This Option Strategy almost always beats a SPY or QQQ Buy-and-Hold

Can you make money by buying LEAPS Calls on SPY and QQQ?

Here are a few backtests that suggest - yes, you can.

As always, the content on this page is not financial advice.

Strategy

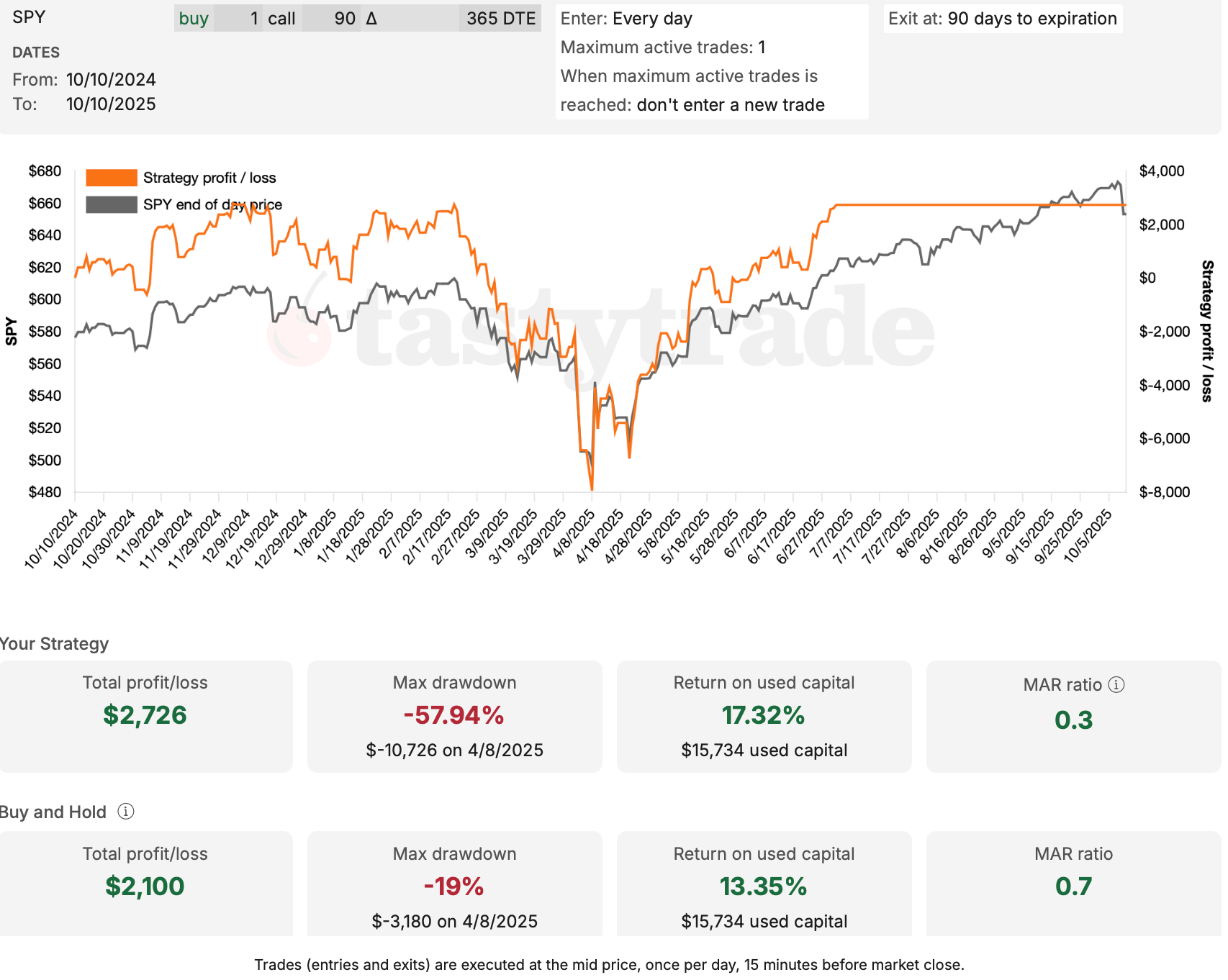

- Buy a LEAPS Call Option.

- Buy at 365 Days to Expiration (DTE).

- Buy 90∆ Option.

- Sell at 60 DTE or 90 DTE.

- Only a single contract should be open at any given time.

