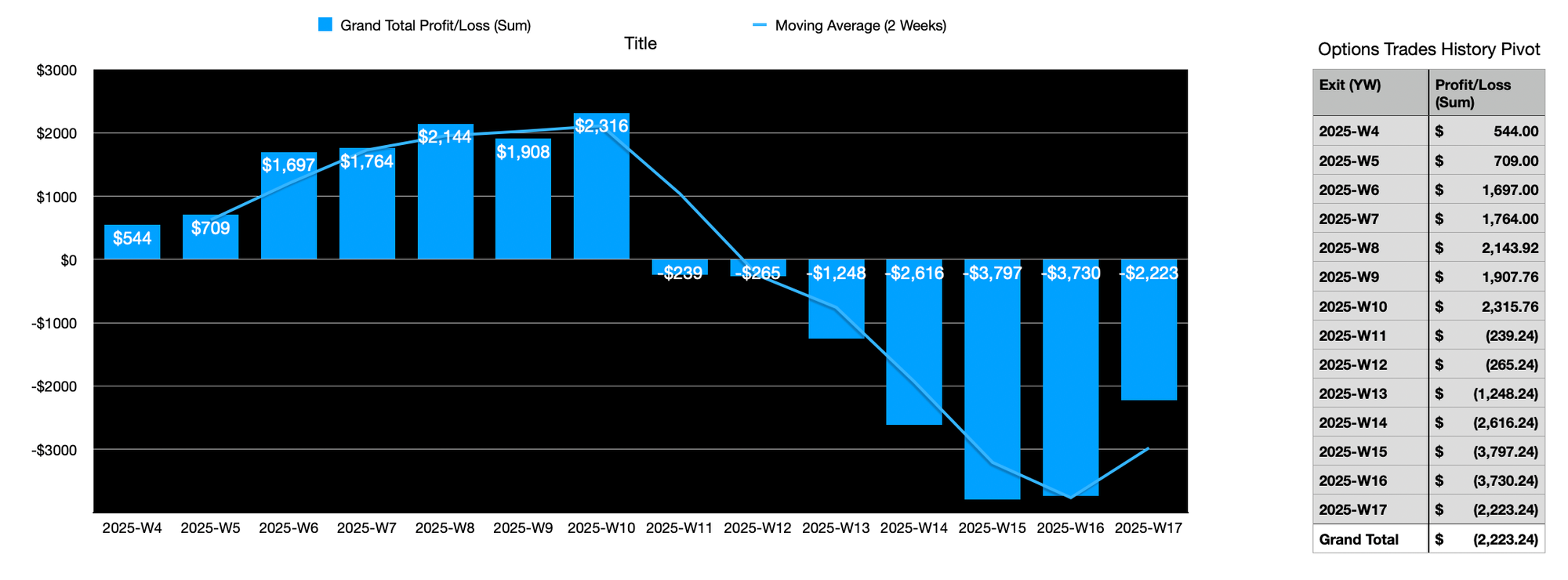

- Current Net P&L for 2025: –$2,223.24

Weekly Portfolio Value

(Down ~$2.2K this year)

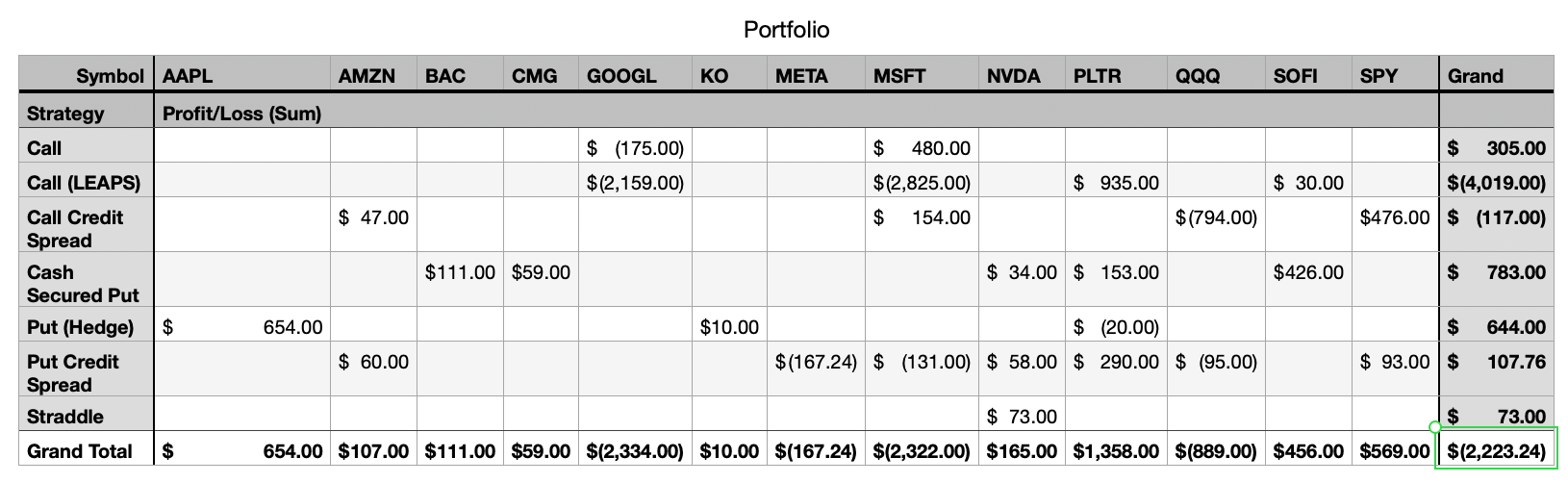

Portfolio Strategy Breakdown

(A breakdown of where my trades are spread across strategies and equities.)

Trade History

Here’s a snapshot of my last 20 trades:

Plan for Next Week

Last week, my plan was to:

Risk up to $2000 for selling vertical spreads.

Risk up to $2000 for selling puts.

I ended up risking a bit more than planned. I’ll see if I can de-risk some and free up buying power.

What's Next?

PLTR has earnings coming up — I'm tempted to bet a little buying power there.

One crucial realization: this is way too fun for me!

Yes, I’ve mostly lost money so far, but not every trade has been a loser (see the strategy breakdown).

The real plan is simple: keep learning without blowing up the account. Stay foolish. Stay patient. Tune out the noise.

Because if there’s one thing I’ve learned, it's this:

Nobody knows anything. No one can predict anything.

The game is to figure out what works for me, stay disciplined, and enjoy the ride - at least until I sober up.

See you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.