Day 101

Are we moving on?

Market Recap

Both SPY and QQQ moved up by nearly a percent.

SPY is at ~$689, and QQQ is on ~$609.

VIX is still elevated, at ~19.

Trading Update

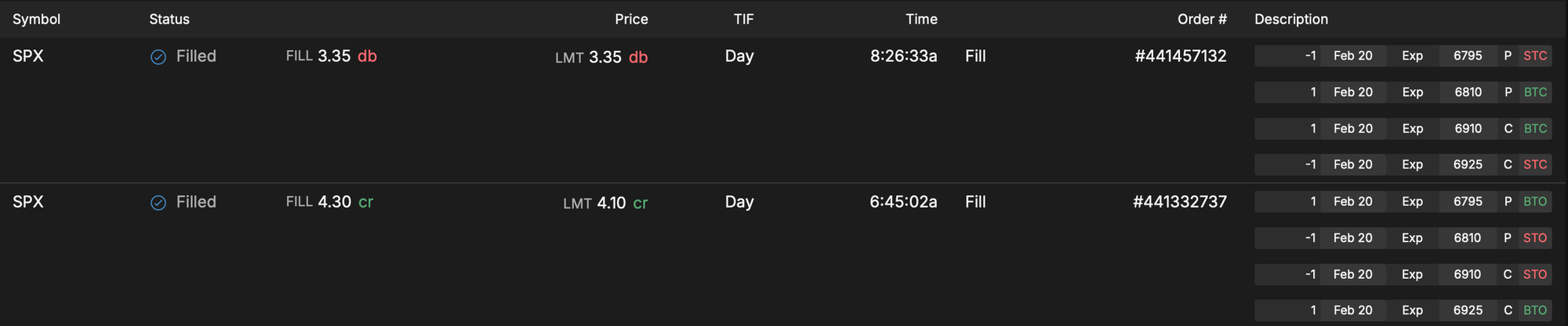

And once again, continuing my experiments with Zero-DTE trades, I placed two more of these this week. This time I made $160 while risking $1500 each day.

The first one was on Feb 18th - an Iron Condor netting me $75.

And the second one was on Feb 20th - another Iron Condor netting me $95.

I held on to the second trade a bit longer than usual - and got a little more than my usual target of around $50-$60 for the extra duration's risk.

Why I am beginning to like Iron Condors more and more?

One thing I have come to realize is that it is futile to guess the direction of the market, and yet I must have some hypothesis or I will never be able to place a trade. And as an option seller - the hypothesis typically involves volatility and not price.

With Iron Condors, you can have a hypothesis that is also sort of price movement neutral. By selling both a Call spread and a Put spread at the same time, you are effectively balancing the bullishness of one with the bearishness of the other.

Read here for a more sophisticated analysis: https://www.tastylive.com/concepts-strategies/iron-condor#:~:text=Iron%20condors%20are%20neutral%20strategies,works%20just%20like%20a%20strangle.

However, when it comes to Zero DTE, we cannot rely as much on the traditional profit targets of 50% or 21-DTE - there is more nimbleness needed, and I typically have a very small profit target - anywhere between 10 to 25 percent of original premium. The trade is still directionally neutral - it is pointless to try and guess the direction for such a short duration trade, but I still typically wait out the first 15-30 minutes to let the market choppiness at open settle down just a tiny little bit.

Then - at that point I put a trade on and hope to quickly catch a profit and run away. It is dangerous, but it's a thrill!

Here is an example of how I would potentially look for a trade on Monday, Feb 23rd.

Current SPX price: ~$6909

Expected Move: $6860 to $6960

1-Standard Deviation Range: $6850 - $6970

With that, I would look for a Put and Call spreads a little down and away from the expected move in the both directions. I also have a little bearish bias where I think if market moves down it moves down more as compared to when it tries to go up it doesn't quite have the same strength going up, so my Puts are further away from current price when compared to the Calls (i.e., they are not equidistant from the current price).

You can visualize this setup on OptionStrat (see here). Be sure to adjust the sliders at the bottom of that page to match below screenshot to get a similar view.

In the above screenshot, the profit tent is between $6836 and $6968. Now, things are not quite as static when prices are moving up and down. Here are a couple of scenarios showing what would happen if volatility went down or it went up.

First up - when IV goes down, SPX price goes up. Or looked another way, if I track price and SPX price is rising - that means volatility must have gone down.

Now say the market rises and I opened a trade at 9:20 AM like this shown below, receiving a $310 net credit.

And then the market keeps moving up and say SPX reaches $6948, my options price would be ~$190. I would typically close my trade at this point making ~$120 in profit for the $1000 risk.

What if market goes down instead? Here is a view showing a spike in volatility and price moving down to $6880. I could close the trade at that point, making $110 in profit.

As you can see, there is potential for profit in both directions, you only truly risk losing if SPX sees a violent move outside of your profit tent in any direction. So to protect myself from such a possible violent move - the best strategy is to never ever risk an amount I would not recover from, i.e., stay small.