Results

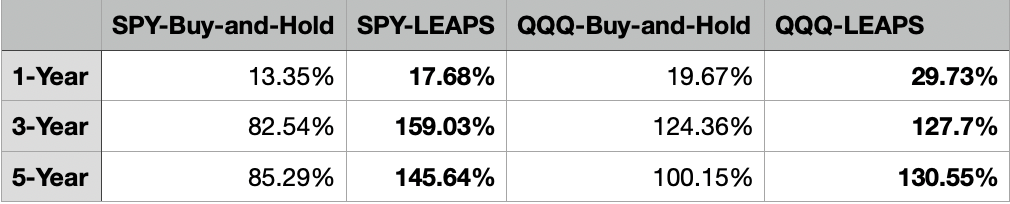

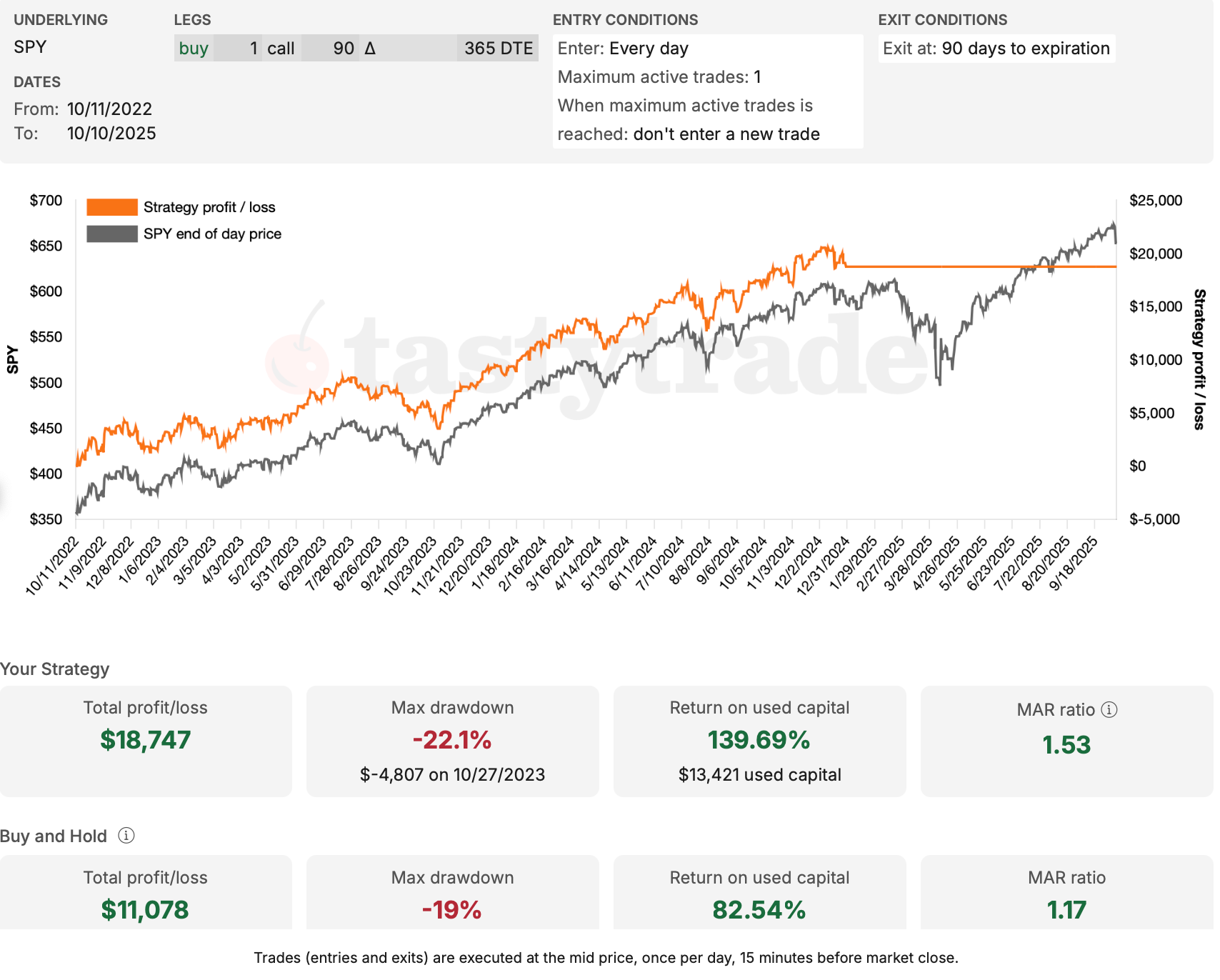

Here are the results when we close the trade at 60 DTE. The LEAPS Option beat Buy-and-Hold in every single instance, across both SPY and QQQ.

