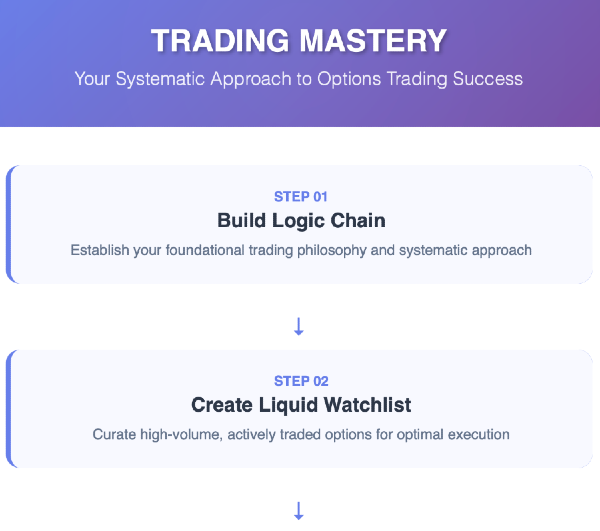

Day 13 - FOMO Got Me: New LEAP Positions Opened

Quick disclaimer: This site is primarily my trading journal that I share for entertainment. While I hope you find it entertaining too, please do not consider this financial advice! Read my introduction here for why I started this experiment: Hello!