So far I have been risking between $1000 to $1500 for each trade. And here is what trading in Zero DTE SPX has made me so far this year - it is nearly $500. That's pretty good for the amount I am risking (i.e,, a max of $1500). However, I am too nervous to scale this up - so I will keep taking baby steps for a little while longer and keep making pennies till I have made the full $1500 I have been risking.

Trade Ideas I am Thinking of For Next Week

Why? More Zero DTE trades in SPX of course - why change a winning hand!

I have a busy work week coming up - unsure if I will be able to trade much, but if I do get a chance, I will love to trade more SPX. Whether or not it is Zero DTE will depend on where VIX is - I have been lucky to get in and out of these trades when the volatility has been high enough to give decent enough premium to justify the risk - I don't know if I would want to keep trading Zero DTEs should volatility fall across the board.

There is earnings coming up for some stocks - maybe I will try my luck there, but am not too eager to try those.

I may try another Iron Condor though - want to first see out Monday and then maybe consider placing a month long Iron Condor on IWM - which has seen some ups and downs but largely seems to be range bound.

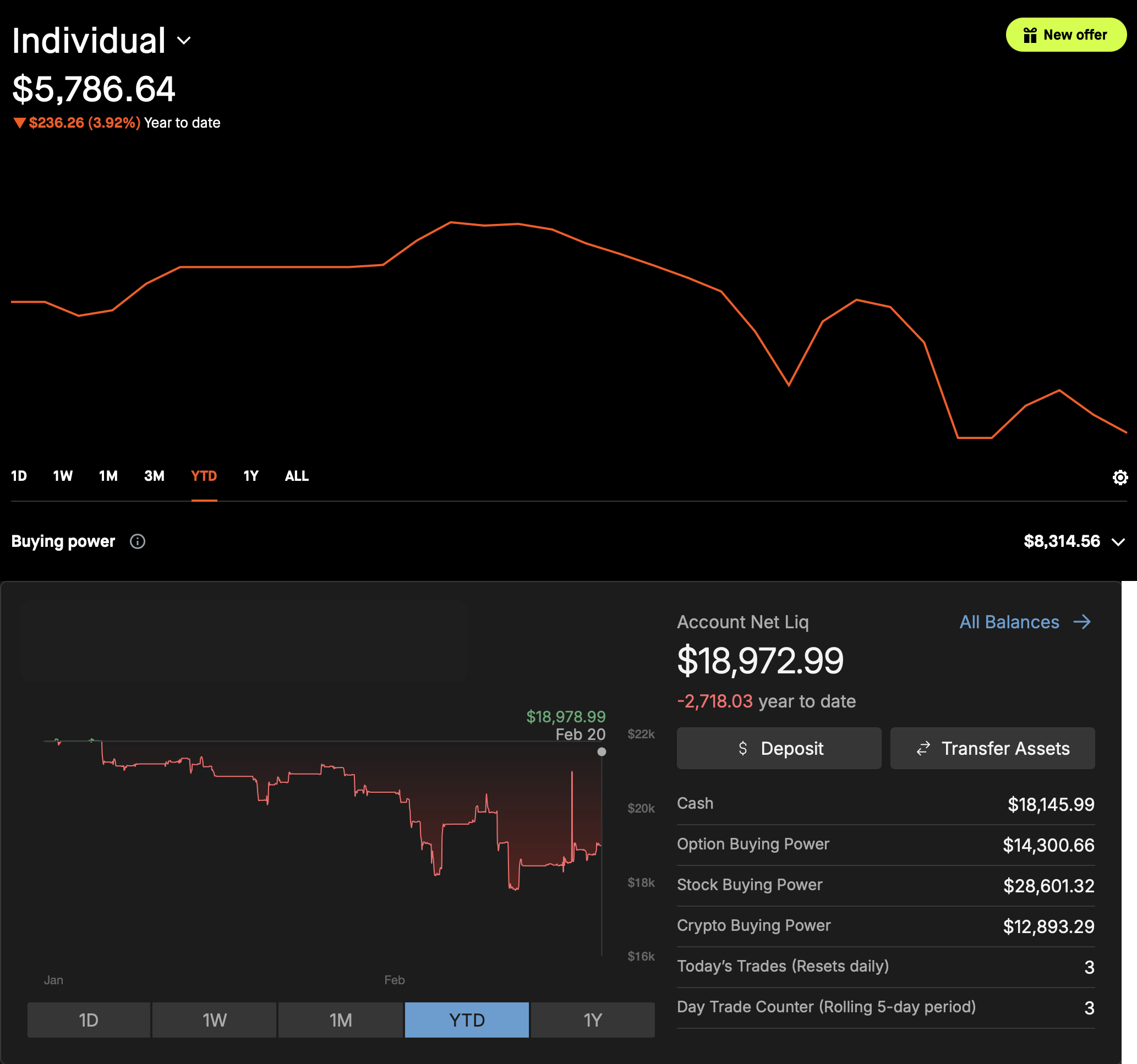

Portfolio Status

Here is the current portfolio status, including unrealized P/L.

I have about ~22K of Option Buying Power available across both accounts.

Thanks for following along. See you next week!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.

Additional References