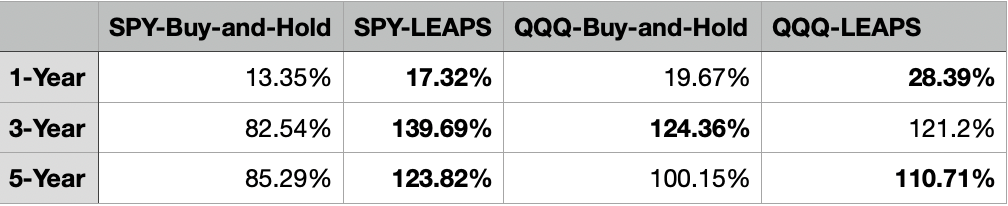

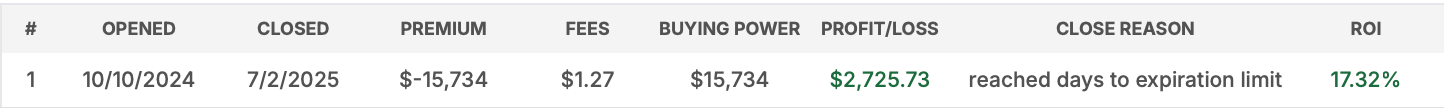

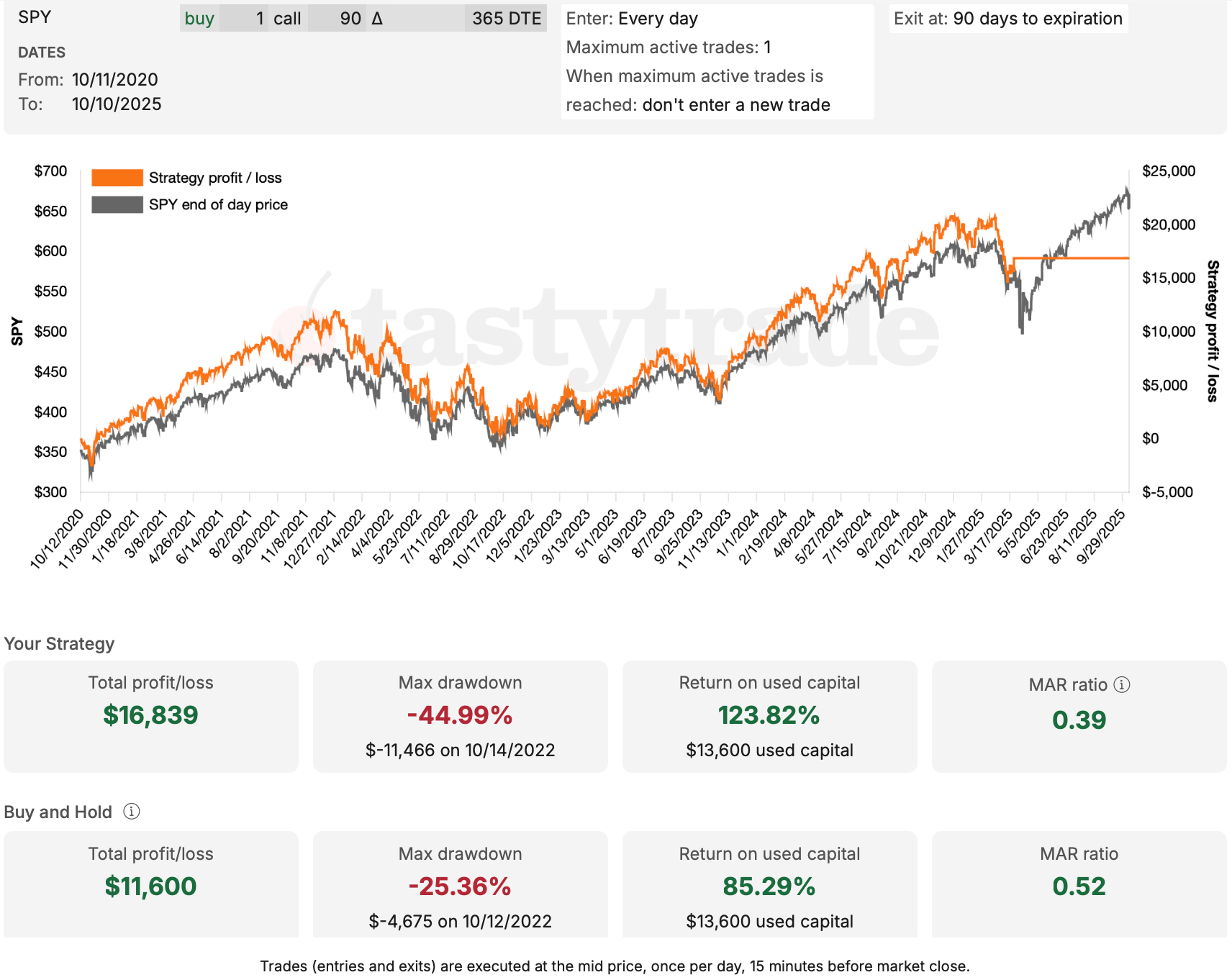

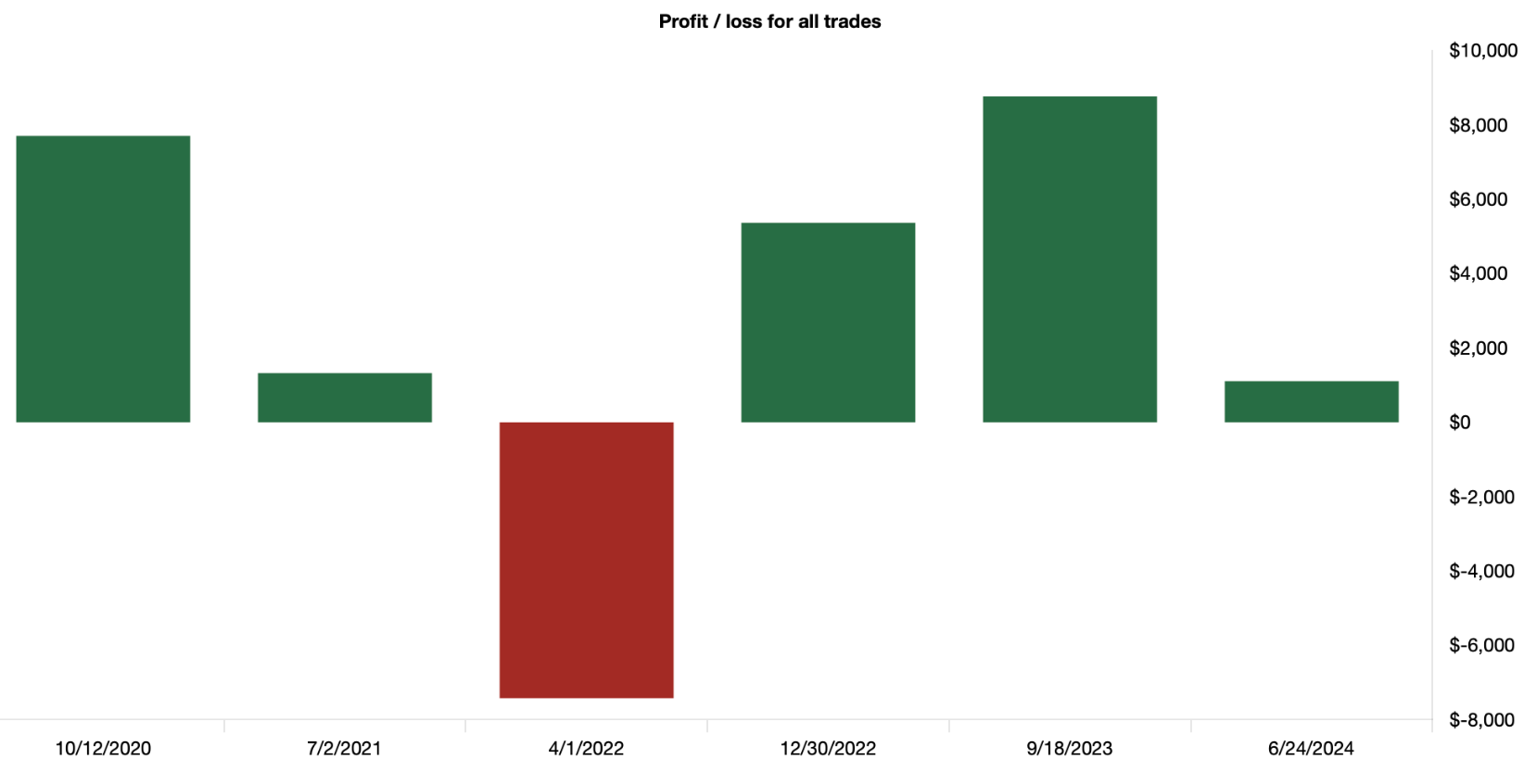

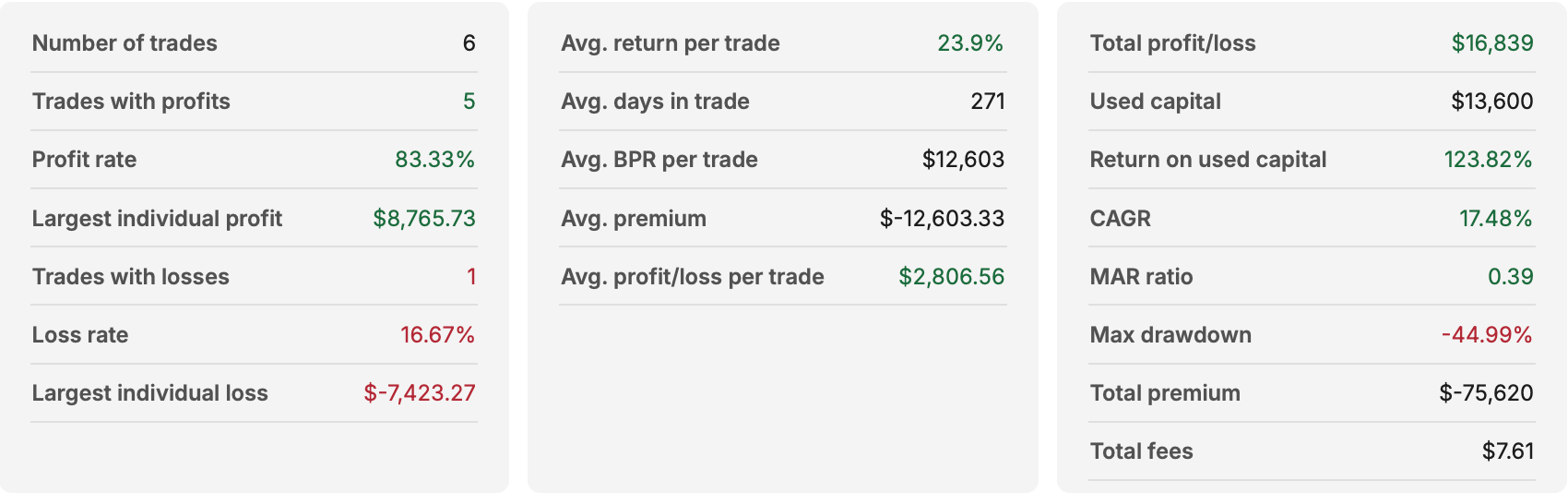

