Day 3

Foolish Trader Journal, Day 3

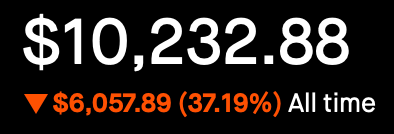

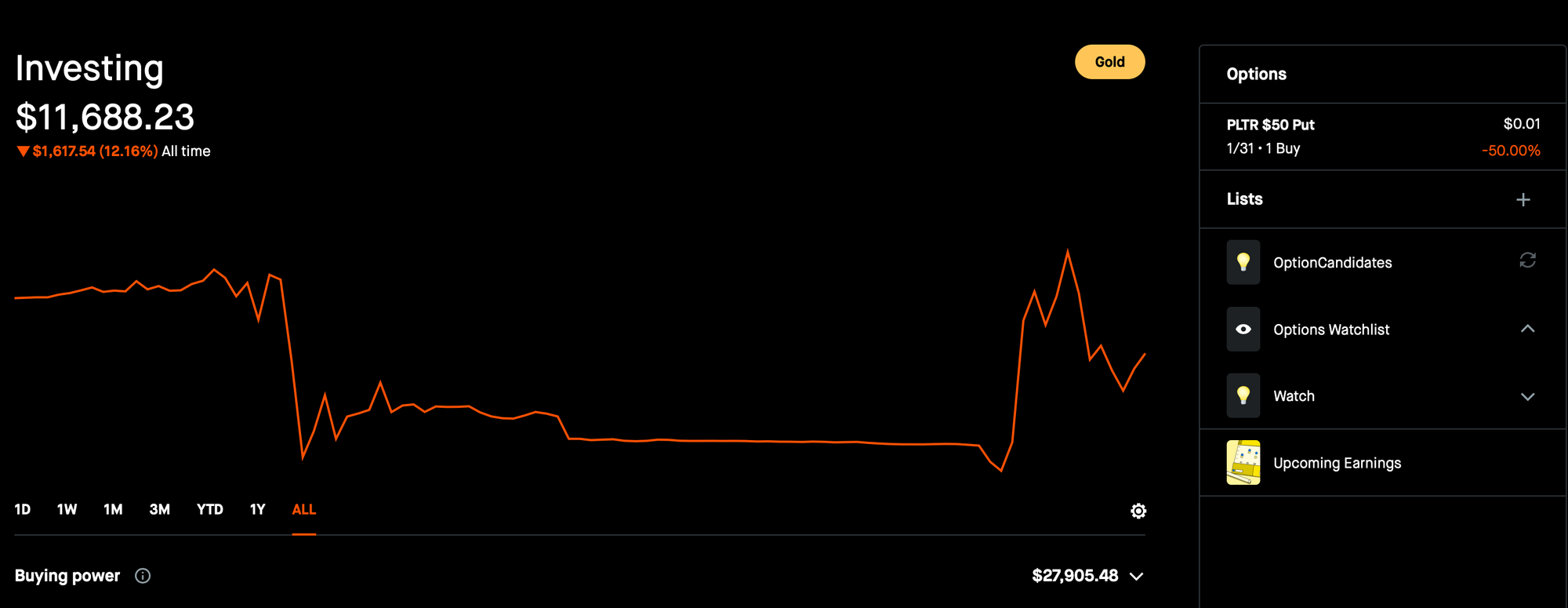

Here is my portfolio balance right now.

- Market Value: ~$11.6K

- Cash on hand: ~$11.6K

Trades Closed Today

- Closed PLTR $67 Cash Secured Put, Expiring 2/14

- I wanted to manage this at 21 DTE, but I hit >40% premium today so chose to lock in some profits. Stock had a 5% rise today, I suspect it may ride a day before it corrects a little bit, I may choose to enter again at that point in time.

- I made a net profit of $153.

- I held the trade for 5 days.

- Here was my thought process at the time of entry.

- PLTR $67 Cash Secured Put, Expiring 2/14

- 30 DTE, 32 ∆

- Premium Received: $370

- Plan to exit at 50% Profit, or 21 DTE

- PLTR $67 Cash Secured Put, Expiring 2/14

- Closed PLTR $65 Call, (LEAP) Expiring 10/17

- I wanted to manage this at 21 DTE, but I hit ~20% premium today so chose to lock in some profits. Stock had a 5% rise today, I suspect it may ride a day before it corrects a little bit, I may choose to enter again at that point in time.

- I made a net profit of $335.

- I held the trade for 5 days.

- Here was my thought process at the time of entry.

- PLTR $65 Call, (LEAP) Expiring 10/17

- 270 DTE, 72 ∆

- Cost $1965

- Plan to exit at 50% Profit, or 90 DTE

- PLTR $65 Call, (LEAP) Expiring 10/17

New Trades Opened Today

- None

Open Trades

- PLTR $50 Put, Expiring 1/31

- Hedge

- Let it expire, or roll for another month if I own a CSP or get assignment

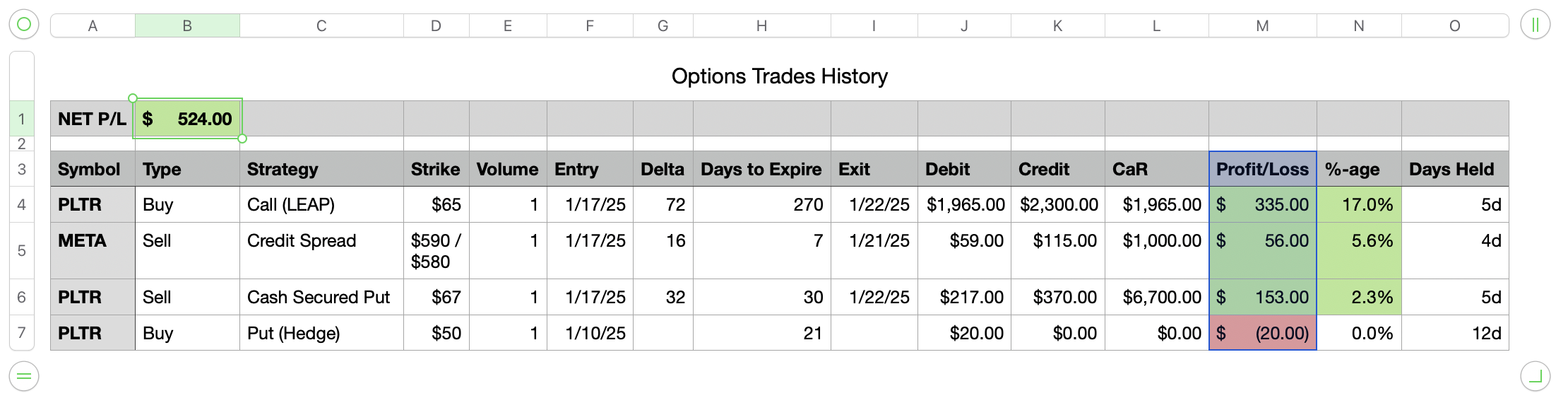

History View

Here are my most recent trades reflecting the above positions in a spreadsheet format.