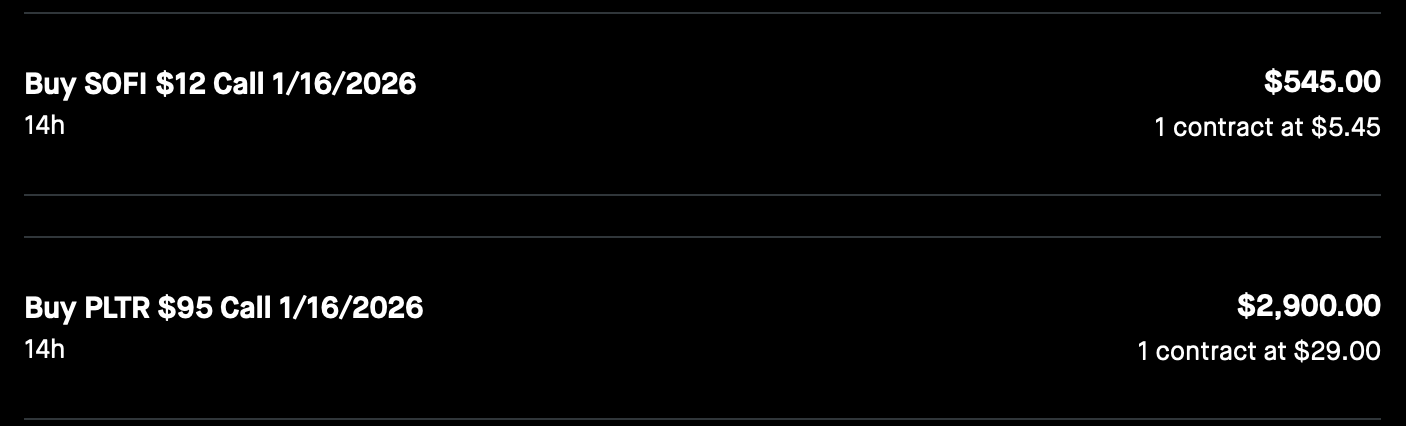

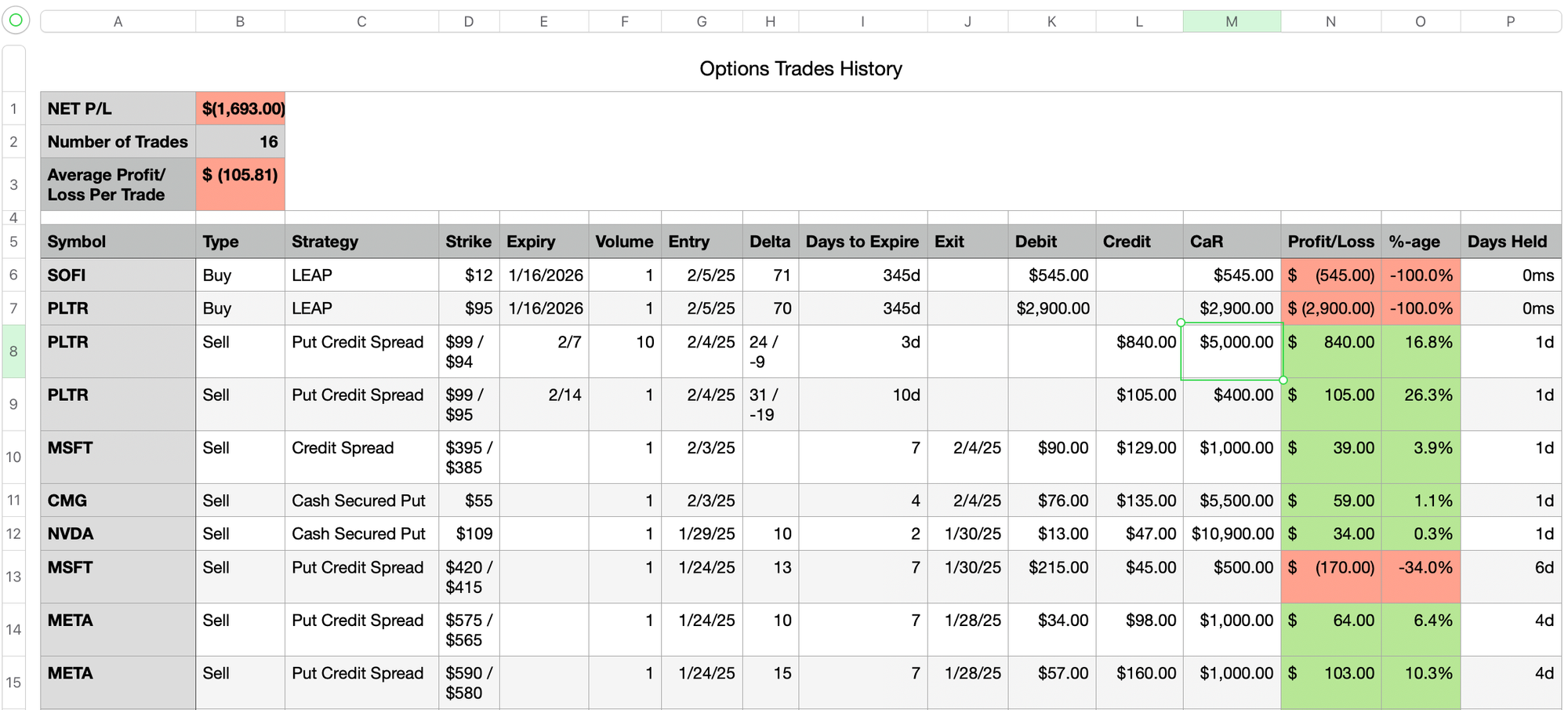

Today's Trading Activity: I tried to resist putting more money into the market after open... lasted about an hour before giving in. I opened two new LEAP positions expiring in January 2026:

- PLTR Call Option

- SOFI Call Option

Strategy Details

- Selected ~70 delta for both positions

- Targeting 15-30% profit on these calls (plan to sell before expiration)

- No intention to exercise or let them expire worthless

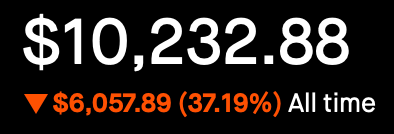

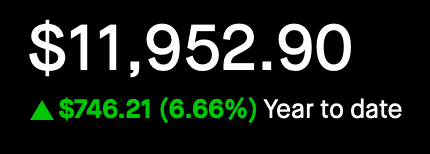

Portfolio Impact

These LEAP purchases have pushed my true P/L into negative territory, though I'm maintaining some cash reserves in this account. I currently have ~4K USD remaining - if the VIX continues to rise tomorrow, I might plough some more money in.

Here is a view of my last 10 trades.

The spreads I opened yesterday have not exactly moved as much as I thought they would. I think I will close at least some of the open Put Credit Spreads tomorrow, even if they are at a loss. Foolishly hoping PLTR doesn't breach $100 on its downward journey, at least until my options expire this week.