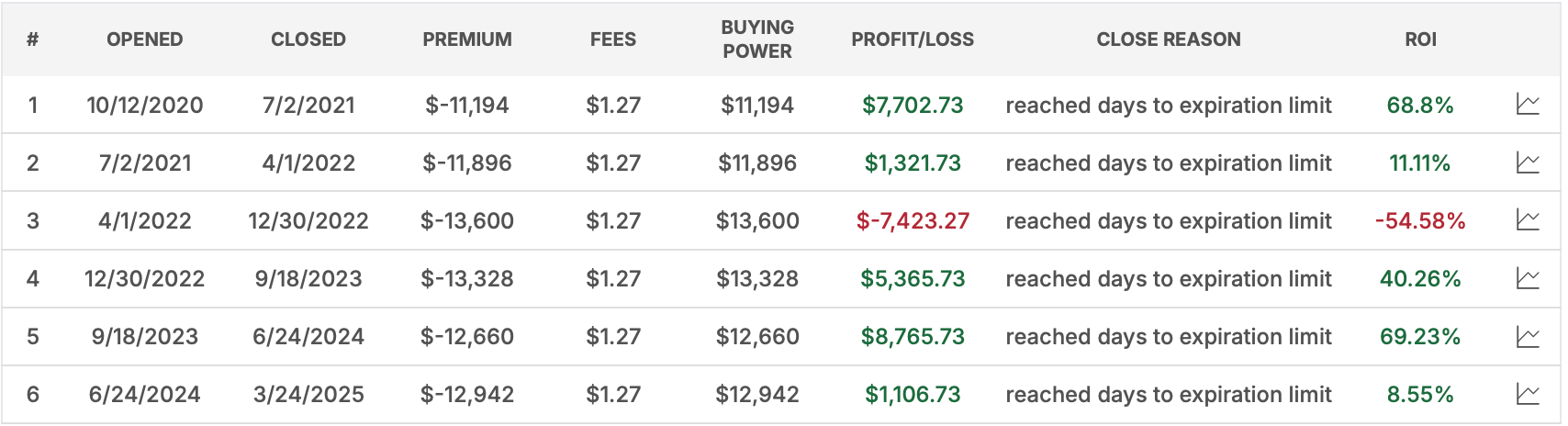

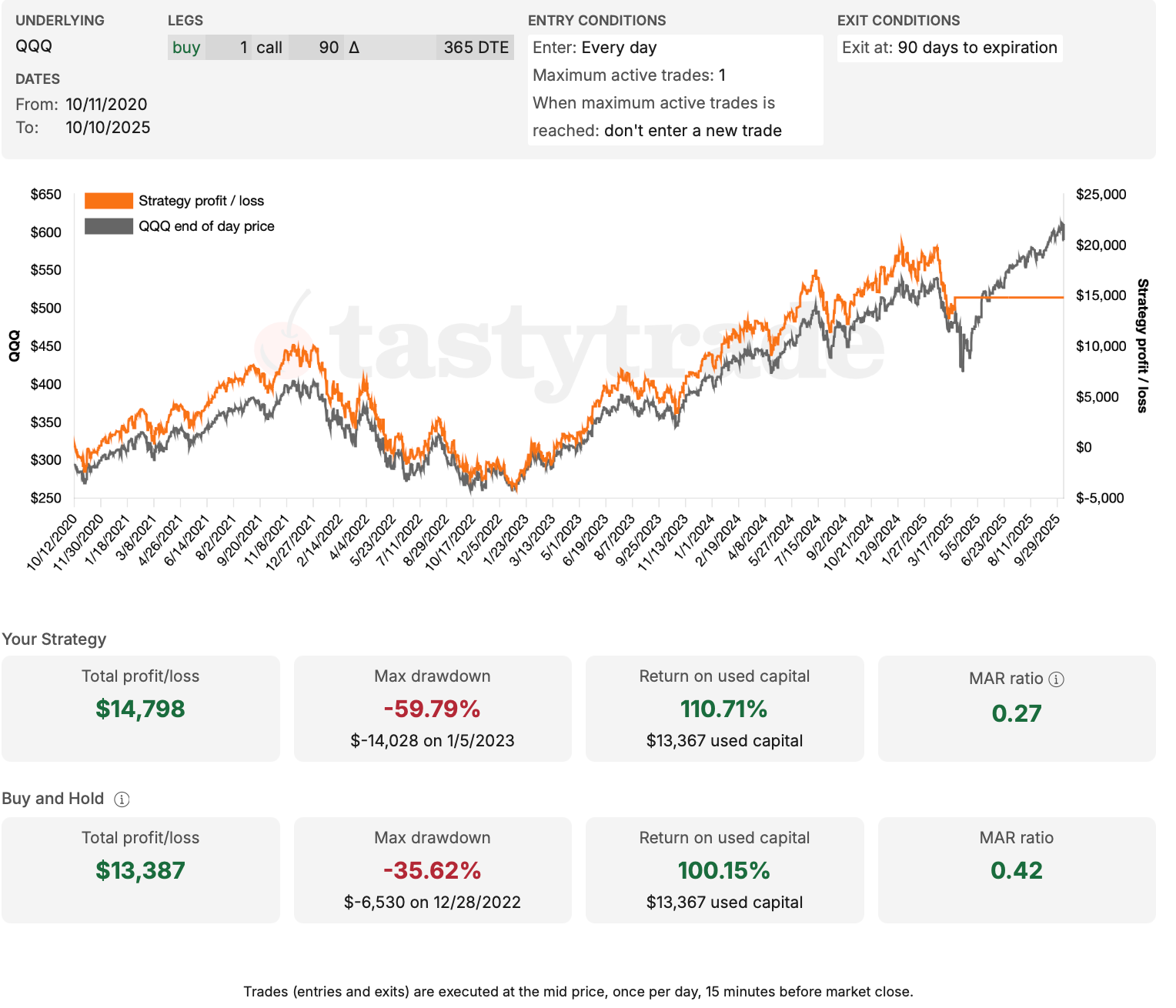

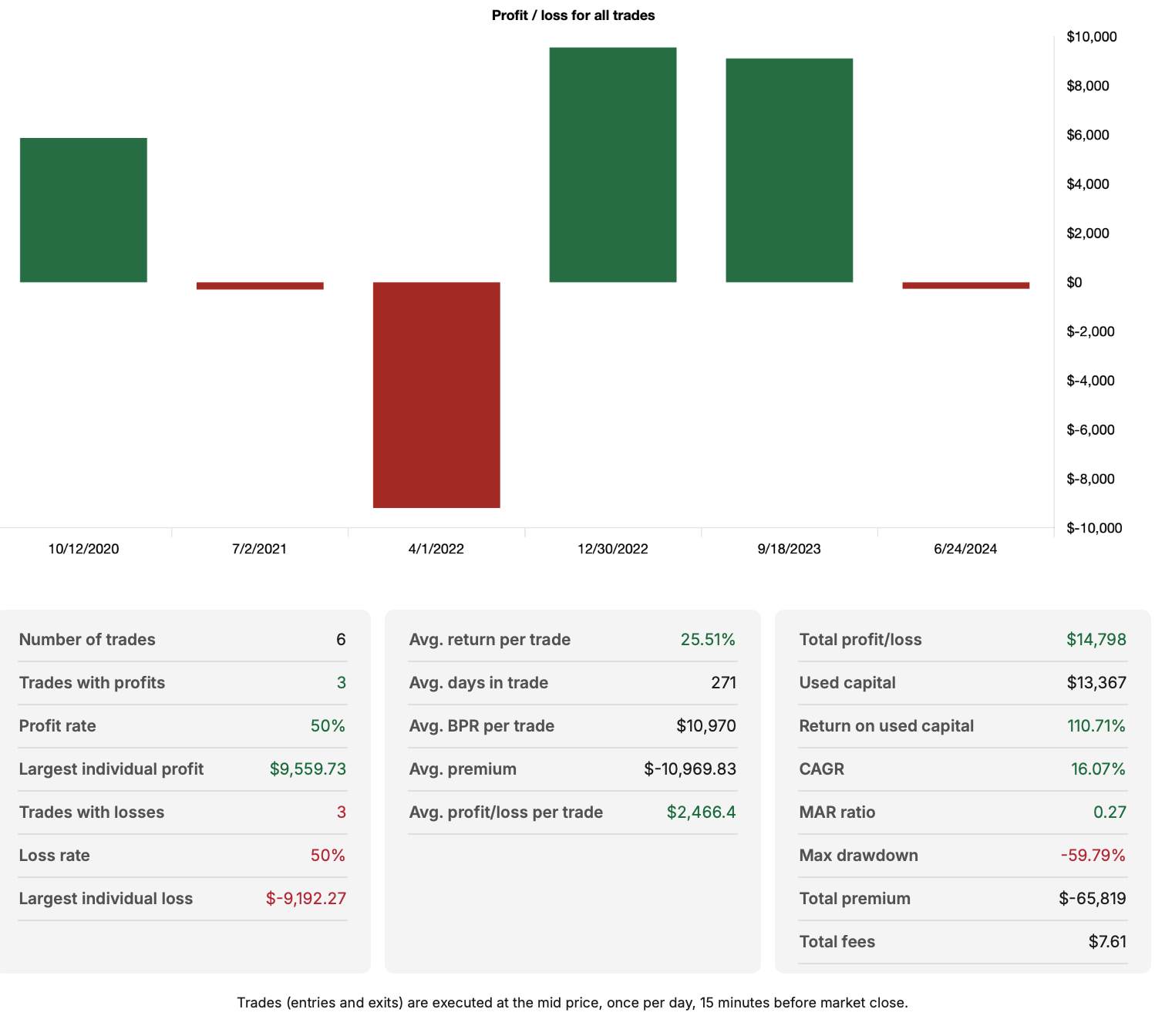

Here are the results when we close the trade at 90 DTE. The LEAPS Option beat Buy-and-Hold for every instance in SPY. For QQQ, for the 3-year period, Buy-and-Hold narrowly edged out LEAPS.

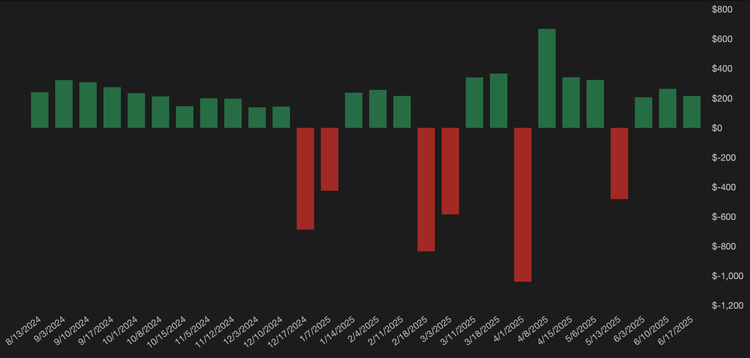

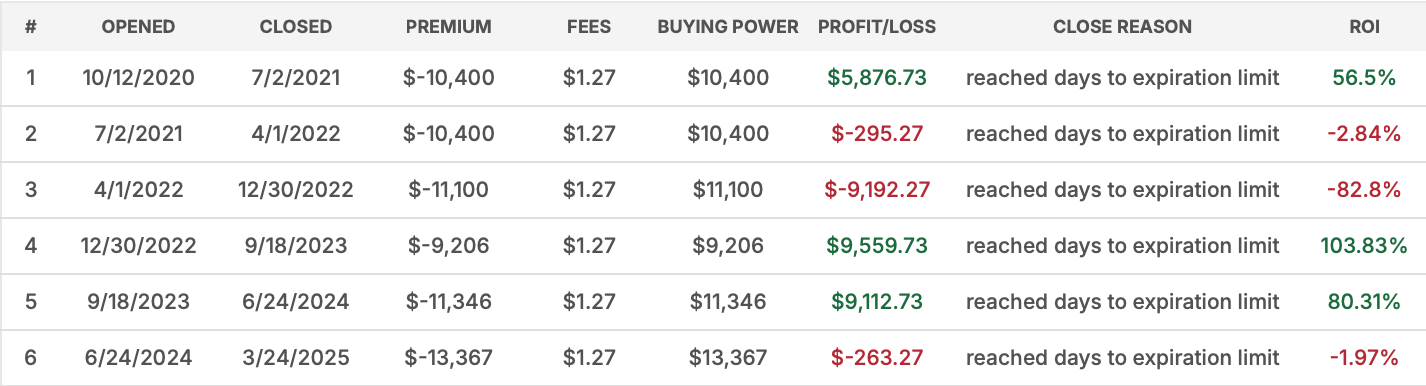

Here are all the experiments (using a 90-DTE close).

SPY

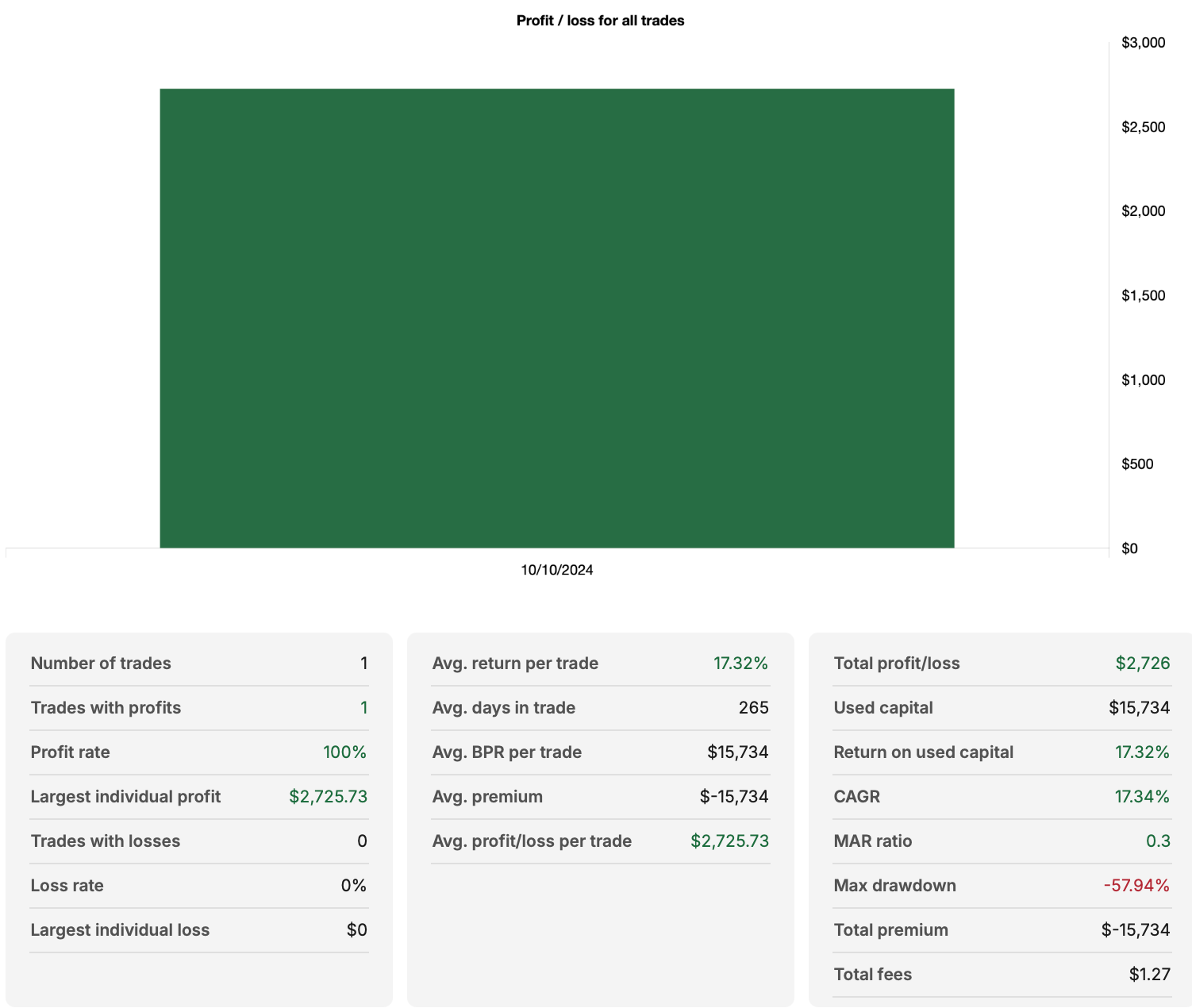

1-Year Backtest [October 2024 - October 2025]

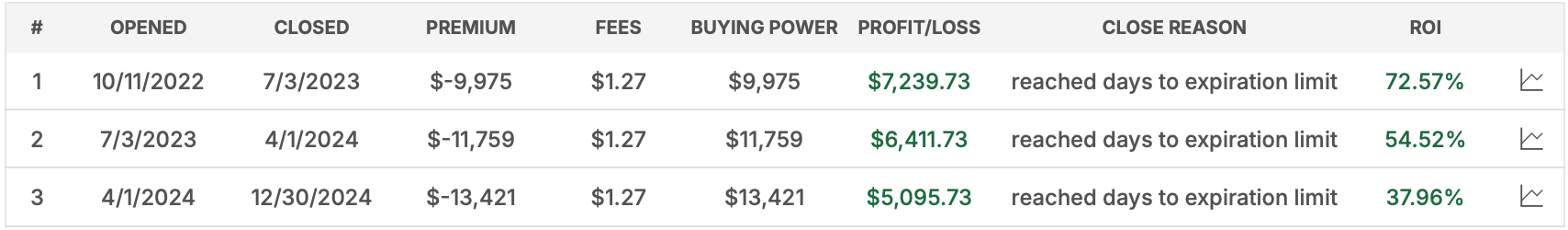

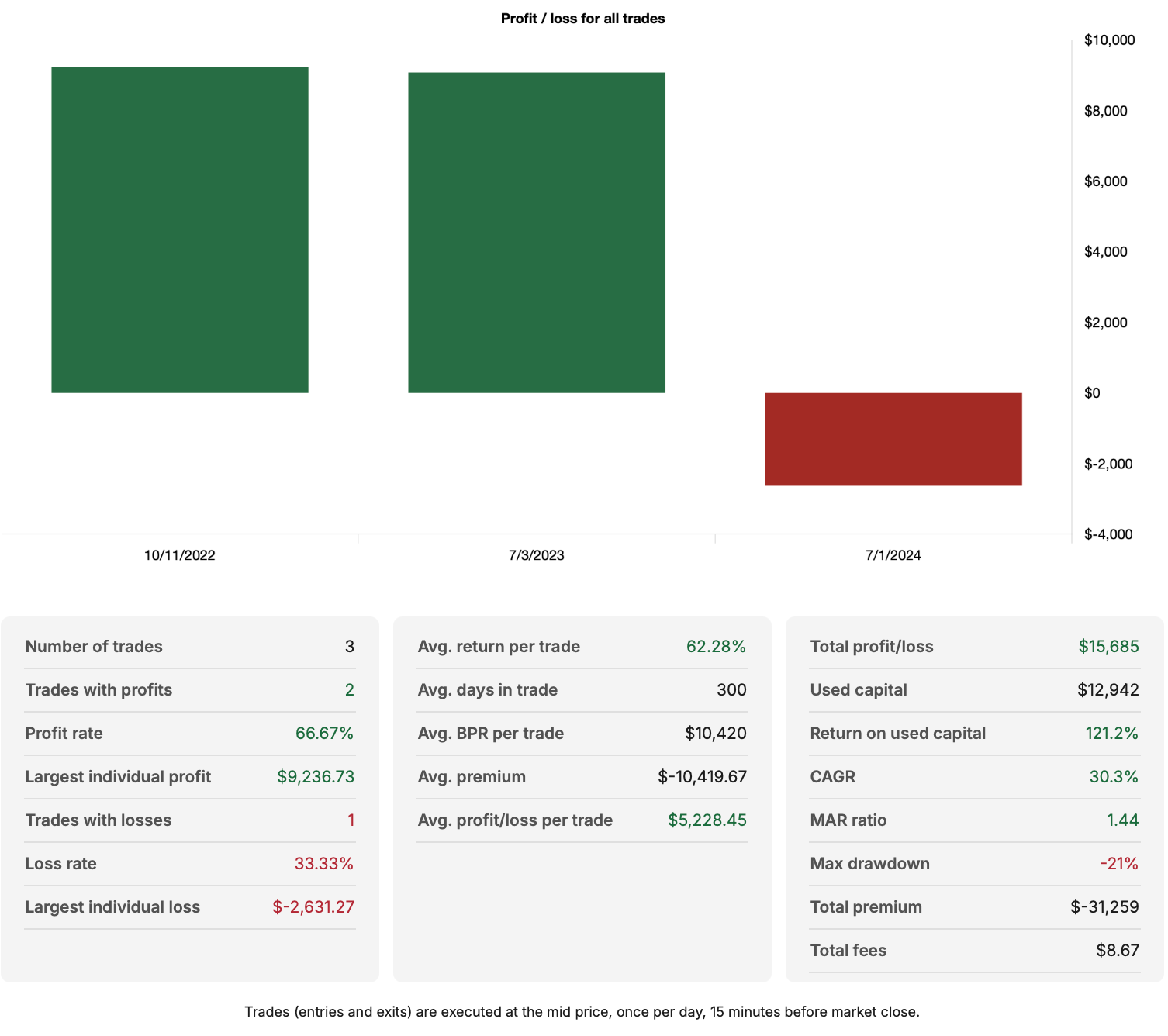

3-Year Backtest [October 2022 - October 2025]

5-Year Backtest [October 2020 - October 2025]

QQQ

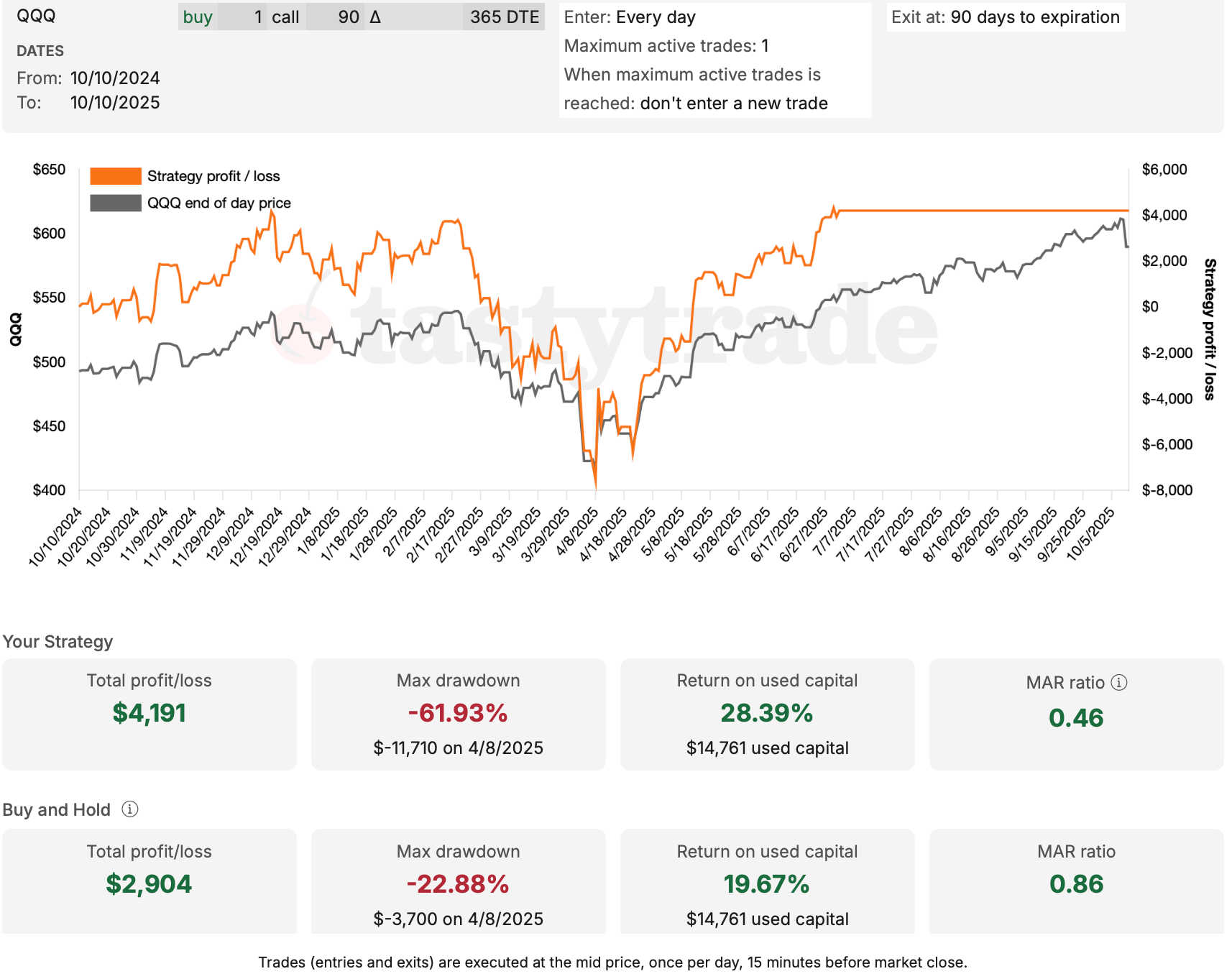

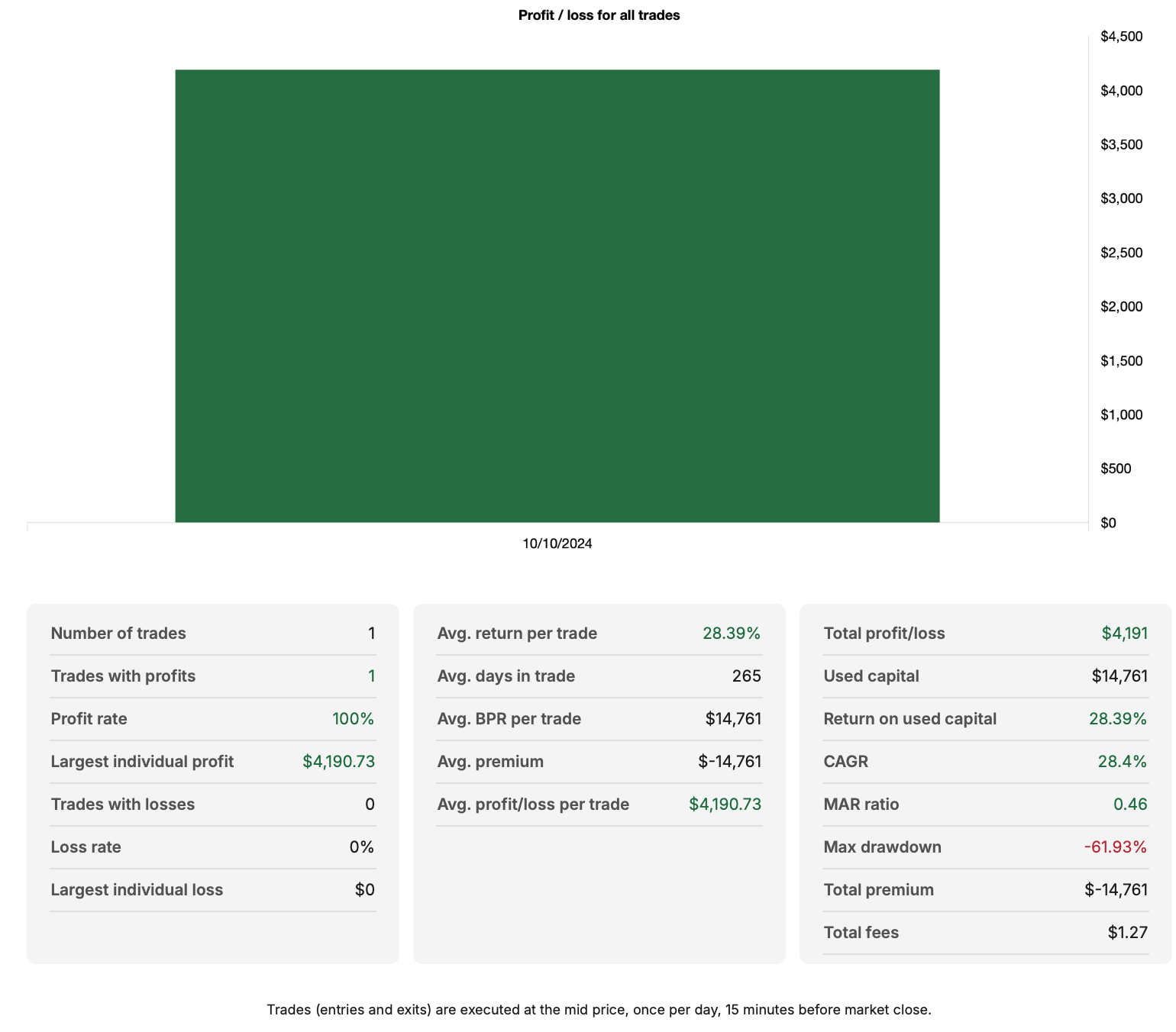

1-Year Backtest [October 2024 - October 2025]

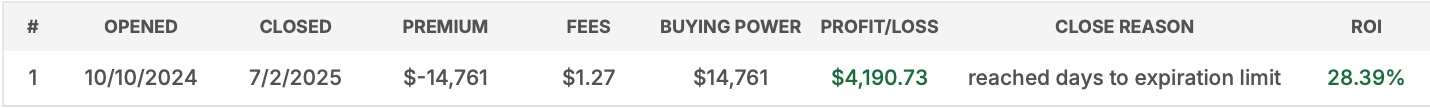

3-Year Backtest [October 2022 - October 2025]

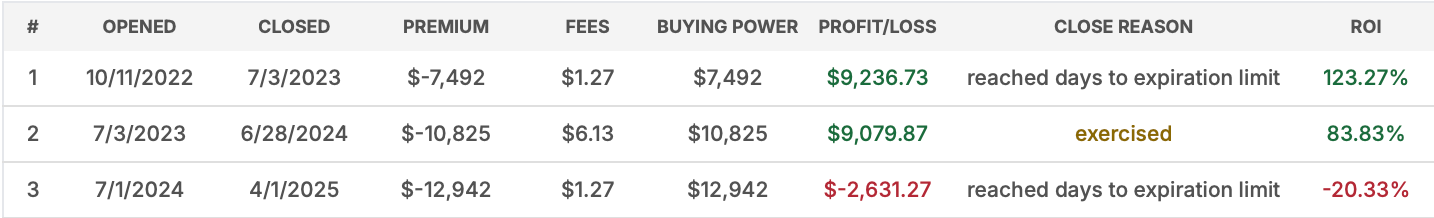

5-Year Backtest [October 2020 - October 2025]

Conclusion

There are no losers here.

Whether you did a Buy-and-Hold in SPY and/or QQQ, or you followed the strategy above, you would have made significant money.

This aligns with the mostly bullish run we have seen in the past decade (and more). While there have been occasional big drawdowns, they have never been entrenched enough to cause a multi-year bearish market. Which means I wouldn't necessarily know if this strategy would be good in such a market.

Bull markets make a lot of people think they are genius.

Pick your poison!

📌 Disclaimer: Nothing on this site is financial advice - I’m just here to entertain! Here’s my introduction, my trading philosophy, and some ground rules.